Crypto Market Update

Prices have whipsawed over the past 24 hours as we enter a pivotal week of macro data releases. BTC -0.70% is moving back toward $60k after dipping lower following the US market open, while ETH -0.21% is trading just below $2,700, and SOL -0.23% is attempting to reclaim the $150 level lost over the weekend. Among the top 100 assets, major outperformers include HNT 8.42% , which continues its recent surge, SUI -1.59% , which has doubled over the past seven days after potentially finding a bottom following its significant cliff unlock in early Q2, and APT N/A% , likely benefiting from its strong correlation to SUI -1.59% . Equities are mixed, with major indices effectively unchanged and most sectors in the red, despite the VIX dropping back below 20. Rates are lower, and gold is up, signaling a possible risk-off sentiment due to escalating global tensions over the weekend. The major event this week is the CPI release on Wednesday, but markets are also closely watching tomorrow’s PPI, retail sales on Thursday, and building permit and consumer sentiment data on Friday.

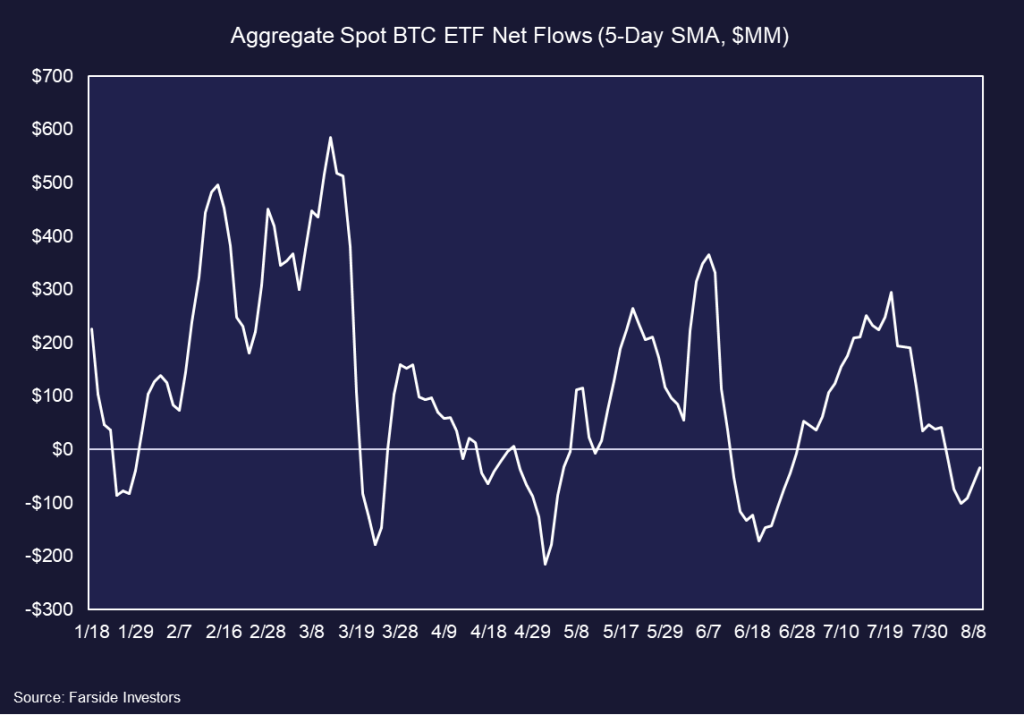

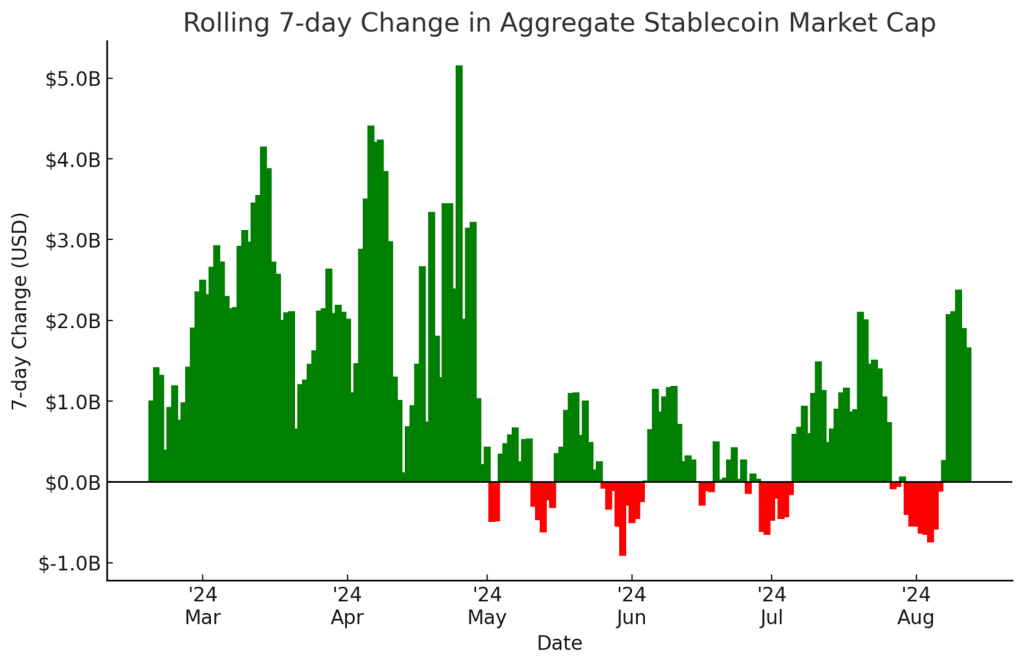

Spot ETFs Post Mixed Weekly Flows While Stablecoin Market Cap Rises

Last week, Spot BTC -0.70% ETFs experienced aggregate outflows of $167 million, though these outflows appear to have peaked on Friday, 8/2, just ahead of the market drawdown. Interestingly, the 5-day moving average for BTC -0.70% has started trending higher in recent days. In contrast, spot ETH -0.21% ETFs saw over $100 million in inflows, helping to support the partial recovery in the ETHBTC pair following the recent market turbulence. Overall, US spot ETFs experienced minimal outflows, which is fairly encouraging given the significant volatility and global uncertainty witnessed last week. Additionally, stablecoin flows have shifted in a decidedly bullish direction, with the total stablecoin market cap increasing by $1.6 billion over the past seven days, bolstered by over $1 billion in USDT minted on Thursday.

MARA to Issue Convertible Notes to Buy More BTC

Marathon Digital Holdings (MARA 0.32% ) has announced plans to privately offer $250 million in convertible senior notes, with the primary goal of using the proceeds to acquire additional bitcoin and support general corporate purposes. The notes, which will be unsecured and senior obligations of the company, will bear interest payable semi-annually and may be convertible into cash, shares of common stock, or a combination of both, at MARA’s discretion. The offering, subject to market conditions, also includes an option for initial purchasers to acquire an additional $37.5 million in notes. Proceeds will be used for acquiring more BTC -0.70% , as well as for other purposes such as working capital, strategic acquisitions, and debt repayment. This follows their $100 million purchase of BTC in July, and is likely to further its high-beta relationship to BTC price. It is interesting to see a miner pursue this strategy, since, while there is potential additional upside, this increases the level of same way risk for the company should BTC move lower, although according to their latest Q2, the company only had about $346 million in total debt, which is rather tame compared to historical debt levels.

As Mark Newton is on break, there will be no Technical Strategy section for this week. Mark will be returning on Tuesday, August 20th.

Daily Important MetricsAll metrics as of 2024-08-12 16:29:22 All Funding rates are in bps Crypto Prices

All prices as of 2024-08-12 16:33:50 Exchange Traded Products (ETPs)

News

|