Weekly Recap

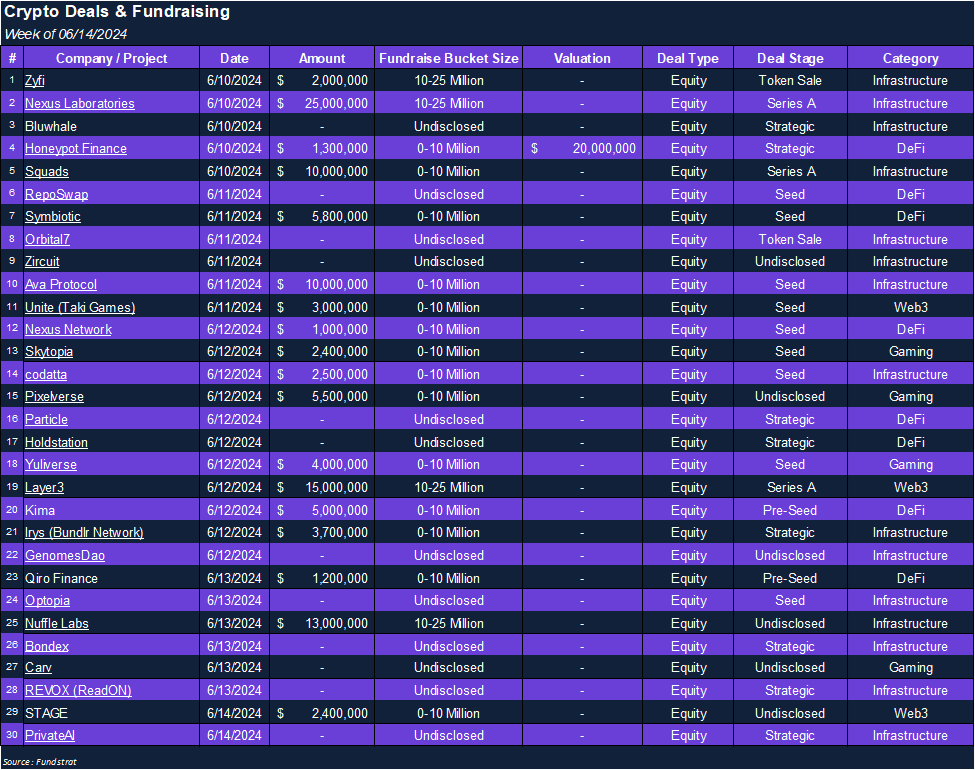

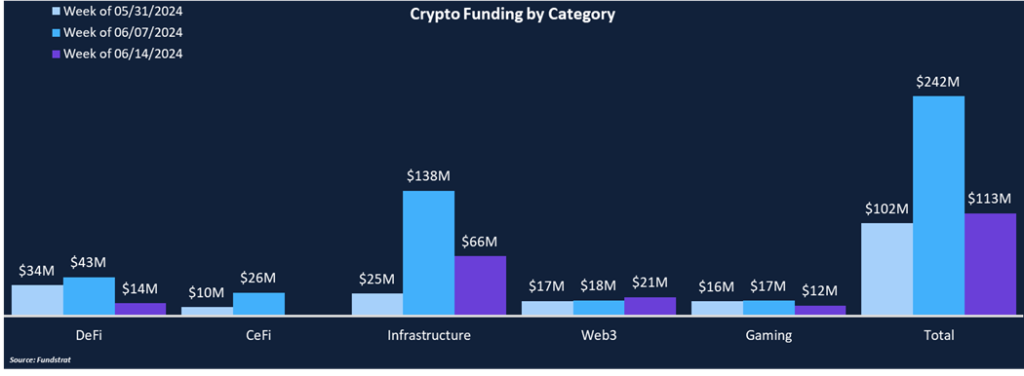

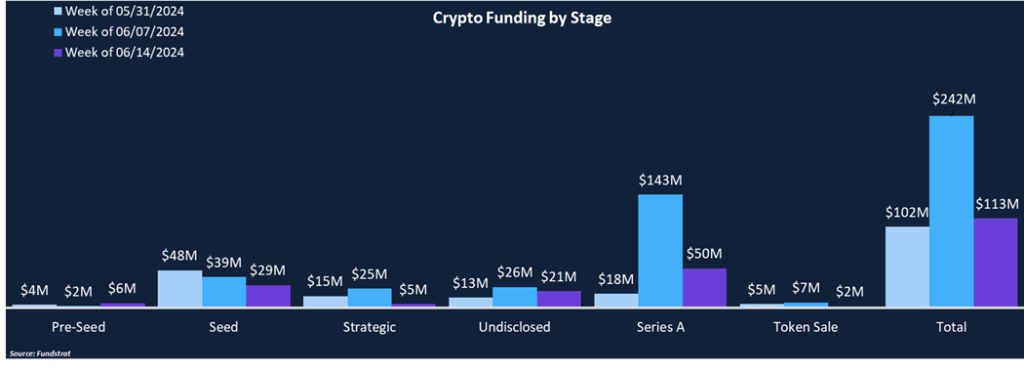

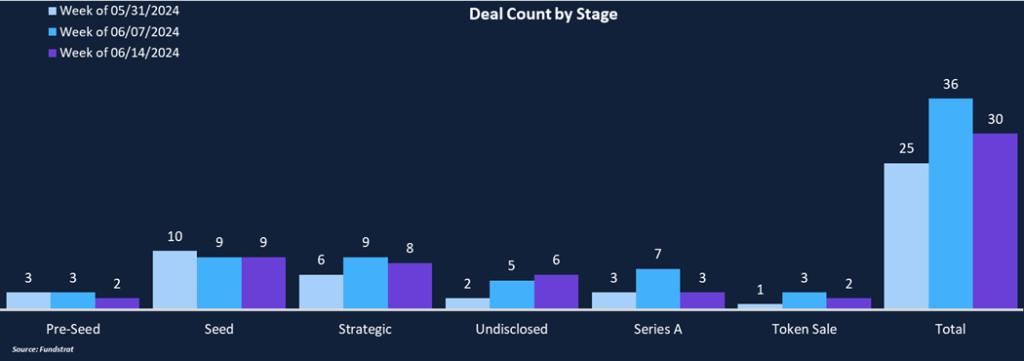

This week’s $113 million in funding was less than half of last week’s $242 million, although the deal count showed a more modest 17% drop to 30 deals. Infrastructure continues to be the most popular investment category. Infrastructure’s $66 million in funding was stapled by Nexus Labs and Nuffle Labs’ $25 million and $13 million respective investment rounds. After tallying a few deals in the previous two weeks, CeFi projects did not garner any investment this week, as the category remains a laggard.

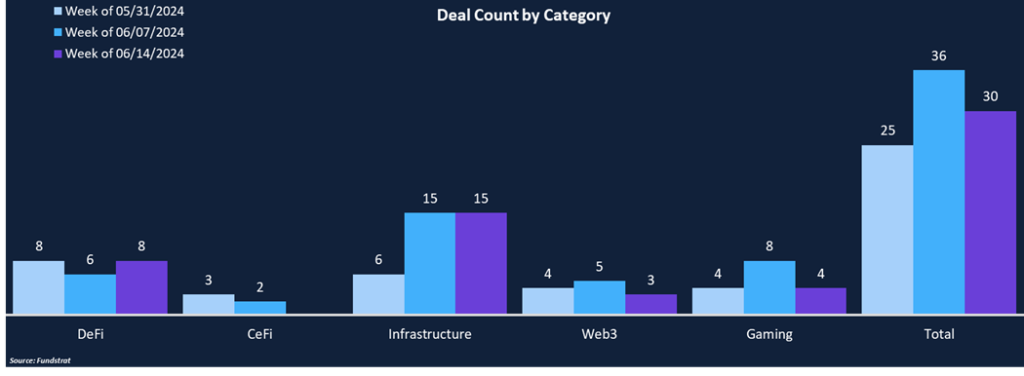

From a funding perspective, Series A was the leading deal stage, totaling $50 million across three deals, including Ava Protocol, our Deal of the Week. Seed rounds had the second most funding ($29 million) and were the most popular in terms of deal flow (9). There were two token sales this week, including Zyfi, who is building an account abstraction protocol on ZkSync.

Funding by Category

Funding by Stage

Deal of the Week

Ava Protocol, an EigenLayer Actively Validated Service (AVS) focused on Web3 automation, raised $10 million in a seed round with investor participation from Electric Capital, Shima Capital, Taisu Ventures, and others. The funding will be used to expand its operations and technology stack.

Why is This Deal of the Week?

A recurring theme throughout Funding Friday is the focus of many development teams on improving the crypto user experience to the point where it feels like using a regular mobile app. Over the last few months, intents-based solutions have grown in popularity as an innovative way to transact. Ava Protocol (formerly OAK Network) is taking the same approach with its intent-centric infrastructure, focusing on supporting private, optimized, autonomous transactions.

Ava uses “super-transactions” that combine multiple smart contract calls into a single operation, allowing for execution of complex workflows. Its super transactions are enhanced with MEV protections and increased confidentiality. Ava hopes to improve the web3 industry with things like scheduled and recurring payments, stop-loss orders, streaming rewards, and more. Super transactions execute based on triggers such as time, price changes, and smart contract updates. With secure and efficient automatic transactions, Ava Protocol hopes to bring simplicity and a more pleasurable experience to all Defi users. Ava Protocol is currently in its testnet phase with plans to launch its native token, AP, in conjunction with its mainnet launch.

Selected Deals

Layer3, a token distribution protocol, raises $15 million in a Series A round led by ParaFi and Greenfield Capital. Other investors included Electric Capital, Immutable, Lattice, Tioga, LeadBlock, and Amber. Layer3 acts as an incentivized middleware for protocols to attract and retain users. Layer3 serves as a unified access point for different networks, projects, and ecosystems where projects can leverage user activity to effectively identify and distribute tokens. Layer3 has accumulated over 1 million active users across 25 different blockchains. The funding round will help them bolster operations and initiatives ahead of its token launch this summer.

Symbiotic, a restaking protocol, raised $5.8 million in a seed round with participation from Paradigm and Cyber Fund. Led by Lido’s co-founders, Symbiotic is a major competitor to EigenLayer. Symbiotic’s permissionless retaking system coordinates node operators and economic security providers. Symbiotic provides a flexible and modular design, offering unparalleled control over their restaking implementation. Network builders can set customized aspects such as collateral assets, asset ratio, node operator selection, and slashing mechanism. Such adaptability enables users to opt in and out of shard security arrangements in coordination with Symbiotic. Symbiotic also allows for multi-asset restaking, expanding the amount of eligible collateral, providing capital efficiency, and reinforcing trust. Symbiotic has accumulated over $239 million in TVL after launching earlier this week.

Nexus Labs, a zkVM protocol, raised $25 million in a series A led by Lightspeed Venture Partners and Pantera Capital, with participation from Blockchain Builders Fund, DragonFly Capital, and Faction. Nexus Laboratories, led by its founder and CEO Daniel Marin, aims to bolster trust in the blockchain by leveraging zero-knowledge proofs. These proofs allow one party to prove the truth of a piece of data without revealing the underlying information. The Nexus 1.0 zkVM is a modular zkVM written in Rust language, focusing on performance and security. Nexus’ zkVM will make large-scale verifiable computing accessible and efficient in dApps while maintaining security.