“Amateurs talk strategy, professionals talk logistics.” -Omar Bradley

Mr. Bradley’s quote above may have become so frequently used as to border on aphorism. We recently penned an article that shows how disastrous poor logistical planning can be, even when done by otherwise highly competent folks like Napoleon Bonaparte. However, we thought we’d discuss it in a little more detail and in the context of an industry that lives and dies by competent logistical management. The Consumer Staples retailers that were a lifeline during the pandemic, and are typically preferred for their consistent, counter-cyclical returns and steady business models, have experienced some of the most disruptive changes in their histories. How they manage post-COVID logistical challenges and evolving consumer demand will make or break them. Superb logistical management is very crucial to the Staples/Retail industry, where margins are thin.

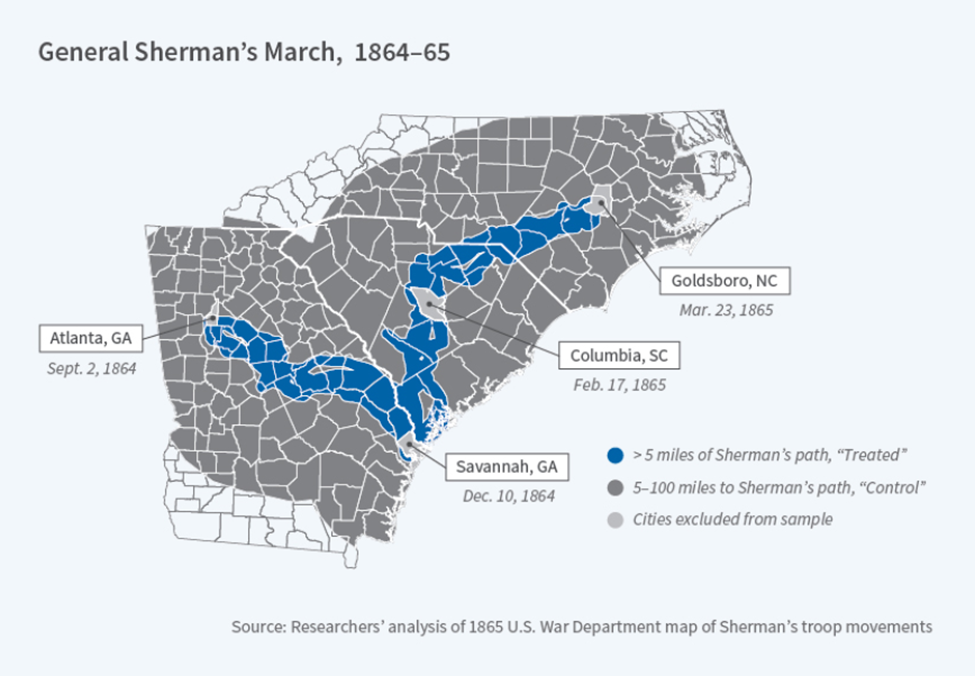

General William Tecumseh Sherman was perhaps our nation’s most underappreciated logistical innovator. His successful and storied March to the Sea was a profound military achievement that brought the Civil War to an end and changed the face of the United States and warfare forever. At the heart of it was clever management and reimagination of supply chains. You could almost say that Sherman is a forebear of the “just-in-time” supply chain with a slightly different spin. You could refer to his innovation as a “just take whatever you want” supply chain, but some of the underlying principles of decentralization and lean operating procedures were present in a nascent form. “No military expedition was ever based on sounder or surer data,” Sherman bragged.

Maintaining uninterrupted and unmolested supply chains was the guiding light in warfare for most of human history. Sherman’s March was based on a revolutionary idea to completely detach from supply chains and to live off the land. Of course, the prerequisite for his success was a meticulous analysis of census data to ensure his route only passed through the most productive counties from an agricultural perspective. Sherman analyzed the data carefully and realized not only would his troops not starve, but they would also eat bountifully and deprive the increasingly impoverished enemy of badly needed resources. Like Sherman, those Consumer Staples names who successfully use their considerable networks and first-party data have an opportunity to disrupt the stolid retail landscape and breathe life into later-stage enterprises.

The State of Retail Going into the Holiday Season: Burgeoning Inventories, Plentiful Promotions

Supply chain bottlenecks obviously dramatically affect modern retailers, particularly the “big box” guys with sprawling logistical footprints and physical assets that rival many nation-states. A recent Holiday Retail Sales survey by Deloitte indicated that holiday retail sales will likely grow at about a third of the rate of growth from 2020-2021. The results indicate a likely increase of about 5% compared to the 15% YoY growth over last year’s period. This is just a reflection of a slowing economy and a base of consumers whose savings and disposable income have steadily eroded since the boon from the pandemic stimulus. Many consumers will get a pleasant surprise when they go holiday shopping this year. Many retailers will have to engage in aggressive promotions to offload piling-up inventory. Big retailers have started promotions earlier and will be relying on them to get inventory back to more historically normal levels.

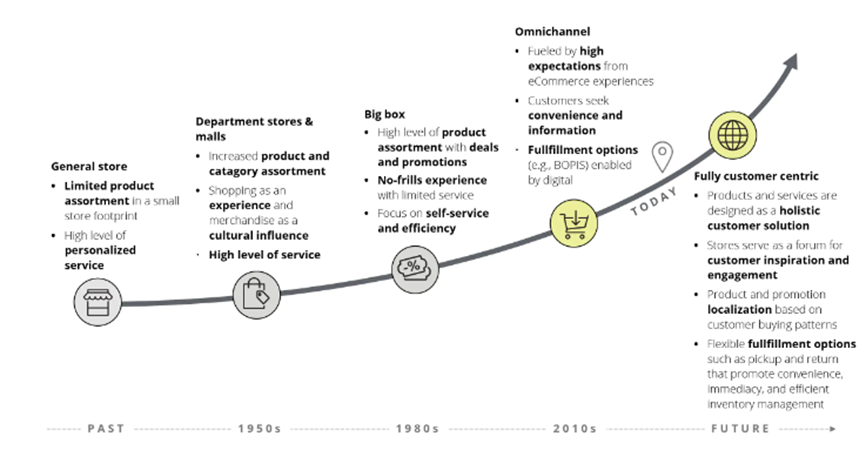

In big retail, inventory is everything. The basic business of running a store has evolved but remains chained to the fundamentals of fickle consumer choice and using data to meticulously plan inventory purchases is key. All else being equal, big box retailers who use their first-party data more effectively in the planning process should outperform those that do not. It has been a tricky process since the beginning of time and remains one. However, the unprecedented “thousand-year flood” of the pandemic disrupted the normally sleepy Consumer Staples sector more than any event in recent history. While much of retail survived the initial blows of the disruption from COVID, now the real challenge begins. The imperative of inventory management is a constantly changing process that is always affected by the whims of fortune, but during a period of such rapid change when anyone’s guess was as good as another’s as to future consumer demand, it is even more difficult.

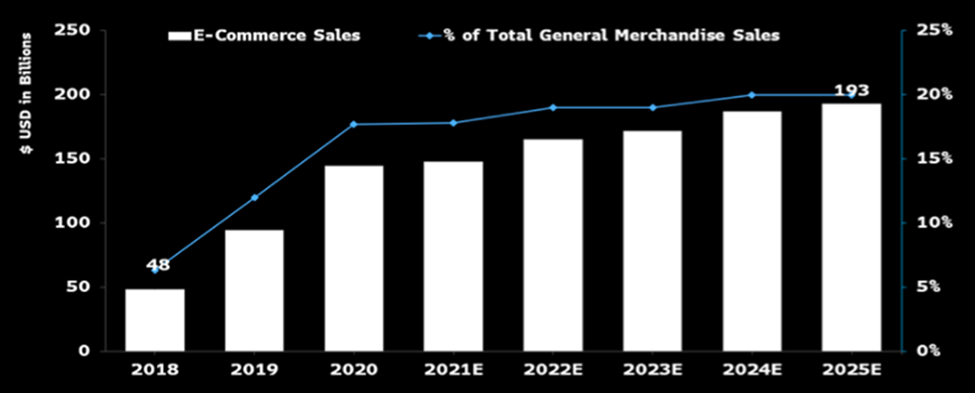

Consumer Staples was once considered a nice and safe corner of the market. The sector is often favored by investors who favor consistency and steady returns regardless of short-term economic cycles. Unlike Consumer Discretionary, the demand for the wares sold by Consumer Staples firms should be relatively consistent regardless of wider economic conditions—it is considered a place to hide from cyclicality. We’re talking things like toilet-paper—you know, the boring stuff you must buy regardless of the comings and goings of the fickle business cycle and even more fickle consumer appetites. But this very example shows how this sleepy and relatively drama-free industry became central to the largest commercial disruption since the Second World War. Some trends, like the move toward increasing online sales (e-commerce) were dramatically accelerated. Some, like the Just-In-Time (JIT) supply chain, have subsided as resilience came to rival efficiency.

The Consumer Remains Resilient and Has Untapped Credit Sources Available

Inventory levels remain about 28% higher for apparel retailers compared with a year ago. However, the effect of bungled supply chains has been largely uneven. While there’s a glut of clothes worth $58 billion sitting on shelves in retailers across the country, there are still plenty of sections within the store where shelves may be empty, or items might be hard to find. The data revolution in big retail has brought down costs and expanded margins over the past years, but when you have large interruptions in consumer behavior that may or may not correct themselves over a given period, it’s very difficult to correctly anticipate demand, which is one of the most crucial things a shopkeeper, big or small, must regularly do to maintain solvency.

The American consumer has remained remarkably resilient despite deteriorating economic conditions and a dose of bitter medicine from Jay Powell and friends. The consumer still has credit sources that they will be able to tap, which should help fuel holiday spending, albeit it at a much more modest pace. Personal Savings have declined from the astronomical levels during the dog days of the pandemic of around $6 trillion to around only a tenth of that. Yet, consumption has remained much steadier. As you can see below, despite some beginnings of a downturn, consumption across various types of retail has remained much more consistent than the levels of consumer savings.

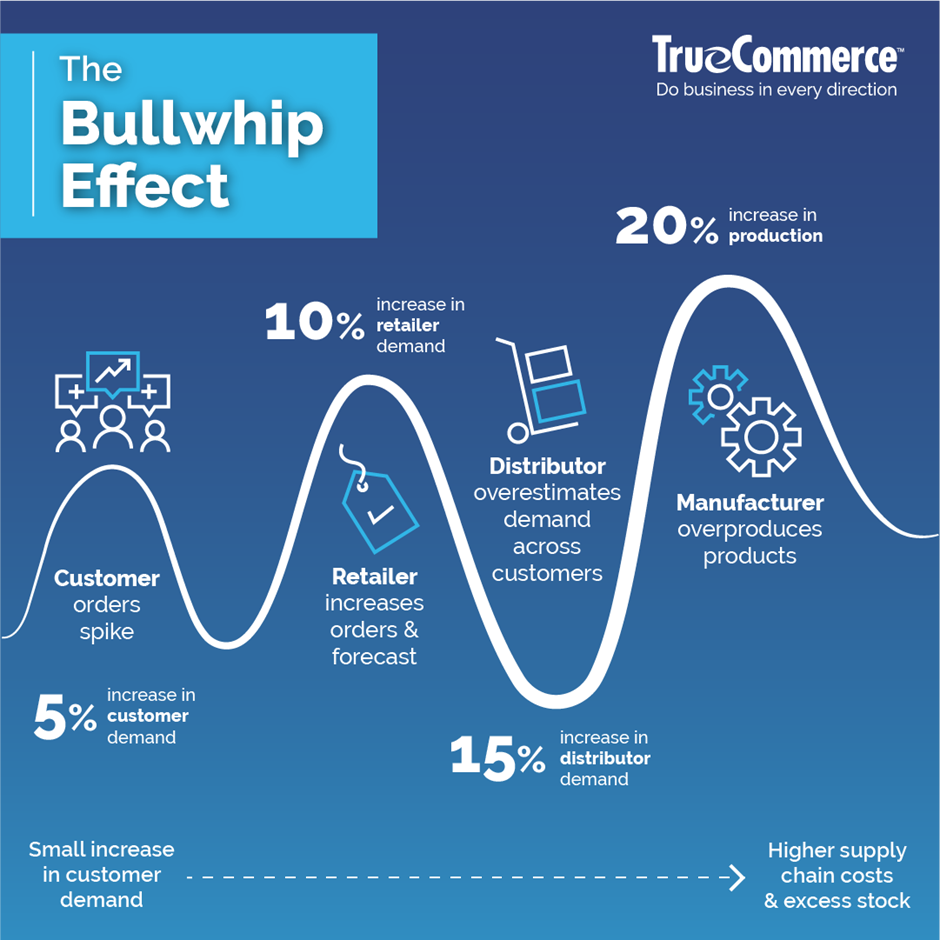

Many retailers have seen the adverse side of the supply chain bullwhip effect. When demand patterns become less predictable, like in the event of a global coordinated economic shutdown, the fundamental function of retail managers becomes nearly impossible to conduct as effectively as during times of more normal demand. So, right now increasingly beleaguered consumers might find a nice holiday surprise in the form of aggressive holiday promotions being used to get overstocked items off shelves to normalize retail supply chains after the recent strain.

Our Favorite Consumer Staples Names

We have a variety of Consumer Staples names on our various stock lists, but we wanted to focus on our favorite three and discuss why we think they are well-equipped to meet the considerable challenges of a rapidly evolving retail environment. Generally, we favor names that have:

- Innovative or differentiated business models that help mitigate inventory volatility

- A stellar brand and deep connection with their core consumers

- A proven track record of managing to reward shareholders through different economic environments

Costco Wholesale (COST -1.33% )

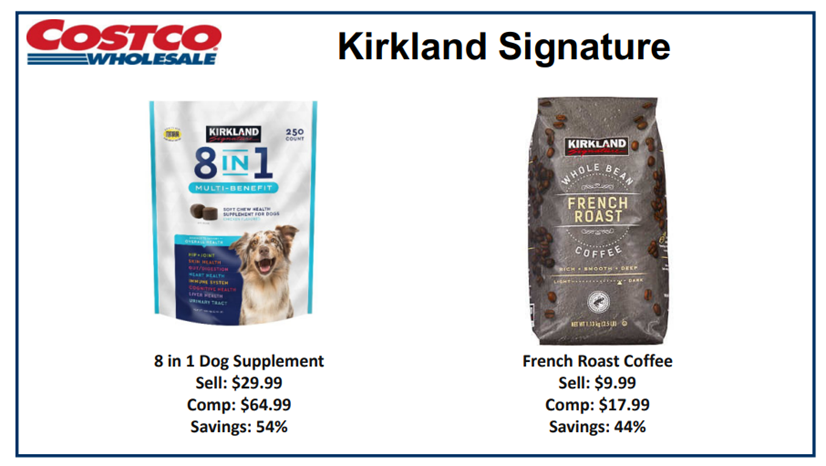

Costco Wholesale has redefined the big box retail sector with its innovative approach to hyper markets. It serves a more affluent customer than its primary competitors and generally have high quality and desirable merchandise. Another big part of solid growth in retail is simply one’s expansion strategy for new locations. Costco is opening new stores while key competitors like Walmart have settled down. We’ve spent a great deal of time going over the challenges of inventory management for retailers, particularly those who have thin margins and buy at wholesale prices. Costco’s membership model helps alleviate some of the dependence on successful inventory planning with its steady membership cashflow. Costco is on our Dunks stock list. Our Head of Portfolio Strategy, Brian Rauscher, thinks that the name is poised to provide attractive relative performance over the next 12-18 months. He suggests adding to the name on tactical weakness. Private-label brands have been a big boon to the big box retailers over the past years and should help them as consumer’s start to prefer savings over other attributes. Kirkland is the gold standard of private-label brands.

Brown-Forman (BF/B)

This name is in our Granny Shots portfolio. It is included in the thematic portfolio for seasonality and the strategic portfolio for the Economic Rise of Millennials. The firm has leading spirits brands including Jack Daniels and Woodford Reserve, which have a gravitas that speaks for itself. However, one of the main differentiating factors we like about this name is its appeal to millennials. The company has proven itself capable of meeting the demand of the lucrative and growing millennial market. PwC’s latest retail survey showed that while holiday spending will likely be subdued compared to last year, one area of strength is in millennials. This generation was able to navigate the labor market tightness to get better salaries in many cases, and they will be a bright spot in holiday demand. Baby boomers, as they move further toward exiting the workforce, will actually see their holiday spending contract. It’s about flat for Gen Z. This company has a unique mix of established brands that have staying power and a strategy that has proven attractive to millennials. Who couldn’t use a bottle this Christmas?

Procter & Gamble (PG 1.25% )

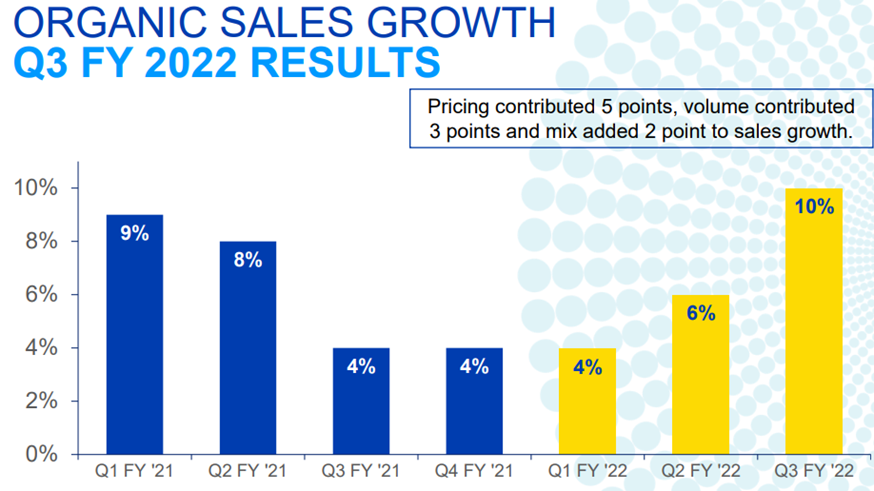

This name is a staple of the Consumer Staples sector. The company provides packaged consumer goods across the entire world. Deodorant and shampoo can seem boring, but they consistently sell and the company’s’ lucrative collection of brands make it one of the shining stars of the sector. Gillette, Venus and Braun are all flagship razor brands. This firm has been selected for Granny Shots for the same reasons as Brown-Forman, for Seasonality and the Economic Rise of Millennials. The company reported bumper results about a week ago. It grows quite a bit for a “boring company” and its adjusted EPS was up by almost 30%. The financials exceeded analyst expectations across multiple metrics. The company has pricing power and is able to pass along costs to consumers, which is a positive in an inflationary environment. The company was at the center of supply-chain issues early in the pandemic and appears to have increased the resilience of its supply chain since. Toilet paper shortages helped the company harden itself for a tougher world. Its financials have started turning around and we think it is well positioned to weather an unpredictable environment.