A daily market update from FS Insight — what you need to know ahead of opening bell

“Ability will never catch up with the demand for it.” — Confucius

Overnight

Nasdaq hits record to kick off the second half of 2024 WSJ

Chewy shares fall nearly 7% for Monday as the boost from Roaring Kitty’s new stake diminishes CNBC

Boeing agrees to buy Spirit AeroSystems in $4.7bn deal FT

Hurricane Beryl churns toward Jamaica as Category 5 storm CNN

Silvergate, of crypto infamy, sued by SEC for securities fraud MW

Ron Howard and Brian Grazer’s Imagine Entertainment seeks buyer WSJ

U.K. film-tech group DNEG valued at $2bn after Abu Dhabi fundraising FT

U.K. startups turn to Silicon Valley to fill void left by risk-averse pension funds FT

The foreign investors left stranded in Evergrande’s web of Chinese debt FT

China’s central bank moves to address bond frenzy FT

Chinese brokers launder hundreds of millions for global crime groups FT

Shein, Temu are swamping airfreight capacity, sending rates soaring WSJ

Bundesbank chief calls for German tax cuts to boost investment FT

BlackRock enters booming market for stock ETFs with a 100% hedge BBG

A real-estate fund industry is bleeding billions after Starwood capped withdrawals WSJ

Frequent trading and overdiversification lead to poor investment strategies IW

Why cheap toilet paper sets off alarm bells among some investors WSJ

Air France-KLM flags financial hit from tourists avoiding Paris Olympics FT

‘NEETS’ and ‘new unemployables’ — why some young adults aren’t working CNBC

Citi was money launderers’ preferred bank, say U.S. law enforcement officials FT

H.I.G. fraud case against Audax allowed to proceed WSJ

UniCredit files legal challenge to ECB order on Russia dealings FT

Meta hit with E.U. charges over targeted advertising WSJ

Chart of the Day

MARKET LEVELS

| Overnight |

| S&P Futures -24

point(s) (-0.4%

) Overnight range: -26 to +1 point(s) |

| APAC |

| Nikkei +1.12%

Topix +1.15% China SHCOMP +0.08% Hang Seng +0.29% Korea -0.84% Singapore +0.88% Australia -0.42% India -0.07% Taiwan -0.78% |

| Europe |

| Stoxx 50 -0.96%

Stoxx 600 -0.64% FTSE 100 -0.27% DAX -1.01% CAC 40 -0.8% Italy -1.11% IBEX -1.55% |

| FX |

| Dollar Index (DXY) +0.07%

to 105.98 EUR/USD -0.25% to 1.0713 GBP/USD -0.13% to 1.2633 USD/JPY +0.11% to 161.64 USD/CNY +0.04% to 7.2713 USD/CNH +0.04% to 7.3081 USD/CHF +0.17% to 0.9042 USD/CAD -0.03% to 1.3732 AUD/USD -0.15% to 0.665 |

| Crypto |

| BTC -1.03%

to 62583.56 ETH -0.58% to 3443.55 XRP +0.92% to 0.4815 Cardano +0.96% to 0.4091 Solana +1.18% to 148.25 Avalanche -1.81% to 28.27 Dogecoin -1.04% to 0.1235 Chainlink +1.21% to 14.67 |

| Commodities and Others |

| VIX +4.26%

to 12.74 WTI Crude +0.82% to 84.06 Brent Crude +0.77% to 87.27 Nat Gas -0.28% to 2.47 RBOB Gas +1.0% to 2.604 Heating Oil +0.89% to 2.638 Gold -0.27% to 2325.65 Silver -0.47% to 29.31 Copper +0.27% to 4.439 |

| US Treasuries |

| 1M -1.1bps

to 5.3567% 3M -0.9bps to 5.3474% 6M -2.5bps to 5.2936% 12M -1.1bps to 5.0927% 2Y +0.2bps to 4.7578% 5Y -0.7bps to 4.419% 7Y -0.8bps to 4.4257% 10Y -0.4bps to 4.4573% 20Y -0.1bps to 4.7296% 30Y -0.3bps to 4.6208% |

| UST Term Structure |

| 2Y-3

M Spread narrowed 2.2bps to -63.1

bps 10Y-2 Y Spread narrowed 0.4bps to -30.3 bps 30Y-10 Y Spread widened 0.0bps to 16.1 bps |

| Yesterday's Recap |

| SPX +0.27%

SPX Eq Wt -0.81% NASDAQ 100 +0.66% NASDAQ Comp +0.83% Russell Midcap -0.86% R2k -0.86% R1k Value -0.64% R1k Growth +0.94% R2k Value -1.04% R2k Growth -0.68% FANG+ +2.26% Semis +0.12% Software +0.51% Biotech +0.36% Regional Banks -0.47% SPX GICS1 Sorted: Tech +1.3% Cons Disc +0.73% SPX +0.27% Fin +0.22% Comm Srvcs +0.1% Energy +0.02% Healthcare -0.56% Cons Staples -0.67% Utes -0.69% REITs -0.99% Indu -1.1% Materials -1.55% |

| USD HY OaS |

| All Sectors +0.2bp

to 358bp All Sectors ex-Energy +0.2bp to 338bp Cons Disc +0.0bp to 289bp Indu -0.7bp to 247bp Tech +0.4bp to 429bp Comm Srvcs -0.1bp to 670bp Materials -0.6bp to 305bp Energy -0.3bp to 267bp Fin Snr +2.1bp to 322bp Fin Sub -0.6bp to 226bp Cons Staples +0.3bp to 294bp Healthcare +0.3bp to 379bp Utes +0.9bp to 218bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 7/2 | 10AM | May JOLTS | 7950.0 | 8059.0 |

| 7/3 | 8:30AM | May Trade Balance | -76.5 | -74.558 |

| 7/3 | 9:45AM | Jun F S&P Srvcs PMI | 55.0 | 55.1 |

| 7/3 | 10AM | Jun ISM Srvcs PMI | 52.6 | 53.8 |

| 7/3 | 10AM | May F Durable Gds Orders | 0.1 | 0.1 |

| 7/3 | 2PM | Jun 12 FOMC Minutes | n/a | 0.0 |

| 7/5 | 8:30AM | Jun AHE m/m | 0.3 | 0.4 |

| 7/5 | 8:30AM | Jun Unemployment Rate | 4.0 | 4.0 |

| 7/5 | 8:30AM | Jun Non-farm Payrolls | 200.0 | 272.0 |

| 7/8 | 11AM | Jun NYFed 1yr Inf Exp | n/a | 3.17 |

MORNING INSIGHT

Good morning!

We discuss the six primary drivers of the bear case. Our overall take is that a soft landing is the most probable outcome.

More in today’s Macro Minute Video, linked here.

TECHNICAL

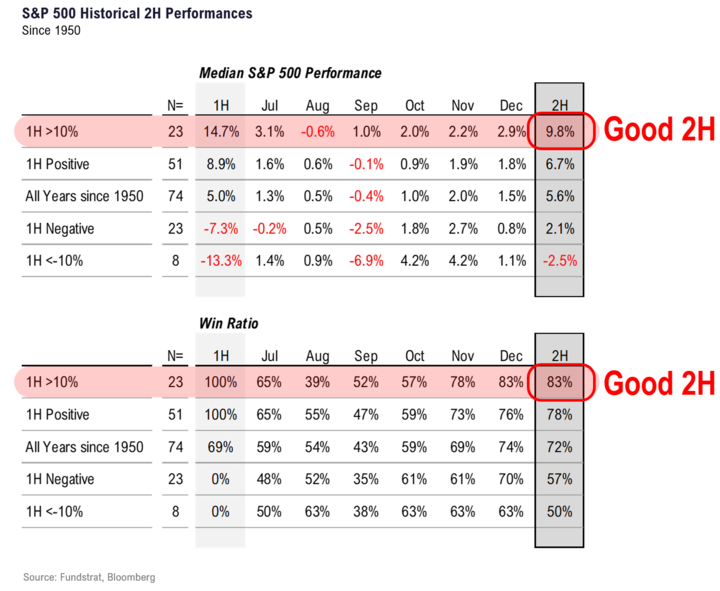

As Q3 gets underway, the most important message should center on sticking with large-cap Technology until sufficient proof of this sector starting to give way manifests itself. Many investors seem to be using the potential for a growth slowdown, coupled with the summer doldrums approaching, as a reason to sell stocks. We feel that’s quite premature. It’s important to reiterate that SPX has been positive in the month of July for nine straight years.

While a broad-based rally hasn’t yet materialized to the extent many investors might want to see, there also hasn’t been any evidence of Technology peaking out more than just for a few days’ time.

Given ongoing bullish SPX and QQQ trends, lack of technical deterioration, hints of bearish positioning among CTAs, and positive seasonality and cycle projections, it still looks right to be bullish on U.S. stocks, expecting a push up to 5650-5700 in SPX into July expiration.

Click HERE for more.

CRYPTO

While we had anticipated the ETH ETFs to go live by the 4th, it appears we will have to wait until at least next week. According to a report, the SEC has returned the S-1 forms to prospective Ethereum ETF issuers with minor comments, requesting revisions and a refile by July 8th. This iterative process means issuers must go through at least one more round of filings before the ETFs can begin trading. The S-1 forms are the second step in the approval process, following the approval of 19b-4 forms in May.

Circle has become the first global stablecoin issuer to be licensed and approved under the European Union’s Markets in Crypto Assets (MiCA) regulatory framework, effective July 1st. This approval allows Circle to issue its stablecoins, USDC 0.02% and EURC 0.29% , within the EU, marking a significant step in its compliance efforts. Circle had previously secured a digital asset regulatory license in France and established a French entity to manage its MiCA-compliant operations. MiCA, which aims to standardize crypto regulations across EU member states, requires increased regulatory compliance for stablecoin issuers, with full adherence expected by the end of the year. However, there are ongoing concerns and confusion regarding MiCA’s implementation and its impact on stablecoin issuers, as expressed by industry leaders like Tether CEO Paolo Ardoino. As of today, USDT still commands a remarkable 70% of the total stablecoin market cap, ahead of USDC in second place at 20%.

Click HERE for more.

First News

China vs. The World. Some of the world’s largest economies want to speed up the green transition — unless, that is, doing so makes China more influential.

Sure, cheap Chinese EVs might convince price-conscious consumers to abandon their gas guzzlers sooner than later, but politicians in Western countries also want to protect their clean energy industries, on which billions have been lavished, and also seek to contain China – even at the expense of addressing climate change.

In recent weeks, Canada and Europe have joined the U.S. in taking a stand against imported Chinese EVs, saying Beijing has propped its clean-energy industries with large subsidies allowing its companies to sell products, especially electric cars, too-too cheaply.

Canadian Deputy PM Chrystia Freeland said last week that an oversupply in China had “undermined EV producers around the world.” The fact is that few of these cars are exported to the U.S. and Canada now. President Biden’s new triple-digit tariff will keep it that way.

Countries are racing to impose tariffs before others, not wanting to stand unprotected, receiving China’s dumped vehicles. On top of this, Western governments have recently started unleashing large incentives for clean technology, including electric cars. Yet China, which, thanks to EVs, is the world’s largest exporter of cars as of 2023, began ramping up subsidies in these industries over a decade ago, spending at least $230 billion in subsidies for its EV industry alone since 2009, making the average price of an electric car in China less than half of what it is in Europe and the U.S., per auto research firm JATO.

With China accounting for ~90% of the amount spent on clean-energy investment worldwide (2022), the supply to drive a rapid global transition in line with the Paris agreement targets exists in China right now. What’s more, China’s production of EV batteries and battery components was four times larger than global demand last year, according to the International Energy Agency.

Alternatives, alternatives

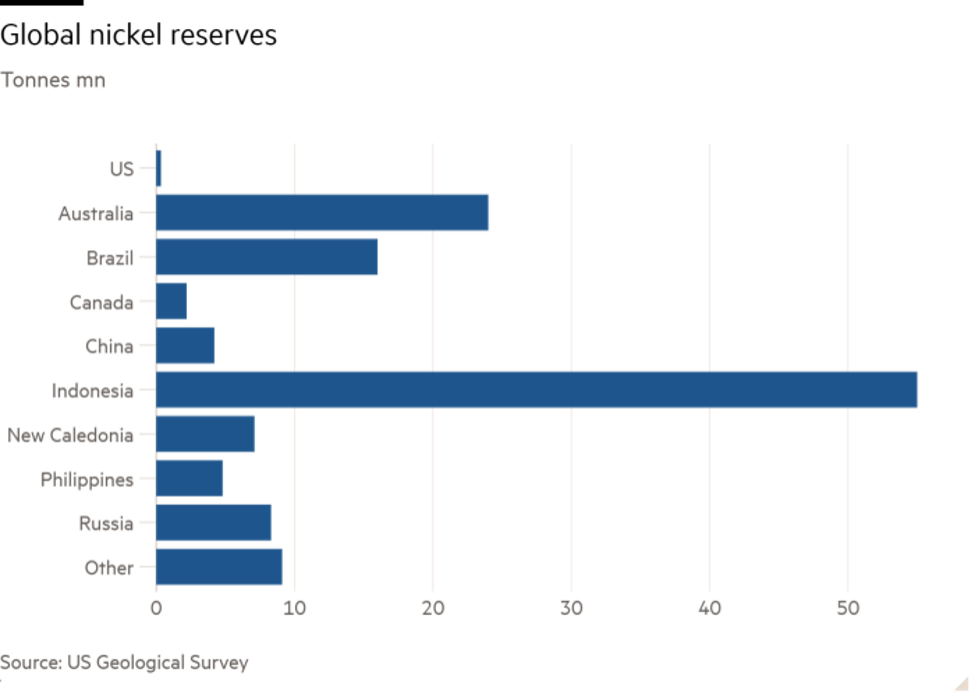

On top of this oversupply, there is determination worldwide to chip away at China’s green-energy advantages, even if it takes time. Some countries are willing to put it in. The Philippines, for one, is scouting for Western investment to further develop its nickel reserves, pitching itself as an alternative to the China-dominated supply chain for the metal critical to battery production.

The world’s second-largest producer of nickel, the Philippines seeks a critical minerals agreement with the U.S. as well as investment from foreign companies to build more refining plants. Sure, the country’s nickel output is just a fraction of top producer Indonesia,* but 90% of the industry there is controlled by Chinese companies – and discomfort with the concentration of nickel supply in the hands of Indonesia and China (not to mention the unease at the artificially low prices curbed the output of other producers) have buyers roving the world, looking for other sources of nickel, which happens to be a critical steelmaking ingredient. Naturally, Russia, a sizable producer of nickel, is off limits these days.

The U.S., U.K., Australia, Japan, and South Korea have shown interest in investing in the Philippine nickel industry – but so have Chinese companies. In a race between China and the U.S., the reason for a non-Chinese investor to go with the Philippines is that it can be the supplier of non-Indonesian, non-Chinese nickel. Then there’s the aim to produce ‘greener’ nickel by using renewable energy to power smelters – unlike Indonesia, which smelts nickel using coal-fired power plants.

The Philippines’ push also comes as, amid tensions escalating with Beijing in the South China Sea, it wants to build closer economic ties with the U.S. and its allies, seeking to sign a critical minerals agreement with the U.S., which would make it eligible for tax credits. It’s a question of the U.S. de-risking its nickel supply chain, and tax breaks and policies favoring non-Chinese companies could attract investment to the Philippines precisely for that purpose.

In the meantime, as rising tensions between the U.S. and China heighten scrutiny of Western businesses operating there, the new head of Bain & Company has said the firm is pulling back from advising certain industries in China, operating less frequently in sensitive industries.

As part of a raft of moves by Beijing against Western businesses, Chinese police raided U.S.-HQ’d Bain’s Shanghai offices last year, interrogating staff and confiscating devices. A number of other Western firms have been similarly treated or put on notice to beware of government action. Capvision Partners, another multinational consultancy targeted by the Chinese authorities, was accused of “degenerating into an accomplice of overseas intelligence agencies”. Bain has adjusted its business to comply with new regulations in China on data and cyber security. No one is clear how exactly the Chinese regulatory environment will evolve. Axios, FT, FT

* Indonesia accounts for 57% of global refined nickel production – 4.5 times more than the Philippines in 2023 – and its share is forecast to rise to 69% by the end of the decade, per Benchmark Mineral Intelligence. Its reserves also far outpace the Philippines’: with 55mn tons, Jakarta has 11 times more nickel, according to the U.S. Geological Survey.