After the Federal Energy Regulatory Commission (FERC) finalized a 1,363-page transmission rule to accelerate the green-energy buildout last week, developers of renewable energy are more ready than ever to participate in the multi-decade, climate-focused initiative. In 2021, Princeton researchers estimated the U.S. grid buildout necessary to create tens of thousands of miles of new transmission lines will cost $3.5 trillion by 2050. In the meantime, mining officials and executives from the U.S. and Europe are even now meeting in Paris to discuss how to increase the supply of critical minerals for the green energy transition, heartily supported by the current administration.

The demand, driven by ambitious climate-change-abatement agendas and clear indications of demand from the high-tech and EV/battery-storage sectors, is clearly there, and with a shift in demand of even 10-15%, one can see a shift in price of 100% or more. With the green transition, many of the components necessary for electricity generation become power fuels – chromium, copper, aluminum, fiberglass, graphite, lithium – and the extraction and processing of these materials need to be priced into green energy prices.

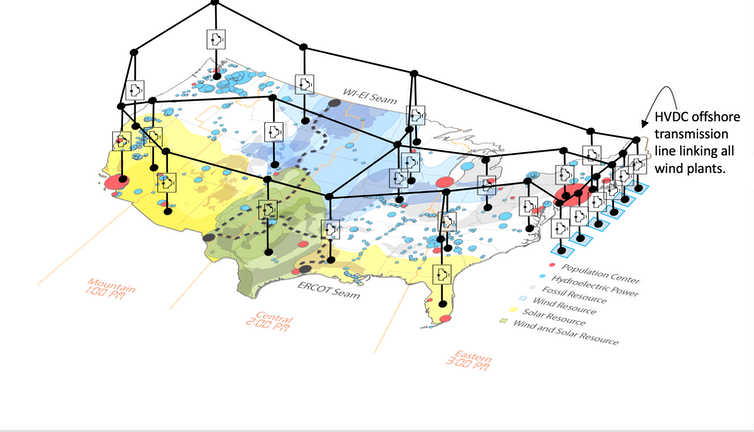

To minimize upfront costs, it makes sense to put technologies that integrate renewables in places where the geography matches the essence of the capacity: you put up solar where it’s sunny, and wind power where it’s windy. With radical innovation in transmission technologies, this can become less important, as it would bring the ability to transport energy from where it’s produced to where it’s needed (i.e. where most people actually live) more efficiently, but that innovation has yet to arrive.

The Grid

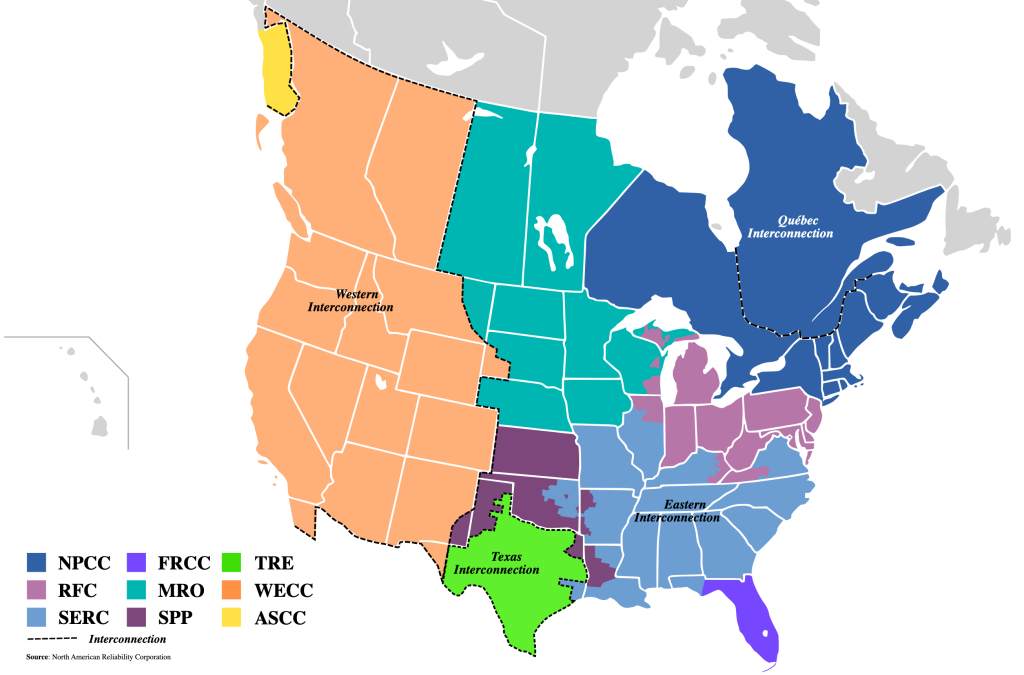

America’s energy grid is anything but monolithic. Built in fits and starts over more than a century, using myriad technologies, standards, and materials, it’s a wildly eclectic collection of infrastructure, divided roughly into three parts: what’s west of the Rockies, east of them – and then Texas. (More on that later.)

To accommodate this variety, as well as the constantly growing types of energy users who plug into the grid, utilities need many different kinds of transformers. Roughly 80,000 varieties exist, according to the American Public Power Association (APPA), so many that a standardization effort is currently afoot at the Department of Energy.

There are over 60 million transformers in the U.S., and they’re essential to everyday life. New housing developments and subdivisions across the country require them to open. The proliferation of energy-hungry data centers powering our digital lives depend on them. Not to mention, the global transition toward renewable power, EVs, and a greener grid would slow down without a more robust stockpile of transformers.

It’s at once ironic and as old as the world that, as we rush to deploy AI and self-driving cars, one can’t avoid the physical reality of having a specially trained electrician hand-wire a copper coil around a core of grain-oriented electrical steel (a rare variant that requires a highly technical extrusion to make it more conductive) to make a transformer that makes all of the above possible work.

Electric Research & Manufacturing Cooperative Inc., known as Ermco, which is not publicly traded, supplies an estimated one-quarter of the U.S. transformer market and made a record ~460,000 transformers last year in its Dyersburg, Tenn., factory. In the meantime, at Duke Energy Corp., (DUK) a company with electric utilities serving six Southern and Midwestern states, the lead times to acquire transmission transformers have increased to ~3 years to obtain higher-voltage transformers.

Energy Supply: How Is Energy Created?

Hydrocarbons

Oil and Natural Gas

The U.S. is one of the world’s largest producers of oil and natural gas, thanks most recently to the shale revolution enabled by hydraulic fracturing (fracking) and horizontal drilling techniques. Major oil and gas production regions include the Permian Basin in Texas and New Mexico, the Bakken Formation in North Dakota, and the Marcellus and Utica Shale formations in the Appalachian region. Offshore drilling in the Gulf of Mexico also contributes significantly to domestic oil and gas production.

Coal

The U.S. also has abundant coal reserves, located primarily in the Powder River Basin (Wyoming and Montana), Illinois Basin, Appalachian Basin (Kentucky and West Virginia), and Western Coal regions. Coal production and consumption have been declining due to increasing competition from natural gas and renewable energy sources, as well as environmental concerns. Coal’s share as a source fuel for electricity has been falling especially precipitously in the U.S.

Currently, electricity generation results in 32% of U.S. carbon dioxide emissions. To mitigate the effects of global warming, electrical generation needs to move from burning fossil fuels such as oil and coal, to emissions-free sources of energy such as wind and solar. Thus we come to:

Renewables

The U.S. has substantial renewable energy resources, including wind, solar, hydroelectric, geothermal, and biomass. Installed wind and solar capacity has grown dramatically in recent years, driven by declining costs, technological advancements, and supportive policies.

Solar Photovoltaic (PV)

The U.S. has seen rapid growth in solar PV installations, driven by declining costs, federal and state incentives, and increasing demand for renewable energy. Major solar PV markets include California, Texas, Florida, Nevada, and Arizona. Utility-scale solar PV projects and residential/commercial rooftop installations have contributed to the growth of solar energy in the United States.

American solar panel manufacturer First Solar (FSLR) recently became the world’s most valuable solar hardware company, marking the first time since 2018 that a Chinese company hasn’t been at the pinnacle of the solar market, as companies there are suffering from a protracted price-cutting war.

Tesla (TSLA), which absorbed the solar panel installer and battery-storage company Solar City, is another player in the space, where, under the name of Tesla Energy Operations, it works with residential, commercial, and industrial customers. In 2023, the company deployed solar-energy systems capable of generating 223 MW and deployed 14.7 GWh of battery energy-storage products.

Concentrated Solar Power (CSP) has operations primarily concentrated in the Southwest region of the United States, in states like California, Nevada, and Arizona, due to their high solar insolation (radiation) levels. Major CSP projects include the Ivanpah Solar Power Facility in California and the Crescent Dunes Solar Energy Project in Nevada. CSP systems offer the advantage of thermal energy storage, allowing for dispatchable electricity generation even when the sun is not shining.

Onshore Wind

The U.S. has significant onshore wind resources, particularly in the Central Plains states, such as Texas, Oklahoma, Kansas, and Iowa. Texas leads the nation in installed wind capacity, followed by California, Oklahoma, and Kansas. Technological advancements in wind turbine size and efficiency, along with favorable wind resources and supportive policies, have driven the growth of the onshore wind industry.

Offshore Wind

The U.S. also has substantial offshore wind potential, particularly along the East and West coasts, as well as in the Great Lakes region, although offshore wind development stateside has lagged behind that in Europe due to higher costs, regulatory challenges, and environmental concerns. Recent advances in offshore wind technology, coupled with state-level commitments and federal support, have paved the way for the development of offshore wind projects along the East Coast.

Here are a few notable companies in this space. GE Renewable Energy (formerly GE Power) has made significant strides in the U.S. offshore wind market, supplying turbines for the country’s first offshore wind farm: the Block Island Wind Farm off Rhode Island. They have also been selected to provide turbines for several upcoming projects, including Avangrid Renewables’ Kitty Hawk project off North Carolina and Dominion Energy’s Coastal Virginia Offshore Wind project. Siemens Gamesa (SGREN) is another major player, with contracts to supply turbines for the Coastal Virginia Offshore Wind project and the South Fork Wind Farm off New York’s Long Island. Ørsted, the world’s largest offshore wind developer, has established a strong U.S. presence, with projects under development including Revolution Wind off Rhode Island, Ocean Wind off the New Jersey coast, and Sunrise Wind off New York. The Danish company is also exploring opportunities in other regions, e.g. the Carolinas. The firm built the world’s first offshore wind farm back in 1991 and is currently racing toward a goal of 22 gigawatts of offshore wind capacity by 2030.

Nuclear

The U.S. has significant nuclear power generation capacity, with 94 operational nuclear reactors across 28 states. Nuclear power plants provide baseload electricity generation and account for approximately 20% of the nation’s total electricity production, but the construction of new facilities has faced high costs, regulatory hurdles, and public concerns over safety and waste disposal. There is, however, growing interest in nuclear energy from a variety of sectors.

Projected load growth from hyperscale data centers,* along with industry-led efforts to decarbonize metallurgical processes such as steelmaking, led Microsoft, Google and Nucor in mid-March to jointly announce a clean energy RFI – a joint initiative to stimulate development and deployment of reliable, low- or zero-carbon electricity generation technologies such as advanced nuclear, next-generation geothermal, and long-duration energy storage. Google’s and Microsoft’s emissions-reduction goals are especially ambitious, with Google aiming for net-zero emissions from company operations and a 50% reduction in Scope 1-3 emissions from a 2019 baseline by 2030. Microsoft aims to be “carbon negative, water positive, and zero waste by 2030,” to match 100% of its electricity generation at all times with zero-emissions resources by 2030, and to remove the equivalent of all its historical emissions by 2050.

With high energy densities and the potential to generate substantial process heat, advanced nuclear is also seen as a promising colocation partner for industrial users that require both heat and electricity. Dow and X-energy are collaborating on a four-reactor, 320-MWe project that would directly supply Dow’s UCC Seadrift Operations petrochemical plant with electricity and process heat.

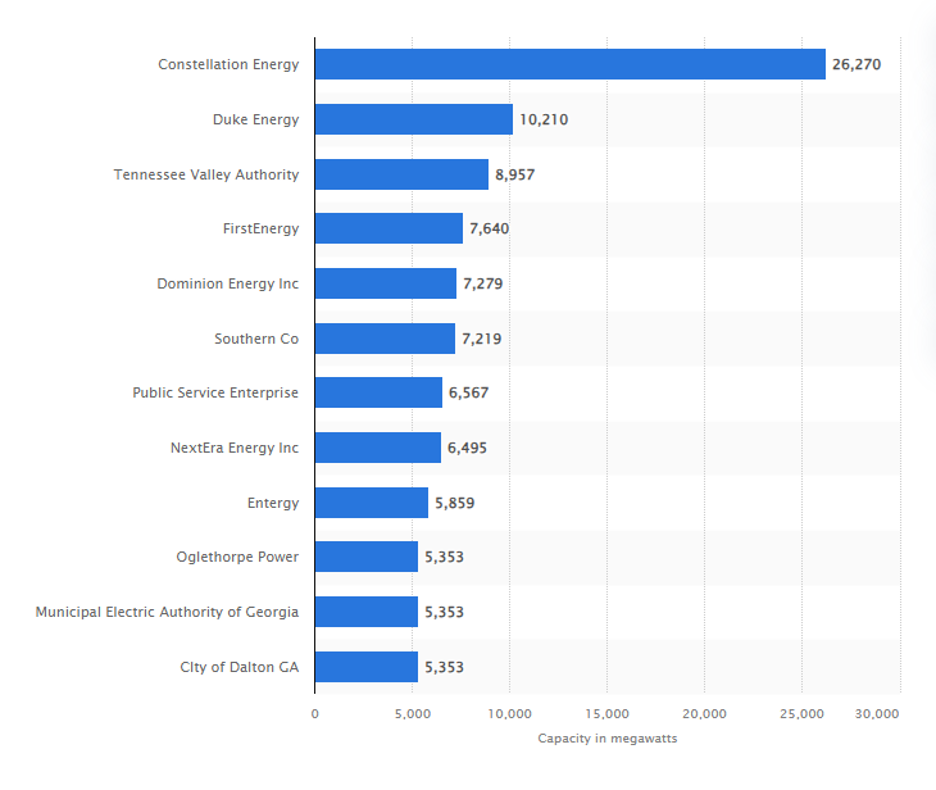

Here are some notable companies in this space. Constellation Energy (CEG) boasts the largest fleet of nuclear power plants with 21 nuclear units, and the electricity generated from it amounts to half the nation’s carbon-free energy and 20% of the nation’s total electricity. Clients include residences, businesses, government agencies, and community aggregators (e.g. municipalities, cooperatives, etc).

Founded in 1913, Entergy Corporation (ETR) delivers power to ~3 million customers spread across Louisiana, Mississippi, Arkansas, and Texas. Its primary focuses are electric power production and distribution operations. Entergy has a generating capacity of 24 gigawatts and owns interconnected high-voltage transmission lines spanning an estimated 16,100 circuit miles. The company’s nuclear fleet is headquartered in Jackson, MS and comprises five nuclear units with a clean nuclear power capacity of 5,000 megawatts.

NuScale Power (SMR) is a leading developer of Small Modular Reactor (SMR) technology, offering smarter, cleaner, safer, and cost-competitive nuclear energy. NuScale reactors take 1% of the space of a conventional reactor and generate 77 Mwe. In January 2023, the NRC certified NuScale’s 50 MWe design for use in the U.S.

Source: Statista

Energy Transmission: How Is Energy Delivered?

Electricity Transmission and Distribution

The U.S. boasts a vast and somewhat interconnected electricity grid, consisting of high-voltage transmission lines and lower-voltage distribution lines. The grid is divided into three main interconnections: Eastern, Western, and Texas Interconnections, which facilitate the transfer of electricity across state and regional boundaries. Because of the history of the electric grid in the U.S., there is not a functioning system allowing for payments and regulation of cross-regional transmission lines. Aging infrastructure, grid modernization, and the integration of renewable-energy sources are key challenges for the electricity transmission and distribution system.

Here’s an overview of some major publicly traded companies playing significant roles in the generation, transmission, distribution, and storage of electricity in the U.S. They are involved in various aspects of the energy industry, including regulated utility operations, power generation from diverse sources (fossil fuels, nuclear, and renewables), and the development of advanced energy technologies.

NextEra Energy, Inc. (NEE) is one of the largest electric power companies in the U.S. and a leading provider of renewable energy, with a portfolio of wind, solar, and nuclear power generation assets across the U.S. and Canada.

Duke Energy Corporation (DUK) is one of the largest electric-power holding companies in the country, operating regulated utilities in several states, including North Carolina, South Carolina, Florida, Indiana, Ohio, and Kentucky and boasting a diverse generation portfolio, including nuclear, coal, natural gas, and renewable energy sources.

Dominion Energy, Inc. (D), a leading producer and transporter of energy, with operations across multiple states, substantial natural gas transmission and storage operations, as well as renewable energy assets.

Exelon Corporation (EXC), a leading utility-services holding company with operations in multiple states, is one of the largest operators of nuclear power plants in the United States; it also has a significant portfolio of renewable energy assets.

Xcel Energy Inc. (XEL) is a major electric and natural gas utility company serving customers in eight states in the Midwest and Southwest regions and operating a diverse generation portfolio, including coal, natural gas, nuclear, renewable energy sources, and energy storage.

ABB Ltd. (OTCMKTS: ABBNY) is a $100 billion Swedish–Swiss multinational corporation offering EV charging, solar and modular substations, and distribution automation to expand the power grid so that it can integrate more renewables.

CrowdStrike Holdings (CRWD) and Palo Alto Networks (PANW), both cybersecurity companies are important players in the field of energy security, and should also be considered as part of an energy-focused portfolio.

As usual, Signal From Noise should serve as a starting point for further research before making an investment, rather than as a source of stock recommendations. Although the names mentioned above each have the potential to benefit from the ongoing green energy transition, this alone should not be the basis of a decision to invest.

We encourage you to explore our full Signal From Noise library, which includes deep dives on the path to automation and opportunities arising from the ever-increasing global water crisis. You’ll also find a recent discussion of the Magnificent Seven, artificial intelligence, and the rise of Generation Z.

WSJ, EIA.gov, Sherwood, WSJ, CNBC, Yahoo Finance, UtilityDive, EIA

* Nvidia’s just released earnings show a 400%+ increase in the data center business. Driven by growing demand for cloud computing, online services, and data storage, data centers are becoming a significant consumer of energy in the United States. Even with energy-efficiency measures, such as efficient cooling systems, server virtualization, and the use of renewable energy sources (implemented to reduce the energy footprint of data centers) their electricity demands are putting s significant strain on the U.S. electric grid and forcing innovation in the renewables sector.