This week, we saw the last two inflation-data releases before the next meeting of the Federal Open Market Committee (FOMC) on Wednesday, March 20. Though neither came in soft, equity markets stayed nearly flat. Our current rally has now continued for 20 weeks, but in the view of Fundstrat Head of Research Tom Lee, “While this rally is certainly mature (compared to the 16-19 week duration of the last two rallies), there remains a substantial amount of dry powder to fuel further gains.”

Based on his conversations with clients, Lee believes current sentiment remains skeptical, not bullish enough warrant apprehension of an imminent end to this rally. In his view, the flows are supportive as well: even with positive net equity flows, there remains a record $6.1 trillion in cash on the sidelines. “In our view, a ‘buy the dip’ regime remains,” he said.

Also supportive of Lee’s continued constructive view of this rally are positive technical signals. As Head of Technical Strategy Mark Newton says, “Uptrends and momentum are intact and positive, and I haven’t seen the warning signs that typically suggest this rally is nearing its end.” To put this in more actionable terms: “Technically speaking, I agree with Tom that any volatility should lead to buying opportunities back to new high territory, and it’s still expected that further gains above 5200 are likely in SPX in the next couple of weeks, which might reach 5250-5300 ahead of a possible period of consolidation.”

Chart of the Week

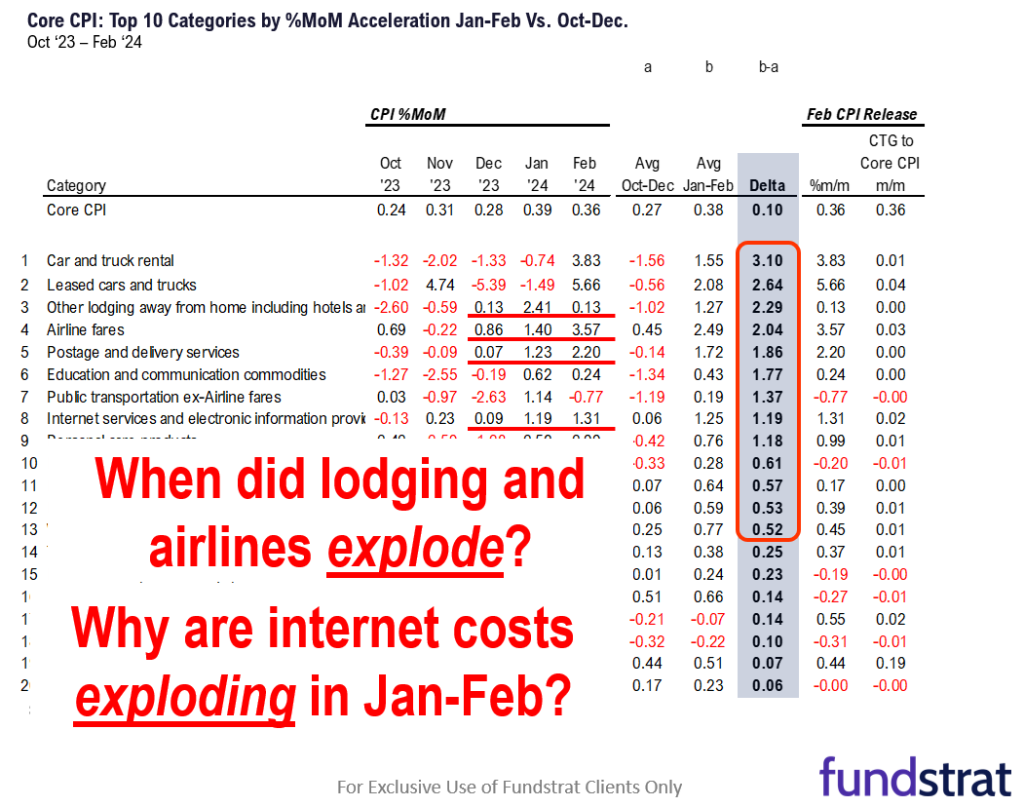

The February CPI report, released on Tuesday, came in hot, in part due to residual seasonality spilling over from January, when many vendors implement annual price increases. However, Fundstrat Head of Research Tom Lee also questioned whether some components in the February CPI report accurately reflect prices in the real world. When looking at the top contributors to inflation acceleration (shown in our Chart of the Week), Lee skeptically and rhetorically asked: “In the last two months, did these suddenly become meaningfully more expensive? Did lodging and airline fares, and postage, delivery and internet services suddenly explode in cost?” Similar questions could be asked about the other components highlighted.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

- 3

/12 8:30 am ET: Feb CPISlightly Hot (as anticipated) 3/14 8:30 am ET: Feb PPIMixed3/14 8:30 am ET: Feb Retail Sales DataTame3/15 8:30 am ET: Mar Empire Manufacturing SurveyTame3/15 10:00 am ET: Mar P U. Mich. Sentiment and Inflation ExpectationTame- 3/18 8:30 am ET: Mar New York Fed Business Activity Survey

- 3/18 10:00 am ET: Mar NAHB Housing Market Index

- 3/19 9:00 am ET: Mar Mid-Month Manheim Used Vehicle Index

- 3/20 2:00 pm ET: Mar FOMC Rate Decision

- 3/21 8:30 am ET: Mar Philly Fed Business Outlook Survey

- 3/21 9:45 am ET: Mar P S&P Global PMI

Stock List Performance

In the News

[fsi-in-the-news]