Please note that this is the first monthly edition of Funding Friday and will continue on a monthly basis going forward.

Monthly Recap

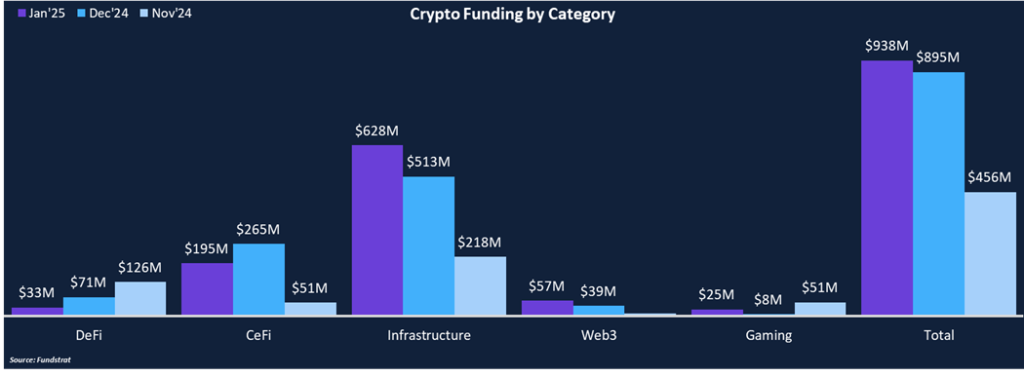

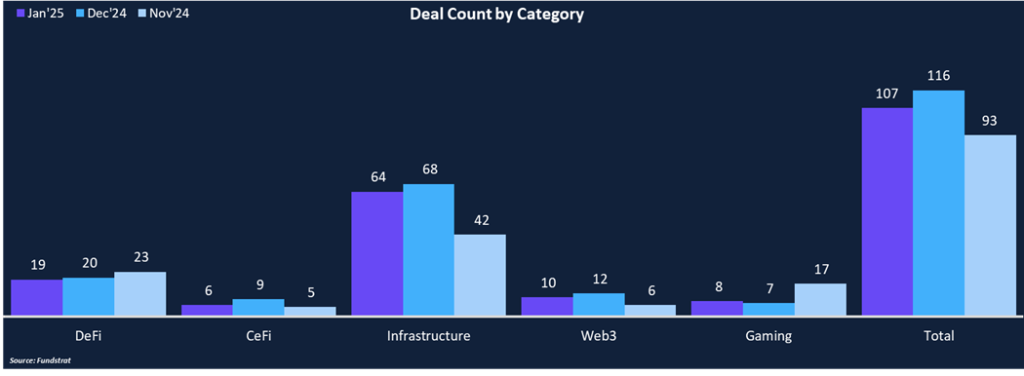

2025 started on a strong foot, with January funding rising 5% month-over-month to $938 million from $895 million in December, while the deal count decreased 8% from 116 to 107. Infrastructure was the leading category of January, totaling $628 million in funding across 64 deals, representing 67% of total funding and 60% of total deal count. Although there were only six CeFi deals in January, it was the second most funded category, with $195 million. CeFi’s total was helped by Phantom’s $150 Series C round and Sygnum’s $58 million Strategic round, two of the three largest deals in January. In contrast, DeFi was a laggard at the start of the year. It will be interesting to monitor if there’s a shift in funding from DeFi to CeFi projects this year as the regulatory picture becomes clearer.

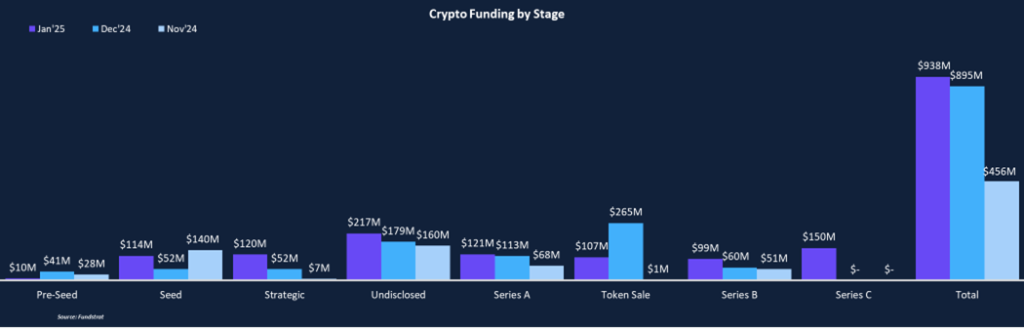

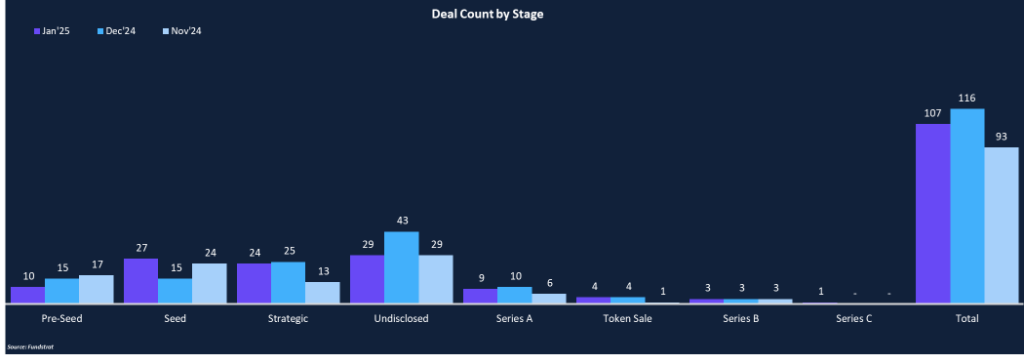

From a deal stage perspective, approximately half of January’s deals were seed or strategic rounds, comprising about a quarter of total funding. There were four token sales totaling $107 million, including a $75 million raise by Bluwhale, an AI personalization layer, and a $10 million raise by Trump-affiliated World Liberty Financial. January was the third consecutive month with three Series B deals, which were elusive for most of 2024. Although it only represented 3% of all deals, the Series B rounds made up 11% of total funding with an average deal size of $33 million.

Funding by Category

Funding by Stage

Deal of the Month

Phantom, a crypto wallet provider, raised $150 million in a Series C round co-led by Paradigm and Sequoia Capital. Other investors included a16z and Variant, and the investment round valued Phantom at $3 billion, positioning it to be one of the largest valuations of the year. For context, the largest valuation in 2024 was Monad’s $3 billion valuation. The funding will be used to accelerate crypto adoption and support Phantom in becoming the biggest and most trusted consumer finance platform.

Why is This Deal of the Month?

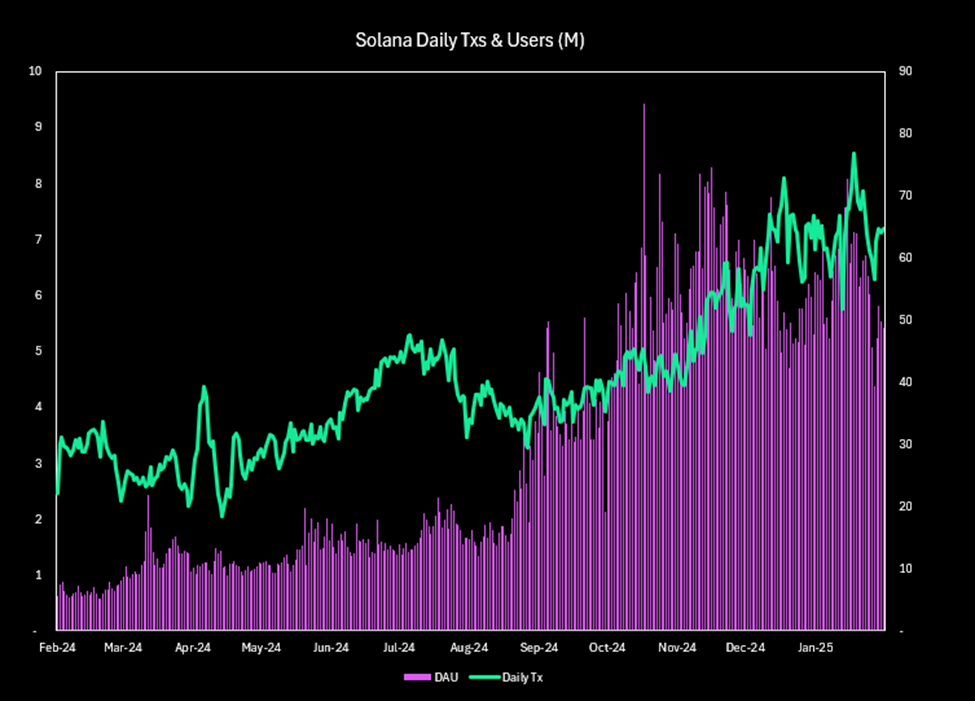

Phantom’s success has been linked with Solana’s over the past year. 2024 served as a success story for Solana as it provided the infrastructure for the crypto casino and became the preferred network among active crypto traders. Pump.fun helped proliferate activity with an easy, standardized way to launch tokens. Thousands of new tokens launch every day, and to top it off, the sitting President of the United States launched his own memecoin on the network. Solana has seen an impressive surge in daily active users and transactions.

Phantom has been one of the largest beneficiaries of increased Solana activity, as it has become the dominant wallet for Solana trading. Phantom’s community has grown and is equally impressive across various metrics:

- More than 15 million monthly active users.

- Over $20 billion in annual swap volume.

- 12 average app opens per day.

- 850 million total on-chain transactions.

- $25 billion in self-custodied assets.

Phantom ended 2024 on a high note, with its November and December active traders, trading revenue, and trading volumes exceeding the combined totals of Metamask and Coinbase Wallet by multiples. Beyond Solana, Phantom has integrated compatibility with other networks, including Ethereum, Bitcoin, Base, and Polygon., providing crypto natives with a wallet that can support all their assets in one app.

Phantom plans to use the fresh capital to accelerate its business plans and support broader crypto adoption. In 2024, Phantom acquired Bitski and Blowfish to make crypto safer and easier to use. Phantom hopes to continue making strategic acquisitions to enhance the user experience and bring more people on-chain. Towards the top of Phantom’s list is expanding its social discovery features and simplifying peer-to-peer payments.

January Selected Deals

Komainu, a Nomura-backed crypto custodian, raised $75 million in a Series B round led by Blockstream Capital Partners. Blockstream was the sole investor in the investment round and will have its CEO join Komainu’s board. The investment will be made in Bitcoin, and Komainu will establish a Bitcoin treasury status to manage the funds. Komainu was launched in 2018 as a joint venture between Nomura, Ledger, and CoinShares. Komainu provides digital asset custody, staking, and collateral management services. Komainu is regulated by the Jersey Financial Services Commission (JFSC), Dubai Virtual Assets Regulatory Authority (VARA), and holds an MLR registration with the UK Financial Conduct Authority (FCA) and an OAM registration in Italy. Komainu’s multi-jurisdictional regulatory licenses position it to provide enterprise-grade custody services globally and provide the confidence and assurance that assets are being held in a secure and compliant manner. Komainu supports custody for over 6,000 tokens across more than 40 blockchains. Pending regulatory approvals, Komainu will use the fresh capital to accelerate its global expansion and integration of Blockstream’s technologies for collateral management and tokenization.

Elastos, a blockchain infrastructure company, raised $20 million in a strategic round from Rollman Management. Rollman Management has made investments into notable projects like Ethereum, Solana, and Ripple, with ELA now being a top-five holding for the firm. The funding will fuel the launch of Elastos’ native Bitcoin DeFi protocol, Bel2, expand its merge-mined ELA token as a Bitcoin reserve asset, and accelerate Elacity – its web3 data marketplace that allows creators to monetize content without third-party intermediaries. Bel2 is set to launch in the second quarter, which allows Bitcoin holders to collateralize their native Bitcoin within non-custodial wallets and access smart contracts on Ethereum. Use cases include minting stablecoins, performing swaps, and peer-to-peer borrowing. This is a huge capital unlock from the Bitcoin ecosystem without the need for wrapped Bitcoin or other synthetic assets. Bel2 combines locking scripts, zk proofs, oracles, and an arbiter network where ELA stakers can earn BTC fees for running decentralized nodes.

Humanity Protocol, a decentralized identity protocol, raised $20 million in an investment round led by Pantera Capital and Jump Crypto, bringing Humanity’s fully diluted valuation to $1.1 billion. Humanity Protocol will use the funding to integrate into more platforms and build out its proof of humanity and human ID infrastructure. Humanity Protocol provides infrastructure so that humans across the globe can verify their digital identities and reduce the number of cases of identity fraud. Users can scan their palms to authenticate their identities and retain full control of their personal data. Humanity plans to expand its operations with further partnerships, developer grants, and community-building efforts ahead of the protocol’s mainnet launch. Humanity is expected to launch mainnet sometime in 2025 and will be one of Worldcoin’s largest competitors.