Last week was a tumultuous one, with strong gains during and immediately after a meeting of the Federal Open Markets Committee, followed by a sharp Friday sell-off that Fundstrat Head of Research Tom Lee unequivocally described as “ugly.” In addition to sharp declines in equities (all three major indices), we saw the VIX (volatility index) surge to nearly 29 before retreating to end the week around 23 – still highly elevated.

This seems to have been driven in large part by labor-market numbers that some interpreted as foreshadowing a broader economic downturn. Federal Reserve Chair Jerome Powell addressed this topic after Wednesday’s meeting of the Federal Open Market Committee (FOMC), telling reporters “we’re watching really carefully for” any signs pointing to a “sharper downturn in the labor market.” He later reiterated that “I would not like to see material further cooling in the labor market.”

Possibly with those remarks in mind, investors greeted Friday’s jobs report with dismay. To Lee, it was an overreaction. “Markets tend to have a ‘fire-ready-aim’ response to negative surprises,” he noted. “In my view, the July jobs report is consistent with a soft landing,” he asserted.

Lee also posed a rhetorical question: “Has the economic picture deteriorated so much in the last two days so as to justify a 10% drawdown in both small caps and the Nasdaq 100?” In his view, “that hardly seems to be the case. We don’t see the economic picture as being incrementally that different today [Friday] than it was at the beginning of the week,” and on Friday evening, Lee found signs – suggestive but admittedly inconclusive for now – that much of the jobs-number miss might have been associated with Hurricane Beryl and its aftermath.

Lee’s intermediate- and long-term equities outlook remains constructive. Yet in the near-term, he suggests patience. “Time is required to let the selling get done as investors de-risk. The selling of the last few days cannot reverse instantly. Keep in mind that opportunities emerge when markets panic. And in the coming days, this is the opportunity that emerges.”

Sector Allocation Strategy

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton – part of the August 2024 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

Chart of the Week

Arguably the biggest impact of the declining numbers in Friday’s jobs report will be its effect on Fed policy. A look at Fed funds futures trading suggests that the market is also trying to figure out what the week’s job numbers might mean for the Fed’s next steps. The FOMC on Wednesday had signaled the possibility of a rate cut in September, and after the U.S. jobs report was released on Friday, the odds of a 50-bp rate cut in September (as opposed to the customary 25 bp) surged to over 73%. (We can see this in our Chart of the Week):

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

7/29 10:30 AM ET: Jul Dallas Fed Manuf. Activity SurveyTame7/30 9:00 AM ET: May S&P CoreLogic CS home priceTame7/30 10:00 AM ET: Jul Conference Board Consumer ConfidenceTame7/30 10:00 AM ET: May JOLTS Job OpeningsTame7/31 8:30 AM ET: 2Q ECI QoQTame7/31 2:00 PM ET: Jul FOMC DecisionTame8/1 8:30 AM ET: 2Q P Nonfarm ProductivityTame8/1 8:30 AM ET: 2Q P Unit Labor CostsTame8/1 9:45 AM ET: Jul F S&P Global Manufacturing PMITame8/1 10:00 AM ET: Jul ISM Manufacturing PMITame8/2 8:30 AM ET: Jul Jobs ReportTame8/2 10:00 AM ET: Jun F Durable Goods OrdersTame- 8/5 9:45 AM ET: Jul F S&P Global Services PMI

- 8/5 10:00 AM ET: Jul ISM Services PMI

- 8/6 8:30 AM ET: Jun Trade Balance

- 8/7 9:00 AM ET: Jul F Manheim Used vehicle index

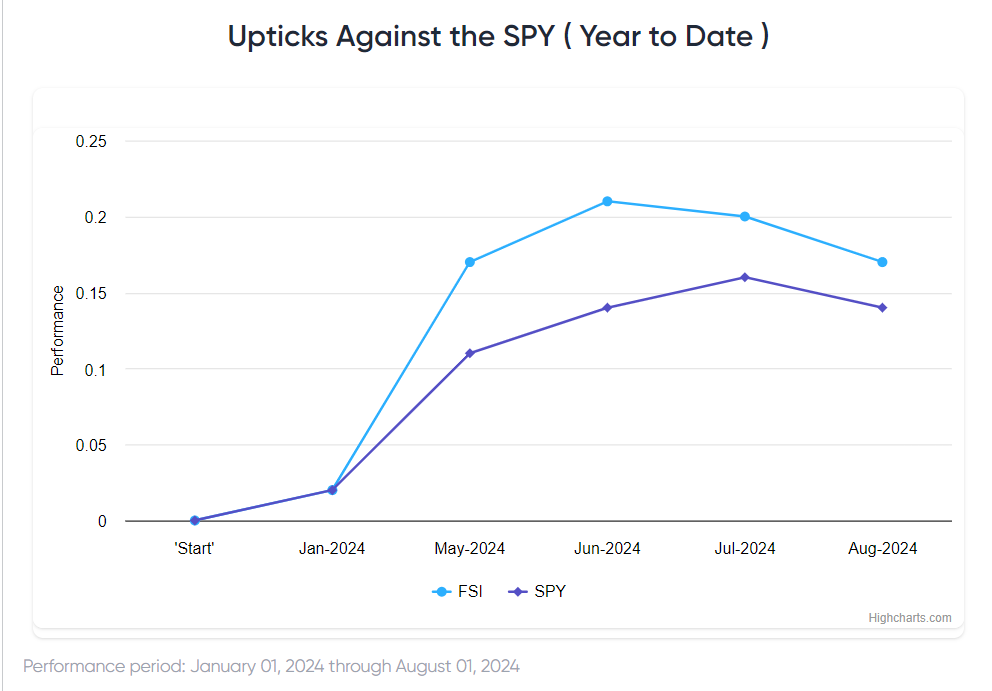

Stock List Performance

In the News

[fsi-in-the-news]