-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

What Does The Fed’s November Hike Mean For Markets? 1 and can accesss 1

"As investors, we also always have to be aware of our innate and very human tendency to be fighting the last war. We forget that Mr. Market is an ingenious sadist, and that he delights in torturing us in different ways." - Barton Biggs

The Federal Reserve held their highly anticipated November FOMC meeting on Wednesday. As expected, the world’s most important central bank conducted their fourth consecutive 75-bps hike. However, expectations for some rhetoric indicating a gentler path for rates going forward were dashed. Markets initially rose on some language from the statement that appeared to open the door for a more moderate path. Powell used the press conference to disavow these hopes of a pause or a pivot and quite directly answered them. “It is very premature to be thinking about pausing,” said the Chairman.

It was a whirlwind for even the most seasoned pros on the Street and was likely a key inflection point in the Fed’s continued efforts to restore price stability. It’s an existential fight, as Mr. Powell pointed out in the beginning of his statement, “Without price stability, the economy doesn’t work for anyone.” Our Head of Technical Strategy, Mark Newton provides his thoughts on the initial price action and the technical state of the market after the meeting below:

The rollercoaster of price action into and after the FOMC’s rate decision proved to be dizzying for many market participants, and the specific act of Treasury yields firming after Powell’s comments proved to be detrimental to US equity markets. Specifically, the 2-year yield along with 10-year yield both showed whipsaws that caused rates to turn back sharply higher following earlier plunges. Importantly, this ^SPX 0.84% pullback has now given back 38.2% of the prior rally and is thought to have a maximum move lower to its 50% retracement of the October bounce, and the area at 3712 directly lines up with some key support near the former intra-day highs from 10/14. Overall, both Equities and Treasuries look to be nearing support from a price perspective, and this early November volatility should be nearing its end by Friday.

The key developments from this meeting were as follows:

- Markets were disappointed in their hopes Powell may show some light at the end of the tunnel. He ended up doing the opposite and suggested that next month’s Summary of Economic Projections (SEP, or “dot plot”) would be higher than what was released in December.

- While he did open the path for a potentially lower rate hike, the fact the terminal rate will likely be higher negates any joy that would come from a hike that is merely 25 bps lower.

- Powell made clear that, given the tools available to him, he would rather overtighten and correct it with accommodative policy than stop tightening too early.

In the runup to the meeting anticipation had been building as rhetoric from members of the FOMC started to evolve. The September FOMC minutes had shown the body discussed potentially adverse effects of tightening. Several Fed officials were more nuanced on what was driving inflation—when inflation is driven by things on the supply-side, like gummed up supply chains, there is little the Fed can do with its monetary mechanisms. The same is true with heat in the labor market, some of this may be structural and won’t respond much to interest rate hikes, particularly in industries less sensitive to rates. Our Head of Research, Tom Lee, also pointed out that even some hawkish members appear to be tempering their aggressive tone a bit.

- Several Fed speakers, including some who have been hawkish, suggested that the 2022 inflation surge is primarily from “supply chains, energy and commodities.”

- This is the beginning of the doves reclaiming their voice, but it still doesn’t represent the majority view.

- Thus, if the supply-side improves, there is a path for the Fed to reduce the heat quicker than the commentary at their last two meetings and Jackson Hole would indicate.

In our last installment of Fed Watch, we elaborated on the rhetorical quandary that Mr. Powell found himself after the summer rally.

- The Fed must talk tough right now because not doing so undermines the tightening of financial conditions they need to achieve to bring price stability back to the economy.

- If you take the Fed at face value, incremental improvement in inflation will not be enough to change course and give markets relief, so they will likely be keeping rates elevated at restrictive levels for some time.

- The Fed is going to wait to see the effects of the tightening on the economy and inflation before reverting to an accommodative policy. Higher for longer is now a reality.

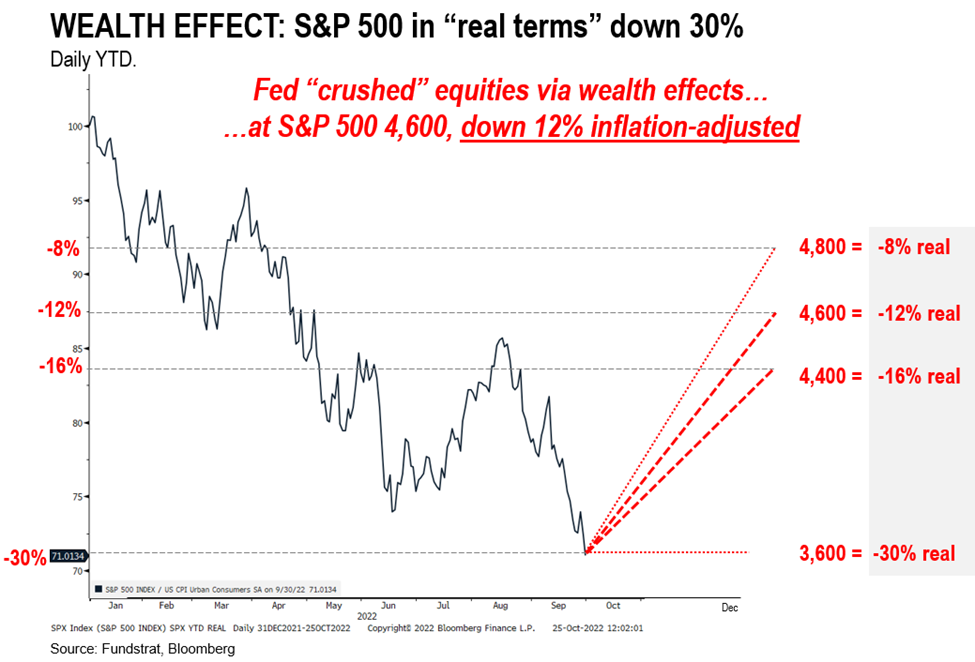

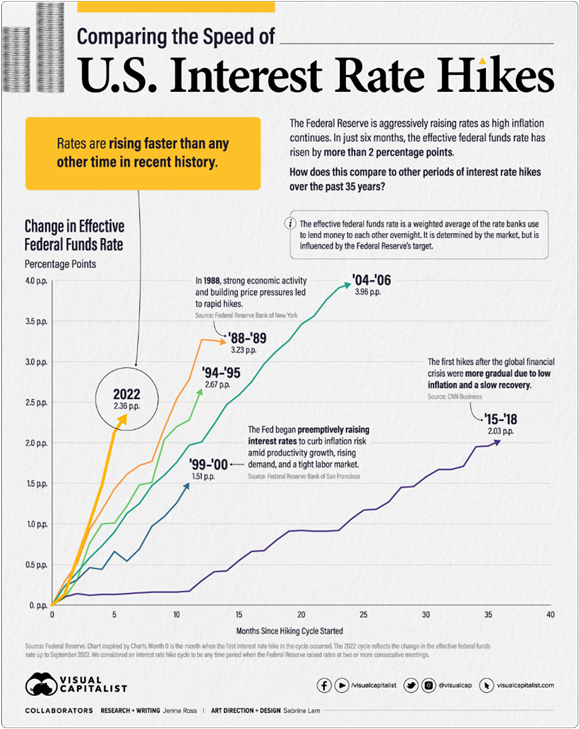

Since March, the Fed has hiked faster than at any time in its history aside from when Chairman Volcker had to go nuclear to stop persistent inflation. As inflation became entrenched, consumers started to expect inflation and then engage in behavior (like purchasing goods before the price went up) that make inflation a lot worse and simultaneously mitigate the effectiveness of the powerful but limited toolset that the Federal Reserve has. The aggressiveness of the current hiking cycle is largely in response to the lessons Volcker’s Fed learned during the Great Inflation. Our own research team has pointed out that the damage done to the stock market has been severe in real terms. Severe enough, that a rally to higher levels wouldn’t undermine the Fed’s desired effect on behavior via the wealth effect.

Volcker has been called the great disinflator and also had a famous rule banning proprietary trading named after him (based on his advocacy for it), Greenspan the great asset inflator and deregulator, Bernanke was referred to as the great moderator. Or Helicopter Ben disparagingly. Powell’s epithet is yet to be seen. You’ve got to hand it to the guy—he takes public service seriously. Had he chosen to hang up his spurs after the extraordinary and successful pandemic intervention, he might already be known as the great economic savior.

While other areas of the government buckled under the strain of an unprecedented pandemic, the Fed shone in keeping the wheels on and ensuring that consumers were able to weather an economic shutdown. Of course, like anything, there was a cost. The greatest inflationary pressure since the early 1980s has been at least partially caused by the pandemic largesse, necessary as it may have been. Powell wants to see this through. However, all indications are that this new task may be more fraught with risk and difficulty. Powell admitted some data was showing progress, but he wanted to play it safe. Mr. Powell very much does not want to make the same mistakes as Arthur Burns, the Fed Chairman under Nixon, whose stop-and-start approach likely made inflationary pressure worse and more entrenched.

The Fed Has Done More Than Take the Punchbowl Away…

“In the field of monetary and credit policy, precautionary action to prevent inflationary excesses is bound to have some onerous effects— if it did not it would be ineffective and futile. Those who have the task of making such policy don’t expect you to applaud. The Federal Reserve… is in the position of taking away the punchbowl when the party was really warming up.” -William McChesney Martin, October 19th, 1955

In the pleasant discourse of the 1950s, former Fed Chairman William McChesney Martin uttered one of the most oft-cited quotes above. The reason for investor disappointment and apprehension at the Federal Reserve is largely based on the intensity of this hiking cycle and that the light at the end of the tunnel isn’t quite as visible as they’d like. If a normal Fed tightening cycle could be described as taking the punchbowl away, what the Fed is doing now is akin to breaking down the door and using the baton on guests. Powell keeps clarifying that he understands the pain could be great, but that by vanquishing inflation now he will be saving markets more pain in the future, and likely will mitigate the impact on labor markets that would normally occur given historical correlations.

What To Look for At the Next Meeting

As we mentioned, Powell has already given a big hint as to what to expect—a higher terminal rate in the dot plot. The terminal rate is very significant because of its centrality to many risk models used by institutional investors. If the data starts to settle down and we get a few prints on key statistics lower than expectations, it will be a good start, but the Fed likely needs a few of these consecutively to really change their tune.

- We will be monitoring commentary from Fed speakers and the data, and we will provide any important updates

- We will be monitoring the bond market to see what it is implying

- We will be monitoring the housing market and other interest rate sensitive areas to assess the progress of tightening in the context of the Fed’s stated goals

- We will be monitoring the inflation data closely with a mind of trying to understand what is happening in the real economy we believe this is often different than lagging indicators.

We dive very deep into the inflation data to try to offer great insights. Healthcare and Leisure and Hospitality have been the hottest elements in the labor market, and we’re not sure how sensitive those will be to Fed policy. It may be that the Fed is valuing credibility too much and is disoriented because of the anomalous data and mass structural changes going on. Even so, if this is the case, it seems to bolster their case for overtightening and fixing it with excessive accommodation. Hang in there, friends, we have evidence inflation will be successfully slain, but the Fed remains in a rhetorical box. They want the party to end and everyone to go home, not to start partying again when they feel the coast is clear. They are small-town cops breaking up a kegger at this point, not slyly removing the punch bowl. However, progress on the supply side will hopefully enable them to change their tune. Who doesn’t like punch?

This research is for the clients of FS Insight only. FSI Subscription entitles the subscriber to 1 user, research cannot be shared or redistributed. For additional information, please contact your sales representative or FS Insight at fsinsight.com.

This research contains the views, opinions and recommendations of FS Insight. At the time of publication of this report, FS Insight does not know of, or have reason to know of any material conflicts of interest.

FS Insight is an independent research company and is not a registered investment advisor and is not acting as a broker dealer under any federal or state securities laws.

FS Insight is a member of IRC Securities’ Research Prime Services Platform. IRC Securities is a FINRA registered broker-dealer that is focused on supporting the independent research industry. Certain personnel of FS Insight (i.e. Research Analysts) are registered representatives of IRC Securities, a FINRA member firm registered as a broker-dealer with the Securities and Exchange Commission and certain state securities regulators. As registered representatives and independent contractors of IRC Securities, such personnel may receive commissions paid to or shared with IRC Securities for transactions placed by FS Insight clients directly with IRC Securities or with securities firms that may share commissions with IRC Securities in accordance with applicable SEC and FINRA requirements. IRC Securities does not distribute the research of FS Insight, which is available to select institutional clients that have engaged FS Insight.

As registered representatives of IRC Securities our analysts must follow IRC Securities’ Written Supervisory Procedures. Notable compliance policies include (1) prohibition of insider trading or the facilitation thereof, (2) maintaining client confidentiality, (3) archival of electronic communications, and (4) appropriate use of electronic communications, amongst other compliance related policies.

FS Insight does not have the same conflicts that traditional sell-side research organizations have because FS Insight (1) does not conduct any investment banking activities, and (2) does not manage any investment funds.

This communication is issued by FS Insight and/or affiliates of FS Insight. This is not a personal recommendation, nor an offer to buy or sell nor a solicitation to buy or sell any securities, investment products or other financial instruments or services. This material is distributed for general informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice.

The statements in this document shall not be considered as an objective or independent explanation of the matters. Please note that this document (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and (b) is not subject to any prohibition on dealing ahead of the dissemination or publication of investment research.

Intended for recipient only and not for further distribution without the consent of FS Insight.

This research is for the clients of FS Insight only. Additional information is available upon request. Information has been obtained from sources believed to be reliable, but FS Insight does not warrant its completeness or accuracy except with respect to any disclosures relative to FS Insight and the analyst’s involvement (if any) with any of the subject companies of the research. All pricing is as of the market close for the securities discussed, unless otherwise stated. Opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, risk tolerance, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies. The recipient of this report must make its own independent decision regarding any securities or financial instruments mentioned herein. Except in circumstances where FS Insight expressly agrees otherwise in writing, FS Insight is not acting as a municipal advisor and the opinions or views contained herein are not intended to be, and do not constitute, advice, including within the meaning of Section 15B of the Securities Exchange Act of 1934. All research reports are disseminated and available to all clients simultaneously through electronic publication to our internal client website, fsinsight.com. Not all research content is redistributed to our clients or made available to third-party aggregators or the media. Please contact your sales representative if you would like to receive any of our research publications.

Copyright © 2025 FS Insight LLC. All rights reserved. No part of this material may be reprinted, sold or redistributed without the prior written consent of FS Insight LLC.

Get invaluable analysis of the market and stocks. Cancel at any time. Start Free Trial

Create New Account

Complete the following information to create your account