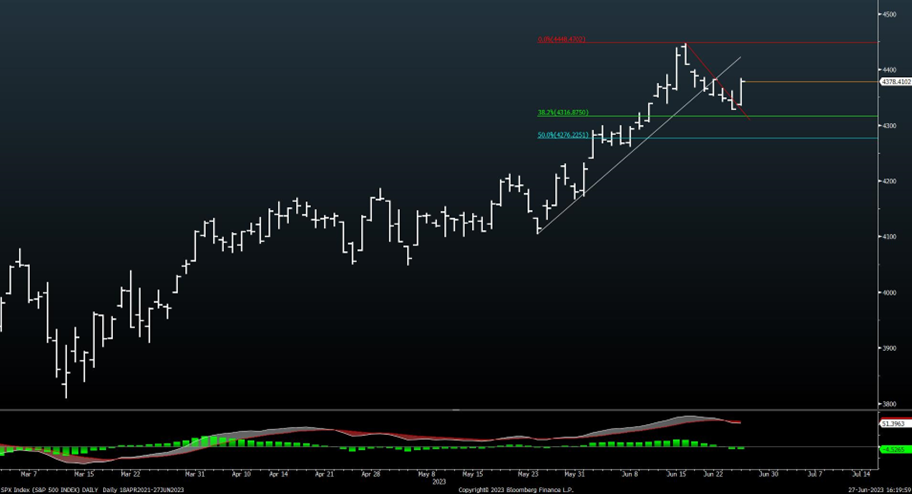

Trend bullish – Pullback looks complete and rapid ascent has nearly recaptured 50% of entire pullback from mid-June. An upcoming test and breakout of June highs likely

Tuesday’s rally back to multi-day highs looked important and positive in having halted the recent decline in its tracks. Following five days lower out of the past six, SPX managed to rally sharply enough to recoup nearly 50% of the entire pullback since mid-June highs.

Six Equal-weighted Sector ETF’s rallied over 1% on the day: Materials, Industrials, Consumer Discretionary, Real Estate, Technology, and Communication Services. Of those, Discretionary and Technology rose over 2% on the session.

As discussed in recent days, the lack of severe downside breadth on recent weakness was thought to be encouraging, and a few days of large-cap Technology weakness largely camouflaged market performance, as many sectors performed quite well throughout last week.

Going forward, I view Tuesday’s strong gains as having been constructive, and should lift SPX back to test and exceed mid-June highs which could help prices surpass SPX-4500.

Until proper evidence of real exuberance combined with defensive strength starts to crop up in the US Equity rally, near-term overbought conditions in QQQ won’t prove too important, and should not be cited as a reason “why” Equities should sell off in July.

An SPX rally back to test and exceed 4448.47 (6/16/23 intra-day peak) looks probable for SPX into July, while QQQ should test and break back over 372.85. Unless Monday’s lows are broken on a closing basis, trends remain bullish and Tuesday’s rally likely ended the recent pullback for US Equities.

Small-caps look to have bottomed

Following a rollercoaster of late in the Russell 2000 ETF (IWM 0.05% ) Small-caps look to have potentially bottomed as of Tuesday’s (6/27/23) close.

As daily charts show below, prices initially broke out before pulling back to test the area of the breakout. Normally, a pullback to test the pivot point (area of breakout from 6/2/23) is expected to have a high likelihood of finding support and turning back higher.

This is precisely what happened in Tuesday’s session. Overall, I expect IWM to push back higher to test and surpass June highs of $189.24 en-route to $197 which is the first real area of upside resistance.

Only a decline back under $180 would serve to postpone the rally, which at present, looks unlikely.

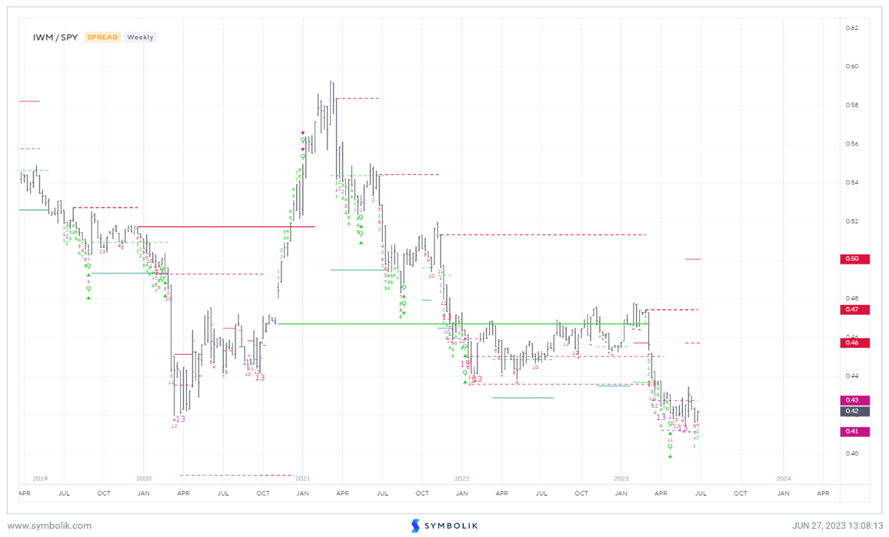

Small-caps look to be bottoming out vs. SPY along with QQQ

Interestingly enough, relative charts of IWM vs. both SPY as well as QQQ look to be trying to bottom out on both a daily and weekly basis.

This conclusion spurs from two important reasons: First, Small-caps rallied sharply in early June before peaking and pulling back to test former lows. However, this level seems to have held and has been followed by a strong push off those lows on Tuesday to multi-day highs. Second, counter-trend exhaustion is now present on both daily and weekly relative charts of IWM vs QQQ and SPY.

Given that recently strong economic data might keep the Fed’s hand steady in continuing to hike rates a couple more times (Higher rates for longer) this might put pressure (eventually) on Technology. Interest rates have been largely sideways for the last month.

However, Consumer Discretionary has outperformed dramatically in recent weeks and this remains over 13% of Russell 2000. While I’m no economist, it makes intuitive sense that the strong labor market can continue to fuel Consumer Spending as Americans gradually get used to higher interest rates. Overall, Small-caps and Russell 2k outperformance might be a natural beneficiary of this.

As weekly charts of IWM vs SPY shows below, this ratio stopped right near prior lows from 2020 before jumping this week. I expect further relative strength out of Small-caps.

China rebound looks important after pullback to support

Finally, China could finally be bottoming out. Chinese Equities seem to finally be paying attention to the recent strength having been seen in Emerging markets. FXI along with the China Internet ETF from Kraneshares or KWEB -0.58% , has risen to multi-day highs on a closing basis following its successful retest of the 61.8% Fibonacci area of support.

I discussed this recent breakout of China’s Large-Cap ETF (FXI -0.05% ) a couple weeks ago and recent consolidation now should be finding support and lift back to challenge June highs.

Overall, my technical thoughts area that recent weakness last week created an attractive risk/reward, and that Tuesday’s liftoff to multi-day highs is important and positive for China.

June highs at $29.25 should be tested and surpassed for FXI, while $30.17 is the level to concentrate on for the KraneShares CSI China Internet ETF (KWEB -0.58% ) Movement above $30.17 should jumpstart a rally back to challenge early year peaks just above $36 in KWEB which is quite important to exceed to argue for an intermediate-term rally.