Daily Technical Strategy Video (3/20/24)

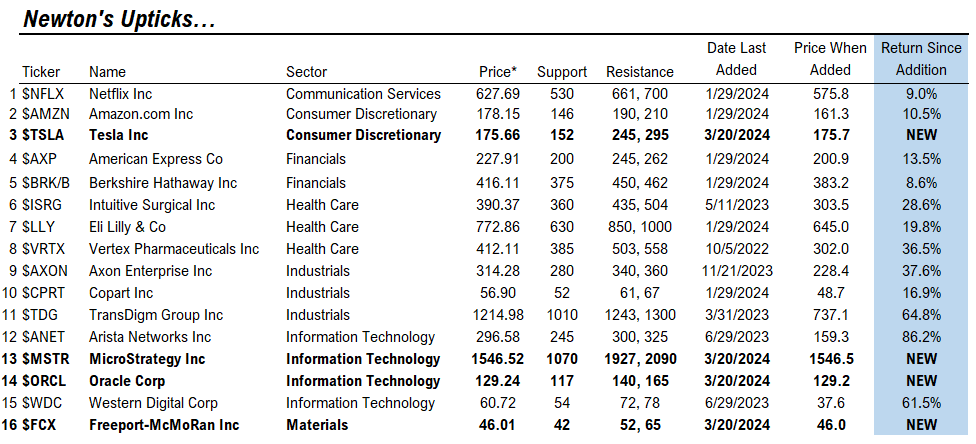

Upticks – Newton’s Law

(New Additions in Bold)

4 New Additions

- MSTR -3.94% – MicroStrategy Inc

- ORCL -1.32% – Oracle Corp

- FCX -1.75% – Freeport-McMoRan Inc

- TSLA -1.93% – Tesla Inc

Upticks Commentary (Commentary on all 16 names)

Netflix (NFLX – $627.69)

Rally to test all-time highs is ongoing

Support- $530, Resistance- $661, 700

Rally in NFLX -2.16% has grown more parabolic since early 2024, and rally up to $700 looks likely

No evidence of deterioration has occurred in recent weeks

Former all-time highs looks like first meaningful resistance target, though 661 might prove temporarily important

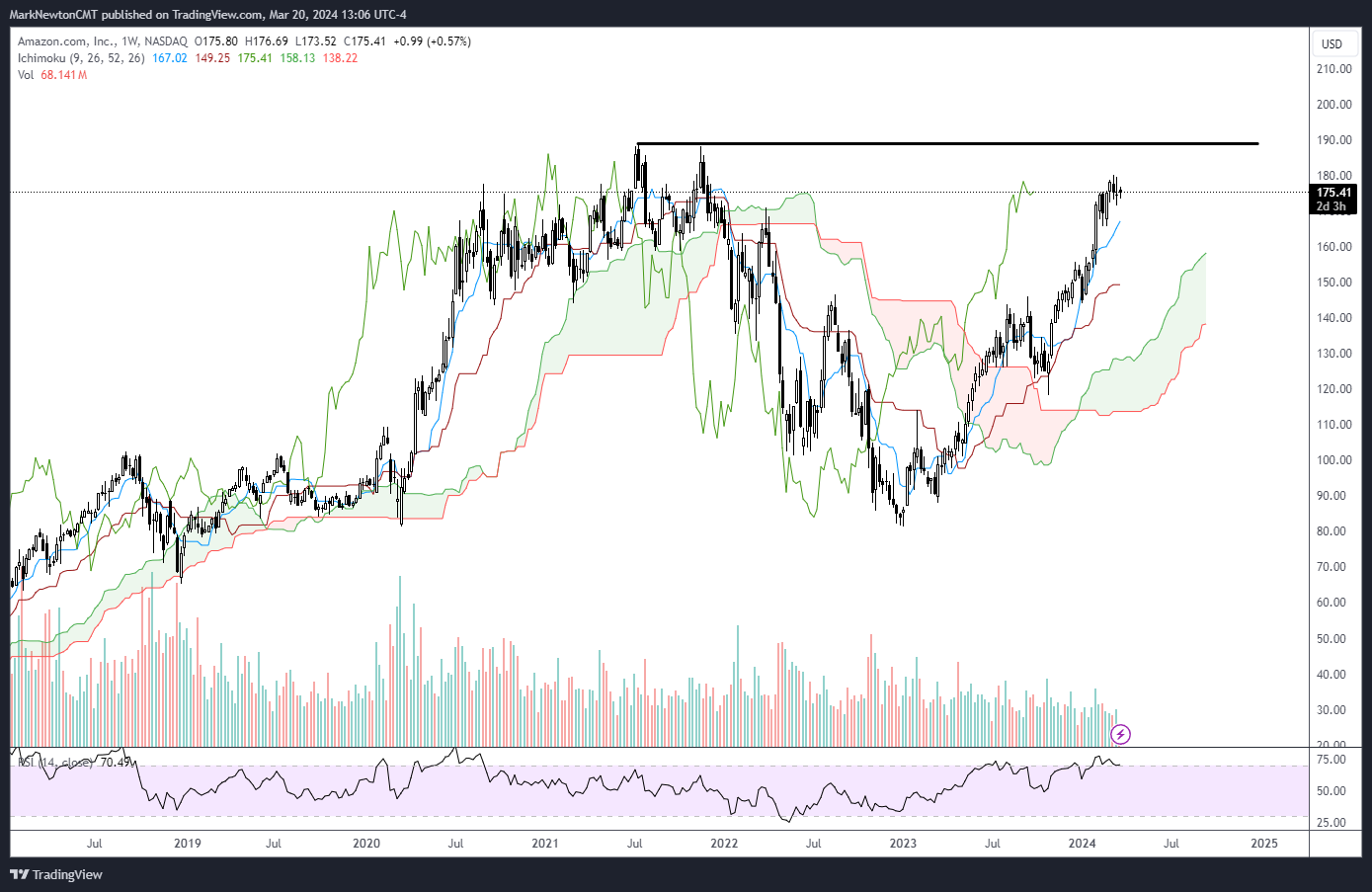

Amazon.com (AMZN – $178.15)

Rally to test all-time highs and exceed this level likely

Support- $146, Resistance- $190, 210

Rally back to test all-time highs is ongoing, and push up to $190 likely without much resistance

Overbought conditions have not resulted in any deterioration

AMZN -1.28% has begun to show some relative strength vs. other Magnificent 7 names, as it shows mean reversion back higher. An eventual push above 190 is likely up to 210

Tesla (TSLA – $175.66)

Tesla has shown the first steps towards bottoming. Shares look attractive from a counter-trend perspective for gains in the months ahead

Support- $152, Resistance- $183, 245

TSLA’s ability to have recaptured former lows from February is an encouraging first step towards bottoming out

While TSLA remains intermediate-term bearish structurally, this shows an excellent likelihood of bottoming out based on cycles, oversold conditions and DeMark exhaustion signals

Cycle composite projections on TSLA -1.93% show this rallying sharply in the months ahead

Climbing above $183 will be the second technical sign of structural improvement following the stock having recaptured last month’s lows. The ability to break its downtrend from late 2023 should help this rally up to $245

American Express (AXP – $277.91)

Quite technically attractive despite recent breakout to overbought levels

Support- $200, Resistance- $245, 262

Quite bullish structurally, despite being overbought after five straight months of gains

Ability to have pushed back to new all-time highs resulted in acceleration above 220 and should help this reach 245 before some minor consolidation.

AXP -1.90% joins V -1.36% and MA -1.17% back at all-time highs and this remains a very bullish part of Financials sector

Pullbacks, if/when they occur, should find strong support near $200

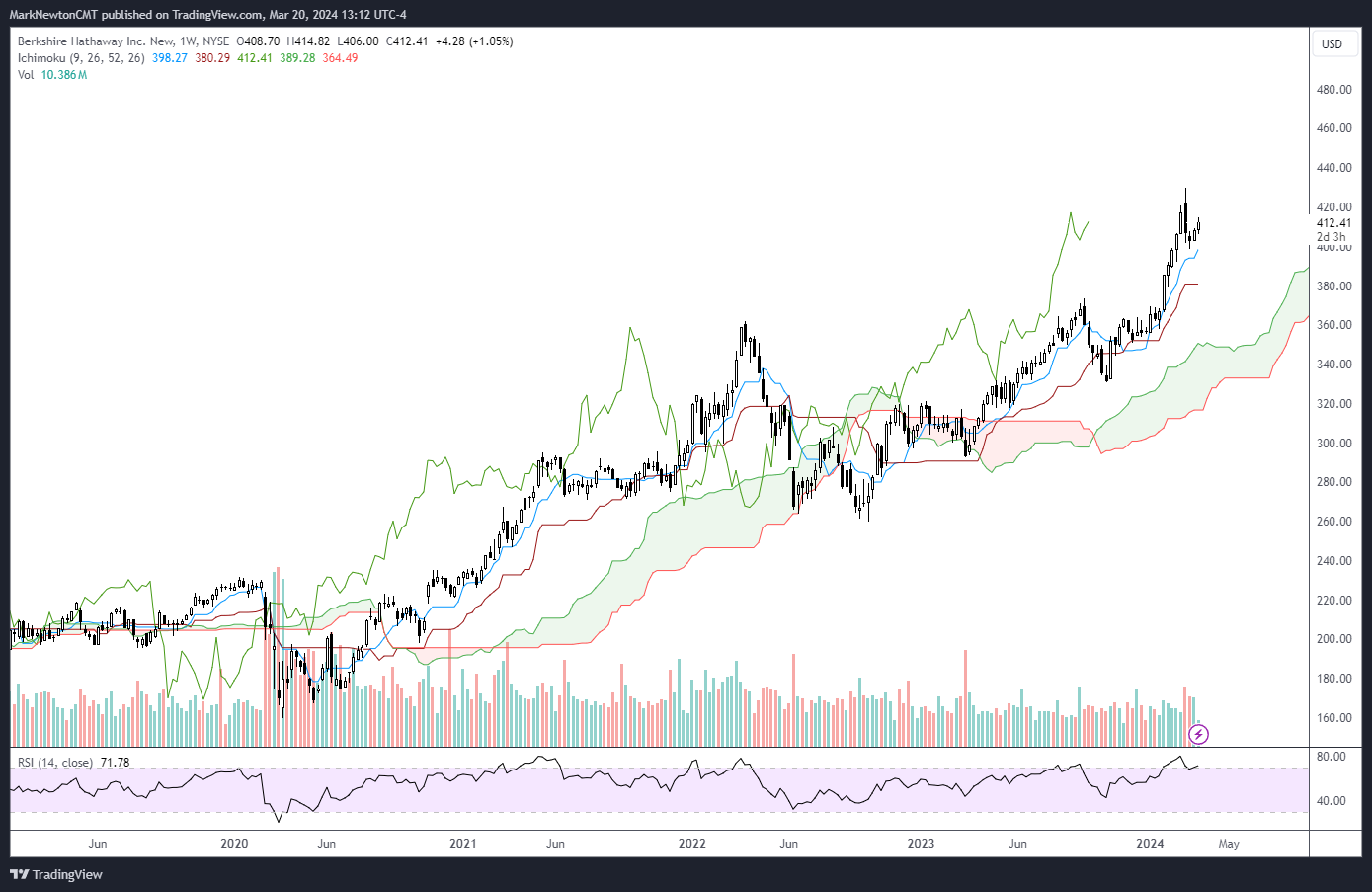

Berkshire Hathaway (BRK/B – $416.11)

Cup-and-Handle breakout has allowed BRK.B to accelerate

Support- $375, Resistance- $450, 462

BRK-B.B broke out of a large two-year Cup and Handle pattern in early 2024 which has helped prices accelerate higher.

Despite overbought momentum, BRK.B has shown no evidence of any deteriorating momentum or negative divergence that would warn of potential trend failure.

Any consolidation into May likely finds strong support near $375 while further gains are likely in the weeks/months ahead up to $450

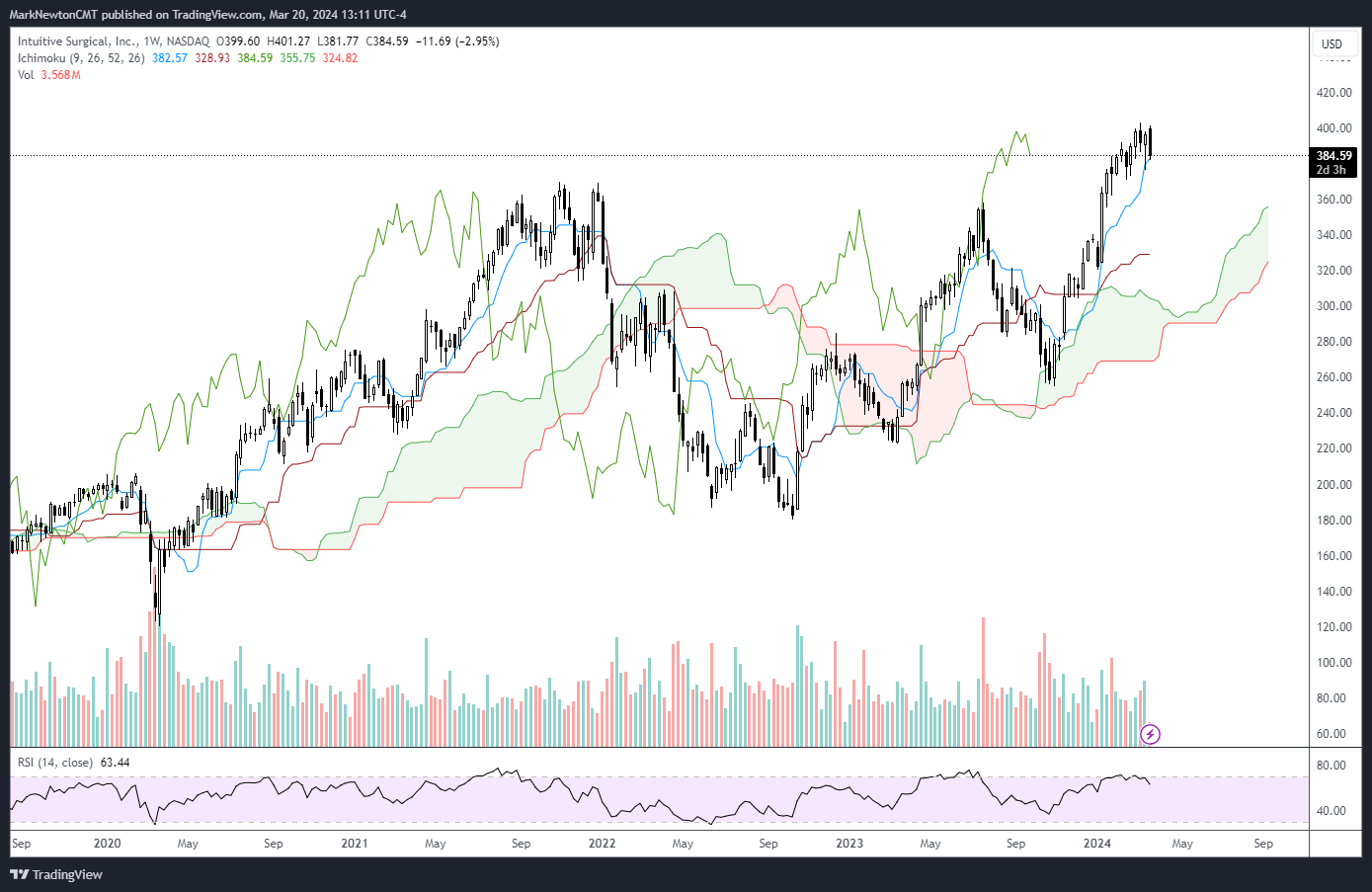

Intuitive Surgical (ISRG- $390.37)

Large base breakout bodes well for intermediate-term gains

Support- $360, Resistance- $435, 504

Breakout back to new all-time highs above a large base which has been building since late 2021 bodes well for intermediate-term gains for ISRG -1.77%

Recent churning following ISRG’s breakout doesn’t appear too bearish, but should pave the way for further gains as Healthcare turns up into the bullish period of June/July

Minor consolidation would likely find strong support near $360 and make this an even more attractive risk/reward opportunity

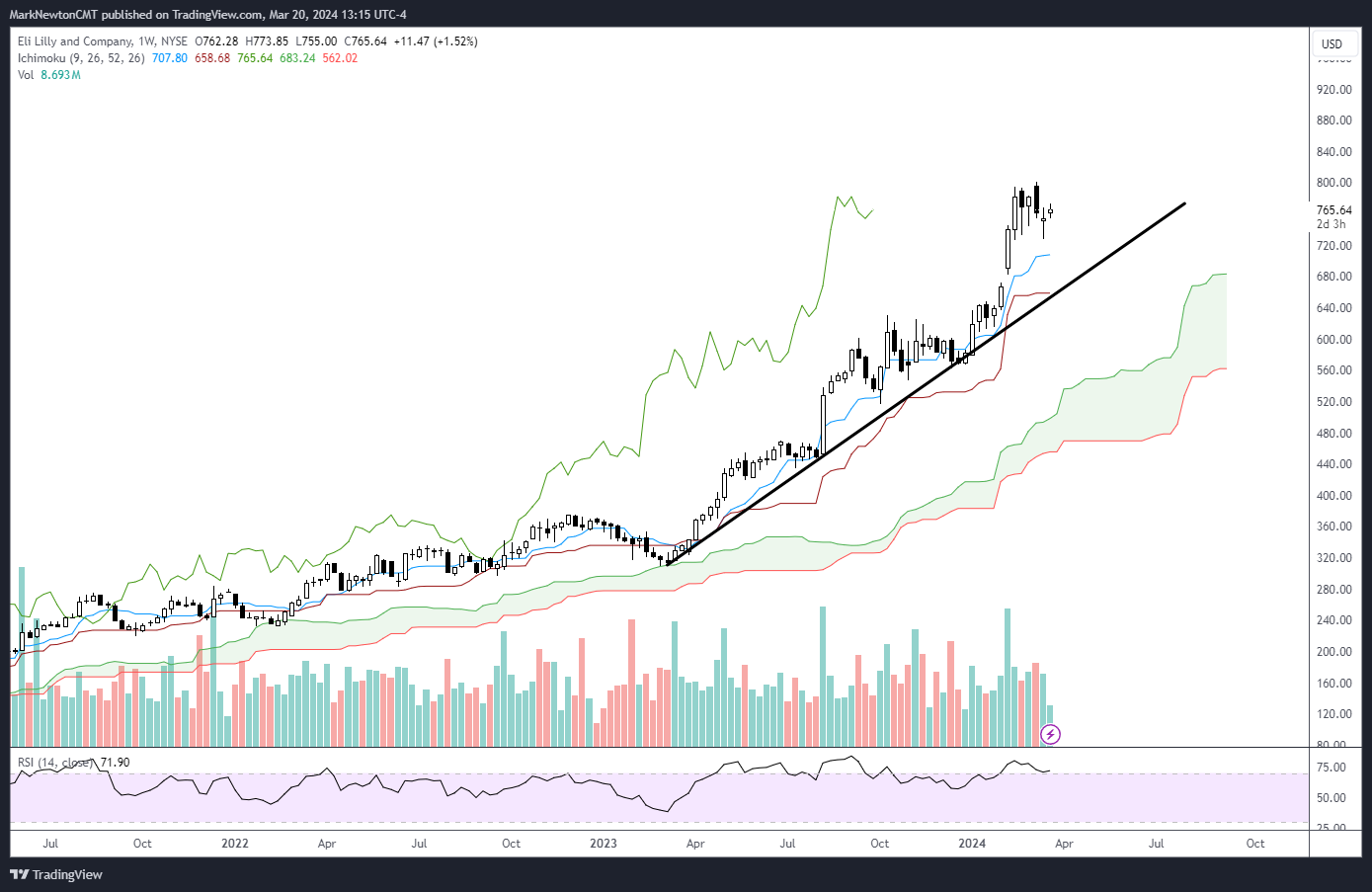

Eli Lilly (LLY- $772.86)

Ongoing parabolic rally looks difficult to fight

Support- $630, Resistance- $850, 1000

Early year upward acceleration in LLY N/A% keeps this uptrend very well intact and likely can lift this to $850 with intermediate-term targets at $1000

Pullbacks from extended conditions, while not anticipated right away, should provide solid support as part of this ongoing uptrend

Difficult to sell based on overbought conditions alone, and attempting to avoid based on overvaluation and/or overextended reasons have both proven to be failures

Vertex Pharmaceuticals Inc. (VRTX – $412.11)

Recent consolidation should prove buyable

Support- $385, Resistance- $503, 558

10% decline over the last month in VRTX 0.63% did little to disrupt VRTX 0.63% ongoing bullish intermediate-term pattern.

Recent consolidation has helped to alleviate near-term overbought conditions and has pulled back in a three-wave pattern

Axon Enterprise Inc. (AXON – $314.28)

Late 2023 Reverse Head and Shoulder breakout proved important and bullish

Support- $280, Resistance- $340, 360

Despite a lengthy rally from mid-2022 to challenge all-time highs from 2021 into early 2023, it was the three-year Reverse Head and Shoulders pattern breakout that has helped AXON 0.66% accelerate

While weekly momentum has become quite stretched, this act of having risen parabolically is quite constructive to the intermediate-term momentum and keeps this trend very much intact

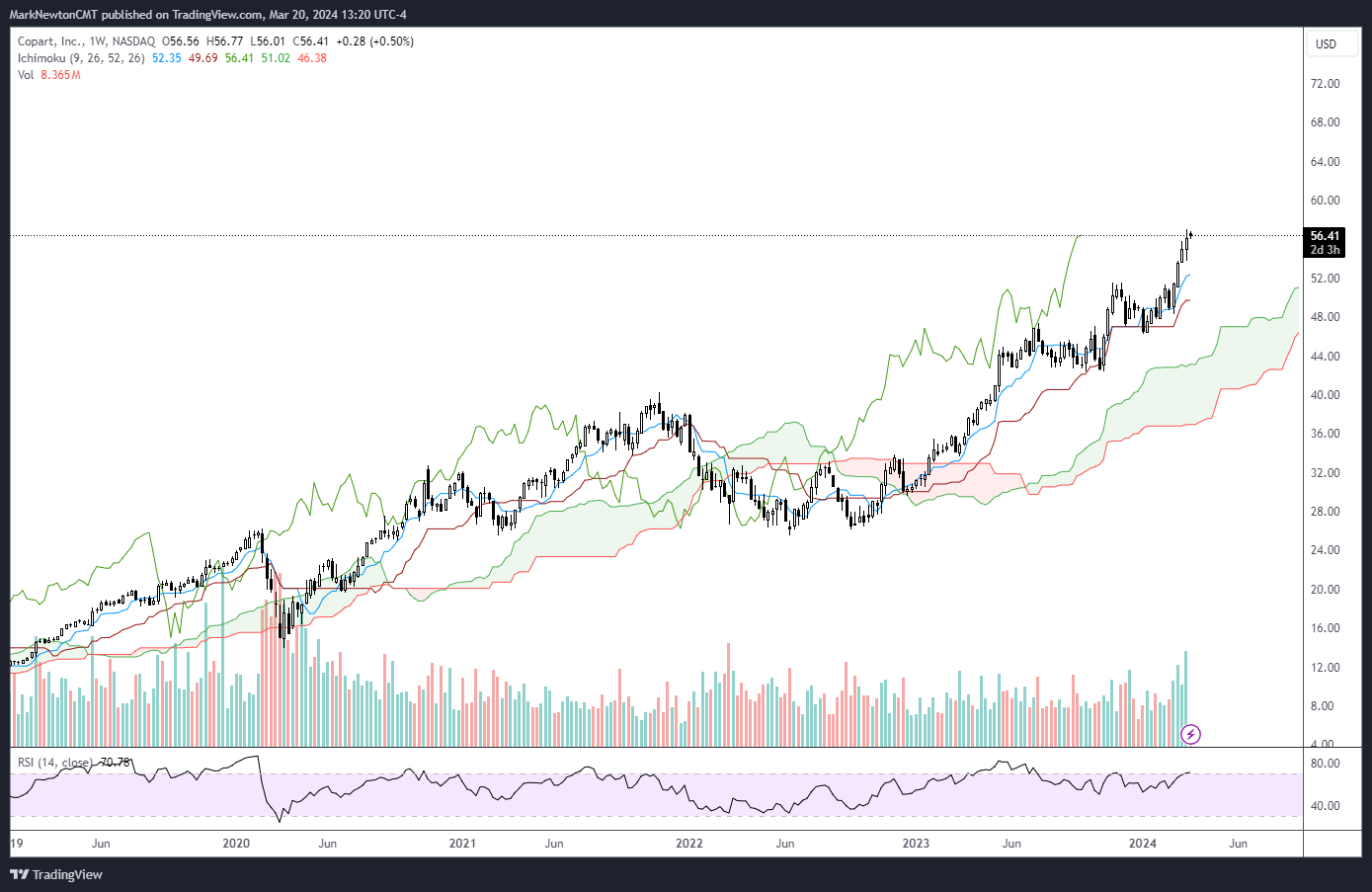

Copart Inc. (CPRT – $56.90)

Continued higher highs and higher lows is bullish

Support- $52, Resistance- $61, 67

February’s breakout has led CPRT -1.36% higher for five straight weeks, helping this approach initial targets at $61.

While near-term momentum has grown extended, this acceleration is also a very bullish technical development. CPRT continues to show excellent momentum and has exhibited little to no evidence of weakness

TransDigm Group, Inc. (TDG – $1214.98)

Push back to new highs keeps intermediate-term uptrend intact

Support- $1010, Resistance- $1243, 1300

Early 2023 breakout of TDG 1.19% three-year base helped this nearly double in price

Trends have grown more parabolic since late 2023 but still looks apt to reach targets near 340, then 360.

Arista Networks (ANET- $296.58)

Triangle breakout bodes well for even more gains

Support- $246, Resistance- $300, 325

Recent churning in ANET was not unlike other areas of Technology, but its push back above triangle resistance is thought to be bullish technically

Triangle breakouts often can lead to immediate acceleration, and I expect ANET 0.92% to likely push up to 300 in the near future, with intermediate-term levels at $325

MicroStrategy (MSTR – $1546.52)

Recent consolidation from $1800 should spell opportunity

Support- $1070, Resistance- $1927, 2090

Recent pullback held Ichimoku support and now should push back higher into mid-April as Cryptocurrencies start to stabilize and rally

MSTR maintains very bullish intermediate-term momentum and a lift back to new highs looks likely

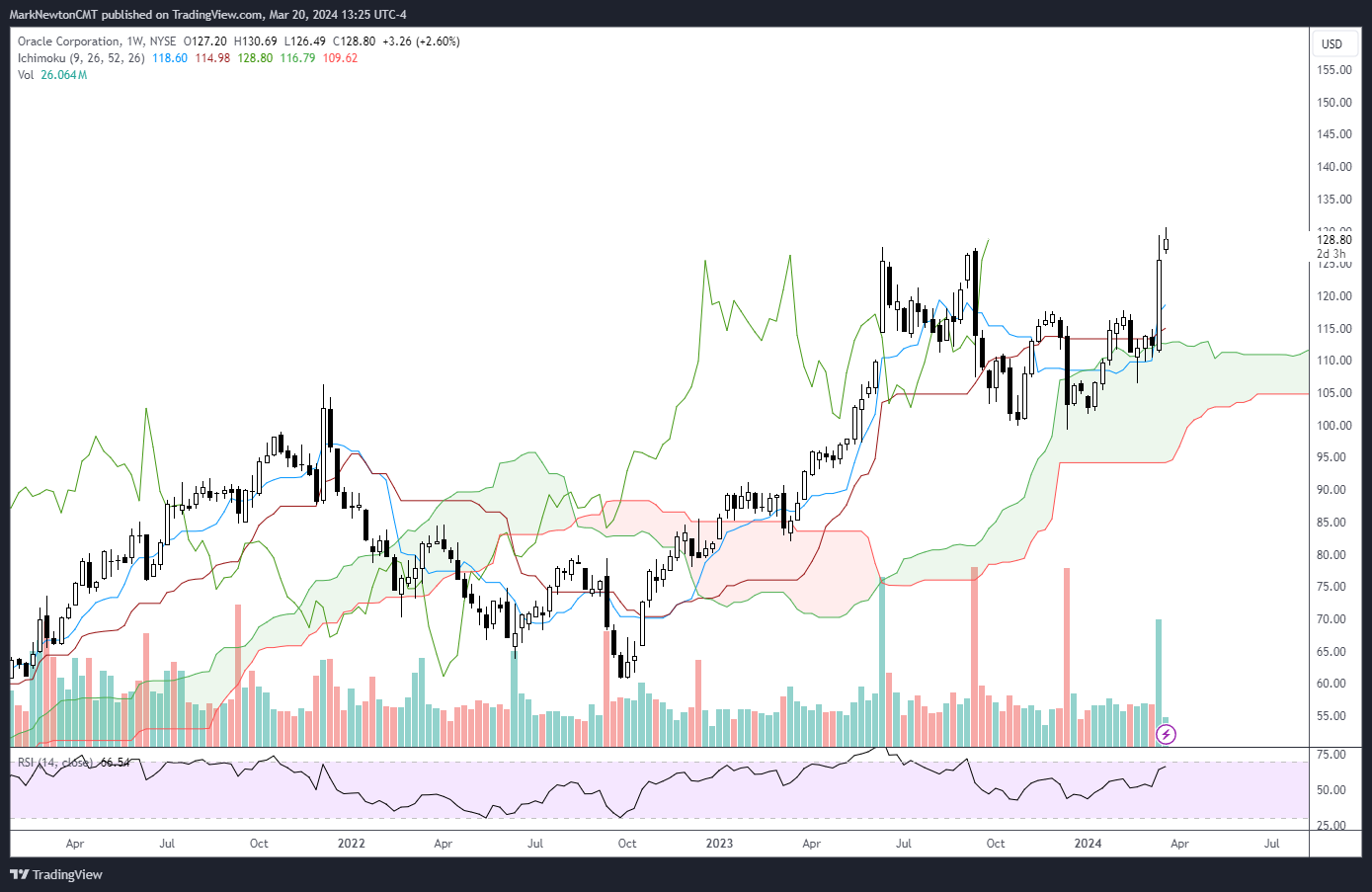

Oracle (ORCL- $129.24)

Breakout back to new all-time highs bodes well for further gains

Support- $117, Resistance- $140, 165

The act of just exceeding prior peaks from Spring 2023 bodes well for a continued push higher to $140, in my view, then intermediate-term technical resistance near $165

ORCL -1.32% recent base from May 2023 was successfully built on top of another base and held support near former highs from late 2021. This week’s breakout bodes well for near-term acceleration

Western Digital (WDC- $60.72)

Pullback in recent weeks represents appealing risk/reward opportunity

Support- $54, Resistance- $72, 78

WDC 2.32% has gradually been improving in relative strength and 2024’s minor upside acceleration bodes well for further gains in the weeks and months ahead.

Minor pullback from the mid-$60’s did little technical damage and WDC looks to be holding trendline support.

A coming rally back to $72 looks likely with intermediate-term resistance found near $78

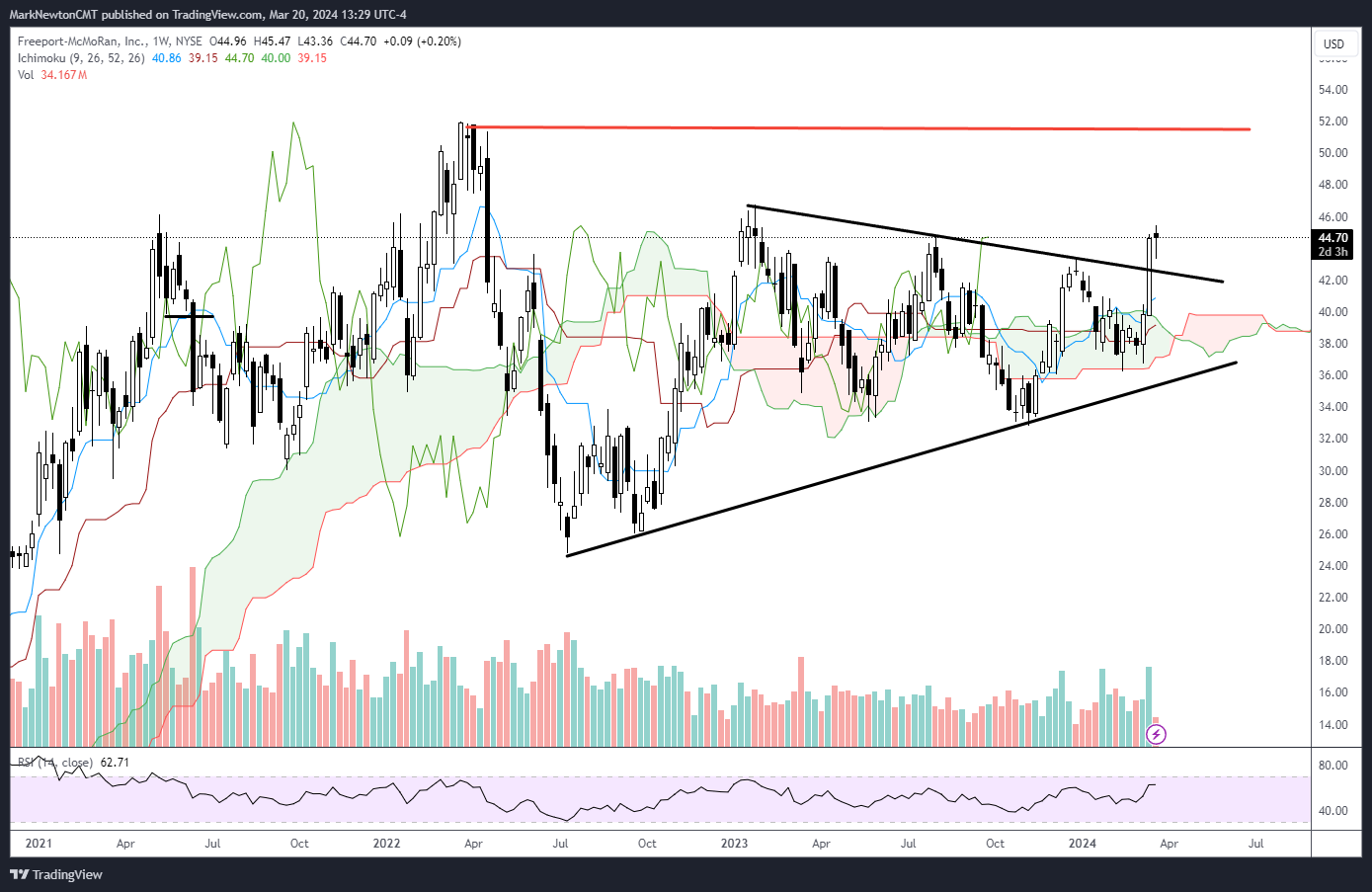

Freeport McMoran (FCX – $46.01)

Year-long consolidation breakout bodes well for FCX gains as Copper rises

Support- $42, Resistance- $52, 65

FCX -1.75% just exceeded a lengthy consolidation which had been ongoing since mid-2022. This is bullish for a coming rally to test and potentially exceed 2022 peaks.

FCX breakout happened coinciding with the breakout in COMEX Copper. Further gains look likely to $52, while movement back to new all-time highs would likely rally to $65.

Upticks Deletions

- DKNG -1.68% – DraftKings Inc

- AMD -2.43% – Advanced Micro Devices Inc

- DPZ N/A% – Domino’s Pizza Inc