No change – Near-term trend for US Equities is bullish, and likely should push up into the Thanksgiving holiday. Treasury yields and US Dollar might weaken a bit further over the next 3-5 days, but larger breakdowns look premature. An Equity rally looks likely into 11/24 or 11/27-28 before consolidating into early to mid-December.

Early Friday losses gave way to gains through mid-day Friday and prices still look positioned to rally in the days to come ahead of the US Thanksgiving holiday. Financials and Consumer Discretionary gains looked to be more important than Energy’s bounce, and the reacceleration in Regional Banks in particular looks important towards helping US markets extend at a time when many Technology names are starting to get stretched.

(I’ll repeat these comments in the paragraphs below for those that missed from recent days, as they’ll continue to be relevant for markets into next Wednesday.)

Following a rally into next week, investors need to be on alert for any hint of negative market breadth, or DeMark-based exhaustion appearing on indices and/or on Treasury yields which might be important towards signaling that consolidation might be overdue.

Finally, 11/27 stands out as being important given its relationship to the 7/27/23 peaks as well as being a perfect 180 days from when US equities began to exert more broadening out in late May.

(I always find 90 and 180 day projections from meaningful highs and lows important, and particularly when aligning with other important angles of the circle for timing purposes (like 120, 135, 225, 270, and specifically, yearly anniversaries). Recall that the US Stock market peaked two years ago in mid-November, 2021.)

QQQ daily charts are shown below, which should push higher to 390 at a minimum, but more likely 392-393 before this stalls out. SPX likely has another 50-75 points higher into next week and anticipate resistance between 4550-4600 area, with many technical targets pinpointing 4560-4575.

Airline rally still should push higher into next week

JETS 2.39% the US Global Jets ETF, still looks attractive, and likely can push higher into resistance between $18-$18.50 into next week before this starts to slow.

Ideally, I expect that strong resistance could happen into the OPEC meeting on 10/26, when potential actions on WTI Crude supply could be undertaken.

While I don’t make much technically of Friday’s Crude rally, I do expect that prices could start to push higher in Energy into December, and that might be a headwind for the Airline stocks rally continuing.

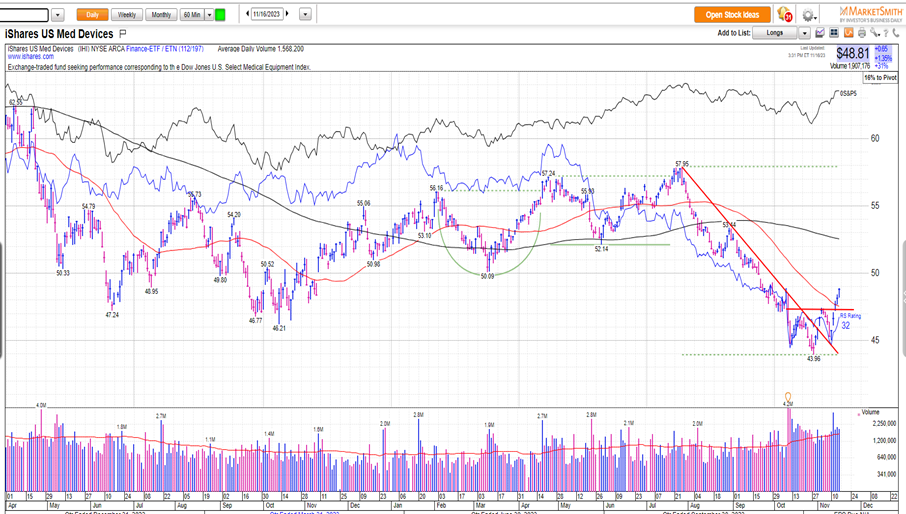

Medical Devices ETF IHI 0.96% has begun to turn higher quicker than Biotech or Pharma in recent weeks

Following up on recent comments on the Medical Devices ETF by iShares, IHI 0.96% , I still feel like rallies can happen into late November. This ETF has provided above-average gains at a time when interest rates have fallen.

While this might prove short-lived into December with TNX nearing support, I like IHI to push higher to $50-$51, and this might prove to be an initial upside zone which could provide resistance to rallies.

Medical devices has proven to be more technically bullish than Biotech in recent weeks, following its trend breakout and acceleration. Until this changes, IHI likely will outperform the Biotechnology ETF, IBB -0.47% (NASDAQ Biotechnology IShares ETF) in the short run.