Fundstrat Head of Research Tom Lee’s mantra of late – “Just get through August” – has borne fruit. Much of the last week of the last month of summer was dominated by expectations, and then digestion of, earnings from Nvidia, the poster child for the popularity and power of AI.

As Lee reminded us, “Pundits said ‘as goes NVDA 1.78% , so goes the market’, and this is why stocks, in our view, were so soft on Wednesday. Investors expected the entire market to follow NVDA in either direction.” Post-EPS, the largest stock (NVDA) in the S&P 500 fell 6%. Yet in his view, it is a sign of market strength that despite this, the S&P 500 managed to end on a positive note.

Head of Data Science “Tireless” Ken Xuan concurs. During our weekly research huddle, he also said, “I think Nvidia’s post-earnings price action was an over-reaction,” following up with some color: “The NVDA results were solid. Revenue growth is slower than before, but the gross is still pretty strong”. Referring to the company’s ambitious plans for a $50 billion share buyback, Xuan said, “the only share buyback that I can think of that was larger than Nvidia’s was Apple’s $100B buyback”.

Addressing a point of interest for many investors, Xuan spoke of another much-discussed stock, saying, “I read the SMCI short-seller report; the delay of the 10K is telling the market that something is wrong; it appears people are questioning the overall story of AI, and this is not the first time there have accusations of fraud in the AI sphere.” He noted that, in a sense, companies such as SMCI and Dell are all living in NVDA’s world. He concluded by saying that “buying the dip is tricky now“.

Head of Technical Strategy Mark Newton’s did not disagree with Xuan’s caution but suggested that “any large pullback would be something you want to own“, noting that NVDA cycles move higher into October and then see a pullback. In terms of the market as a whole, Newton remarked that “the market is looking past NVDA and more to the Fed’s rate cuts”. While acknowledging that, based on cycles and sentiment, we may see consolidation soon, Newton also pointed out that “the VIX in the low teens is going to be a steal between now and November” and reminded us that “fortune favors the bold“.

We hope you are enjoying a happy and safe Labor Day Weekend.

Chart of the Week

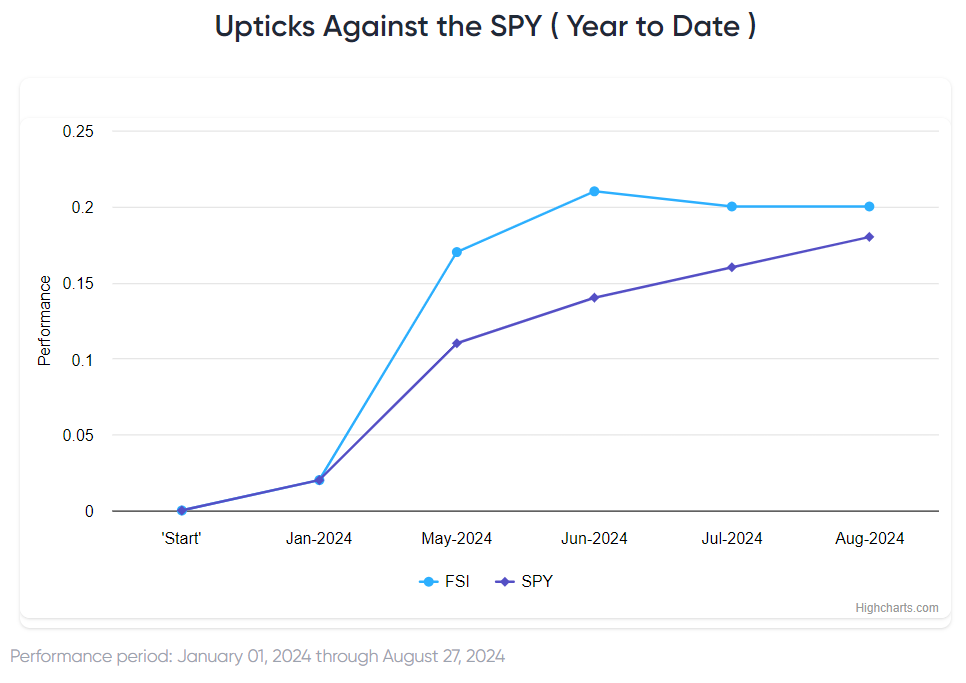

While many investors sought signal for the broader S&P 500 from Nvidia’s results, Head of Research Tom Lee asserted that small-caps (IWM 1.66% ) could be the better bet post-Nvidia’s earnings. We see this in our Chart of the Week, and also in what Head of Technical Strategy Mark Newton described as “a nice bounce” after Nvidia’s latest quarterly report. Newton said his analysis of this post-Nvidia bounce sees the likelihood of continued advances in small-caps for at least the next two weeks.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

8/26 10:00 AM ET: Jul P Durable Goods OrdersMixed8/26 10:30 AM ET: Aug Dallas Fed Manuf. Activity SurveyTame8/27 9:00 AM ET: Jun S&P CoreLogic CS home priceTame8/27 10:00 AM ET: Aug Conference Board Consumer ConfidenceTame8/29 8:30 AM ET: 2Q S 2024 GDPTame8/30 8:30 AM ET: Jul PCE DeflatorTame8/30 10:00 AM ET: Aug F U. Mich. Sentiment and Inflation ExpectationTame- 9/3 9:45 AM ET: Aug F S&P Global Manufacturing PMI

- 9/3 10:00 AM ET: Aug ISM Manufacturing PMI

- 9/4 8:30 AM ET: Jul Trade Balance

- 9/4 10:00 AM ET: Jul JOLTS Job Openings

- 9/4 10:00 AM ET: Jul F Durable Goods Orders

- 9/4 2:00 PM ET: Fed Releases Beige Book

- 9/5 8:30 AM ET: 2Q F Non-Farm Productivity

- 9/5 8:30 AM ET: 2Q F Unit Labor Costs

- 9/5 9:45 AM ET: Aug F S&P Global Services PMI

- 9/5 10:00 AM ET: Aug ISM Services PMI

- 9/6 8:30 AM ET: Aug Non-Farm Payrolls

Stock List Performance

In the News

[fsi-in-the-news]