Technically, the near-term pattern remains stretched to the upside and it’s hard to yet declare that Wednesday’s quick decline was just a one-day event. Pullbacks into Friday of this week and/or next Tuesday (post the Christmas holiday) likely should prove buyable for a move back to exceed SPX 4818. Overall, movement back over Wednesday’s highs is needed before thinking the “coast is clear”

It remains difficult to say with any certainty that Wednesday’s late day decline was just a one-day affair and markets should push immediately back to new highs. While the short-term momentum gauges certainly did reach oversold conditions, this was part of an overall picture following daily momentum having reached the most overbought levels in five years. Overall, while a one-day decline might be helpful to alleviate this to a minor extent, the large rally will still require greater consolidation in my view before thinking much more upside is possible.

It’s often difficult to buy dips on bearish reversal days which occur on heavy volume and very negative breadth that undercut several prior days of lows following a runup to the highest overbought daily momentum conditions in five years. However, this year has proven to be anything but normal. I still find that initiating new positions in market indices with prices up against all-time highs for SPX, QQQ as well as stocks like AAPL don’t make much sense until this situation can be resolved.

The Hourly S&P Futures chart is shown below, detailing the wild reversal from Wednesday followed by Thursday’s rebound attempt. Will Wednesday’s highest TRIN reading of the year which occurred on a 90% “down day” be an anomaly, signaling an immediate buying opportunity? Perhaps.

My experience with markets since the 1990’s suggests that waiting until these overbought conditions are either resolved, or lead back above the prior peaks creates a clearer situation than attempting to pile in simply because the Santa Claus rally period starts tomorrow.

S&P 500 Futures

Bottom line, I sense that a US Equity market pullback is still possible into early next week. However, any ability of ^SPX to claw back above 4760 would probably push back to new highs as volume starts to wane even further into the final week of the year.

Overall, a pullback similar to Wednesday which closes near the lows of the session on hugely negative breadth is often difficult to erase right away. Bottom line, I still sense that markets are in a choppy period following the sharp runup followed by Wednesday’s abnormal snapback, with SPX, QQQ and also AAPL still underneath all-time intra-week highs.

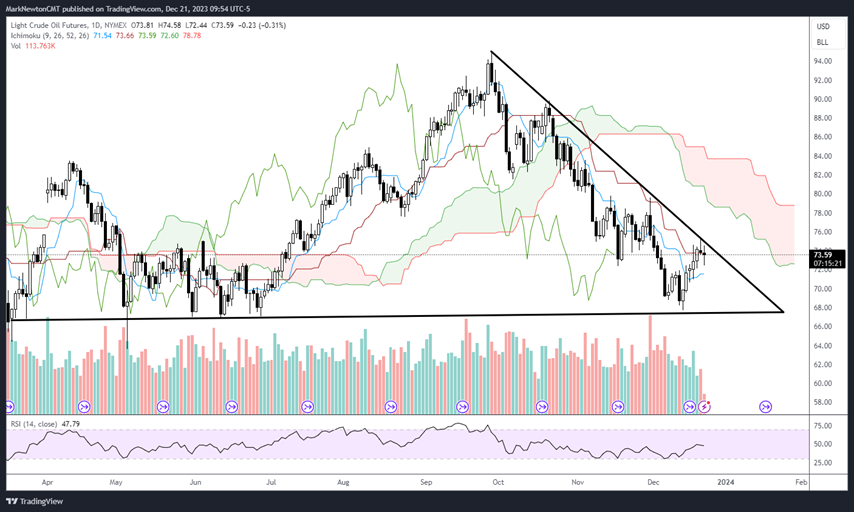

Has Crude bottomed? This still looks premature, but most of the Technical damage has been done

A few weeks ago I made the technical case that Energy should outperform in December, and suggested that Energy might be a good sector in which to position.

Since 12/12/23, Crude has rallied over 8%, yet its intermediate-term downtrend remains intact.

Overall, there hasn’t been sufficient strength yet in WTI Crude to suggest that this ~three-month decline has run its course, regardless of the cyclical tailwinds which remain suggestive of higher prices.

Bottom line, movement over $75 in front month Crude futures (shown below) should lead up to $81, or near a 50% retracement. Conversely, any decline back under $70 should lead to fractional new lows before a more meaningful bottom.

Overall, most of the technical damage looks to have been done in Crude. However, trends will need to improve before expecting that immediate gains can begin. Similar to the SPX and QQQ, some improvement is necessary before getting too bullish in the near-term.

Light Crude Oil Futures

Clean and Solar Energy looks to be turning the corner

Both the Solar ETF from Invesco (TAN -1.99% ) along with the Ishares Global Clean Energy ETF have shown some promising absolute performance off the October 2023 lows, and this has directly occurred as interest rates have fallen.

Relatively speaking, charts of TAN -1.99% vs. RYE 1.49% , or Solar energy in ratio form to the Equal-weighted Energy sector ETF by Invesco has been outperforming for nearly two months.

I suspect that many parts of clean energy might continue to show some relative outperformance as interest rates are pulling back. The correlation with the Solar Energy ETF, TAN -1.99% and Treasuries has proven quite strong in recent months.

Thus, for those seeking outperformance within Energy, TAN looks like an appealing ETF technically which might be able to show good relative strength in 2024.

A snapback in Interest rates early next year might bring about some mild consolidation. However, this would be an area to favor given my thoughts of Treasuries beginning an even larger rally in 1st-to-2nd Quarter in 2024.

Stocks like FSLR 6.63% remain preferred within the Solar Energy space, while SEDG 26.59% , and ENPH 10.24% are both technical laggards. However, the entire space has interest to me heading into next year. Furthermore, my thoughts on Energy being an outperforming sector could also deliver above-average relative strength to many Fossil fuel names, and the period for broad energy outperformance should be likely between February to September in 2024.

The chart below highlights the start of a bounce in TAN vs. RSPG. If/when this can exceed the larger downtrend, this will start to lead to a larger period of outperformance.

At present, the short-term trends still remain bullish, and suggest that TAN can outperform within Energy right now, despite Crude being in a downtrend over the last few months. Thus, investors that have gotten impatient towards Energy might give Clean Energy stocks a second look, particularly during a time of falling yields.

TAN -1.99% / RYE 1.49%

SPX Percentage of Stocks within 20% of 12-month highs has reached July peaks

Another intteresting breadth gauge I like to track concerns the percentage of SPX names within 20% of 12-month highs.

Normally when this is expanding, and momentum gauges like MACD are pointed higher, it illustrates a healthy market and one which can lead higher in the months to come.

Conversely, when this begins to fall, it can often provide a visual warning to periods where market indices can begin to weaken. As seen on the left hand side of this chart, the break of a lengthy uptrend in this particular breadth gauge largely pinpointed a time when many SPX names began to peak out, which happened in Spring 2021.

Despite SPX carrying higher until January 2022, this gauge started to roll over sharply and was pivotal in letting investors know that “all was nnot what it seemed” with regards to SPX strength in the 2H of 2021. This period led to the peak of the broader stock market in November 2021 and subsequently to the SPX as 2022 got underway.

At current levels, the percentage of SPX names within 20% of 12-month highs has now reached close to 80%, or near levels which was seen back in July.

This still looks quite healthy at current levels, and any minor pullback which might result in early 2024 will likely not do too much damage to this breadth gauge given that momentum has been rising rapidly.

Once this begins to peak in a manner where momentum starts to roll over, investors would be given a warning sign (which is not the case at present) Overall, while the short-term for SPX looks a bit choppy with prices up near all-time highs, this rising breadth gauge is generally a healthy sign, and should make SPX appealing on any minor consolidation.

% S&P 500 Stocks within 20% of 12 Month High