Equities faced some new headwinds this week. (i) Vaccine supply in the US is being questioned, as the White House passed on buying more Pfizer doses (but US has ordered 700 million doses), (ii) the stimulus relief package seems stuck in the Washington quagmire (iii) The Federal trade commission and multiple state attorney generals brought anti-trust charges to Facebook and (iv) there is a natural questions of whether the AirBnB and Doordash IPOs created a lot of new supply.

And if these were not enough, COVID-19 cases are surging widely in the US, hospitalizations are at record levels and deaths are elevated. Nevertheless, I think there are still several reasons that stocks and epicenter stocks in particular have solid runway through year end and into next year. More on this below.

The absolute number of COVID-19 cases continues to set new records. Thursday daily cases were 213,446, but the 7D delta (leading indicator) is slowing and excluding California (which has ~30,000 per day), this 7D delta is now negative. Hence, I see this as a tentative rollover, as post-Thanksgiving cases can again surge. Next week we will be clear of those post-holiday distortions so if the 7D delta remains negative, the rollover is confirmed.

One of the key questions we all want to know is when will COVID-19 have diminished enough to be out of our lives. This week, we highlighted research from one fairly credible researcher, Youyang Gu.

He has created a new model to look at herd immunity. We have referred to his work in the past, because he had built some big-data models that really well explained COVID-19 forecasted deaths — in fact, more accurately than the IHME. And in summary he estimates a “return to normal” by June/July 2021.

His rationale is straight forward. There are basically three moving parts to his model: (i) Herd immunity threshold exceeding 60% of US population, (ii) Population already infected (ergo, immune) exceeding 30% by June 2021, and (iii) required vaccinated population exceeding 30% by June 2021. Stay tuned for more on this. We are going to try to arrange a call with him for you in the coming weeks.

Strategy: Is a recovery in 2021 Epicenter stock earnings too optimistic?

Over the past few weeks, a number of our clients have wondered whether a 2021 recovery in Epicenter stock earnings is too optimistic. Mostly, many think revenues levels will not recover to pre-COVID-19 levels in 2021, thus, for earnings to rebound, this requires a major margin recovery. There are two reasons we think margins will recover quickly:

First, in 2020, these companies massively cut costs and restructured operations, at a scale they never had to in history. The sheer collapse of the economy warranted this action.

Second, in past expansion, Cyclicals, aka, Epicenter, saw pre-recession margin recovery within 12 months

– hence, in 2021, we should see EBIT margins at or above pre-2019 level

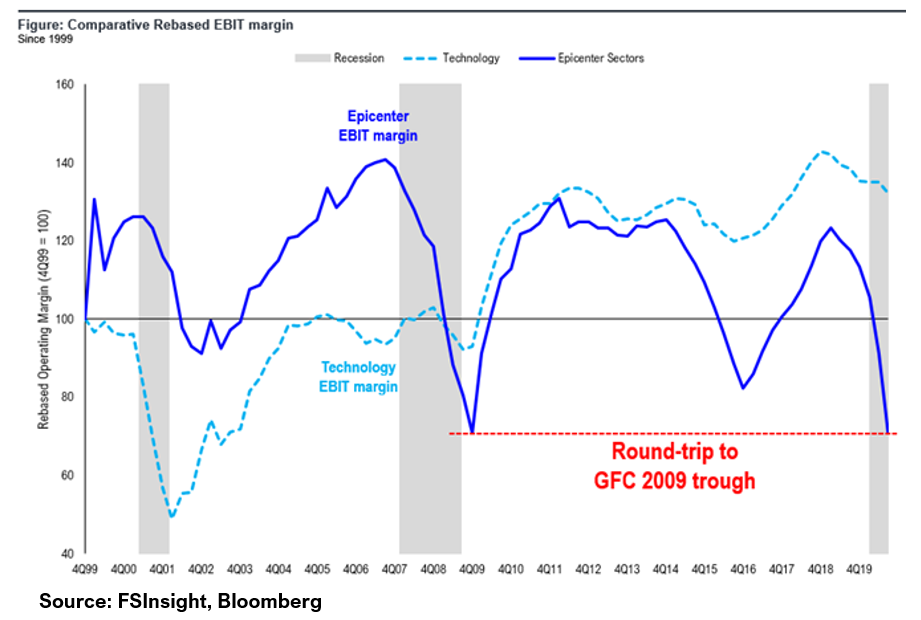

Take a look at the chart above. As you can see, the baseline is that EBIT margins for epicenter stocks are at the troughs seen in 2009 during the Great Financial Crisis (GFC). So, we have seen a complete 12-year round-trip on profit margins. This is due to a sales collapse.

And importantly, look at the massive rise in EBIT margins per the chart above in the 2002 and 2009 recoveries. This is during a time when I do not think companies were nearly as desperate. In 2020, with a pandemic and global shutdown, these companies would have been forced to cut and rationalize expenses at a far greater rate. And if this is indeed the case, we should see an even sharper rebound in margins. Demand recovery could be fierce in 2021 and plus, post-GFC, margins recovered within 4 quarters.

So, my guess is this rebound will surpass GFC — I think that is reasonable. And to capitalize on this rebound, we have updated our Trifecta Epicenter stock list this week. These stocks were hit the hardest by the pandemic and have the greatest operating leverage to a re-opening. I encourage you to our Friday note for the full updated list.

Bottom Line: I do not think that a recovery in epicenter stock earnings in 1021 is too optimistic. Companies have undertaken major cost cutting overhauls, and based on prior cycles, improving EBIT margins should be strongly supportive.

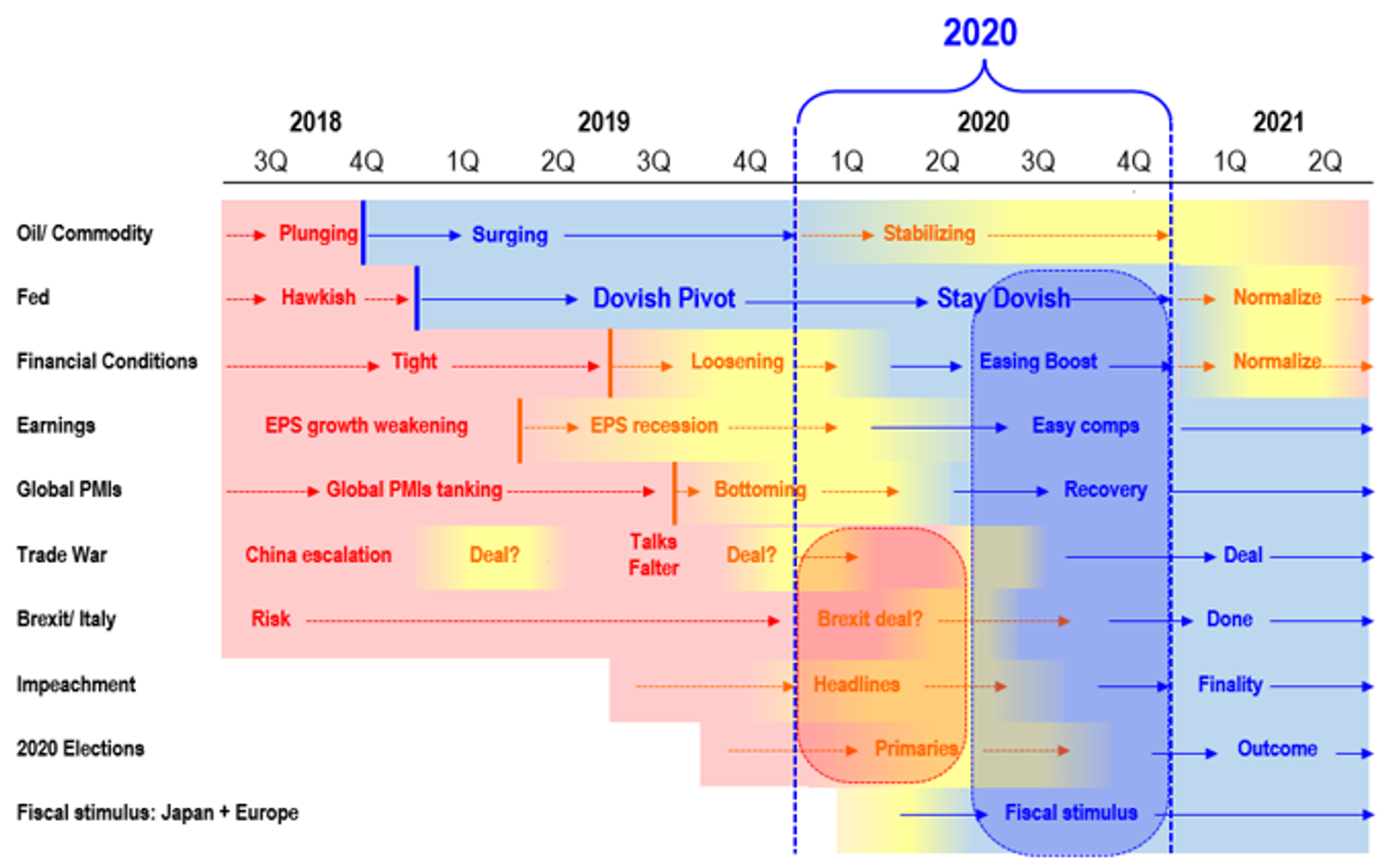

Figure Comparative matrix of risk/reward drivers in 2020

Per FSInsight

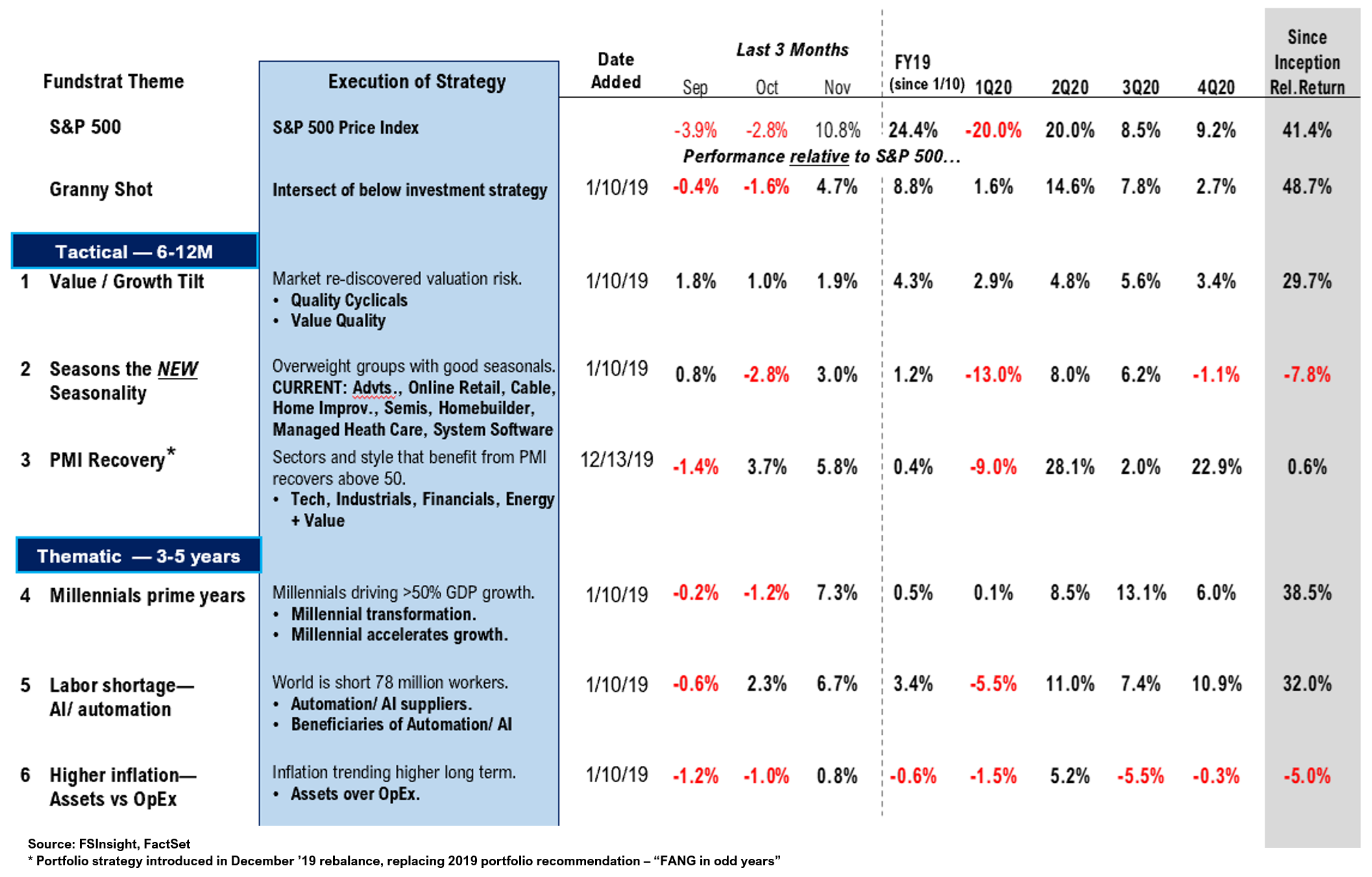

Figure: FSInsight Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019