It’s likely that US Equities show further rally this week as minor bounce looks to be underway; However, it remains difficult to say that January volatility is complete. At present, pullbacks in US Dollar and Treasury yields should likely coincide with Equities showing further strength while Bitcoin is helping to fuel a large rally across the Cryptocurrency space ahead of a possible SEC decision this week. Overall, Monday’s bounce looks encouraging; Yet, better strength out of Financials along with further pattern improvement from AAPL would be promising for January Equity performance

Monday’s early Tech-led rally broadened out sharply as the day progressed, and by end of day, Equal-weighted S&P 500 had achieved a +1.07% gain, which was encouraging to kick off the new week.

Five sectors managed to turn out gains of more than 1.00% in Equal-weighted terms to join Technology’s gains, and this was encouraging for Monday’s performance: These sectors with 1% gains outside of Technology were: Industrials, Discretionary, REITS, Communication Services, and Healthcare.

Overall, numerous technical signs last week helped to give encouragement about the potential for a rally starting this week. AAPL’s gains in particular were a good sign technically, and this stock looks to make further progress this week.

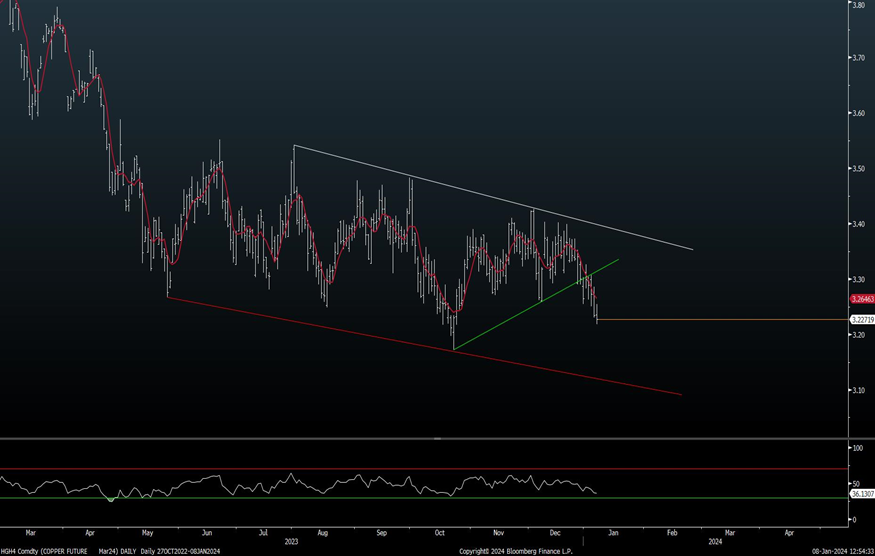

As daily charts show for SPX cash index, prices successfully recouped more than 50% of what had been lost since late December. While SPX performance remains lower for January, this was an encouraging snap-back between Europe’s close and the end of day in US trading.

It looks likely that SPX should challenge and get above late December highs at 4793.30 at this point, and I still don’t feel that 4600 will be breached in SPX before prices push up to 4850-4900. Keeping a close eye on Treasury yields should also be important given the ongoing negative correlation between yields and stocks. Under 4.93% should be quite positive for SPX in the days ahead, I believe. Conversely, any daily close back above 4.10% for yields has the potential to thwart this rally temporarily. However, as has been mentioned in recent weeks, the trend in both US Dollar and US Treasury yields remains bearish. Thus, a pullback to new monthly lows is likely for both in the weeks to come.

The Daily SPX chart is shown below. Given that breadth expanded throughout Monday’s session, I’m inclined to view this positively in the short run, and specifically because of Technology and Healthcare’s rally, I’m inclined to think this continues.

S&P 500 Index

AAPL bounce encouraging, but faces an upcoming test

This AAPL bounce looks to have happened at an exact area of important price and time-based support which bodes well for upside follow-through in the days to come.

Specifically, the 10/25/23-12/14/23 rally in AAPL -0.44% shares (based on low close to high close) lasted 50 calendar days. Interestingly enough, the 50% time retracement of this former rally arrived at 1/8/23, or today/Monday, and AAPL’s 50% price retracement of the former rally from last October intersected just below $182.75.

Thus, AAPL showed nearly a perfect price and time-based retracement before rallying back to multi-day highs today, Monday 1/8/24.

The question most investors have is as follows: “Was this “the low” or “a low?”. Technically, it’s going to be important for AAPL to show more strength before weighing in that a move back to new highs can happen uninterrupted, and this requires a close back above $192. After all, weekly MACD had rolled over to negative following recent weakness, and the stock’s 50% retracement for any upcoming bounce (based on its 12/14/23-1/5/24 decline) lies near $190.

Overall, I expect that AAPL likely does rally up to $187.65 and has the potential for $190. However, I view this latter area as quite important technically as this also lines up with a gap in the stock from 12/29/23 into 1/2/24.

I feel that $190-$192 is an area of huge importance for AAPL. Only once this area has been surpassed is it possible to begin estimating upside targets for an intermediate-term rally back to new highs. At present, I do expect further strength. Yet, I feel that AAPL likely will experience some congestion on this rally and gains likely will find strong technical resistance. Moreover, any rally back to new highs likely will take time.

At present, my key takeaway is that AAPL looks to have bottomed where this “needed to” technically speaking. Near-term gains look likely, but will face some congestion between $190-$192 which might limit progress for this stock, and by extension, potentially for Technology given AAPL’s outsized presence within this sector.

Apple Inc US Equity

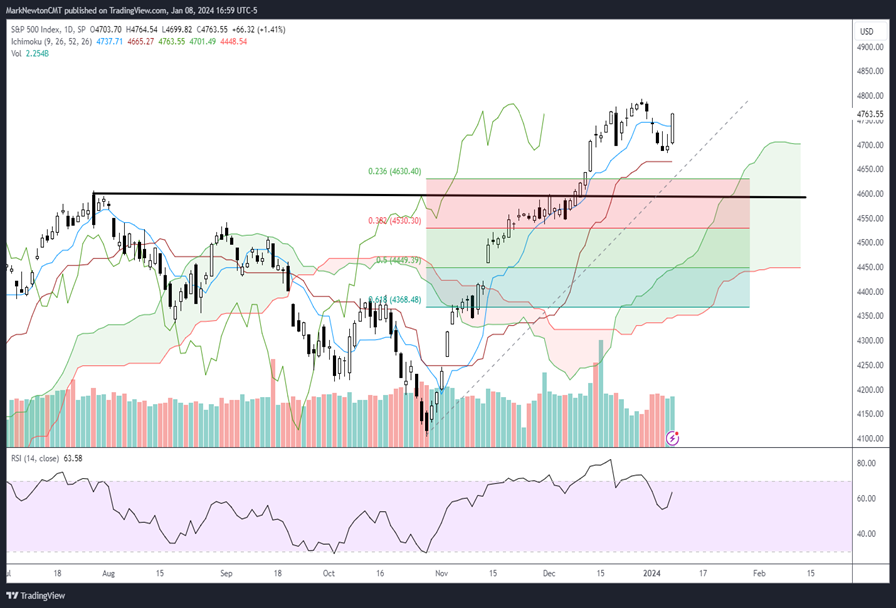

Crude Oil should be watched carefully for any move back above $74

Despite Monday’s -3.5+% decline in WTI Crude oil, I’m not inclined to feel that prices need to get back to lows right away. Given the current wave structure, I’m expecting an upcoming rally back above $74 which should allow for a bounce up to $77-$78.

However, it does appear likely that Crude might still experience some weakness back down to lows in the month ahead, until Crude enters the month of February. This looks to be an important month where cycle composites show Crude bottoming.

At present, I like Energy technically and expect Energy to outperform in January.

WTI Crude Oil Futures

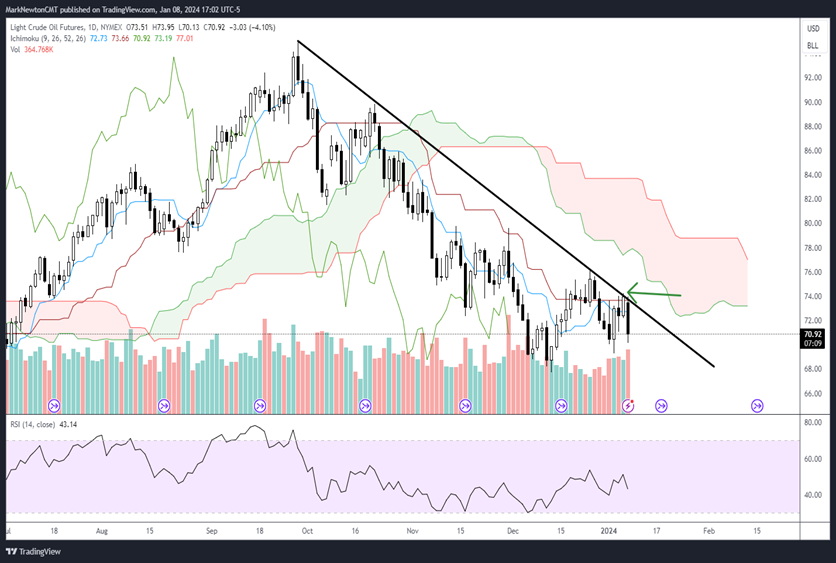

Copper breakdown looks to be tied to China; Patience warranted until this can give more evidence of bottoming

The breakdown in Copper over the last two weeks looks technically damaging temporarily, and Copper’s weakness has occurred coinciding with ongoing pullbacks in Chinese Equities.

Looking at daily Copper charts, the rally from October looked to be very choppy and overlapping.

However, it was the breakdown of $3.30 which proved to be technically damaging, suggesting a good likelihood of additional weakness.

Technically I expect that Copper might revisit $3.10, or slightly under into February before a larger bottom. Both China and Copper cycles show strength between February and June, and I’ll discuss this in more detail when it’s time to revisit these. At present, trends in both Copper along with Chinese Equities remains bearish, and looks premature for dip buying.

Copper Futures