Markets have increasingly turned a bit defensive in the short run yet have signaled no real ability to make even a new two-day low close. Until there is at least some evidence of the uptrend from either July or June being broken, it pays not to try to fade this rally. Furthermore, market bears will have to increasingly lean on factors like cycles, sentiment and structural deterioration to pave the way for even a minor pullback, vs. expecting that fundamental data will pave the way. Importantly, cycle composites from the Foundation for the Study of Cycles show near-term SPX trends pushing up into September, not dissimilar from the Gann Mass Pressure index I’ve discussed in the past. The combination of upward sloping cycles along with DeMark exhaustion tools still being early to signal a peak (based on both daily and weekly analysis) makes me skeptical that any near-term pullback lasts all that long before a continued grind higher to 4350-60 or above that level to near 4400. Once breadth starts to deteriorate and some evidence of weakness holding by the close is present, it will be right to expect the start of some weakness. At present, it’s expected that markets will still push up until late August at the earliest.

As this cycle composite shows for SPX above, cycles turn down in September into October before a year-end rally. This composite gels with the studies from the Mass Pressure index, which show a possible peak in price in mid-September, turning down into early October before a sharp rebound. Given that these cycles have worked so well thus far in 2022, it pays to give them some credence as to likely provide a lot of value over the last few months of 2022.

DeMark counter-trend analysis seems to focus on late August/early September for a possible Stalling out

TD Sell Setups will require at least another two weeks before signaling a TD Sell Setup (9 consecutive weekly closes above the close from four weeks prior) This was present back in late 2021 as a factor that coincided with market indices peaking as well as in June as a TD Buy Setup which coincided with a Low.

Until weekly exhaustion is in place, it seems wrong to place too much faith in a large pullback, particularly when trends remain trending higher and have not been breached.

Note, AAPL 0.49% is used in this example given its outsized presence among major US indices and ETF’s and is thought to be a good gauge for big-cap Technology.

QQQ -0.18% , SPY 0.28% along with AAPL 0.49% all show weekly 7 counts at present, which will need two more consecutive higher weekly closes (above the close from four weeks ago) before signaling an official TD Sell Setup which might coincide with market weakness. At present, all of these seem to focus on late August and/or early September.

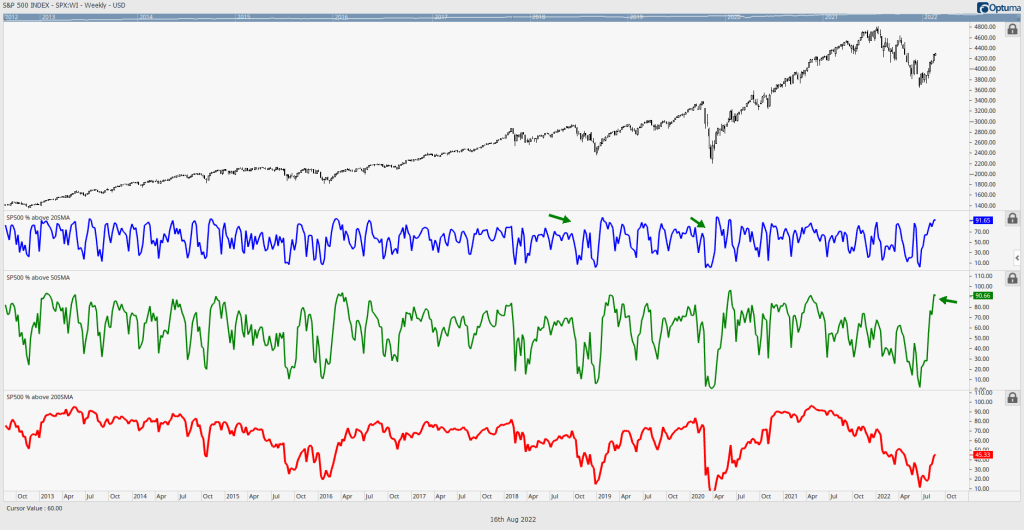

SPX Percentage of Stocks > 50-day Moving Average has now exceeded 90%

In the last week, we’ve seen a fairly bullish intermediate-term development in breadth appear that needs to be discussed. The percentage of stocks above their 50-day moving average (m.a.) has eclipsed 90%. This looks like a powerful signal that historically has been bullish for stock indices to signal further intermediate-term strength.

While near-term overbought conditions, a rotation into more defensive names signal that upside might prove limited over the next few weeks, the combination of ongoing bearish sentiment that hasn’t embraced this rally along with a lack of DeMark exhaustion, bullish cycles and massive breadth expansion are keeping the bears in hibernation.

Overall, we’ve discussed the recent pickup in strength in Financials, and Industrials to join the initial Technology and Discretionary outperformance, and markets look to be continuing to show evidence that this rally is broadening out. While corrections likely do materialize in September, my thinking is that any pullback does not test 2022 lows but proves short-lived before a rally from October into December of this year, aligning with seasonal positives.

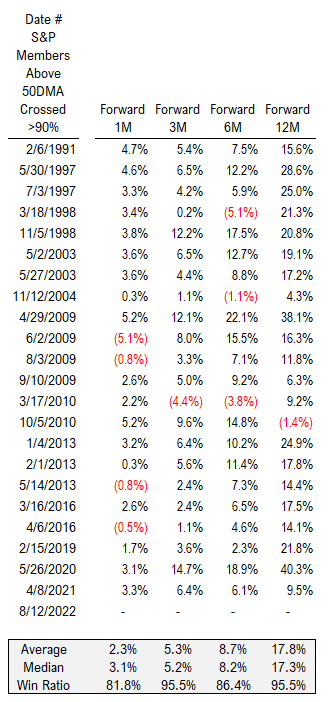

Percentage above 50-day m.a. has had an impressive record

When looking back at historical data to determine what the forward performance has been when S&P breadth starts to show percentage of members crossing 90%, we see that the Median returns have been quite impressive on a 1, 3, 6, and 12-month basis.

This should be grounds to embrace the possibility of a move back up above 4600 by year-end which remains clearly an out-of-consensus call. Yet, this lines up with my 2022 Technical Outlook which I presented back on 1/20 (My base case scenario discussed SPX dropping to 3815 into June before bottoming and rallying back to near unchanged on the year). (Thanks to Matt Cerminaro for help in compiling).