S&P and QQQ have largely been treading water in recent weeks as the SPX remains just a few ticks above where it was back in mid-June (closed on Monday 6/17 at 5473.24 two weeks ago). Given that economic data continues to miss expectations, Treasury yields should be starting to pull back to new monthly lows in the near future and US Dollar likely should follow suit. Overall, cycles, seasonality, and ongoing strength in Technology arguably argues for a bullish stance in US Equities in the weeks ahead of any possible stallout. As mentioned last week, I expect the first part of July to lead back to new all-time highs, and suspect that a broad-based rally should be forthcoming. SPX targets could materialize between 5650-5700 before any consolidation gets underway.

Overall, as Q3 gets underway, the most important message should center on sticking with large-cap Technology until sufficient proof has been shown of this sector starting to give way. Many investors seem to be using the potential for a growth slowdown coupled with the “Summer doldrums” approaching as a reason to sell stocks. However, I feel that’s quite premature. It’s important to reiterate that SPX has been positive in the month of July for nine straight years.

While a broad-based rally hasn’t yet materialized to the extent many investors might want to see, there also hasn’t been any evidence of Technology peaking out, more than just for a few days’ time.

Given ongoing bullish SPX and QQQ trends, lack of technical deterioration, hints of bearish positioning among CTA’s and positive seasonality and cycle projections, it still looks right to be bullish on US stocks, expecting a push up to 5650-5700 in SPX into July expiration.

As shown below, SPX closed Monday 7/1 less than two points from where it had closed two weeks ago, on 6/17/24. Technically speaking, it’s hard to find much fault with this current pattern, and the minor bounce in Treasury yields in recent days has had little to no real net effect on Stock indices.

Overall, downside in SPX should be limited to 5400 while upside could find resistance near 5650 initially. It’s thought that the combination of FOMC Chair Powell’s comments on Tuesday along with Christine Lagarde could reflect more of a dovish tone that allows Yields and the US Dollar to begin to work lower. (ISM data on Monday was the latest example of economic data having missed expectations.)

S&P 500

Treasuries look attractive with yields having bounced into end of Quarter

Yields look close to reversing course following a multi-day bounce in TNX up to key resistance levels. It’s thought that exceeding 4.55% should prove quite difficult before a reversal back lower to challenge and break 4.19%.

This in turn should result in yields falling into late August/early September before a bounce happens. However, TNX very well might break 4.00% before any stabilization happens.

Overall, it’s hard to be too negative on Treasuries, and yields should be watched carefully this week ahead of the July 4th holiday.

US Government Bonds 10 YR Yield

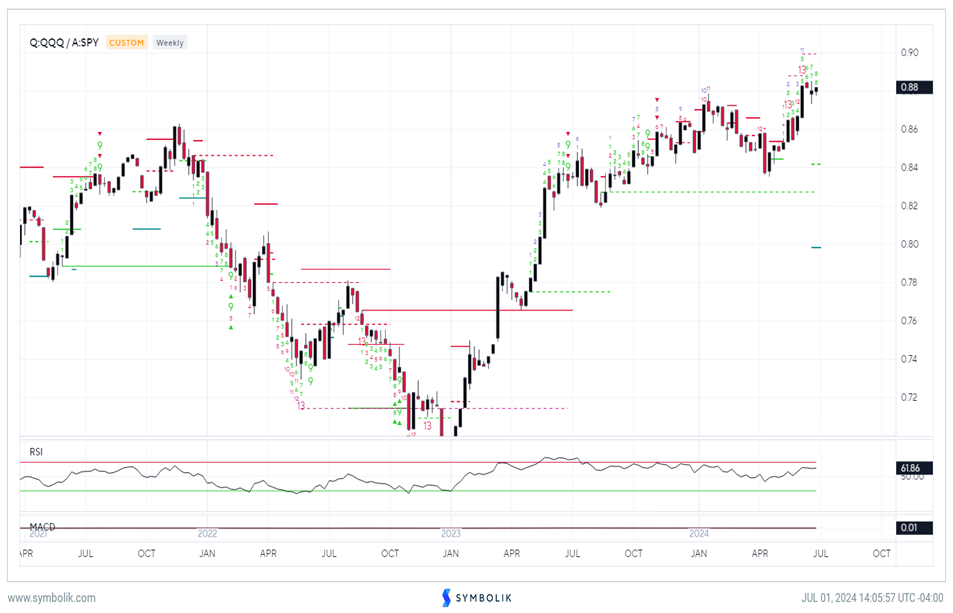

QQQ still positioning for a push back to new highs vs. SPY

Everyone wants to be able to tell friends at the 4th of July barbeques that they’ve successfully sold their Technology stocks at the peak. However, I don’t sense that this is the right message.

QQQ remains pointed higher vs. SPY after the June breakout and just three weeks of minor consolidation. This doesn’t seem too bearish, technically speaking.

Moreover, Symbolik charts still show DeMark exhaustion to be premature at this time on ratios of QQQ to SPY. Specifically, TD Combo “13 Countdown” signals are not present at this time and the TD Sell Setup count is also not complete. (While weekly TD Sequential exhaustion is present, this is insufficient to harbor much concern about the possibility of a reversal when other counts are not yet complete.)

If/when SPX turns up sharply over the next two weeks, there would be the possibility of generating a signal likely by July expiration. However, given the track record of Election Year July, I find it difficult to have much concern at a time when the selloff “attempt” in Technology over the last few weeks has proven quite muted, indeed.

Technically I expect a push back to new monthly highs in QQQ vs SPY, and this should materialize over the next 2-3 weeks. I’ll address the various counter-trend signals if/when they appear and also if/when they are confirmed. At present, there’s precious little reason to try to “top-tick” this move in Technology when there’s been insufficient technical deterioration.

QQQ vs SPY

Cybersecurity stocks look attractive for continued strength

Recent strength in HACK 1.76% (Amplify Cybersecurity ETF) looks attractive towards thinking this group could show further relative outperformance in the days/weeks to come.

This ETF is largely made up of AVGO 11.07% , CSCO 0.20% , CRWD 3.29% , FTNT 1.16% , PANW 0.54% , NET 4.08% which account for more than 1/3 of the 23 holdings as of 7/1/24.

As shown below, strength in HACK managed to exceed the minor downtrend that’s been in place since February and points to a likely rally to challenge the former peaks from four months ago.

Stocks like CRWD, PANW, and AVGO have gained more than 20% in the last three months and are relative leaders within this ETF.

Technically speaking, momentum has begun to turn up sharply on daily and weekly charts for HACK and gains to challenge $67.50 look likely into mid-July.

However, exceeding $67.50 would be even more bullish as this had formerly lined up with a peak in prices from late 2021.

Thus, the entire pattern from 2021 resembles a huge Cup and Handle pattern in the making which would be confirmed on any move back over $67.50.

If this happens sometime in July then a potential rally up to $80 could get underway. Overall, Cybersecurity looks to be a favorable sub-sector to overweight for additional outperformance in the weeks and months to come.

Amplify Cybersecurity ETF