Flows and Sentiment Still Subdued

Last week, we received a better-than-expected CPI print, but the DXY continued to move higher due to global weakness and a hawkish Fed. We discussed the risks appearing in the metrics we use to gauge sentiment and flows. The overall lack of follow-through in the crypto market was evident.

Volumes, net ETP flows, the Coinbase discount, stablecoin market cap trend, and search interest for key crypto-related words all suggested that the market was ripe for a pullback, particularly among altcoins. As a result, we moved a portion of our altcoin allocation to stablecoins on Friday.

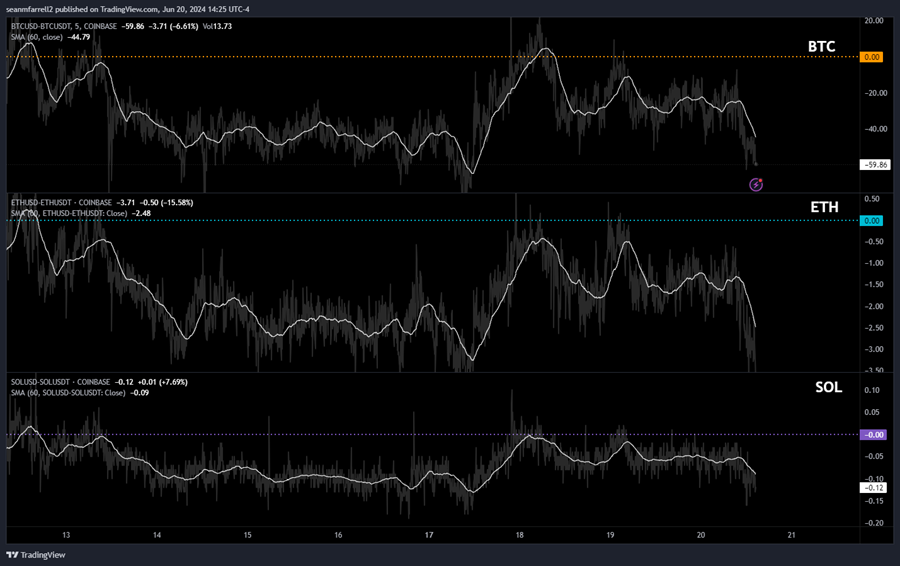

A week later, conditions remain consistent with what we observed last week. BTC, ETH, and SOL are still trading at a discount on Coinbase relative to Binance.

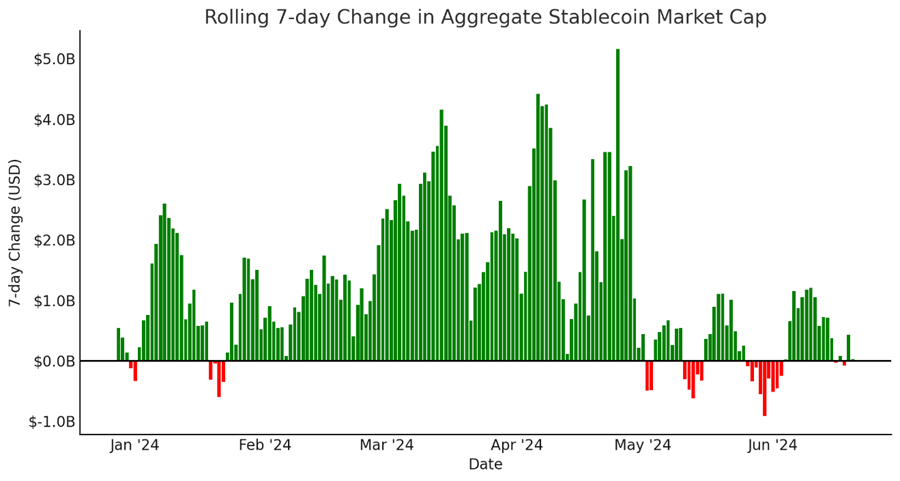

There remains a lack of stablecoin inflows, signaling a lack of capital desiring to enter the crypto ecosystem.

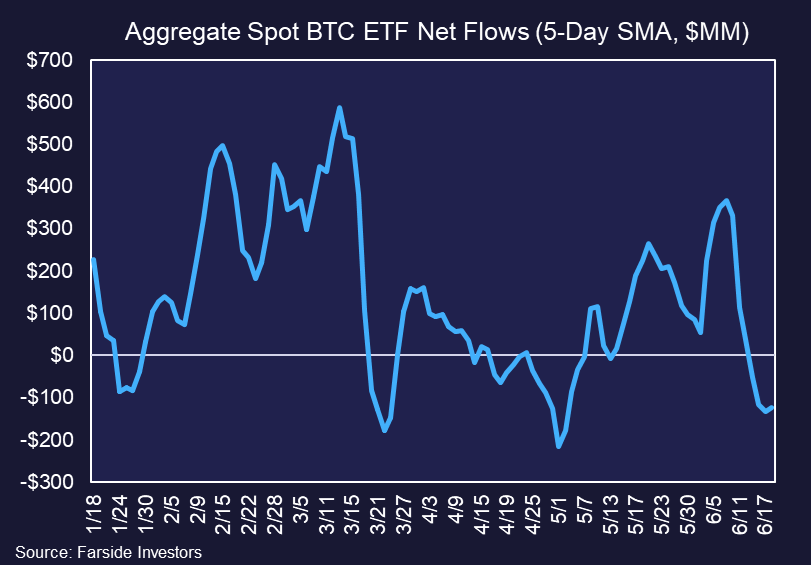

Bitcoin ETFs have also continued to see net outflows, with the 5-day moving average nearing year-to-date lows.

To be clear, on a longer timeframe, we still view dollar liquidity as being in an expansionary part of the liquidity cycle, meaning we are still within a larger bull market. However, tactically speaking, until we see DXY weakness and/or global liquidity continue to expand, it is prudent to remain cautious.

We will continue to monitor flows and sentiment to identify a viable turning point for this market, which has moved lower over the past couple of weeks.

The Divergence Between BTC and QQQ

One thing puzzling the more passive crypto investors is the divergence between major equity indices (QQQ, SPX) and crypto prices, particularly evident over the past few weeks. This is confusing for many because investors have been conditioned to think that if the QQQs are increasing, then BTC must also be bid. However, right now, that is not the case.

In Tuesday’s crypto comments, we shared the chart below, which illustrates the simple dynamic at play. This chart shows BTC versus the equal-weighted S&P 500. While one has outsized volatility, generally, you can mark a similar point in time at which both assets peaked and started to move sideways. This coincided with a rise in rates and rate expectations, a strengthening dollar, and reduced fiscal and monetary flows.

However, the market cap-weighted S&P 500, save for a brief dip in April, has not found the same ceiling that the equal-weighted index has (market-weighted QQQ and equal-weighted QQQ share a similar relationship).

The somewhat obvious conclusion here is that the equity market is top-heavy and is rallying on increasing earnings expectations among chip makers and hyperscalers, not on macro-driven easing of financial conditions, which is what assets further out on the risk curve need to garner the same bid.

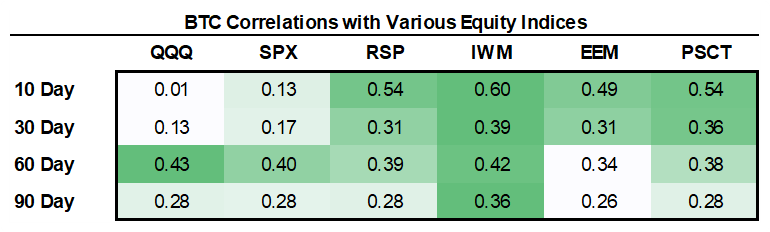

In the table below, we calculate the correlations between BTC and several different equity indices – QQQ (Invesco QQQ Trust), SPX (S&P 500 Index), RSP (Invesco S&P 500 Equal Weight ETF), IWM (iShares Russell 2000 ETF), EEM (iShares MSCI Emerging Markets ETF), PSCT (Invesco S&P SmallCap Information Technology ETF).

Clearly, for the longer-term lookback periods, BTC maintains a strong correlation with the market cap-weighted indices. However, as of late, its correlations with small caps, equal-weighted indices, and emerging market equities are the strongest, while its correlations with QQQ and SPX are near zero.

These are the equities that are the most sensitive to macro conditions and the most heavily burdened by a strong DXY. Thus, it is reasonable to think that if we see liquidity conditions improve, DXY start to roll over and BTC start to move higher again, the aforementioned macro-sensitive equities will start to rally in concert.

LDO Risk/Reward Looks Good Here

We want to wait for evidence that immediate-term liquidity conditions are improving before we reduce our stablecoin allocation back to zero. However, we like the risk/reward profile for re-adding LDO to our core strategy basket at this time.

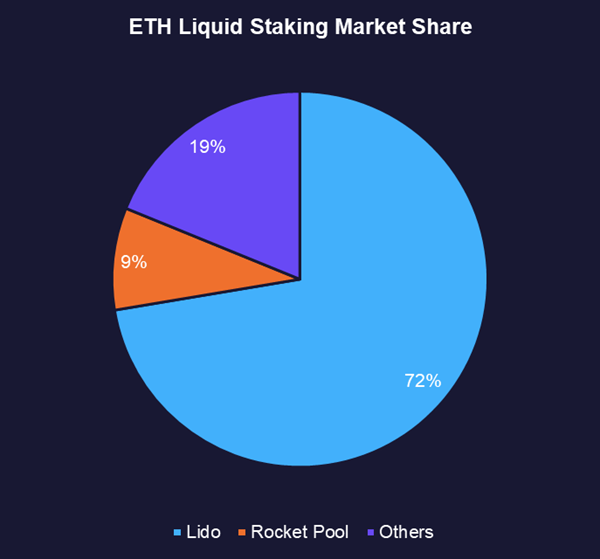

This was a trade we initiated last year in anticipation of the ability to unstake from the ETH Beacon Chain, which we believed would increase demand for liquid staking since ETH staking was now derisked. The rally was certainly narrative-driven to a large extent, but the underlying liquid staking adoption was also impressive. Fast forward to today, and Lido has cemented itself as the preeminent liquid staking service provider on Ethereum, garnering over 70% market share of all liquid-staked ETH.

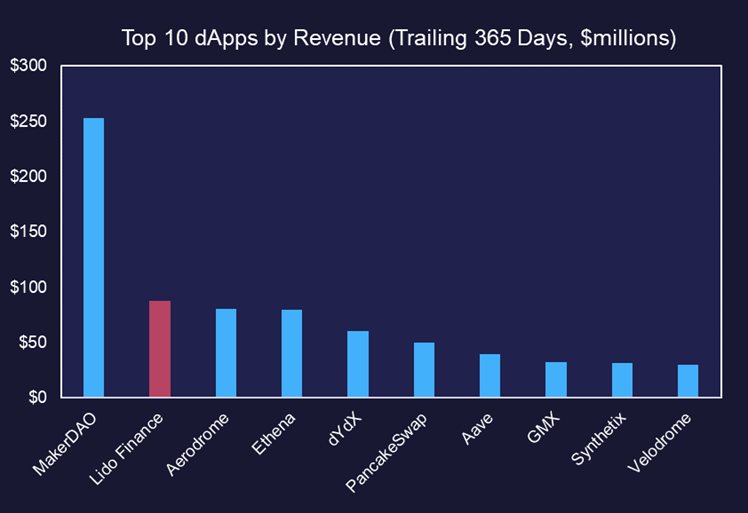

Lido is also a money-printing machine that takes a small cut of all staking rewards paid out to liquid staking token holders and node providers.

Below, we see that of all dapps above $100 million in market cap with a liquid token, Lido is second in revenue that accrues to the protocol, right behind MakerDAO (MKR -0.80% ), another Core Strategy constituent.

The only shortcoming of the LDO token is that there is no straightforward value accrual mechanism for token holders—only the ability to vote on governance and the promise of eventually enabling cash flows to flow through to token holders, either outright or via a token burning mechanism, as is the case with MKR. LDO has underperformed this year, possibly due to overall ETH beta underperformance, or perhaps due to perceived regulatory pressures.

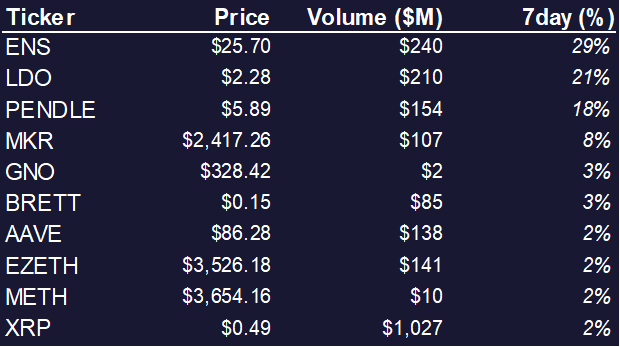

However, following the latest altcoin wipeout, we have seen very few assets rebound strongly, one of them being LDO (the other being PENDLE -1.69% , a liquid venture bet).

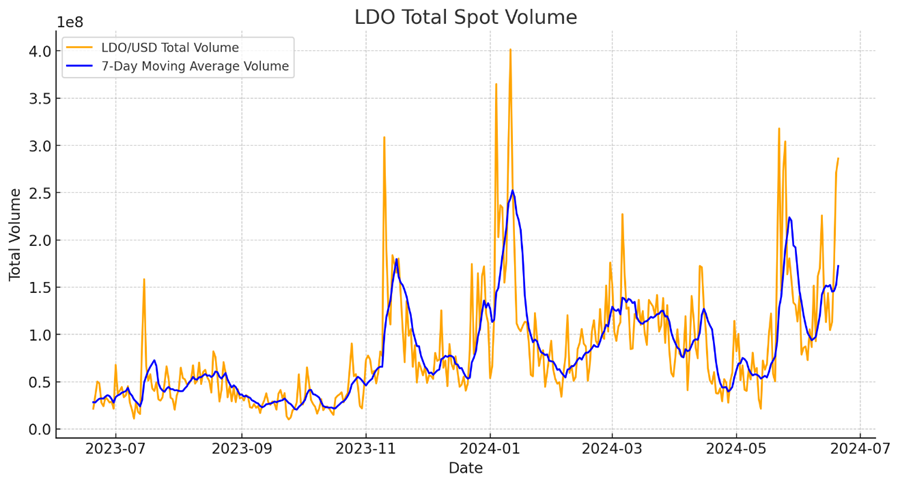

We have also seen volumes pick up over the past couple of weeks, surpassing levels seen earlier in the year when LDO prices were much higher, suggesting increased interest in the asset.

Stepping back, and considering that the ETH ETF launch is right around the corner—now projected to come to market the first week of July—we should be looking for ETH beta that will outperform in the event of a successful first couple of months post-launch.

We think that the recent outperformance of LDO and MKR are signs of things to come and serve as the best avenues to achieve ETH beta exposure.

Further, in addition to the ETH ETF approval, we have seen the SEC drop its lawsuit against Consensys, a legal pursuit aimed at potentially labeling ETH as a security. We think that this overall regulatory softening toward ETH is conducive for LDO’s success, as the logical next step in crypto exchange-traded products in the US will be to allow investors to achieve exposure to staked ETH.

These ETPs already exist in other jurisdictions, and it is possible that the US funds could very well leverage Lido’s services, further increasing Lido’s traction in the market and their relative importance in the crypto ecosystem. Afterall, it would be better for ETH custodied by Blackrock to be distributed to different nodes within the Lido ecosystem of node operators as opposed to one in-house Blackrock node.

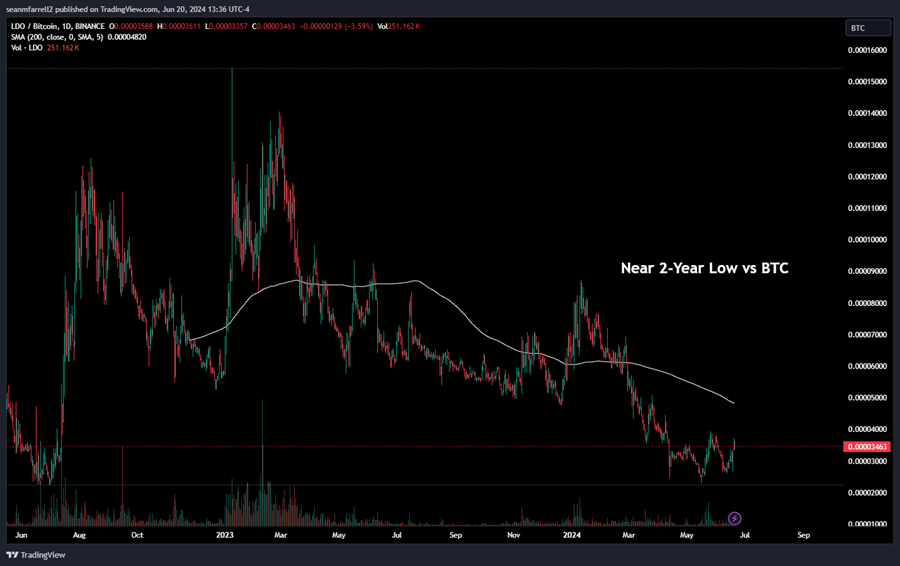

In summary, the near-term tailwinds for the LDO are apparent, and the downside risk seems to be measured, as we can see that the price relative to BTC is still relatively close to a 2-year low. Thus, despite the immediate-term uncertainty in the market, we think that now is the right time to add exposure to LDO. Since this is viewed to us as ETH beta, for the time being, we would rotate some ETH exposure into LDO.

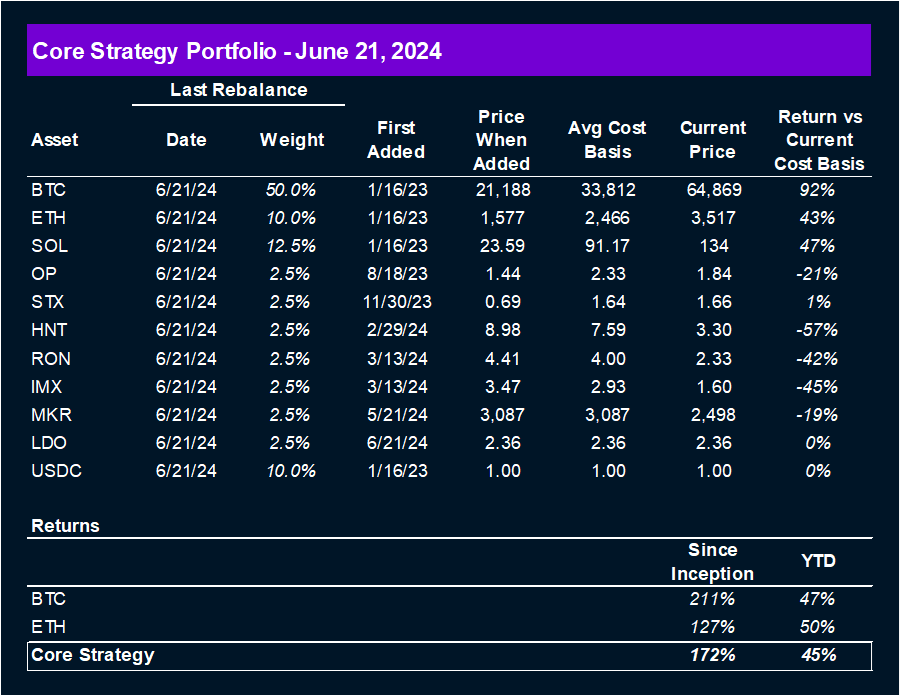

Core Strategy

The lack of flows and reduced market sentiment in the wake of a stubbornly strong move in the DXY leave us tactically cautious, but we remain steadfast that we are still within a larger uptrend in global liquidity. Despite the near-term caution, we think it is right to add LDO to our Core Strategy, given its recent strength, fundamental adoption, and its high likelihood of outperforming into and after an ETH ETF launch.

Tickers in this Report: BTC -2.18% , ETH -2.89% , SOL -3.45% , OP -6.65% , STX N/A% , HNT -3.22% , RON -5.93% , IMX -8.18% , MKR -0.80% , LDO -6.99% , USDC -0.02% , PENDLE -1.69% , ETHE N/A% , MSTR -3.96% , ETHE N/A% , COIN -1.64% , HOOD, MARA -2.98% , RIOT -1.52% , WGMI N/A% , CLSK, WULF, IREN, CORZ, BTDR, BTBT, HUT, HIVE -0.88%