The Growing Case for ETH Outperformance in Q4

Key Takeaways

- Last week's optimistic outlook on easing liquidity hasn't fully materialized due to global economic weaknesses, but upcoming CPI data could pivot the market from fearing stagflation (bad for the coins) to a more crypto-friendly goldilocks scenario.

- Bearish market positioning in the short term, as indicated by options data and BTC delta skews, may offer bullish opportunities for contrarian investors, while pricier long-term call options suggest underlying long-term optimism.

- We posit that the filings for a U.S. spot Ether ETF, along with likely approvals for ETH futures ETFs, could drive short-term ETH outperformance, particularly as the BTC spot ETF decision may face further deferrals, shifting focus and demand toward ETH and related assets (ETHE, OP, ARB).

- Core Strategy – Despite recent asset price declines, the bearish market positioning—along with the possibility of near-term easing in U.S. dollar strength and the potential realization of various crypto-specific catalysts—leads us to skew toward staying allocated and buying on dips in anticipation.

The US Dollar Wrecking Ball Continues

Last week, our near-term outlook remained uncertain, though we leaned toward the possibility that a positive catalyst, such as a victory for Grayscale, could coincide with easing liquidity conditions. This would mark a significant departure from the tightening conditions—indicated by the DXY—that followed the last two crypto-specific catalysts this year.

The likelihood of interest rates reaching a peak, the dollar beginning to decline, and liquidity conditions finding a local low was supported by several factors: (1) ongoing softening in U.S. economic conditions, which is disinflationary; (2) the RRP’s continued drain back into the banking system, and (3) China’s addition of liquidity to the market.

Technically, all three of those things have happened, unfortunately, due to prevailing weaknesses in the global economy, the liquidity China has injected into the global market continues to diminish when denominated in USD. Encouraging economic data from either China or Europe could certainly help counteract the recent increase in interest rates and the DXY.

There is also a particular importance in next week’s CPI reading, as continued disinflation coupled with strong economic growth moves us from a stagflationary picture (bad for the coins) to goldilocks or a growth picture (good for the coins).

Good News: Market Positioning Has Turned Bearish

Options markets offer valuable insights into investor positioning. The more bearish the market positioning, the fewer marginal sellers there are to consider. Optimal trading opportunities often arise when the market leans heavily toward one side of a particular trade. While not a foolproof strategy, this should be a key consideration in any market analysis.

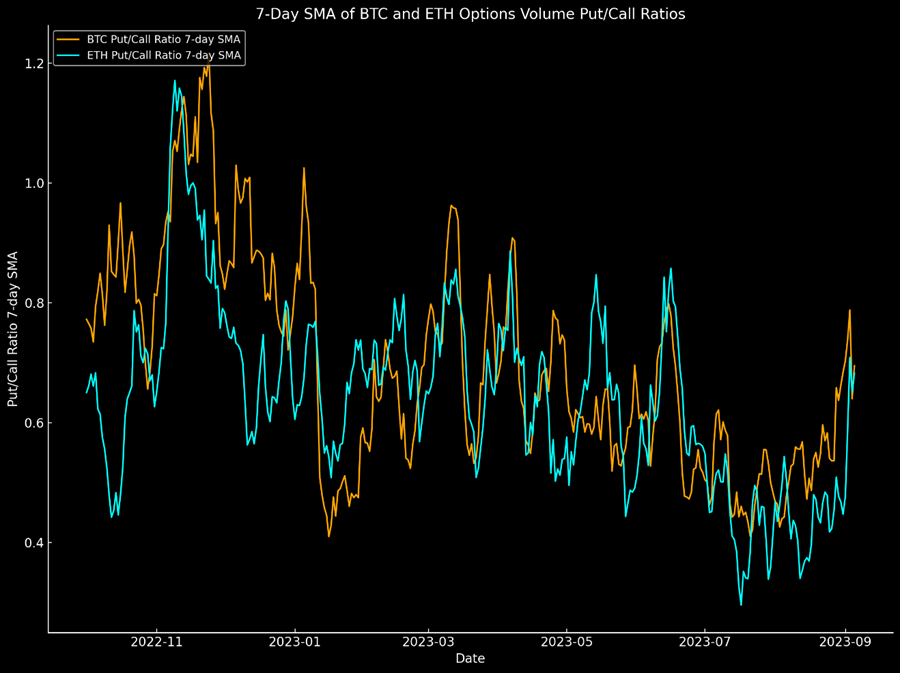

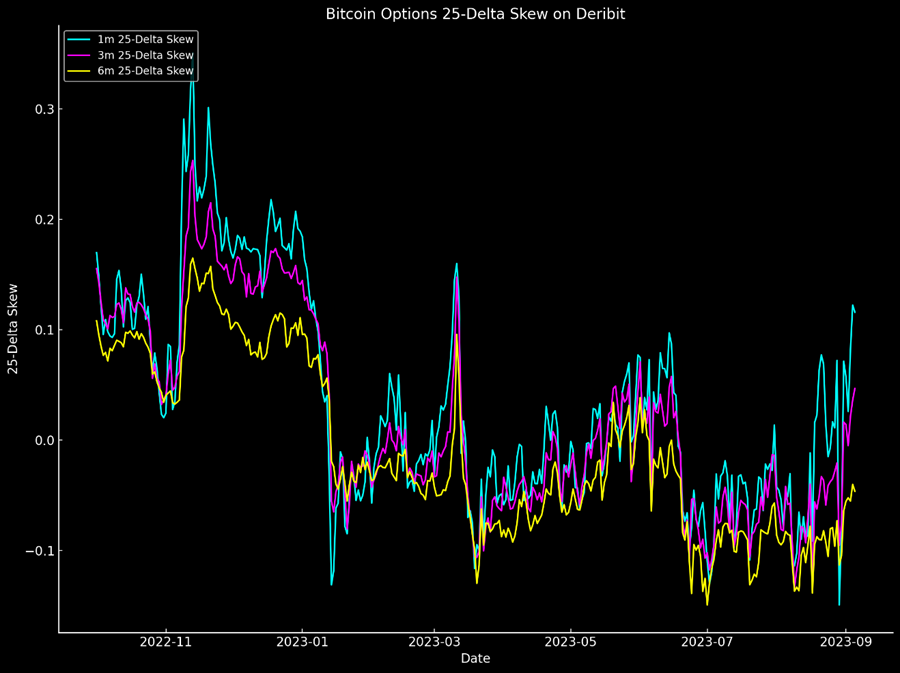

A significant increase in the volume of put-to-call options indicates that a larger proportion of option trading over the past several weeks has favored put options.

Moreover, the delta skews for BTC options reveal a greater demand for put options over call options in the 1-3 month timeframe. The 25-Delta Skew is calculated as the implied volatility of the 25-Delta put minus that of the 25-Delta call. A positive skew signifies bearish market sentiment, characterized by a higher demand for puts. Conversely, a negative skew indicates bullish sentiment, marked by a higher demand for calls. Intriguingly, call options remain more expensive for longer durations, suggesting that the market perceives the current downturn in the crypto sector as a short-term phenomenon.

Macro Correlations are Still There (And Never Really Left)

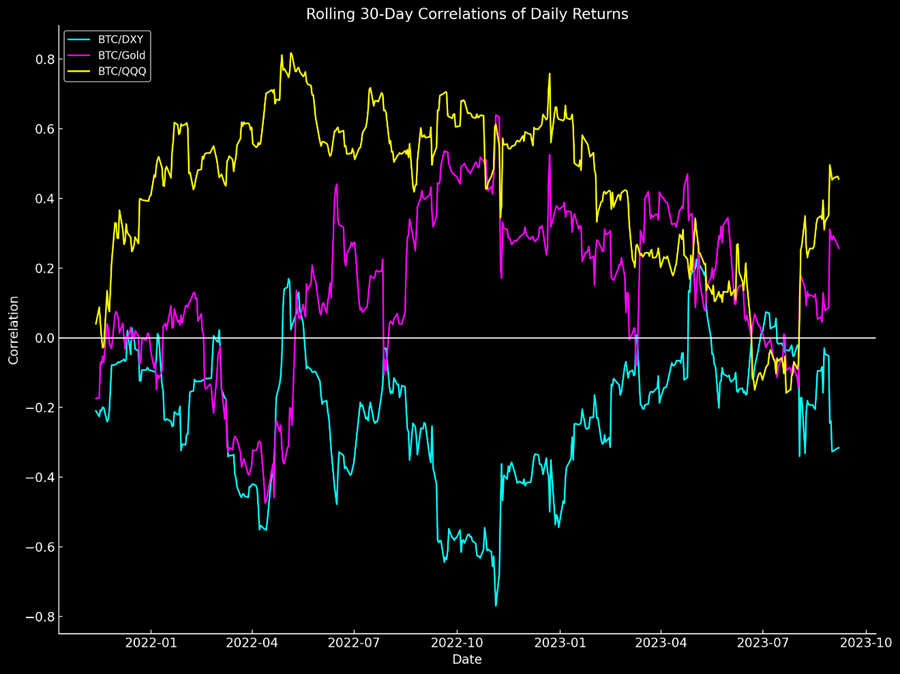

Many crypto investors may be questioning the importance of monitoring liquidity conditions, especially when the crypto market appears to be stagnant. It’s crucial to recognize that the correlations we’ve grown accustomed to over the past few years remain intact. In the absence of any crypto-specific catalysts, these correlations should be expected to persist.

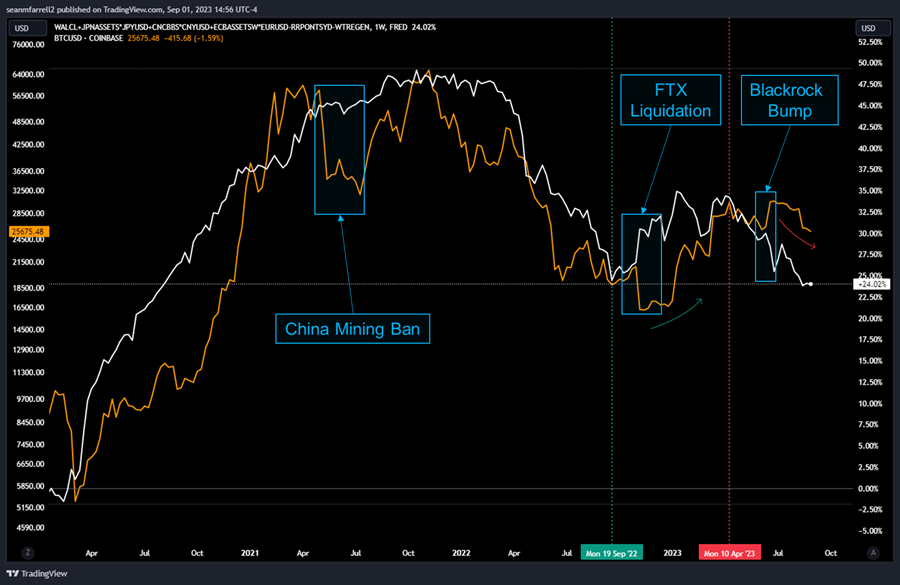

The chart below illustrates the balance sheet sizes of the Fed, PBOC, BOJ, and ECB over the past few years, plotted against BTC price. As we’ve emphasized before, BTC is particularly sensitive to USD liquidity conditions. When liquidity conditions improve, BTC prices are likely to outperform on the upside; conversely, if conditions tighten, BTC is expected to underperform. This relationship has remained fairly consistent over the years, except for when influenced by crypto-specific events.

There have been three major periods of deviation between crypto and macroeconomic factors in recent years, as shown in the chart below. These are:

- The China mining ban

- The fall of FTX

- Performance following BlackRock’s application for an ETF (one could also include Ripple’s legal victory, although its impact was more pronounced in the altcoin market)

Examining this observation with recent data, we find that after a few months of divergence from traditional markets, correlations with equities, gold, and the DXY are beginning to return for both ETH and BTC.

The Case for ETH Outperformance

As highlighted in yesterday’s FlashInsight, Ark Invest and 21Shares have submitted filings for the U.S.’s first spot Ether ETF, broadening their crypto product offerings. If approved, the ETF would be listed on the Cboe BZX Exchange. Though the filing didn’t reveal a ticker or fee structure, and the SEC has yet to comment, the move is undoubtedly a positive development for ETH, ETH-adjacent assets, and ETHE.

This development also elevates the importance of pending ETH futures ETF applications. SEC approval of an ETH futures ETF would effectively confirm ETH’s status as a commodity, as the SEC wouldn’t approve a futures-based ETF that tracks an unregistered security. Therefore, if both the ETH futures and BTC spot ETFs gain approval, we can be nearly certain that a spot ETH ETF will follow by early next year.

As indicated in the table below, key decision deadlines for the ETH futures ETFs are expected in October. We anticipate likely approvals around this timeframe, which would significantly boost interest in both ETH and ETHE.

This situation is likely to unfold alongside a probable further deferral of the BTC spot ETF timeline, with ARK’s final decision deadline set for January.

We think this scenario sets the stage for potential short-term $ETHBTC outperformance. Should more favorable macro conditions for crypto emerge, particularly during the traditionally bullish Q4 period, this trade could gain momentum. In such a scenario, ETH-adjacent names like OP and ARB would likely also benefit.

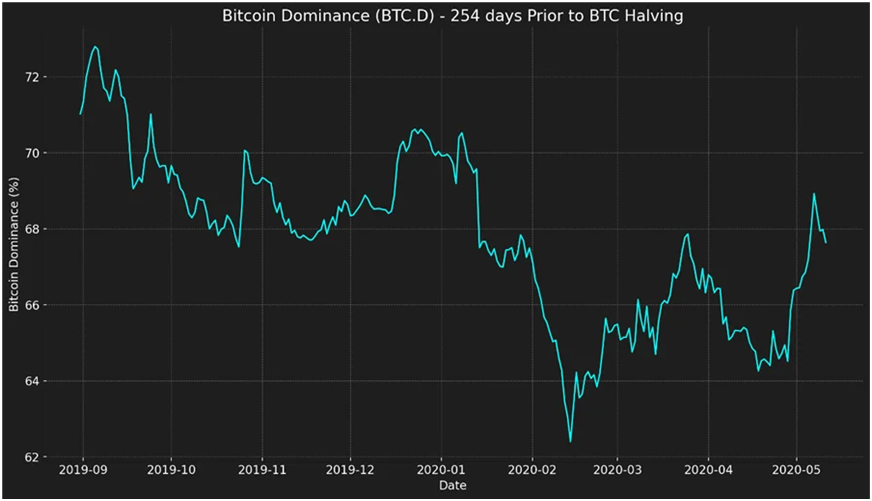

Before anyone argues that Bitcoin dominance surging pre-halving is a given, consider the chart below. It shows BTC dominance 254 days leading up to the last halving (the specific number of days is because this chart was originally created 254 days prior to the next halving). As evident, dominance actually decreased during this period, and it was only post-halving that Bitcoin saw sustained outperformance.

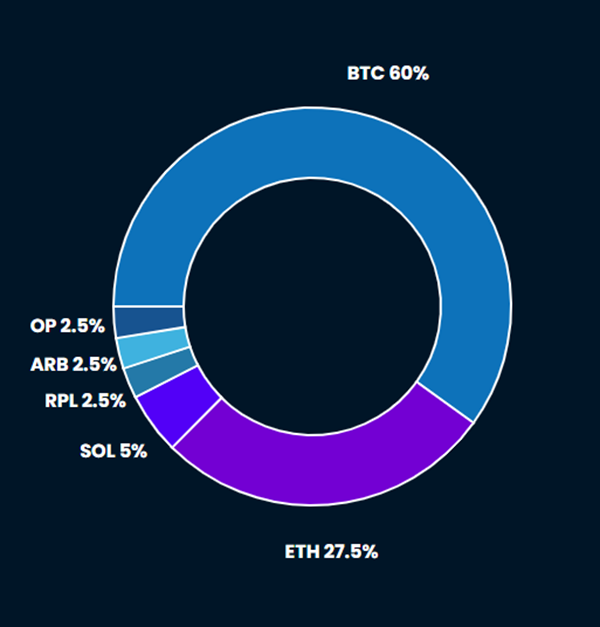

Core Strategy

Despite recent asset price declines, the bearish market positioning—along with the likelihood of near-term easing in U.S. dollar strength and the potential realization of various crypto-specific catalysts—leads us to recommend staying allocated and buying on dips in anticipation.

We also found that some might benefit from us listing a brief summary of our theses behind each component of the Core Strategy. We will include in our strategy notes going forward:

- Bitcoin ($BTC): Censorship-resistant money that serves as a liquidity sink in developed markets and base layer money in the global south. It is provably decentralized and can be used to build out a more robust, green energy grid throughout the globe. Potential catalysts include Grayscale vs. SEC, Spot ETF, the halving (April 2024), potential nation-state adoption (Argentina).

- Ethereum ($ETH): Distributed internet architecture whose proven use cases include the distribution of fiat currencies on global rails and a venue through which one can exchange digital assets globally in a permissionless fashion. Potential to supplant rent-seeking intermediaries via immutable smart contracts and digital ownership rights. Key catalysts include Futures ETF, Grayscale vs. SEC, bitcoin halving (indirect catalyst).

- Solana ($SOL): The monolithic competitor to Ethereum’s layered strategy. High throughput L1 relying on the eventual reduction in hardware costs to scale. Goal is to be a global shared state operating at the speed of light. A hated token due to affiliation with SBF but has proven resilient.

- Rocket Pool ($RPL): An ETH liquid staking provider who we think stands to benefit from: (1) an increase in total % of ETH staked over time, (2) a relative increase in liquid staking relative to the overall amount of ETH staked, and (3) being the only (for now) LSD token with utility beyond governance. We think that over time, the token should outperform if Rocket Pool is able to gain even a semblance of market share on Lido. Key Catalyst: Protocol upgrade slated for Q4.

- Optimism ($OP) & Arbitrum ($ARB): As ETH looks to scale in layers, more applications and users will migrate to layer 2 networks. The two leaders in this arena with publicly traded tokens are poised to outperform as we near EIP 4844.

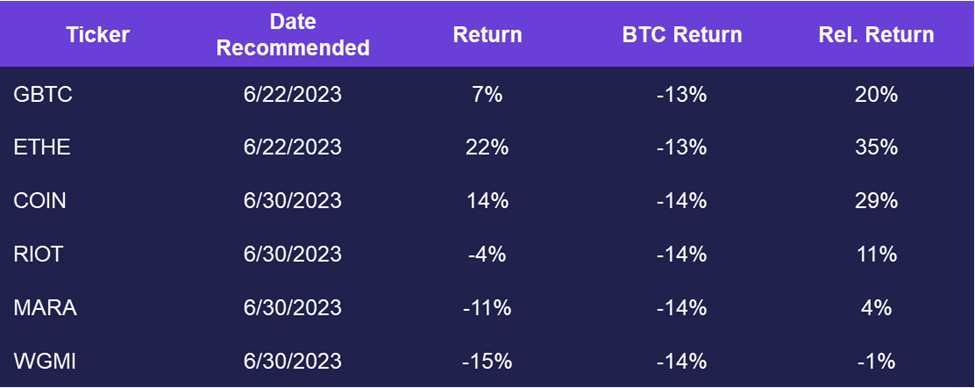

Active Crypto Equities Trades

Reports you may have missed

INFLOWS RESUME On Monday, market sentiments were rattled by a surprisingly strong manufacturing PMI figure, marking the first expansionary reading in 18 months. This led to a rise in rates, with risk assets across the board experiencing selloffs amid renewed inflation concerns and fears that the Federal Reserve might need to implement further measures to cool the economy. However, in our crypto comments video on Tuesday, we outlined a couple...

Adding RON and IMX As a Different Flavor of ETH-beta and Gaming Exposure (Core Strategy Rebalance)

MARKET SHRUGS AT HOT CPI The latest Consumer Price Index (CPI) data indicated a hotter inflationary environment than forecasted for February. Despite the surprise in the numbers, market participants appeared largely unmoved, suggesting that the potential impact had already been factored into their calculations prior to the release. This resilience reflects a broader sentiment that a rates-driven selloff, in response to the CPI figures, is not a significant near-term risk....

RESEND: Bitcoin ETF Equilibrium Price Dynamics: ETF likely to drive significant rise in daily demand

BY POPULAR DEMAND, WE ARE RE-SENDING THIS BITCOIN PRICE IMPACT OF SPOT ETF REPORT FROM JULY 24, 2023 The Bitcoin spot ETF was finally approved. And we are seeing the surge in price of Bitcoin because of attractive supply and demand dynamics.We received multiple requests to resend this report from July 24, 2023 which looked at supply and demand dynamics if a spot ETF was approved.In short, we believe a...