Markets have entered a window for a potential low. This could take place Tues-Thursday into Thursday’s CPI report. US Dollar and US Treasury yields look to be on the verge of a larger decline in August which should aid Emerging markets, and Commodities.

US Equities have now declined four out of the last five trading sessions, representing the worst week since mid-March. However, no serious technical deterioration has occurred, and trends remain pointed higher from May lows as well as the lows from mid-May.

As discussed, SPX has an excellent chance of bottoming this week and lows might materialize between 4450-85. Following Monday’s 1% rise, patterns have not yet improved enough to think that lows could be in place.

However, the minor pullback has been helpful technically speaking in alleviating near-term overbought conditions, while also causing some pullback in bullish sentiment.

Despite groups like Technology having weakened with MSFT -1.09% holding resistance near former all-time highs along with AAPL having broken its lengthy uptrend from December 2022. However, sectors like Utilities fell even greater amounts and underperformed.

Overall, interest rates and the US Dollar should be two things most Equity investors should be tracking closely, as the SPX selloff happened directly as rates started to push higher above 4.00% in the 10 and 30-year yields. Last Fridays’ reversal in both DXY and ^TNX looked important, and I suspect further weakness should be forthcoming.

As seen below, Monday’s rally attempt has failed to break back up above the key 4560 level in SPX. This will be key to recoup given the structural breakdown that turned Elliott-wave patterns bearish in the short run.

The bounce attempt on Monday (8/7) has thus far failed to recoup levels that would help to satisfy this pattern as being complete.

The wave pattern seems to show a three-wave decline into last week’s lows. However the rally attempts have proven non-convincing and very well would pull back a bit to make the first leg down from 7/27 equal the second wave in price points lost.

Overall, this would allow for 4425 to be tested, which seems like a bit of an overreaction on this first move lower. Overall, 4455 lines up with Gann levels, and I suspect that 4450-4485 could prove to be tested in the days ahead before a move back higher.

Bottom line, I do suspect a low in this decline is near. Any advance this week back over 4560 would be bullish. Meanwhile, any decline back to 4485 should represent an attractive area towards expecting SPX has reached a good risk/reward area. Thus, opportunities should arise this week either on strength, or (more likely) on weakness.

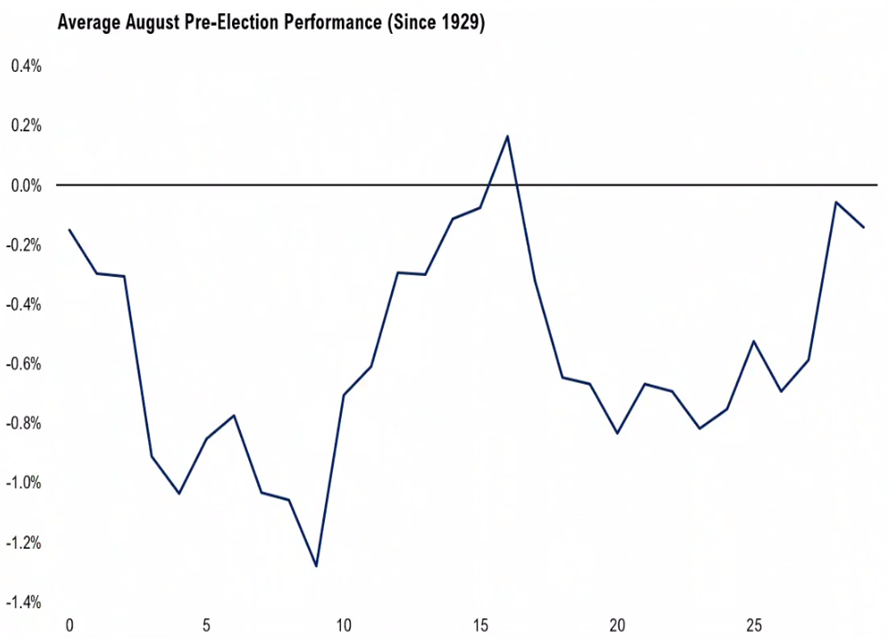

August intra-month seasonality normally has been weak in early August during preelection years before a rally

Data going back since 1929 on pre-election years shows that despite August being a weaker than average month for markets, there does seem to be opportunity to buy dips for rallies into mid-month along with into end of month.

The first week of August typically tends to move lower ahead of a rally into mid-month.

This August seems to have gone as planned according to the seasonal chart below. This might also allow for a coming low this week and a sharp rally into mid-month.

US Dollar looks to have found strong resistance and should be on the verge of turning down sharply

The decline in DXY following last week’s economic developments looked important as price held exactly where it needed to at technical resistance before turning lower.

USDJPY broke down from a minor Head and shoulders pattern, while both EURUSD and GBPUSD began to stabilize after recent weakness down to support.

This week’s CPI data could prove important in coinciding with additional weakness in the US Dollar, which I expect to pull back lower to $97.50 in DXY.

Such a decline likely would spur on the commodities trade in bigger fashion, along with aiding Emerging markets like China.

As daily DXY charts show below, the Dollar rally since early July rallied right to key resistance based on ongoing trends from March before starting to turn lower late last week.

This weakening in DXY likely can continue, with initial support found near $99.50. EURUSD should advance back to test July’s peak just above $1.1250. GBPUSD looks likely to rally back to $1.3150.

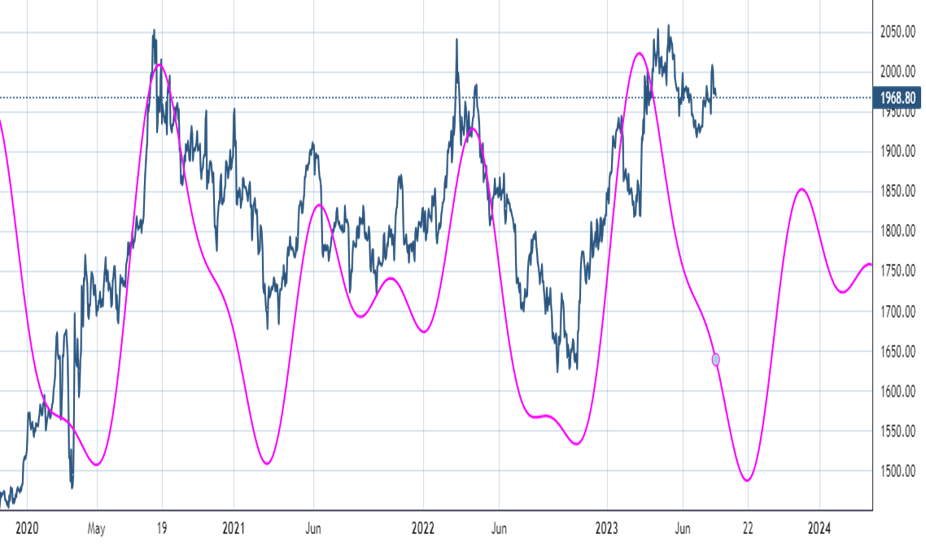

Gold cycles show a coming Low and Rally in back-half of 2023

One of the more reliable Gold cycles in the near-term seems to revolve around the period of 228 trading days. When combining other cycles to form a composite that share harmonic relationships, like 114 days and 334 days, the resulting composite has successfully peaked and troughed almost in unison with most of the major turns in recent years.

This composite turned back down this Spring and seems to bottom in the August/September timeframe before pushing higher for most of the back half of 2023.

Overall, I view Gold as being attractive to buy on weakness, and this could directly start to kick into gear upon evidence of rates and US Dollar weakening post this week’s CPI report.

Technically precious metals tend to rally as real yields wane. Technically 10-year Real yields are trading at 1.688% and have found strong resistance since last October 2022 at 1.82%.

Bottom line, it looks technically that 8/4 intra-day lows of $1924 might hold and not be undercut. Thus, minor weakness this week should translate into providing an attractive risk/reward opportunity for Gold. Only upon 1948 being exceeded again would Gold give confirmation of a trading low at hand. This should send prices back to new highs into the back half of 2023.

Thus, paying close attention to real yields along with the US Dollar is important in the next couple weeks.

My recent UPTICKS inclusion of NEM 3.66% was designed to be able to participate in an upside move in Gold at a time when technical might ordinarily not appear too bullish for Newmont Mining’s prospects. While short-term weakness has played out over the last few weeks (and tough to rule out a move to 37.50-38) this should make NEM quite appealing technically from a risk-reward standpoint. Gains back over $45.92 would help NEM start to push back higher to new 2023 highs.