Markets Rally on Hopes for Fed Pause, Earnings Have Been Mixed 1 and can accesss 1

Our Views

In our multiple conversations with investors this week, the main question is why should any investor expect equity prices to stage any meaningful gain from here, in the midst of a Fed tightening cycle and in the midst of great uncertainty around the Russia-Ukraine war, increasing stress in financial markets (UK issue tabled for now) and in the midst of massive gloom of CEOs and Americans and investors.

- in a way, investors broadly only see one type of capitulation ahead

- the stock market needs to “capitulate” with a VIX surge >40, or a 20% further drawdown, or a “hedge fund imploding” or some financial accident.

- mostly, investors see this as the “path of least resistance”

But this is not the only “capitulation” that could lay ahead. There are other forms of “capitulations” that could similarly boost investor confidence, in turn, fueling a firm footing for equities:

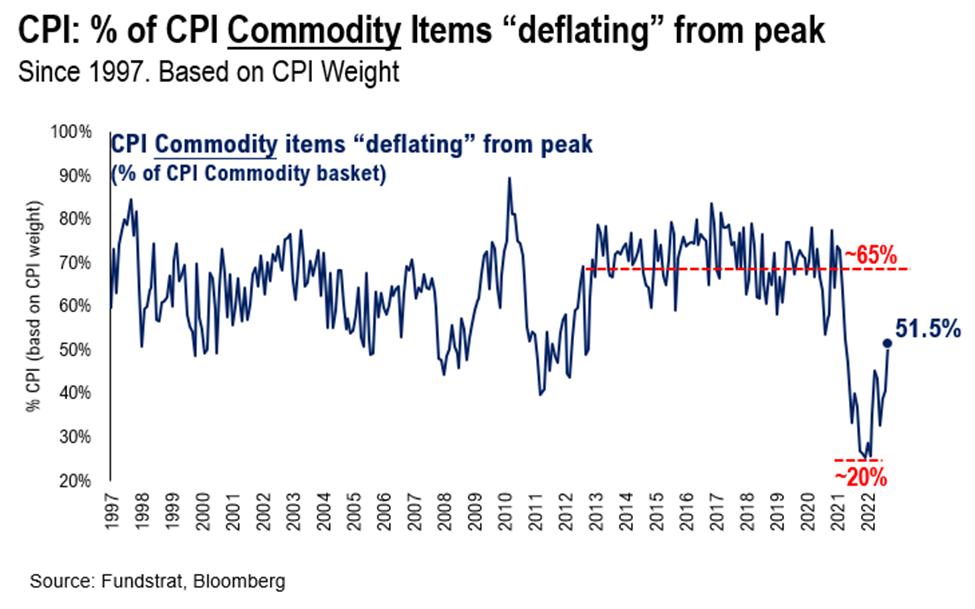

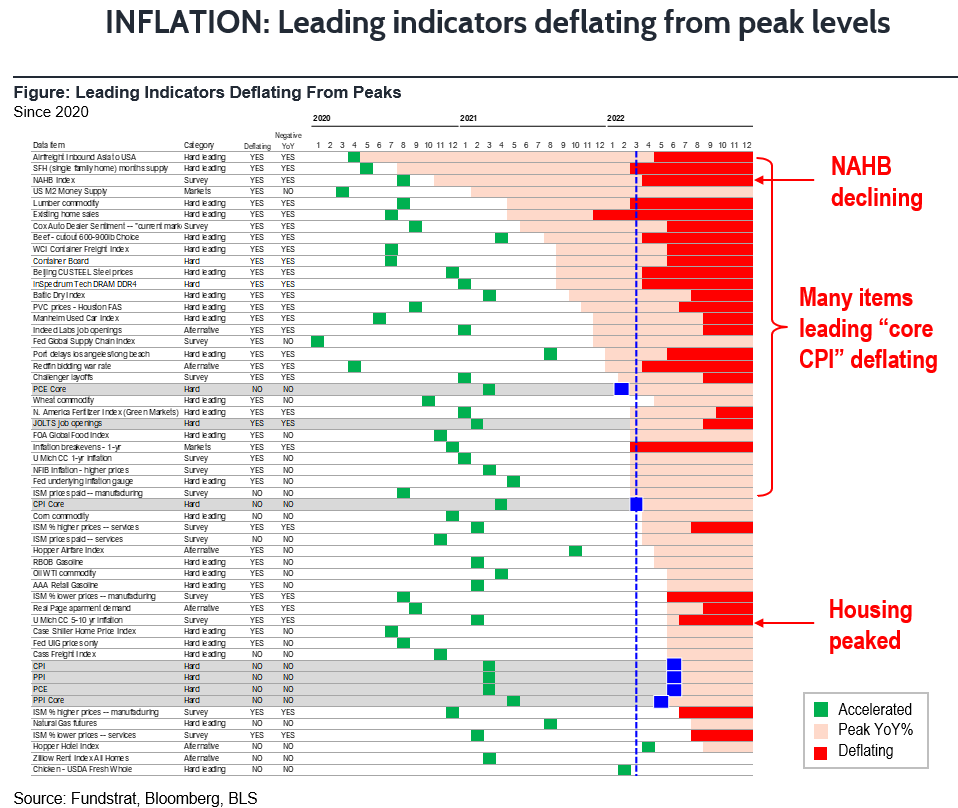

- inflation “hard data” could capitulate, syncing up with the “soft data” which have been showing growing signs of falling inflation

- There has been little breakdown in goods inflation (less inflation, but not visible disinflation) and this “payback” could weaken overall inflation

- Fed reaction function could “capitulate” and shift from banging 75bp at every strong CPI print

- Alternately, the Fed could shift to a more “inflation tolerance” view, acknowledging part of core inflation reflects supply chain tightness (transportation services) and recognizing severe lags in data such as shelter/rent CPI component

- The tight labor market could start to “capitulate” and we could see falling job openings and far less wage growth pressures. Jobless claims have been strong, so this has not been the case.

- Interest rates could stop powering higher (“capitulate on yield”) and the surge in 2Y and 10Y have been notable. The US 10Y is now 4.239% while the UK 10Y is 3.913%.

- Why is the UK yield lower than the US??

- We know sentiment has largely capitulated.

- And the BofA FMS (fund manager survey) shows that institutional investors most underweight equities in more than 20 years.

- By the way, if the Fed changes its reaction function, we think investors will dramatically shift their expectations for a recession — ala “recession capitulation”

Bottom line. There are multiple pathways for markets to move higher. And while investors are mostly expecting equity markets to capitulate. There are other capitulations that could drive asset prices higher.

FED SPEAK: Fed speakers this week doesn’t dispel notion of a December “pause”

There were multiple Fed speakers this week (see below) and the good news is none of the statements by Fed members created a market tailspin. No comments seemed to scramble new eggs.

But interestingly, what caught our attention, is the fact that several Fed officials emphasized the origin story of inflation:

- Several Fed speakers this week, including Kashkari and Bostic, suggested that 2022 inflation surge is born from “supply chains, energy and commodities” and “didn’t come from the labor market”

- In our view, this is a small but notable change in Fed communication and may not represent the majority view (as previously, Fed officials including Powell, cited labor markets as the source of concern).

- As such, this does suggest that any easing of supply chains (and commodities), could be viewed by Fed as aiding the effort to fight inflation. Fed has been fighting inflation by trying to slow demand, but if supply eases, this should be a support for incoming data to improve.

- The war, by amplifying the surge in commodity prices for energy and food-related, further accelerated inflation.

POSITIONING: Eventually positioning changes market to see things “half-full”

Investors are skeptical of any market gains, because of the continued failure of equity rallies to move above prior highs (instead lower highs) and our Head of Technical Strategy, Mark Newton, sees S&P 500 >3,820-3,850 as the key level. And we know markets continue to point an eye towards rates and USD to confirm any move in equities.

But at some point, another change in market psychology will take place. The same incoming economic data, which has to date been mostly viewed as “bad news” will start to be viewed as “less bad” or even good. Yet, the cadence of the data may not be changing that much.

- that is, we believe confirmation biases could flip

- we previously talked about confirmation bias is a human tendency

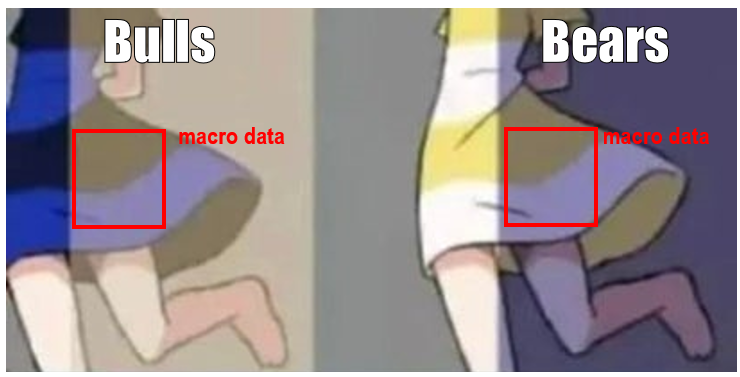

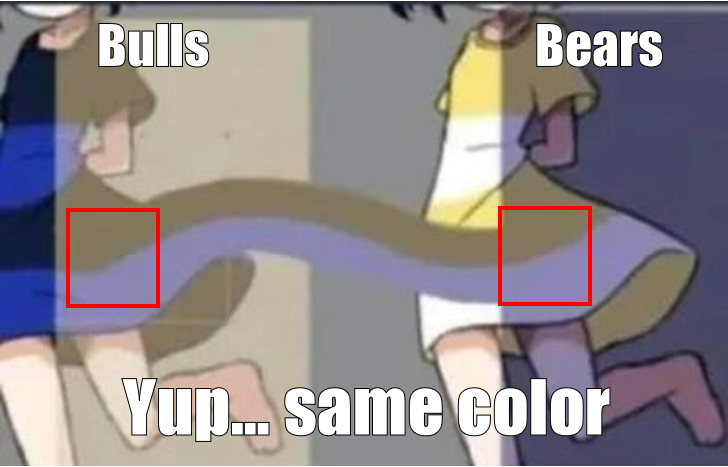

- take a look at the pictures below

- and take a look at the colors of the dress highlighted

- think of this as macro data, but seen from the eyes of a bull and eyes of a bear

Surprise. The dresses are the same color.

- yup

- literally shows what we see as bullish or bearish can be a function of our own confirmation bias

FED PAUSE: 4 reasons a Fed “pause” would cause significant change in asset allocation

A lot of investors might be quick to dismiss a “pause” because this is different from a Fed “pivot”

- a pause simply means Fed is shifting back to data dependency

- vs the current “hurry and catch up” to the inflation puck

- a pivot is Fed preparing to cut rates

Why does a “pause” matter? Investors are not positioned for a pause:

- fixed income/credit investors have been betting on higher rate (Fed is behind)

- retail equity investors are buying record levels of “puts” surpassing that of COVID-19 lows

- institutional investors, per the BofA FMS (Fund Manager Survey) are 3 std deviations UW equities

- even corporate insiders are beginning to buy stocks again

PAUSE: Would Street still keep these positions in a “pause”?

Logically, would the Street still keep these positions if there was a “pause”? We don’t think so.

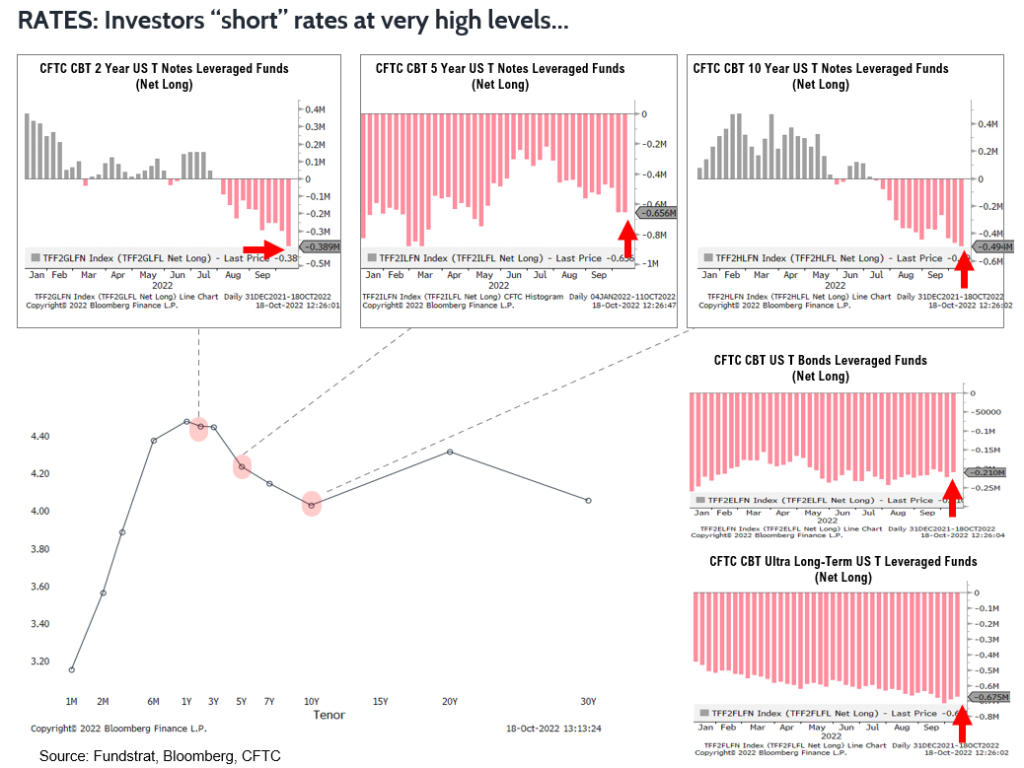

As the CFTC data below shows, investors are short bonds (bet on higher rates) for all tenures of rates. This is an expression of a “hawkish Fed”

And the “net allocation” to equities is even lower than in 2008. This is what makes 2022 so unusual, as stocks have fallen faster than the economic cycle has moved. Interest rates have also moved far faster, following Fed action. But this is the source of the cross-roads.

- if a deeper economic retrenchment is underway, then uncertainty can grow

- but if the Fed is set to “pause and look around”

- this would mark an important point for equities

- The “net allocation” to equities is lower than COVID-19 low and the GFC

- again, if the world is set for a “Greater hurt” then things can get worse

- SPX bounce still should stretch up to 3800-50 but expecting that is meaningful

- Rise in TNX this week had little damaging effect on Technology

- ARKK looks close to bottoming and I anticipate a rally back to the mid-$40’s

- Despite chatter and hopes that the Fed is going to dovishly pivot, my work strongly suggests that the Fed may have to do MORE than what is currently priced in, which is out of consensus and certainly not priced into the equity market.

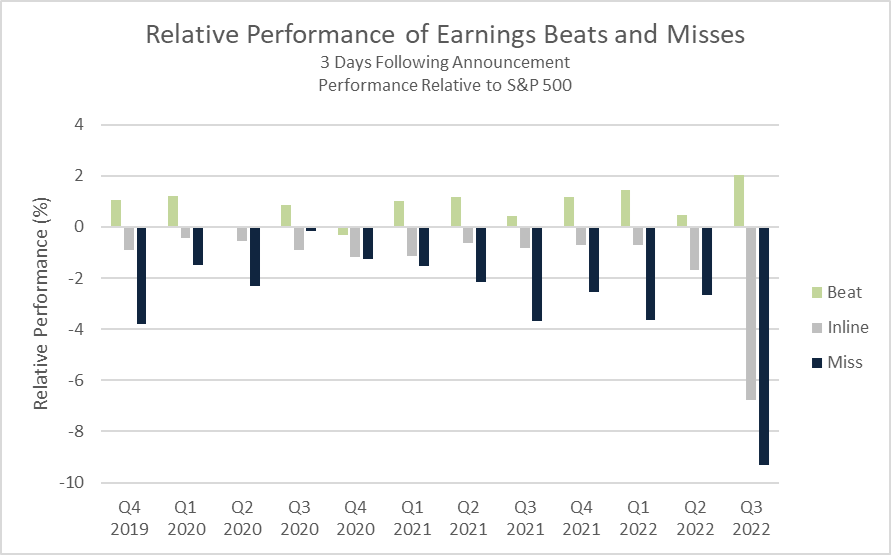

- The 3Q22 earnings seasons has not been disaster, but this does not change my views that forward profit expectations remain too high, that the negative earnings revision cycle has further to go to reach max negativity, and that earnings DO matter.

- THE equity market bottom is NOT in, and considerable downside risk remains for the U.S. equity markets so my view remains that strategic investors should not be chasing rallies but using strength to sell into as they drift higher.

- Yes, there is a degree of bearishness that could support countertrend tactical rallies and is probably my biggest worry point for my longstanding unfavorable view as we move into the historically favorable seasonal period into year end.

- What are your thoughts on 2023 OEPS for the S&P 500 and a fair value P/E valuation multiple? To get the index back to the old highs one must assume the current 2023 outlook for OEPS ($249) is achievable with a 20x P/E. My work suggests that both are likely to be lower.

- Stock specific risk continues to increase, which benefits stock pickers.

- The increased importance of stock-specific issues is reflected in the performance during earnings season so far. It’s still early, but companies beating earnings estimates are outperforming the market to a larger degree than during any of the prior 12 earnings seasons. Should this trend of earnings beats continue, it could support the market in the intermediate (~1 month) term.

- I’d be more constructive on a short-term move in the market if our Reddit-based retail sentiment indicator turned negative. It remains in the middle of the historical range.

- The market continues to look expensive; investment grade corporate bonds still look attractive compared to equities.

- ETH has outperformed the rest of the altcoin market, as net supply issuance has been deflationary over the past couple of weeks. This dynamic offers a window into the potential benefits of the reduced daily supply issuance in any future bull market.

- Lido (LDO) has outperformed most cryptoassets over the previous week following the announcement of critical integrations on Ethereum L2. LDO is a name we have recommended for a while and continue to view as a critical piece of crypto infrastructure moving forward.

- Solana (SOL) has recently declined relative to other altcoins due to a drop in NFT activity on the network.

- Further evidence suggests that crypto is largely agnostic to equity earnings. Crypto has decoupled from equities in recent trading sessions in which equities moved higher/lower due to key earnings announcements.

- The days are counting down as the November 8th midterm elections approach. Polls over the last few weeks seem to indicate a shift of momentum to the Republicans.

- House midterms are usually a referendum on the party in power and with Biden’s approval rating south of 50% this can’t be good news for Speaker Pelosi and House Democrats. The Democrats go into Election Day with a majority of only five votes.

- With the economy front and center as a key issue in nearly all the races, the Fed could become a factor by creating a last-minute surprise at the meeting of the Federal Open Markets Committee (FOMC) just a week before the midterms.

- Fed officials are raising rates at the most aggressive pace since the early 1980s. Until June, they hadn’t raised rates by 0.75 points since 1994. Another 75 bps raise is expected at November meeting.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- Stocks rallied strongly. Rates and the dollar rolled over. The S&P 500 closed at 3,752.75 and the VIX closed at $29.69.

- Earnings season so far has been better than expected despite some misses. Idiosyncratic risk is rising, and concern is growing that the Fed may be overtightening. Hopes for a pause in hikes drove today’s rally.

- We discuss the issues facing markets: persistent negative sentiment helps the bull argument, while declining earnings expectations make it harder for the market to reach new highs, bolstering bearish arguments.

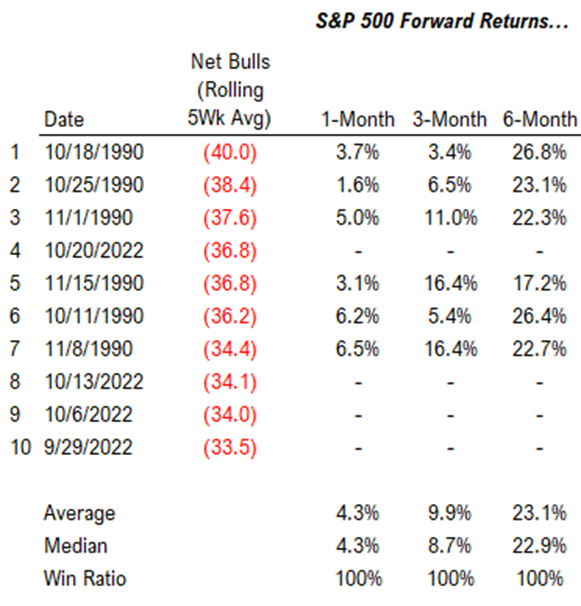

Markets had their best day since June in a furious rally that was led by Materials, Financials and Technology. This was the third positive week in a row, and the first three-week winning stretch all year. A Wall Street Journal article by Nick Timiraos renewed hopes that the Fed would back-off from its Old Testament approach to fighting inflation. Our Head of Research, Tom Lee, has been ahead of the curve on this issue, and has been suggesting all week that the reaction function to the Fed would be changing as a pause came into view. Remember, markets are forward discounting machines, and the stock price is a leading indicator. So sometimes when you get through the eye of a storm, markets can see through risks. Our data science team has been analyzing sentiment data and it has been persistently terrible. Recent readings have ranked with some of the worst in the history of the AAII survey.

As you can see, when sentiment is this persistently bad, the forward returns have been positive historically. So, sentiment is a feather in the bull’s cap, to be sure. However, the tightening financial conditions that have already started raining fire and brimstone in the housing market will be meandering their way through the rest of the economy in due course. High rates, which the Fed is likely to keep elevated, act as persistent drag on equity valuations. This is part of the reason no one wants to do an IPO in this environment. Instacart pulled their IPO today and their valuation has come down significantly. Klarna, one of Europe’s FinTech Buy Now, Pay Later (BNPL) darlings, had to write their valuation down by 85% in a recent capital raise.

This same drag on private valuations affects public ones as well, and the market has become more dependent on high P/E stocks over the years as technology has become more ingrained in the economy, enabling higher rates of growth. Our Head of Global Portfolio Strategy, Brian Rauscher, did a great table showing what P/E ratios would be required to reach new highs at various earnings levels for the S&P 500. Given that high rates seem likely to be with us for a while, this table illustrates why it will be so difficult to get the valuation levels necessary to achieve “escape velocity” to new highs.

It’s like a rocket without enough power to get out of the atmosphere. It will go up fast, but without a second or third stage, it will fall back to Earth. The Fed tightening is like extra gravity. It’s hard to get out of the atmosphere to new highs without the rocket fuel of the Fed pumping liquidity into markets. The stretched sentiment can provide the first phase in the form of oversold bounces. However, the earnings expectations for the S&P 500 right now are at $249. At that level, you would need a market P/E of 20 to get to a new high, and all indications are the earnings expectations will come down from those levels, in which case you must get to even more anomalous levels of 22 to 23 times earnings to get above where we peaked in November 2021 (particularly without accommodative Fed policy). This is the crux of why Rauscher sees the downside tug being more pervasive than the upside over coming months.

Embattled British Prime Minister Liz Truss resigned Friday. The wrath of bond vigilantes and a somewhat naïve approach to fiscal policy made her the shortest-serving Prime Minister in British history. Despite firing her controversial finance minister and reversing most of the tax cuts that earned the aforementioned wrath, she was not able to salvage her office. The blows her ill-fated mini-budget struck to Britain’s previously high fiscal credibility were too significant for her to survive. She will remain on until a successor is chosen. There’s even a possibility that Boris Johnson (BoJo), like Napoleon from Elba, may return from his current Caribbean vacation to reassume his recently vacated post.

While this threat to financial stability appears to have subsided in prominence, others may be lurking. Academics, traders, and economists have been warning about lurking trouble in the Treasury markets and BofA suggested the market is vulnerable to a potential shock and forced liquidations. The yen hit its lowest level against the dollar since 1990 this week, which prompted intervention from the Bank of Japan. Of course, Europe is struggling with the gas crisis stemming from the ongoing war in Ukraine. American Express beat expectations and raised guidance today, but the Street didn’t like how much it raised its loss provisions by. Other CEOs have been sounding cautious and even pessimistic. Tesla had a rare revenue miss, partially due to the strong dollar. This may be an ominous sign for Apple, which has massive foreign currency exposure.

Nick Timiraos has been uncannily accurate in his reporting on the Fed over the last year. The chair assignments shift around for other journalists frequently, but Mr. Timiraos is always seated front and center. He is dubbed “the Fed Whisperer” and his reporting has been remarkably prescient. Like David Wessel, who was also a WSJ Fed Reporter during Alan Greenspan’s tenure, he has become something of a go-to source of the highest authority on anything involving the Fed. It is rumored sometimes he may be the beneficiary of leaks directly from Fed officials, but he’s also a fine reporter with a first-rate understanding of the institution he so adeptly covers.

Wessel, who once held the exalted journalistic position of Fed whisperer himself, put it this way: “If you’re good at covering the thing, you kind of know how they think, you have some sense of where they’re going, you can have your hypothesis either confirmed or denied.” As for leaks, the veteran reporter who is now a senior fellow at the Brookings Institution says, “Maybe that happens sometimes. I’m not saying it doesn’t.”

So, it was significant this morning when Timiraos released an article entitled Fed Set to Raise Rates by 0.75 Points and Debate Size of Future Hikes. The futures were down after Snap’s earnings showed a severe slowdown in cyclical digital advertising revenue and dragged other companies dependent on that revenue source down with it. However, markets perked up after “the Fed Whisperer’s” article came out. The article showed that the uber-hawkish line that has pervaded over the past months is beginning to show some cracks and signs of evolving. The rhetorical groundwork for slowing rate hikes and not being ultra-sensitive to persistently high CPI data appears to be in the initial stages of being laid. Leading data is also showing some hope that major drivers of inflation are reversing.

Basically, there are growing signs of two things. The first is that there’s mounting concern amongst Fed officials that the pace of the hikes may risk “over-tightening,” or restricting financial conditions to an extent that causes unnecessarily harsh economic fallout. Brainerd, Daly, George, and Evans all gave indications that lower sized hikes, and a pause, should be considered soon. Bostic and Kashkari spoke about how alleviation of supply-side inflation drivers could result in a gentler path. The doves may just be coming out of hibernation. It is still tempered, though. No one is beginning yet to talk about cuts, and all still seem to favor keeping rates restrictive for some time so the Fed could weather what Evans termed, “a few not-so-great reports.”

But secondly, the hawks still have the upper hand, and one of the reasons for the rhetorical hibernation of the doves was the summer rally. The Fed, even those members who are more dovishly inclined, doesn’t want to reverse the effects of tightening prematurely. Timiraos speculated that in the event the Fed wanted to slow the pace of hikes to 50 bps in December, they would likely do so with concurrent actions that would temper a rally. One such strategy would be to indicate in the December dot plot simultaneously that they intend to lift rates higher in 2023 than the previous one would suggest.

Kashkari, who still can look a bit awkward in his new-found hawk wings, nonetheless summarized the hawkish position well. The Minneapolis Fed President opined that “The problem for me with trying to say, ‘Hey it’s time to pause’ is that we’re not even sure that we’ve got rates high enough to push services inflation down.” One potentially ominous phrase buried in the Fed minutes from the last meeting was that the staff economists see less output potential in the economy.

Next week sees a crucial week for earnings as mega-cap Technology reports. Given the pervasive uncertainty in the market this will likely be a watershed moment. If Tech earnings disappoint, this could be a major downside catalyst. Snap’s earnings faceplant has set a somber mood going into the crucial week, particularly for Meta and Google, who are those most concentrated in digital advertising among the illustrious Tech generals. However, Technology staged an impressive outperformance this week. Particularly in the face of persistently rising rates. Equities in general have held up well in the face of losses in bonds that have resulted in some investors being taken out on stretchers. This relative resilience is encouraging. Adam Gould, our head of Quantitative Strategy, has also observed that idiosyncratic risk is rising, which improves the environment for stock-picking. Evidence of this can be seen in market reactions to earnings.

President Biden on Wednesday announced that the government would release 15 million barrels of oil from the Strategic Petroleum Reserve (SPR) as part of his continued effort to lower gasoline prices, completing a move first announced in March. In a nod to what we have previously described as a “structural shortage” in production, the President also suggested that US plans to repurchase oil (once the price falls to $70 a barrel) to refill the SPR should motivate firms to “invest in production.” In the short term, the latest small release – about three-fourths of US average daily consumption – is unlikely to have much of an impact on inflation or related numbers, however. Energy is one area where our team continues to see strength.

Mark Newton has highlighted Oilfield Services (OIH) as an area to watch. Schlumberger (SLB -0.96% ) reported bumper third quarter earnings and cleared a high bar. It smashed expectations on the top and bottom line and raised guidance. Its stock rose more than 10% and was the leading S&P 500 gainer today. Energy continues to be one of the only areas where investors have found refuge from the unusual simultaneous pain in stocks and bonds. Energy remains one of the only areas of the market with positive earnings momentum. Mr. Newton also suspects the dollar should begin to roll over from its very precipitous rise, which should further help the sector. Brian Rauscher also has Energy overweighted in his active sector allocation strategy, and Tom Lee recently added some great Energy names to our famous Granny Shots stock list.

Have a Great Weekend,

FS Insight Team

Important Events

Est: 49.3 Prev: 49.5

The Purchaser’s Managers’ Index is a diffusion index. It summarizes the views of Purchasing Mangers who are asked whether they think market conditions are expanding, contracting or staying the same. A reading above 50 indicated expansion, one below 50 indicates contraction.

Est: 105.3 Prev: 108.0

This is a monthly survey of consumer attitudes, buying intentions, vacations plans and expectations for inflation and other financial benchmarks. This gives detailed insight into the thinking and economic decision-making of US Consumers.

Est: 4.5% Prev: 4.7%

The PCE Price Index Excluding Food and Energy, also known as the core PCE price index, is released as part of the monthly Personal Income and Outlays report. This reading strips out the volatile components of Energy and Food and is closely watched by the Federal Reserve.

FS Insight Media

Stock List Performance

| Strategy | YTD | YTD vs S&P 500 | Inception vs S&P 500 | |

|

Sector Allocation

|

+11.75%

|

+8.17%

|

+33.22%

|

View

|

Small Cap Stock List Performance

| Strategy | YTD | YTD vs Russell 2500 | Inception vs Russell 2500 | |

|

SMID Granny Shots

|

+11.21%

|

+17.90%

|

+40.44%

|

View

|