Recent stalling out in Equities, US Dollar and Treasury yields awaits some evidence of resolution, and despite this week’s dovish message and accelerated QT tapering schedule, there hasn’t been enough progress to argue that a rally back to March peaks is yet underway. Near-term, both AAPL earnings and Friday’s Jobs report might prove important, but the key rests on a broad-based Equity rally which likely should proceed as DXY and TNX are beginning to turn back lower. As discussed yesterday, I suspect that 4/19 lows near 4953 should hold on any backing and filling, while a rally back over 5123 should result in a quick move back to test and exceed 5265.

Overall, the first part of this week has largely proven constructive towards reiterating the Fed’s dovish stance while affirming their focus on still being restrictive. Both Treasury Yields and US Dollar showed evidence of pulling back on the accelerated QT tapering scale, but yet neither has officially broken down enough to argue a new downtrend is underway.

Interestingly enough but not surprisingly, Treasuries, US Dollar as well as US Equities remain in a one-month range, without much resolution for Bulls nor for Bears.

Given the robust earnings picture, it’s thought that AAPL very well might serve as an important catalyst towards helping Technology reassert itself after a difficult couple of months. (The key level for AAPL to remain above by Friday 5/3’s close is $180.)

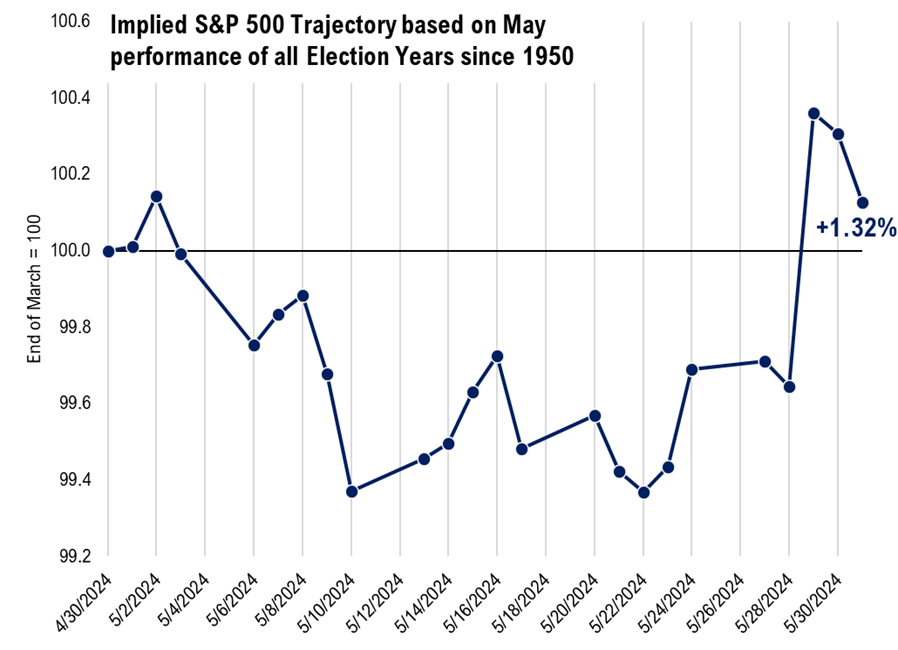

Seasonally speaking, the month of May looks likely to provide some relief following a dismal -4% showing for April, and Election year performance data has proven that May tends to be a better month than April going back since 1950.

However, as this Election-year seasonality chart shows, it might not be a straight line higher just yet over the next month. While I personally view 4/19 lows near SPX-4953 as being an important low for SPX, the structure hasn’t improved meaningfully enough to verify that Equity markets are completely “out of the woods” at present.

Since 1950, the average May has returned a median of +1.1%, which is more than double April’s median return of +0.4%. Both May and June tend to be very bullish months during Election years.

However, it appears like the first couple weeks tend to lag performance of the back half of the month. This trajectory over the last 74 years shows that the back half of May tends to be much better. Thus, while I’m optimistic that markets should be at or close to a turning point, one cannot rule out weakness into May expiration before a sharp recovery.

If AAPL earnings along with Friday’s Jobs report (5/3) help Equities extend back over SPX-5123 arguably I’d have a much greater certainty that markets could rally into the middle part of June with little to no drawdown. Furthermore, above SPX-5123 would lead prices immediately higher to test and exceed 5265.

AAPL downtrend has begun to stabilize, and requires a move back over $180 for technical confirmation of a low in place

The Symbolik chart below is helpful as it delineates the current downtrend in force for AAPL and shows the area that needs to be broken to have more confidence of a low at hand.

The arithmetic trendline is drawn to connect the high that precedes the lowest low and intersects near current levels. As can be seen, this held the initial bounce into late April, making this an important technical spot.

However, I feel that $180 is a far more significant level as it represents two prior lows from earlier this year and the two bounce attempts in March and April of this year both failed when trying to exceed $180.

Thus, a weekly close back over $180 would give me confidence that the stock has bottomed and could begin its rally back to $198. (AAPL has spiked post-close following Earnings on Thursday, but I’ll hold out on commenting until Friday’s close.)

Apple Inc. (Daily)

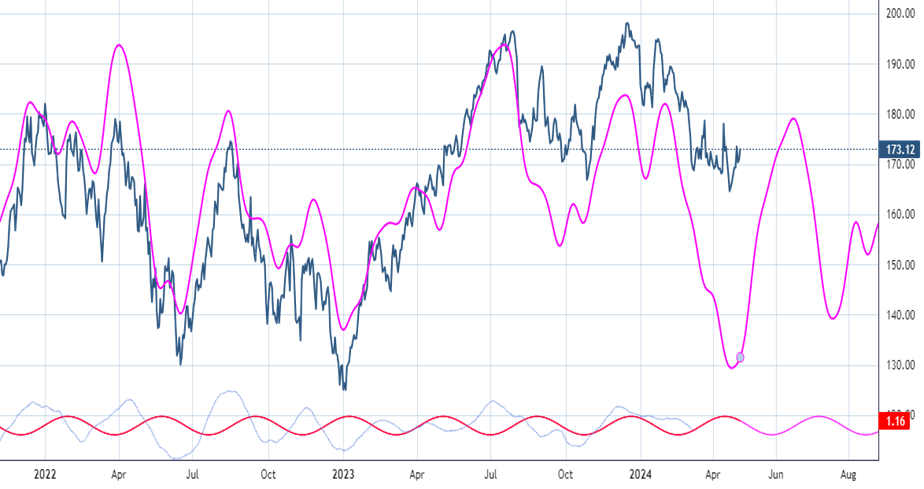

AAPL weekly chart helps to give conviction about the intermediate-term trend

While the daily chart has been bearish since last December, the weekly chart tells a much different story.

Price has not violated the long-term trend and has recently stabilized at an area near both prior lows from October 2023 along with an area of its intermediate-term uptrend.

As shown below the intermediate-term channel resistance that formerly marked 2022 peaks extends to an area where it intersects right near current levels.

Monthly MACD remains positive, and I don’t view this consolidation since last year as anything more than a temporary period of sideways price action which should be resolved by prices pushing back to new all-time highs into Fall 2024.

It will take consecutive weekly closes under $155 to shake my bullish conviction on AAPL. At present, I view any move back over $180 into end of week as jump-starting its move back to new high territory.

Furthermore, given AAPL’s 8% weighting in ^SPX and 12% weighting in QQQ -0.23% , this expected move should prove to be a positive catalyst for “waking up the US equity market out of its recent slumber.”

Apple Inc. (Weekly)

AAPL turn back higher should be imminent based on its cycle composite

Given a combination of the top cycles which have ruled AAPL’s price movement since 1980, the pullback from last Fall looks to bottom in the first week of May.

It trends up initially into June expiration before settling into July and then another spike up to mid-August.

Note, the weekly cycle composite isn’t shown here but has a similar projection, and bottoms during May before pushing higher into mid-September.

Thus, both daily and weekly cyclical projections look bullish on AAPL over the next 3-4 months. I suspect if AAPL can clear $180, it should pave the way for a move back to new high territory.

Apple Inc. (Cycle Composite)

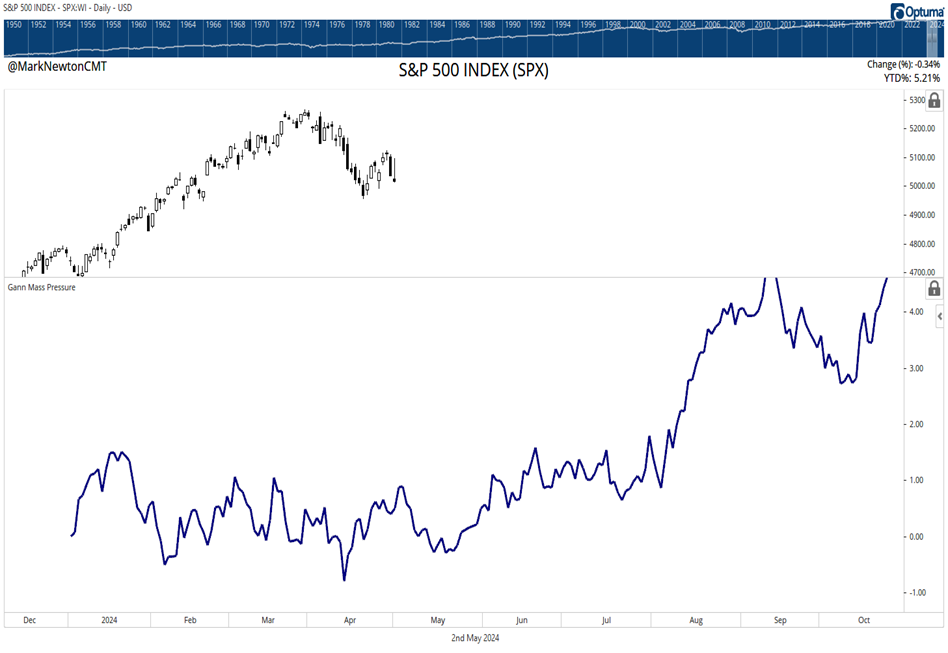

Gann’s Mass Pressure chart for 2024 shows prominent lows in both April and May before turning higher into the Fall

For those familiar with the Mass Pressure chart, it has a decidedly bullish cyclical projection for 2024.

This is constructed utilizing an overlay of several long-term cycles, which when combined, have often proven insightful as a way to making projections for the year.

While this year’s rally from January has not been captured meaningfully on this Mass Pressure chart, the composite below did successfully make a very important bottom in the month of April, not dissimilar from the US Equity market bottom which happened back on 4/19.

It shows a bottoming out near 5/20-4, not dissimilar from the Election-year seasonality chart (shown at the beginning of this report).

However, if AAPL can manage to hold above $180 by Friday’s close, and SPX gets back over 5123, I’m willing to bet that this traditional seasonality chart proves wrong and markets might be a lot more resilient, and move straight higher into June. Overall, a strong Friday (5/3) close by AAPL 2.14% is important, along with a Jobs number that results in yields starting to retreat.

Gann’s Mass Pressure Chart