This week’s selloff looks to be nearing important support heading into next week which should allow for some stabilization and a snapback rally into late April and the month of May. I don’t make much of the recent SPX decline when eyeing its technical pattern along with the ongoing strength in Technology in holding up very well relative to SPX. However, the key might lie with stabilization in both Financials and Healthcare as their combined weight is roughly 25% within SPX.

Simply stated, I don’t make much of this recent selloff and feel that US Equities should be close to bottoming which should happen sometime next week. The reasons are as follows:

-Technology has held up admirably vs. the SPX despite its underperformance in recent months. Charts of MSFT, META, GOOGL, NVDA look quite bullish and recent evidence of AAPL 0.47% having broken out looks constructive for Technology.

-Financials and Healthcare are both nearing support after recent underperformance. These two groups account for 25% of SPX.

-Insufficient strength in Defensive groups like Staples and REITS has been seen to argue that the market should begin a larger selloff.

-My former cycle composite that showed 4/20 as being important, very well could help markets bottom on/near that date before turning higher.

-TRIN readings for Friday registered a 1.86, showing outsized downside volume. This normally has been a great predictor of possible market turns when it gets to 2 or higher, and should be watched early next week.

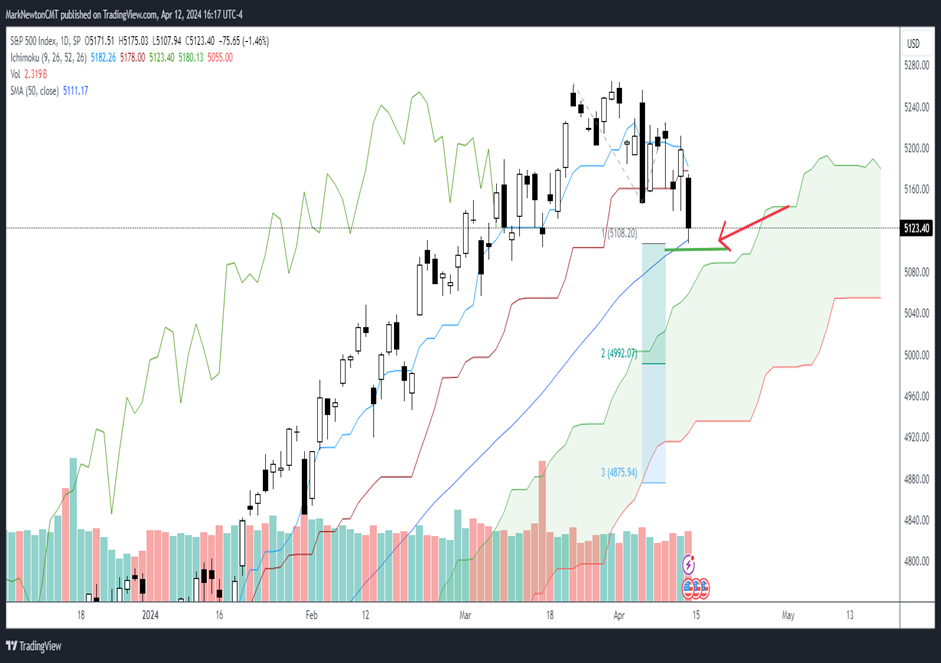

Overall, I suspect that SPX getting near its Ichimoku cloud support and its rising 50-day moving average (m.a.) could prove important for SPX. Gann levels of support based on a 180 degree move from SPX’s 3/28 high close pinpoints 5110, an area near where SPX bottomed on Friday.

Bottom line, I don’t expect much further selling, and expect that US indices are growing close to support.

S&P 500 Index

Financials downturn looks to be nearing support

The carnage experienced in Financials this past week has been expected, but should be nearing an end now that Financials get closer to support. When comparing RYF -0.89% to RSP -0.21% , this ratio is now right at March lows, which looks important. Moreover, given that Financials represent the 3rd largest sector within the SPX, stabilization in Financials might also be significant for the US stock market.

While the weekly relative chart showed the upside challenges faced by Financials into April, the chart below now shows one reason why Financials might bottom out. Furthermore, daily charts of RYF -0.89% shown on an absolute basis, not relative (Not shown) show RSPF hitting Ichimoku cloud support, which is an additional reason for optimism.

Overall, I discussed this sector last Friday, and feel that Financials have been hit a bit too hard in the near-term. While the weekly resistance shown in the prior chart proved to be a viable reason for why Financials might stall out and weaken, the weekly momentum remains quite positive and should help the sector strengthen over the next couple months.

Equal-Weight Financials ETF / Equal-Weight S&P 500 ETF (Intraday Performance)

My favorite Financials stocks from a technical perspective are: BRK-B/B, JPM -0.89% , WFC -0.22% , ING -0.76% , PGR -0.34% , TRV -0.35% , BBVA -1.13% , ING -0.76% , SAN -1.56% , OWL 0.47% , KKR -0.29% , DB -2.06% , UBS -0.44% , and MFC -0.84% .

Financials held right where it needed to vs. SPX

Despite the strong rally off last year’s Fall lows, it’s been tough for Financials to extend higher vs the S&P 500 sufficiently to argue for intermediate-term strength.

As relative charts of the Equal-weighted Invesco Financials ETF (RYF -0.89% ) vs. the Equal-weighted S&P 500 (RSP -0.21% ) shows below, Financials still lies within a two-year downtrend, relatively speaking.

I raised Financials to an overweight given the extent of its momentum off last Fall’s lows and expected this first downtrend from 2022 might be exceeded. Thus far, this hasn’t happened and this past week looks strongly like a reversal from key resistance.

While I’m bullish on Financials over the next few months, this week’s technical damage will need to be repaired, on an absolute and also relative basis, before one can start making the case for a larger Financials rally. Regional banks in particular require a lot of selectivity, as this group has been under pressure for two years as well.

Overall, it will be worthwhile to monitor the relative charts for Financials vs. S&P 500, as Financials is the third largest sector within the SPX and a very important “piece of the puzzle.”

Equal-Weight Financials ETF / Equal-Weight S&P 500 ETF (Weekly Performance)

Broker Dealer & Security Exchanges ETF (IAI) by Ishares looks to have stalled out

An interesting observation within the Financials sector concerns the IAI -0.63% , which holds many of the broker dealer shares like MS -1.39% , GS -1.08% which experienced losses this past week.

As weekly charts show, IAI had been a strong performer before finding resistance right near a level of prominent highs from October 2021.

Given a 30% + rally from last Fall’s lows, it’s logical to expect that 2021 peaks might have served as resistance to this recent rally.

However, now prices look to have plunged to multi-week lows and have arrived near its first support just above $110.

This will be an important level and I expect that some effort to recover should happen between April expiration and mid-May.

However, given the rapid selloff to multi-week lows, this looks to have put a dent in the upside acceleration, and it’s thought that IAI likely won’t be able to push higher at the same kind of velocity it showed in recent months until this can climb back up above $116.

Overall, one should be quite selective about Broker Dealer stocks as well as Regional Banks within the Financials sector until these groups can start to strengthen a bit more. However, the broader Financials space should be close to bottoming technically speaking, next week.

Ishares Broker Dealer & Security Exchanges ETF