While some of the risks that prompted our cautious stance in early February have been partially mitigated, most remain—with the ongoing trade war still the most pertinent. Therefore, we believe it remains prudent to exercise patience. That said, improving liquidity conditions, favorable seasonality, and the possibility of a budget-neutral BTC acquisition strategy offer reasons for optimism. Regardless of the direction, depressed implied volatility (BVIV < 50) suggests that a significant move may be imminent.

A Quick Rehash

We won’t belabor the point about why we’ve had a more defensive view on the crypto market. Below are the key reasons underpinning our risk-averse stance since early February

- Trade War – After tariffs on Canada, Mexico, and China were announced, it became clear the administration was serious about realigning global trade and willing to endure short-term pain to achieve it. The market’s reaction also revealed that tariffs weren’t as fully priced in as many had expected. While the long-term implications of balanced trade could ultimately be bullish for BTC, the path there is likely to be bumpy, as tariffs raise the risk of stagflationary pressures—an environment crypto typically dislikes.

- Lack of a Dovish Fed – From September through January, robust economic data forced the Fed to pause rate cuts and scale back its dovish stance. Subsequent data suggested much of the Q4 economic strength may have been due to front-running tariffs. As of early February, the Fed’s reaction function remained limited. Although their tone shifted slightly in March, they appear to still favor patience over rate normalization.

- Headline Risk – Regardless of one’s political views, most agree that Trump is unpredictable and frequently leverages social media during negotiations. This unpredictability creates an environment where he can post market-moving commentary at any moment. Crypto, as a reflexive asset class dependent on trend-following flows, remains particularly vulnerable in such a skittish climate.

- Lack of Flows – ETF flows and spot volumes were waning in early February—a concerning sign given the volume of bullish news circulating (e.g., the White House executive order, bullish agency appointments). Apart from isolated instances of capitulatory volumes, USD inflows into crypto remain subdued.

- Growth Scare – We didn’t anticipate how swiftly fears of an overheated economy would pivot to concerns over slowing growth. This shift was not entirely disconnected from the trade war but was also influenced by rhetoric from Trump and Bessent regarding fiscal constraint, along with developments related to DOGE. It’s worth noting that growth scare concerns have somewhat dissipated in the near term, evidenced by the recent rebound in yields.

- Lack of Near-Term Catalyst – Despite massive medium- and long-term tailwinds for crypto, government processes simply don’t move as swiftly as the crypto market does, leaving investors without imminent policy catalysts to consider.

The Elephant in the Room

The elephant in the room remains the self-imposed April 2nd deadline for the White House to provide clarity on reciprocal tariff levels. Attempting to predict these tariff levels with precision is a fool’s errand, and therefore we believe the best strategy for next week is to adopt a “read and react” approach.

There’s no doubt the Trump administration is determined to rebalance global trade, and tariffs have become their primary tool to facilitate this shift. Yet, significant uncertainties remain:

- If the ultimate objective is achieving a “Mar-a-Lago”-style accord among trading partners, what level of tariffs will incentivize other countries to negotiate?

- Will other countries retaliate before offering concessions?

- How much economic pain are trade partners willing to absorb before coming to the negotiating table?

- Conversely, how much economic discomfort is the U.S. prepared to tolerate?

- What impact will this period of uncertainty have on global commerce in the interim?

Ultimately, a multipolar global trade system—which inherently requires dollar debasement, as running a trade surplus is incompatible with a persistently strong domestic currency—would be beneficial for crypto in the long run. However, it’s the uncertain and volatile path to that destination which currently concerns us.

Reasons for Optimism

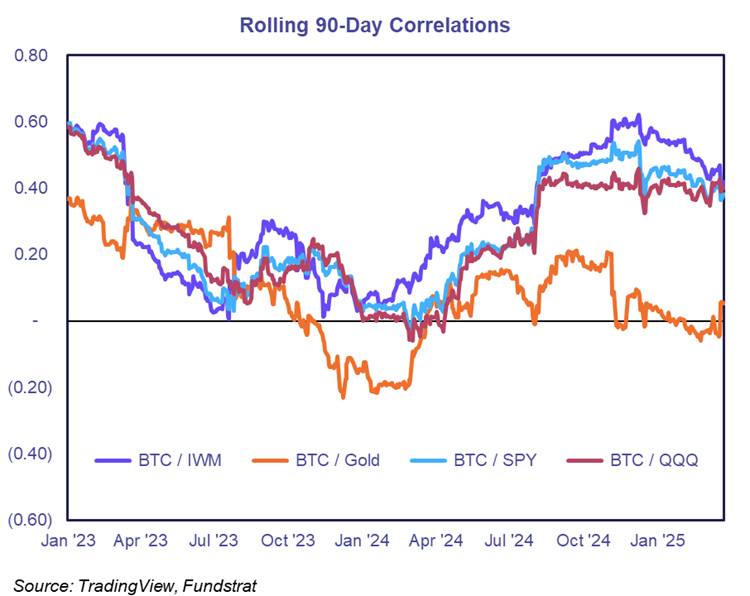

The best outcome for crypto investors would be for BTC to look ahead, front-running the eventual resolution of trade deals and anticipated dollar weakening. To a large extent, this dynamic is already playing out in gold’s recent strength, with prices now above $3k due to sustained central bank demand as trade partners prepare for a post-Mar-a-Lago-accord world. However, BTC has notably failed to trade in lockstep with gold for quite some time.

Let’s assume, for now, that the immediate “trade war risk” clears. What are some near-term reasons for optimism? We’ve touched on these sporadically over recent weeks, but to summarize:

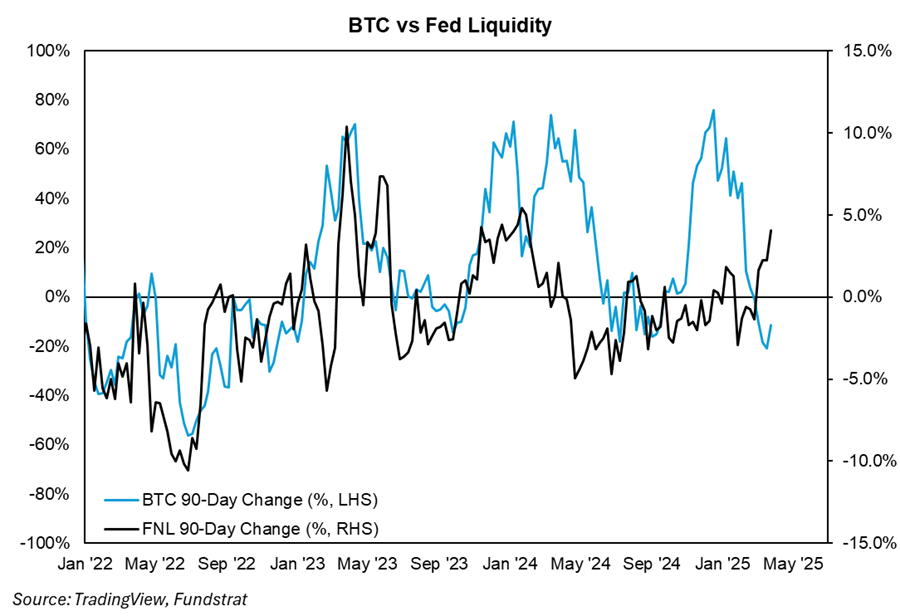

Liquidity Conditions Improving – While the trade war presented the primary risk to crypto in Q1, crypto markets also contended with concurrent liquidity headwinds. The DXY surged dramatically over a three-month span, the RRP liquidity faucet dried up, clarity around the timing of QT tapering was absent, and the TGA remained elevated. However, in recent weeks, we’ve observed significant improvements: (1) funds from the TGA have started moving into the private banking system, (2) the Fed announced a substantial QT taper beginning in April, and (3) the DXY has sharply declined from over 109 to just below 104. Although some liquidity headwinds could emerge following the resolution of the debt ceiling and around tax season, domestic liquidity conditions have improved markedly compared to Q4 and Q1.

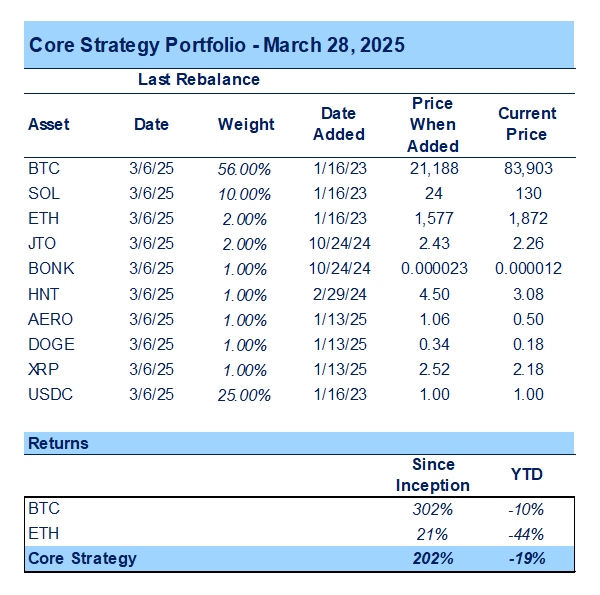

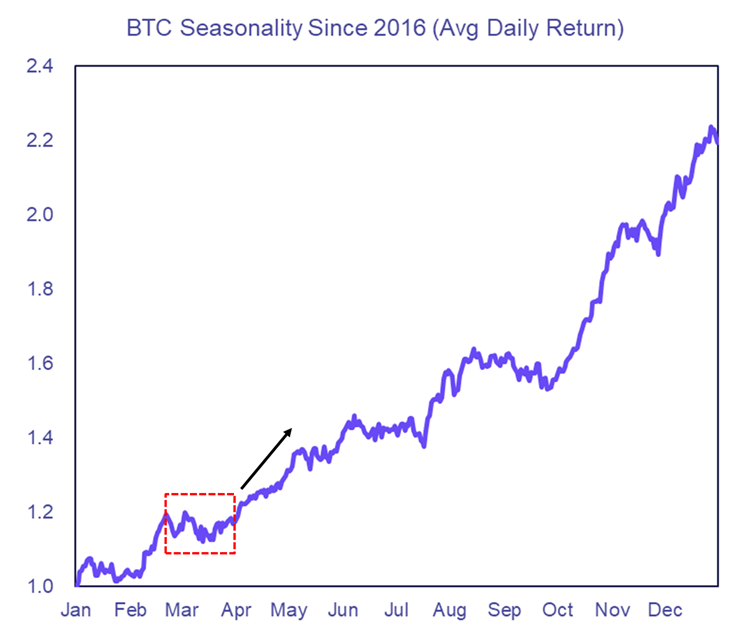

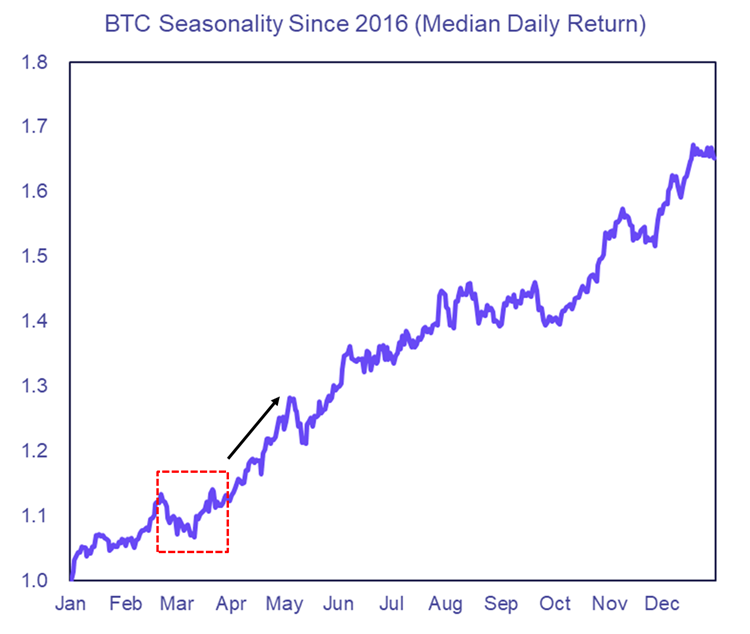

Seasonality Improving – Many are unaware that March is historically a challenging month for BTC. Below, we’ve provided seasonality charts—one illustrating average daily returns since 2016 and another showing median daily returns. Historically, March has been characterized by choppy price action for BTC, whereas April has typically demonstrated more uniformly bullish behavior.

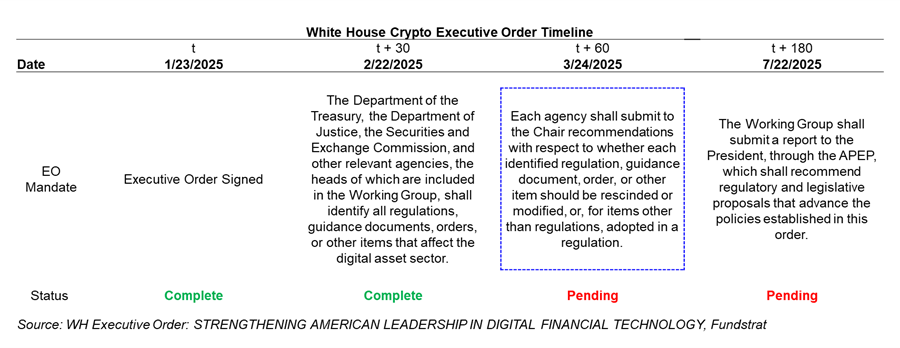

Potential Catalyst in “Budget-Neutral Strategies” – We discussed this speculative catalyst in last week’s note. Our view is that the market is currently underpricing the likelihood that budget-neutral strategies to acquire BTC for the Strategic Reserve could be publicly revealed sometime in April. This stems from the President’s Working Group (PWG) having been scheduled to deliver its findings to David Sacks on Monday 3/24. Notably, the Treasury Secretary—who would oversee any potential reserve—is part of the PWG. It’s plausible that any recommendations or commentary on BTC acquisition and management strategies could be included within these findings. Additionally, there’s a strong chance these recommendations will be opened for public comment before reaching the President’s desk. If this occurs, it could significantly boost market sentiment and ignite animal spirits.

Elevated Odds of a 15%+ Move

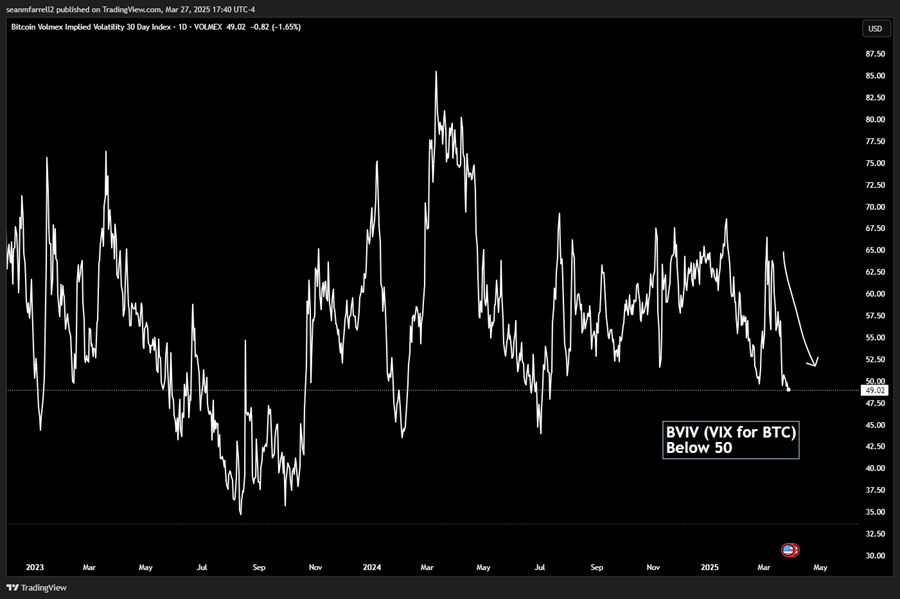

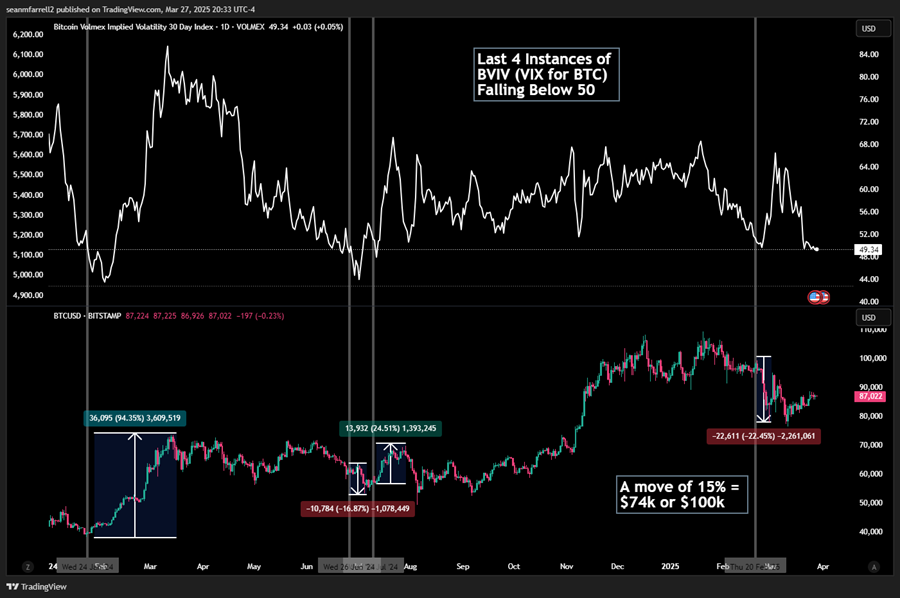

Regardless of how next week ultimately shakes out, implied volatility suggests a sizable move might be imminent. Below is the BVIV index, structurally similar to the VIX used in equities.

It’s important to note that BTC’s volatility profile leads BVIV to rise following large moves in either direction. This contrasts with the VIX, which is typically more of a pure “fear gauge.”

The BVIV has now moved below 50 for the second time this calendar year.

In the previous four instances when this index dropped below 50, BTC experienced a move of 16% or greater shortly thereafter. Two of these moves were bullish, and two were bearish. It’s likely that clarity on tariffs will provide the catalyst needed to exit this “no man’s land,” prompting a more decisive move.

If this historical pattern holds, it implies a potential move toward either $74k or $100k in the coming weeks.