Today we update the top 5 “Super Grannies” and bottom 5 “Sleeper Grannies. “

If you have not yet registered, sign up with the webinar block below.

________________________________________________

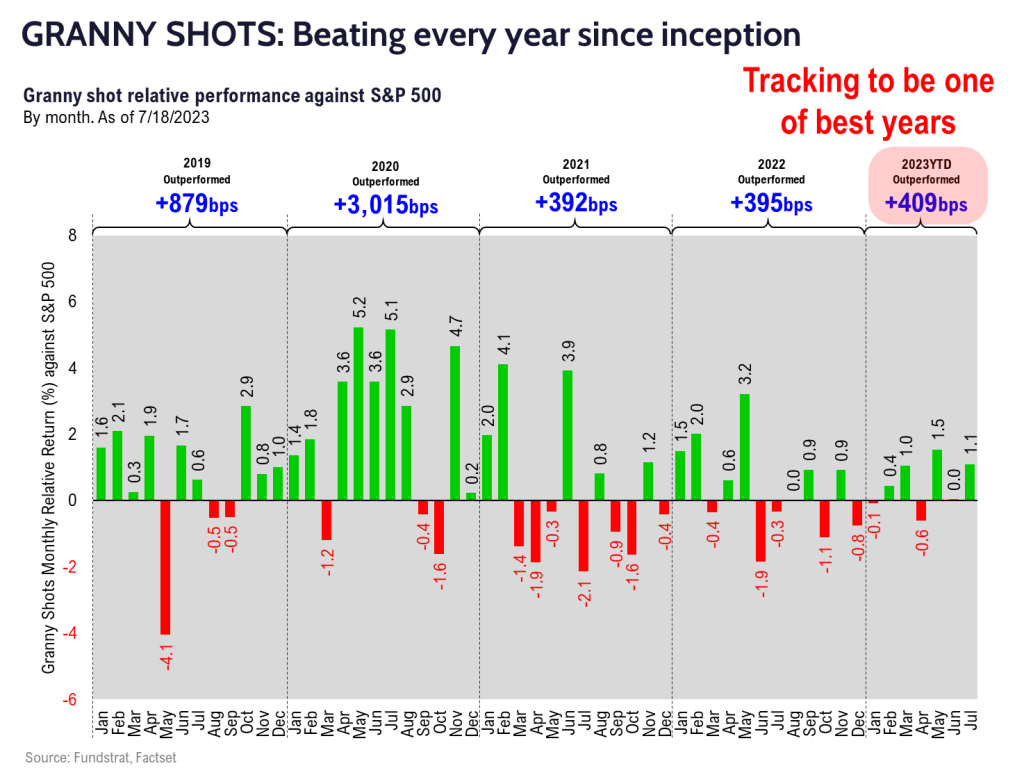

Today’s note will include a short video update. We discuss: The 3Q23 rebalance of Granny Shots is today. Tune into the webinar as we discuss the revised Granny Shots list and the top 5 (Super Grannies) and bottom 5 (Sleeper Grannies). YTD Granny Shots is up +22.7%, outperforming by 409bp. (Duration: 6:06).

___________________________________

- Granny Shots July Quarterly rebalance today

- Updating 5 Super and 5 Sleeper Grannies

- See below for adds and deletes

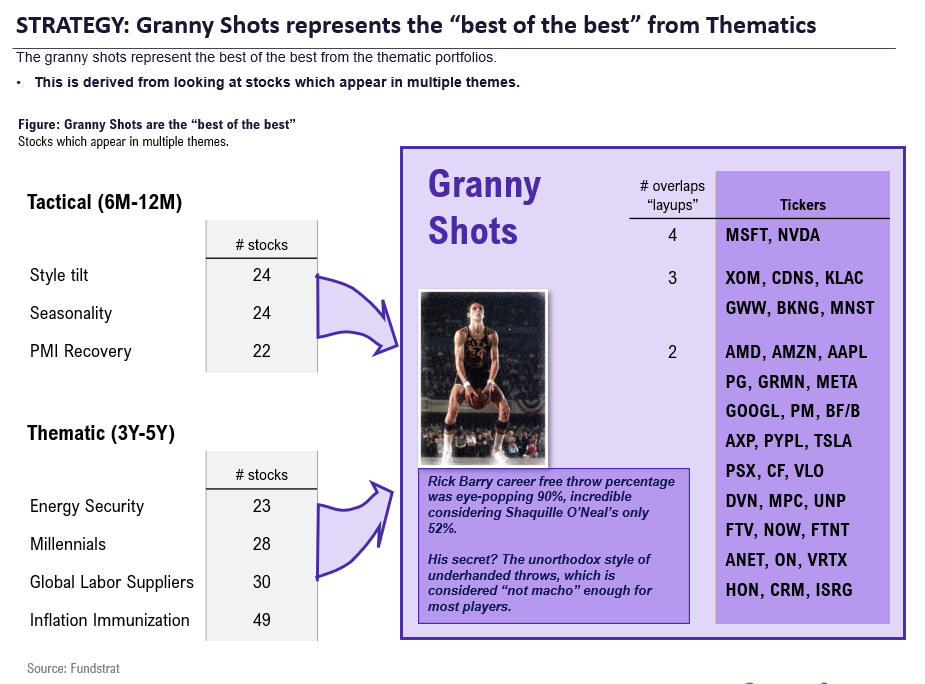

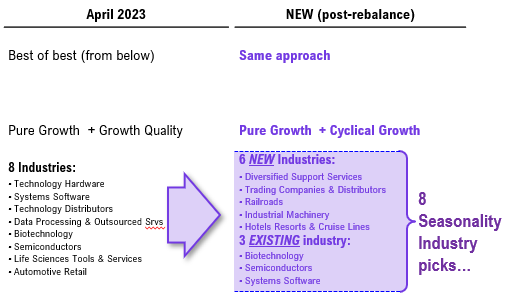

This note is focused on the quarterly rebalance of Granny Shots, and also the updated list of Super and Sleeper Grannies. We view Granny Shots as a core portfolio of stocks and the portfolio is adjusted to reflect seasonal and structural changes:

- The additions: GWW -0.93% , BKNG -0.54% , CF 0.84% , UNP 0.70% , FTV -0.71% , ANET 0.48% , HON -0.44% , CRM 1.34%

The deletions: OXY 1.76% , AMGN 0.22% , FI, MRK 0.01% , KO 0.13% , ULTA -0.85% , HUM 0.16% - There are a lot of moving parts in a rebalance and these are both on style changes and seasonally attractive industry groups. We don’t necessarily want to focus on these as stand alone factors, but the industry groups are shown below.

- YTD Granny Shots is up +22.7% (outperforming by 409bp vs S&P 500). This is tracking to be one of the strongest years for Granny Shots. Grannies have outperformed every single year since inception in January 2019.

- We know many do not want to buy a 35 stock list. So we have launched Super and Sleeper Grannies:

– Top 5 “most attractive” are Super Grannies

– Bottom 5 “least attractive” are Sleeper Grannies

– we refresh these lists the third Wed of every month - Top 5 tactical buys aka “Super Grannies”

– Intuitive Surgical (ISRG -1.16% ) <–carry over from June

– Meta Platforms (META -0.07% ) <–carry over from June

– KLA Corp (KLAC -1.87% )

– Arista Networks (ANET 0.48% )

– Booking Holdings (BKNG -0.54% ) - Bottom 5 “Sleeper Grannies” are:

– Garmin (GRMN -0.48% )

– Philip Morris (PM 0.18% )

– Union Pacific (UNP 0.70% )

– Brown-Forman (BF/B) <–carry over from June

– Devon Energy (DVN 2.28% ) <–carry over from June

BOTTOM LINE: 2Q23 EPS results supporting equity market.

As we discussed in our earnings preview, we believe 2Q23 results would surprise to the upside, supporting stocks to gain. And we explained that the “breakout” group would likely be Financials. This still holds.

___________________________________

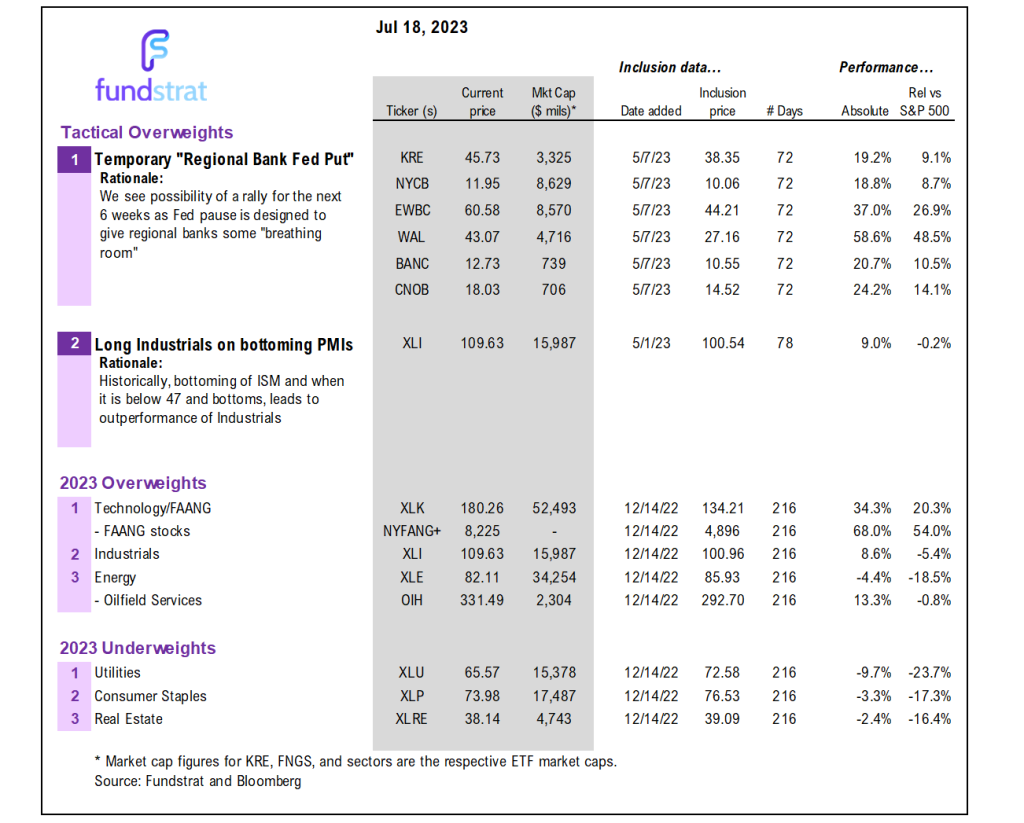

REBALANCE GRANNY SHOTS: +8 adds, (-7 deletes). YTD outperformance +409bp

Today is the July quarterly rebalance of our Granny Shots portfolio.

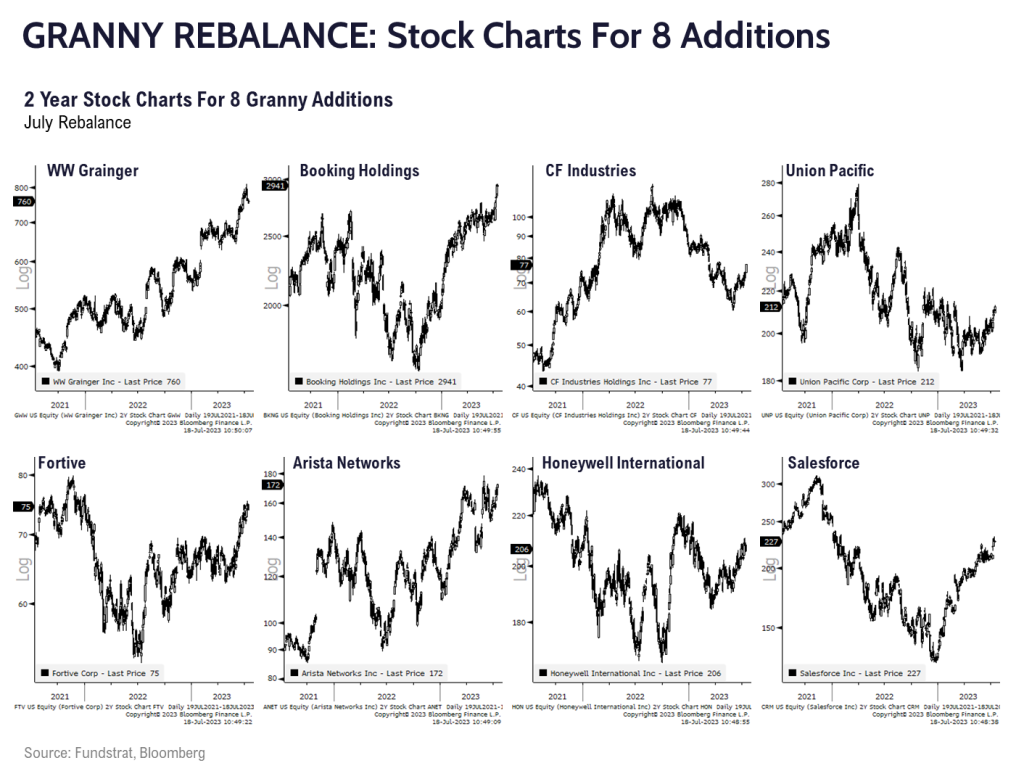

8 rebalance additions are:

- Booking Holdings Inc (BKNG -0.54% )

- Fortive Corp (FTV -0.71% )

- WW Grainger Inc (GWW -0.93% )

- Honeywell International Inc (HON -0.44% )

- Union Pacific Corp (UNP 0.70% )

- Arista Networks Inc (ANET 0.48% )

- Salesforce Inc (CRM 1.34% )

- CF Industries Holding (CF 0.84% )

Below are the 2-year stock charts for the 8 additions

7 rebalance deletions are:

- OXY 1.76% , AMGN 0.22% , FI, MRK 0.01% , KO 0.13% , ULTA -0.85% , HUM 0.16%

Think about Granny Shots as a “core portfolio” that we rebalance every quarter. The Granny Shots is a list of our core stock holdings, using 7 thematic/quantitative portfolios and is designed to identify long-term EPS growers. Since inception in 2019, Granny Shots has outperformed every year:

- 2019 +879bp –> great year

- 2020 +3,015bp –> great year

- 2021 +392bp –> good year

- 2022 +395bp–> good year

- 2023 +409bp–> great start

SUPER GRANNIES: 5 Super and 5 Sleeper

“Super Grannies” (long) and “Sleeper Grannies” are derived from our core stock list of 35 ideas called “Granny Shots”

- The rationale is many clients ask us to narrow this list of 35 names down to a list of “fresh money” ideas.

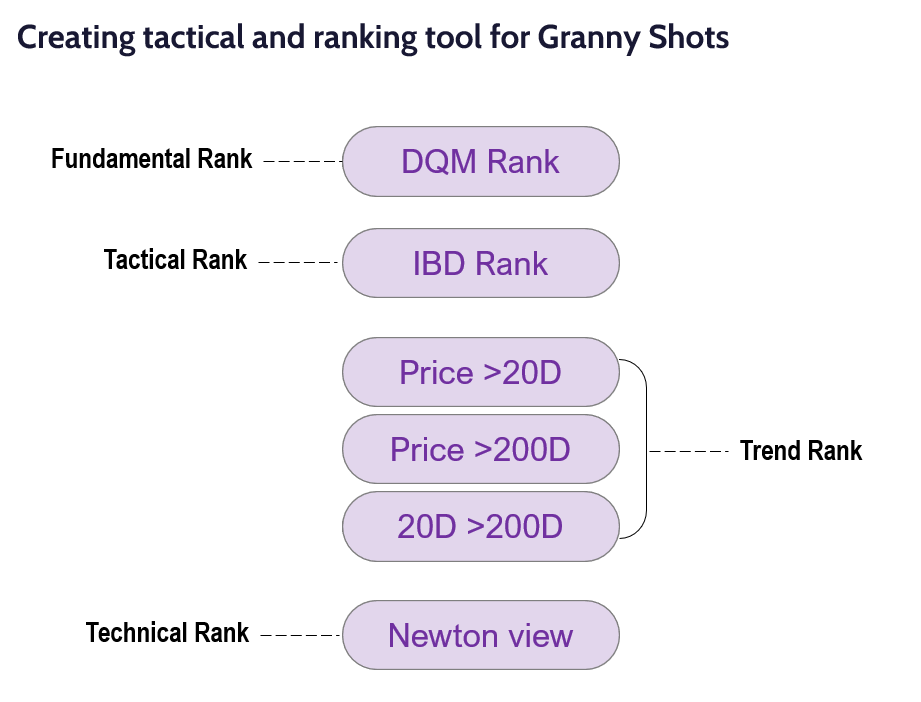

- We established a criteria of 4 factors to narrow the list to tactical buys:

– fundamentals using DQM model managed by “tireless Ken”

– IBD momentum rating

– technical strength measured by Price >20 DMA, 20 DMA vs 200 DMA and combos

– Mark Newton’s judgement on technical outlook

- We have 5 tactical buys aka “Super Grannies”

– Intuitive Surgical (ISRG -1.16% )

– Meta Platforms (META -0.07% )

– KLA Corp (KLAC -1.87% )

– Arista Networks (ANET 0.48% )

– Booking Holdings (BKNG -0.54% ) - The bottom 5 “Sleeper Grannies” are:

– Garmin (GRMN -0.48% )

– Philip Morris (PM 0.18% )

– Union Pacific (UNP 0.70% )

– Brown-Forman (BF/B)

– Devon Energy (DVN 2.28% )

TECHNICALS ON 5 SUPER GRANNY SHOTS: By Mark Newton

Intuitive Surgical (ISRG -1.16% ) – Following steep gains over 14 out of the last 18 weeks, ISRG has risen to within striking distance of late 2021 peaks near $370. Momentum has gotten overbought, yet weekly DeMark-based counter-trend indicators still look premature to line up with any upside exhaustion indicators by at least 4-5 weeks. Despite Healthcare’s underperformance this year, ISRG’s strength has been strong enough to help this rank in the top 5 performers of all XLV -0.47% issues over the last 1, 3, and Year-to-Date basis. Thus, while Healthcare has disappointed in 1H 2023, ISRG has gained over 33% YTD and should continue to strengthen in the weeks/months to come. Former peaks near $370 look important, as this also lines up with an alternate Fibonacci wave projection 138.2% from the bottom that occurred last October 2022. Dips should find strong technical support at $340 on any pullback.

Meta Platforms (META -0.07% ) – META still looks attractive despite having gained over 200% in the last eight months. Price has moved higher in a very symmetrical manner, and while technically overbought, trends have given no indication of a possible peak in price. Gains look likely over the next few weeks up to $340-5 which might signify the first meaningful area for rallies, and DeMark exhaustion could allow for some temporary stalling out in META next month. However, most DeMark indicators still appear to be roughly three weeks early, and there remains no evidence of any disturbance in this very linear uptrend. Overall, technical trends still look quite attractive for META and gains back over $340 look likely. To have any concern about a possible pullback, META would require a break of its existing uptrend from late 2022 which currently intersects near $275.

KLA Corp (KLAC -1.87% ) – KLA’s breakout in May back to new all-time highs makes this attractive technically, and the seven-week consolidation has helped momentum to pull back a bit from overbought levels on weekly charts. The broader pattern of KLAC -1.87% looks quite positive when seeing its nearly two-year rally gave way to consolidation which lasted nearly 16 months before being resolved by a strong upside breakout on above-average volume. KLAC’s selloff into last October managed to bottom at nearly a perfect 50% retracement ratio of its former rally from the 2008 lows. Now the push back to new highs after more than a year of sideways action is considered bullish and should translate into KLAC pushing higher to $533 with additional targets at $601. Strong support lies at $430 which should provide a cushion to any pullback into the Fall season. Overall, this breakout from a tight bullish base back to new all-time highs is a positive for KLAC, and higher prices are likely.

Arista Networks (ANET 0.48% ) – Arista Networks looks quite bullish technically following its quick rally which has brought this back to test highs of the last six months. Since this stock bottomed out last June, it’s recovered in an increasingly parabolic fashion, with a trend of higher lows in recent months. While daily charts show the stocks breakout attempt into late May initially failing, its subsequent retracement proved quite constructive and formed lows at much higher levels before immediately pushing back higher towards the highs of its recent four-month range. The success in recouping losses so quickly is quite positive technically towards expecting an upcoming breakout, which likely would carry up to $193, or a 100% price extension of the move up off this past January lows. Momentum remains positively sloped on a weekly basis and not overbought given the extent of the minor consolidation since March. Overall, ANET looks likely to make a new all-time closing high this week with a weekly close above $170.35 which should jump-start some upside acceleration into end of month. Only on pullbacks under $148 would ANET violate support and postpone its rally, which is not expected in the weeks ahead.

Booking Holdings (BKNG -0.54% ) – Booking Holdings has gotten quickly overbought following its recent breakout above February 2022 peaks which has taken this quickly back to new high territory. However, the act of just arriving at weekly overbought levels doesn’t appear as important when seeing that BKNG -0.54% was range-bound for over two years ahead of its recent breakout. Upside targets lie initially near $3150, and pullbacks likely encounter support near 2800 before likely turning back up to show additional strength to intermediate-term levels at $3741, which equates to a 1.382X alternative projection target from the initial rally from March 2020 lows when measured from October 2022. Bottom line, overbought conditions do not look like an important reason to avoid BKNG as the range-bound consolidation which started in March 2018 has just given way to an upside breakout which began last week.

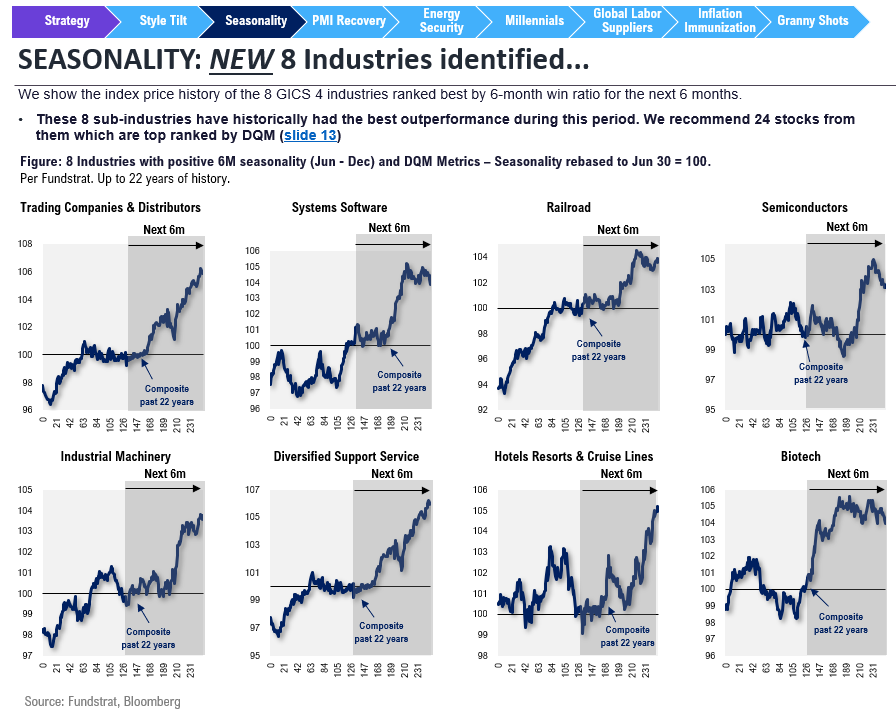

Seasonally Attractive Groups

Key incoming data July

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed7/17 8:30am July Empire Manufacturing Survey7/18 8:30am July New York Fed Business Activity Survey7/18 10am July NAHB Housing Market Index7/18 Manheim July Mid-Month Used Vehicle Value Index- 7/20 8:30am July Philly Fed Business Outlook Survey

- 7/25 9am ET May S&P CoreLogic CS home price

- 7/25 10am ET July Conference Board Consumer Confidence

- 7/26 2pm ET July FOMC rates decision

- 7/28 8:30am ET June PCE

- 7/28 10am ET July Final U Mich 1-yr inflation

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

The Granny Shots page will be updated shortly. See above for more details.

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

We publish on a 3-day a week schedule:

– Monday

– SKIP TUESDAY

– Wednesday

– SKIP THURSDAY

– Friday