An old stock-market adage calls for investors to “sell in May and go away.” Yet to Fundstrat Head of Research Tom Lee, multiple factors make it wiser to “buy in May” this year. Stocks rose last week to extend their weekly win streak to three, and Lee believes more gains are likely for this month.

In his view, stocks last week were helped by soft jobs data from May 3, which helped convince investors that the “economy is no longer red-hot” and that the Fed is thus increasingly likely to stay dovish. Those numbers are also consistent with the latest weekly unemployment data, which rose to the highest level since August 2023.

As Head of Technical Strategy Mark Newton pointed out, the bond market’s immediate response to the jobless numbers was positive: “Rates plunged, and we also saw the dollar pull back.” In fact, Newton continued, “I sense that this could be the start of why the bond market actually starts to rally pretty sharply between now and late summer. I think yields are going to pull back. I think the dollar is going to also weaken, and I think that this recent weakening of economic data sort of sets the tone for why this is going to happen.”

Summing his views up, Newton said, “My thinking is the S&P [500] will challenge the March highs of around 5,265. If and when it gets above that, we could see it rise to 5400.” He added, “Don’t forget about seasonality. Generally, markets tend to do very, very well during this time of most election years – and in years where the prior year was up more than 10% they tend to do even better. So I think between now and the fall should be a great time for a broad-based rally.”

Lee is similarly constructive. “We are still in the ‘buy in May’ camp. The fact that stocks rose this week is a positive signal. And next week we expect incoming data (CPI, PPI) to show overall softening of the key components of inflation.”

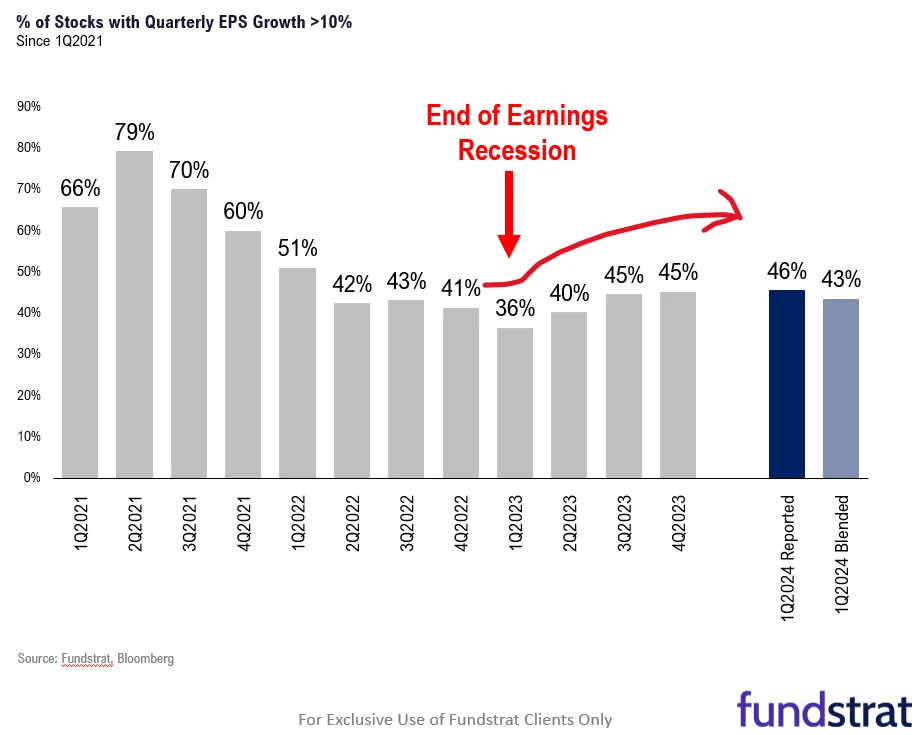

Chart of the Week

The earnings season thus far has been strong, with 46% of companies reporting EPS growth of 10% or more, as seen in our Chart of the Week. As Fundstrat Head of Research Tom Lee pointed out, this is the best reading of this metric since early 2022. About 81% of companies have beat expectations, and the overall earnings beat for the S&P 500 is around 7.5% – the best it’s been since 2021. In fact, earnings beats have turned out to be strong enough to raise estimates for 2Q2024 EPS as well as FY2024 EPS. “This strengthening of earnings momentum, of course, is a tailwind for stocks” in Lee’s view.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

5/7 10:00 AM ET: Apr F Manheim Used vehicle indexTame5/10 10:00 AM ET: May P U. Mich. Sentiment and Inflation ExpectationHot but expected- 5/13 11:00 AM ET: Apr NYFed 1yr Inf Exp

- 5/14 6:00 AM ET: Apr Small Business Optimisim Survey

- 5/14 8:30 AM ET: Apr PPI

- 5/15 8:30 AM ET: Apr CPI

- 5/15 8:30 AM ET: Apr Retail Sales Data

- 5/15 8:30 AM ET: May Empire Manufacturing Survey

- 5/15 10:00 AM ET: May NAHB Housing Market Index

- 5/15 4:00 PM ET: Mar Net TIC Flows

- 5/16 8:30 AM ET: May Philly Fed Business Outlook

- 5/17 10:00 AM ET: May M Manheim Used vehicle index

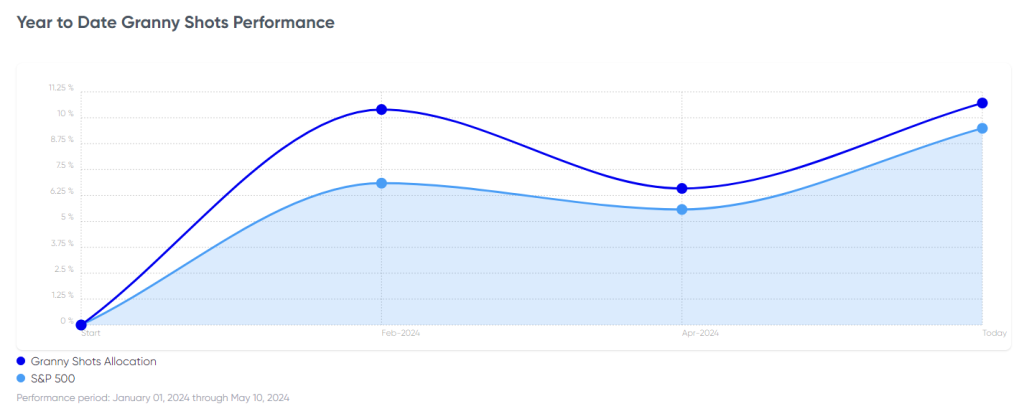

Stock List Performance

In the News

[fsi-in-the-news]