We closed out last week with the S&P 500 hitting all-time highs, an unambiguously positive milestone. Yet the celebratory mood at Fundstrat was somewhat muted this week. Head of Research Tom Lee argued that “the easy money has been made for now.” As he has previously written, the beginning of January tends to foreshadow how the full year will play out, and in his view, the “sloppy trading” we have seen thus far “is a reminder to expect a challenging year.” He said, “We are now overbought […] so this is not a full ‘risk-on’ market.”

“It’s true that the indices have been holding up – the S&P has been somewhat flat year to date and the Nasdaq is up almost 1%,” he acknowledged. “However, those owning individual stocks might have noticed a lot more tumult and turmoil,” he said.

Or, as Head of Technical Strategy Mark Newton put it, “Technology, the trickster, has been at work again, making the U.S. Equity market seem flat,” he said. “When excluding Technology, this year has actually gotten off to a rough start and most sectors are down, despite what the indices seem to suggest.”

One of the things contributing to volatility this week was uncertainty over the Fed’s timeline for rate cuts. Various Federal Reserve officials publicly suggested that March could be too soon to begin cutting. “Fed officials simply are not convinced inflation is falling fast enough to warrant cuts,” Lee said – a view that diverges from what his research shows.

Our view remains that inflation is falling faster than many realize. And at the core is that housing and autos remain the primary driver of inflation. “Auto insurance actually accounted for nearly half of the rise in core CPI and core services inflation these past few months,” Lee pointed out. This leads to two questions:

- Does tight monetary policy stop auto insurance rates from rising?

- Is the Fed aware of the outsized impact of auto insurance?

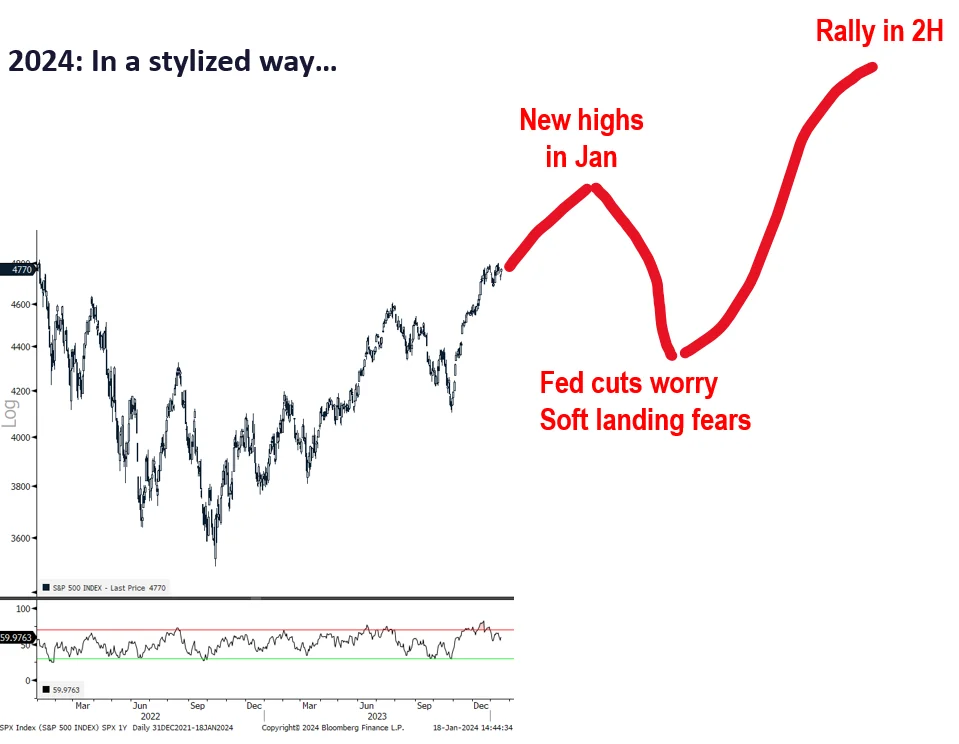

These questions matter because they affect the rationale for rate cuts. If auto insurance was generally viewed as the last residual for higher CPI, the Fed would likely cut sooner and faster. After all, why keep monetary rates at 5.5% if the other components of inflation are running at 3%? The bottom line remains that we believe inflation is tracking softer than many appreciate. When this becomes more broadly accepted, we see this as leading the Fed to cut sooner and potentially faster than expected. Despite last week’s milestone, our general roadmap for markets remains the same: We see challenges and possibly a correction in the first half, then a rally from there into year-end.

Chart of the Week

The Chart of the Week illustrates (roughly but stylishly) where the markets have been thus far, and where Fundstrat Head of Research Tom Lee sees them going for the rest of the year.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

1/16 8:30am ET January Empire Manufacturing SurveyTame1/17 8:30am ET January New York Fed Business Activity SurveyTame1/17 8:30am ET December Retail Sales DataStrong1/17 9am ET Manheim Used Vehicle Index January Mid-MonthTame1/17 10am EST January NAHB Housing Market IndexMixed1/19 8:30am ET January Philly Fed Business Outlook SurveyTame1/19 10am ET U. Mich. Sentiment and Inflation Expectation January PrelimTame- 1/24 9:45am ET S&P Global PMI January Prelim

- 1/25 8:30am ET 4Q 2023 GDP (Advance)

- 1/26 8:30am ET December PCE

Stock List Performance

In the News

[fsi-in-the-news]