US Equity markets likely have begun their trek back to test July 2023 highs. Both US Dollar along with Treasury yields are likely to show further deterioration in October, but also could show some backing and filling in the near-term this week. The expansion in breadth has been a slow process to a market that’s been rather narrow for the last month. However, the recent improvement in many former lagging sectors coupled with bearish sentiment remain reasons to be constructive for the back half of October.

The resilience in SPX, DJIA, and QQQ in pushing up above initial resistance makes it likely that a rally back to July highs is underway, in my view.

Interestingly enough, this strength has occurred coinciding with Yields rising, which has been unusual to see in recent weeks. (The US Dollar did manage to weaken further on Monday.)

Breadth showed some decent expansion today, with 8 out of 11 sectors rallying more than 1% in trading. However, this paled in comparison to last Tuesday’s lift, which was considered important for US Equities.

Hourly QQQ charts, shown below, managed to exceed an area near prior lows (which could have been important as resistance on today’s bounce, but gave way to strength).

DJIA, to its credit, pushed up to the highest levels since September, and SPX managed to successfully gain enough ground to approach last week’s highs.

Overall, this is constructive price action. The fact that Monday’s gains happened above initial resistance while rates pushed higher is seen as bullish.

I suspect that even if TNX were to climb above 4.72 to reach 4.80-4.85%, this should prove short-lived before a larger decline in Treasury yields gets underway for the balance of October.

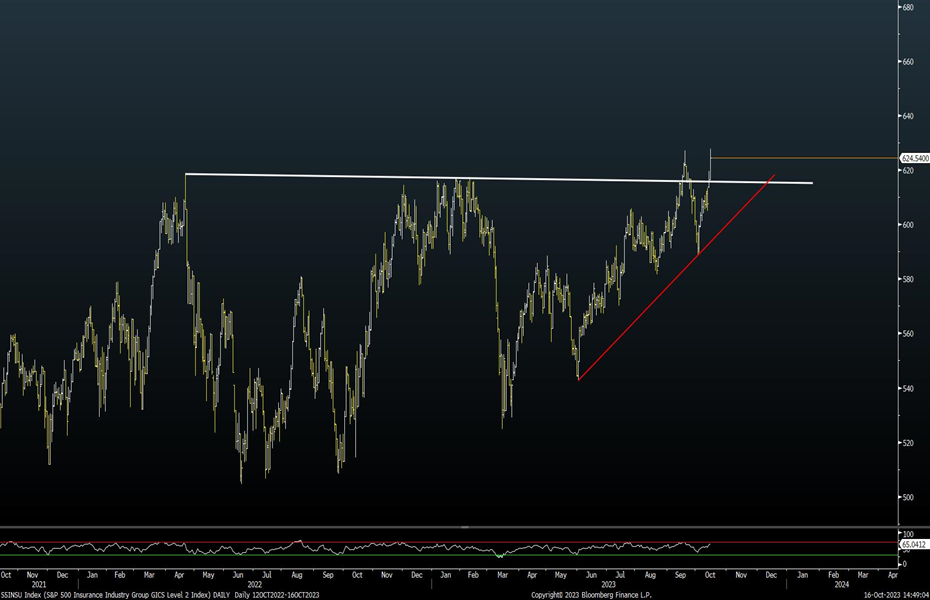

Insurance is making an attractive breakout; Top 10 Insurance names to favor

The Insurance sub-industry has continued to make excellent strides within the Financials sector over the past year, and this doesn’t show evidence of reversing any time soon.

In fact, the S&P Insurance index (S5INSU) is in the process of breaking out of the entire consolidation base since Spring 2022. This is quite constructive for this group and should drive outperformance in the Insurance sector in the weeks and months to come.

While Property/Casualty has been working well since July, and outperforming Life/Health (which normally might be expected during times of market volatility and/or times when stock indices are falling), the Property Casualty has also far stronger than the Insurance Brokers and also general Insurance.

Technically speaking, consolidation bases which form multiple peaks and take the shape of Ascending triangle patterns normally can be quite bullish when price pushes back above the former highs of this pattern. This is specifically has happened on a closing basis as per Monday’s (10/16) Close, and augers well for additional upside follow-through into November, and potentially into end of year.

My top 10 Insurance names from a technical perspective

- Everest Group (EG -2.07% )

- Erie Indemnity (ERIE -2.01% )

- Aflac (AFL -2.36% )

- Arch Capital Group (ACGL -0.73% )

- Primerica (PRI -0.91% )

- Progressive (PGR -0.76% )

- Renaissance Re Holdings (RNR -1.20% )

- AJ Gallagher (AJG -3.89% )

- Assurant (AIZ -0.43% )

- Unum (UNM -0.01% )

KIE vs. SPY has broken out to the highest levels in over a Decade

When eyeing the SPDR S&P Insurance ETF (KIE -0.65% ) vs. the S&P in ratio form, the last couple months have helped to successfully engineer a breakout which has taken out highs going back since 2000.

This ETF is comprised of 50 holdings and none of these exceeds 2.50%.

Despite many investors thinking they’ve missed the move in Insurance, the monthly DeMark count when overlaying indicators like TD Sequential and/or TD Combo still shows this count to be at least 2-3 months away before any exhaustion appears.

Stocks like EG -2.07% , ERIE -2.01% , AFL -2.36% , ACGL -0.73% (among others) have recently just pushed back to new all-time high territory, and EG and ERIE in particular have just exceeded bullish bases which have been formed over the last year.

Overall, I am bullish on Insurance as an area of outperformance between now and end-of-year and feel that this area is far superior to most Regional and Money Center Banks.

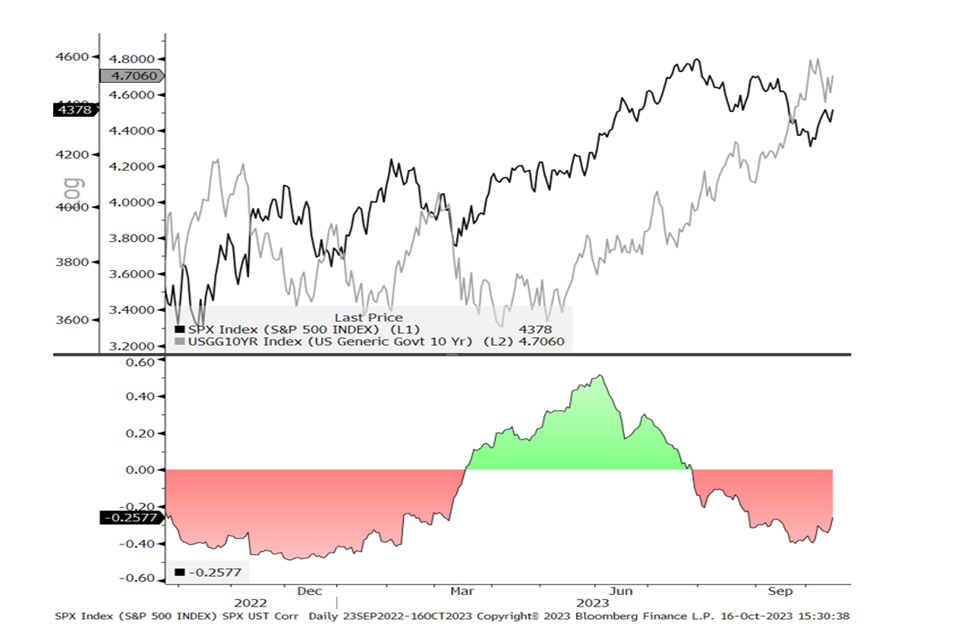

Treasury correlation to US Equities could start to unwind

This daily correlation chart between SPX and TNX shows the degree of correlation starting to gradually unwind after reaching an area of maximum negative correlation last month.

Monday’s trading was fairly pronounced in showing both Equities rallying as Yields also moved higher.

While I expect that Yields are in a peaking process and further upside for yields should prove quite minimal and temporary over the next 1-2 months before yields start to break down further.

At present, I find this lessening of negative correlation to be interesting, and one reason not to feel like the market is “wrong” when yields push higher as Stock indices also rally.

Ultimately, yields look to be in a technical peaking process. I expect that any further attempt at TNX in pushing up near 4.80-4.90% should find strong resistance before turning back to the downside.

Initially, key support for TNX lies at 4.37-4.40%, and I expect that yields breaking 4.53% will help to jumpstart the downward acceleration in yields with first support found near 4.40%.