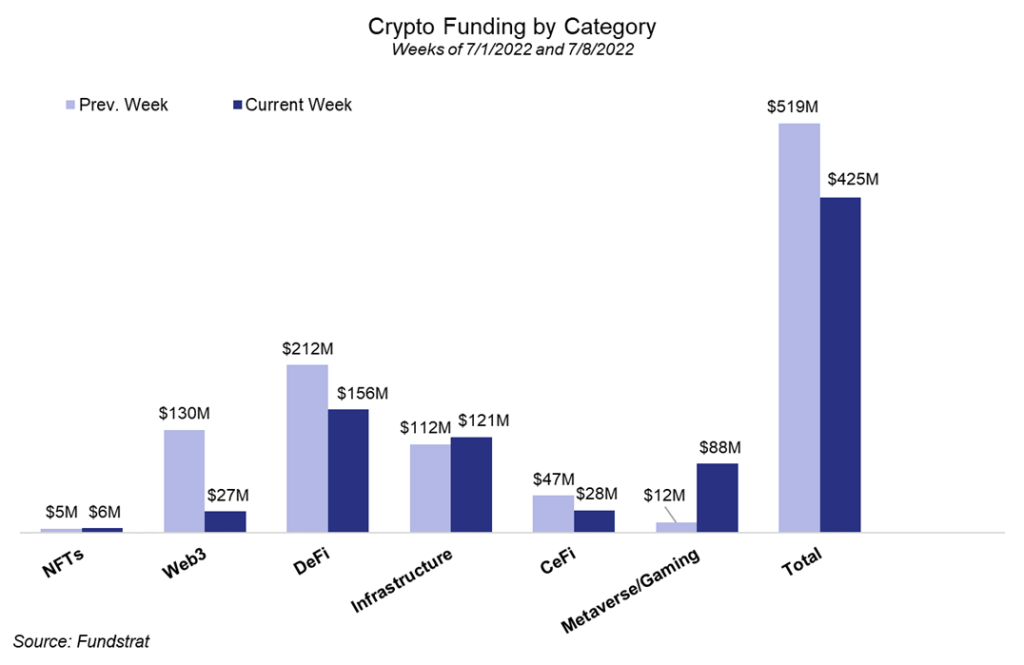

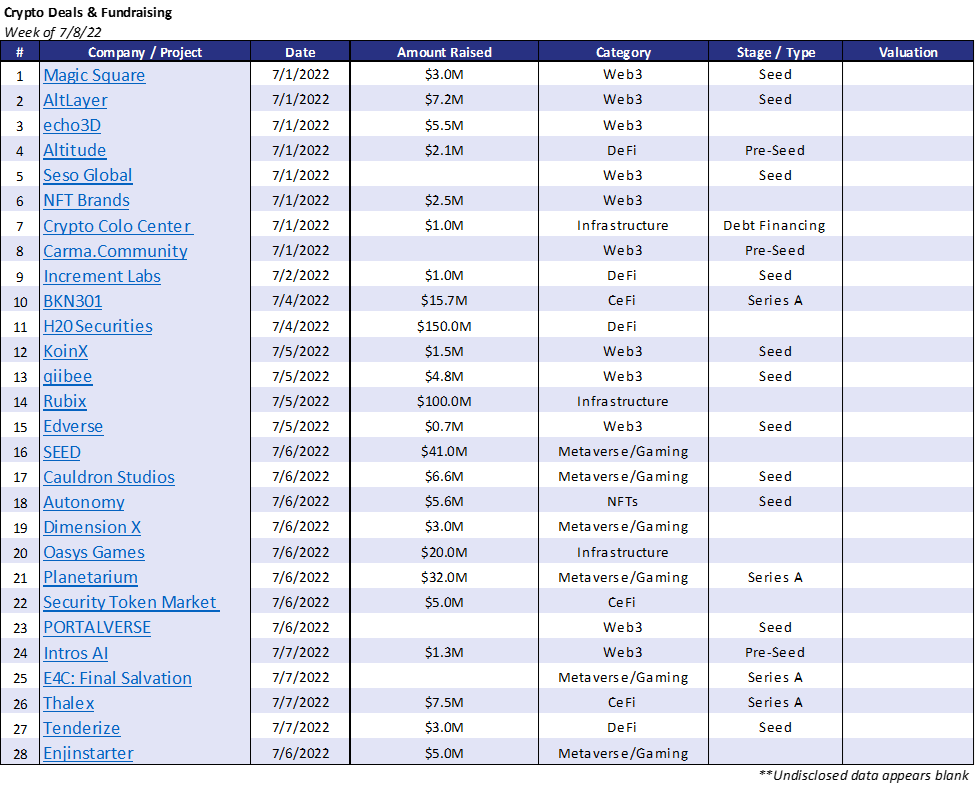

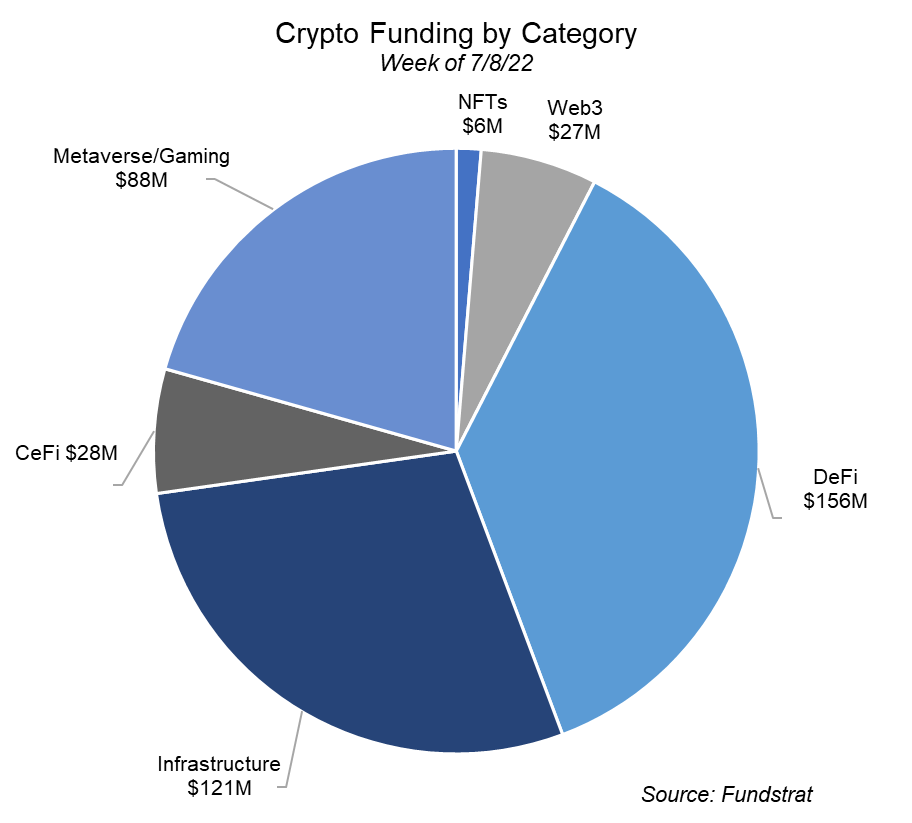

Funding declined this week, dropping from $519M to $425M, but total deals remained at 28 each week. This week’s most considerable increase in funding was in the Metaverse/Gaming sector, which increased 7x from $12M to $88M. There were six total gaming deals, the largest of which being a $41MM Series C funding round for Klang Games to develop SEED, an MMO (Massively Multiplayer Online Game) that allows users to participate in a virtual world with a self-governed, player-driven economy. Web3, DeFi, and CeFi all saw funding declines while infrastructure funding increased. NFT funding has been the lowest funded sector the past two weeks and stayed relatively unchanged. Three sizable funds were raised this week: Konvoy Ventures raised $150M, Sequoia Capital China raised $8B, and OP Crypto raised $100M.

Most of the dealmaking remains in the early stages. Seed round deals saw the most activity at 61%, up from 55.6% last week. Pre-seed and Series A deals were 16.7% and 22.2%, respectively, and Series B and Series C deals each accounted for 5.6%.

Deal of the Week

AltLayer, a flexible and versatile scaling solution for Web3, raised $7.2M in a Seed funding round led by Polychain Capital, Breyer Capital, and Jump Crypto. The round also saw participation from investors such as Balaji Srinivasan, former Coinbase CTO, and a16z general partner; Gavin Wood, Ethereum co-founder and Polkadot founder; and Kain Warwick, co-founder of Synthetix. AltLayer was founded by Yaoqi Jia, the co-founder of blockchain firm Zilliqa, and is designed to assist developers in setting up a disposal layer to withstand surges in traffic (such as the ones seen during NFT mints). The developers can set up a rollup secured by a Layer 1 protocol such as Ethereum and dispose of it when the traffic returns to normal. The firm aims to launch a testnet in the third quarter of the year.

Why is this the Deal of the Week?

This deal is not only backed by some of the brightest minds in the industry, but it also takes a unique approach to blockchain scaling. General-purpose chains such as Ethereum force decentralized applications to compete for blockspace, leading to congestion or higher fees. Application-specific chains allow each DApp to have its own chain, but this can result in an unnecessary waste of resources. AltLayer takes the best of each approach and will enable DApps to have the flexibility and convenience of an application-specific chain, while also being resourceful. AltLayer’s initial focus will be the gaming, NFT, and metaverse sectors.

Selected Deals

H20 Securities specializes in water plant operations with the aim to solve water scarcity. Its token (H 2.72% 2ON) provides individuals with the ability to invest in water infrastructure through the use of DeFi and blockchain technology. It has raised $150M in funding from Gem Digital.

Planetarium Labs is a Web3-based company that focuses on providing a decentralized blockchain gaming platform. The company has secured $32M in funding through its Series A round led by Animoca Brands with participation from Samsung Next, Wemade, and Krust Universe, the investment division of South Korean instant messaging platform KakaoTalk.

Rubix is a Web3 blockchain protocol that provides a peer-to-peer (P2P) platform for efficient data transfers and transactions. The company has secured $100M in funding from LDA Capital. This investment will contribute to developing educational opportunities and maximize growth for the platform.

Thalex is a stablecoin-settled cryptocurrency derivatives exchange that allows customers to trade options, perpetuals, and futures. The platform has received $7.5M (EUR) in funding through its Series A round. Participants include Bitfinex, Bitstamp. Flow Traders, IMC Trading, QCP Capital, and Wintermute.

Klang Games, a game development studio, has secured $41M in funding to develop SEED. This massive multiplayer online (MMO) game allows players to interact with virtual humans driven by artificial intelligence (AI). Lead investors in the deal were Kingsway Capital and Animoca Brands, with participation from Anthos, Supercell, AngelHub, Novator, Roosh Ventures, and New Life Ventures.