The bounce in US equities in recent days finished the day on a strong note, giving hope that a bit more is in store before prices stall out. As discussed in recent days, this snapback has been far more defensive than what’s needed to have lots of confidence about a bottoming out process getting underway. While Growth has perked up a bit along with high growth “FAANG” stocks, the underlying damage in Energy, Materials, Industrials has proven quite severe recently. This is largely due to commodity weakness, which should be exactly what the FOMC is looking for. At present, the equity market’s bounce can’t be called complete just yet with any proof. I expect strength does prove short-lived and likely finds strong resistance directly overhead near SPX 3850 before turning back down to challenge and briefly undercut lows. Friday and/or next Monday might prove important as a time-based turning point before weakness down into end of quarter.

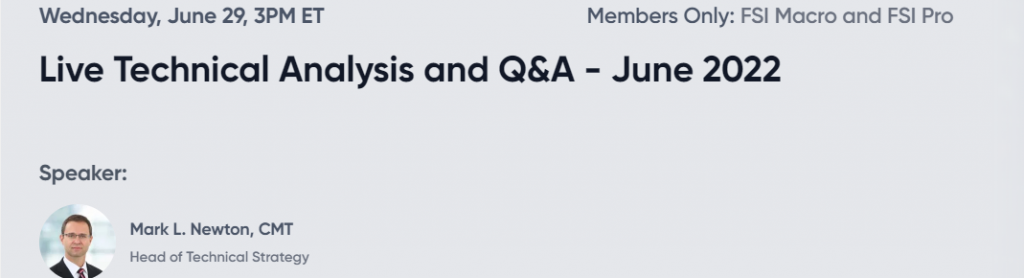

Commodities decline looks to be broadening out, yet larger uptrend remains very much intact

It’s no surprise that many now expect a recession in the US could be a very real possibility over the next 6-12 months. Using “the R word” is something that’s certainly gaining popularity given recent signs of economic weakness.

Commodities have begun to come under pressure given recessionary fears in the short run. The S&P GSCI equal-weighted Commodity sector (EWCI) has officially broken down to the lowest levels in four months this week. Moreover, the prior weakness in grains and base metals has begun to broaden out given that Energy looks to have finally joined suit.

I expect that weakness persists into next month, and that the EWCI pulls back to challenge this longer-term uptrend from March lows. This should have further detrimental effects on the Materials sector. Yet, until evidence of EWCI starting to violate long-term uptrends, it should be right to buy into this pullback. Loosely translated, this means that the battle between recession vs. inflation is very much ongoing. It’s tough to call for peak inflation just yet, and technically speaking, it should be right to buy into Energy and Materials into next month on this weakness. (As discussed yesterday, Energy stocks look to be closer to areas where they can bottom out). I expect that Energy is a better bet to buy dips in the short run, than Materials names, many of which could weaken further into July.

Metals and Mining should be avoided until prices reach support near last year’s lows

Specifically, the SPDR S&P Metals and Mining ETF (XME) has broken May lows over the last week. This is a technical negative and should result in prices pulling back to challenge last year’s lows. Technically, daily XME charts show this to be near the $40 level, and little exists between here and $40 that should help prices stabilize.

In general. the recent weakness in base metals should extend into precious metals in the near future as the DXY starts to push back to monthly highs. Overall, XME should pullback from its current $43.67 level down to $40-$40.50 over the next 2-3 weeks. This should be a level to consider buying dips in XME. As for Gold and Silver, weakness might persist into July’s FOMC meeting, after which precious metals could bottom out as the US Dollar rolls over.

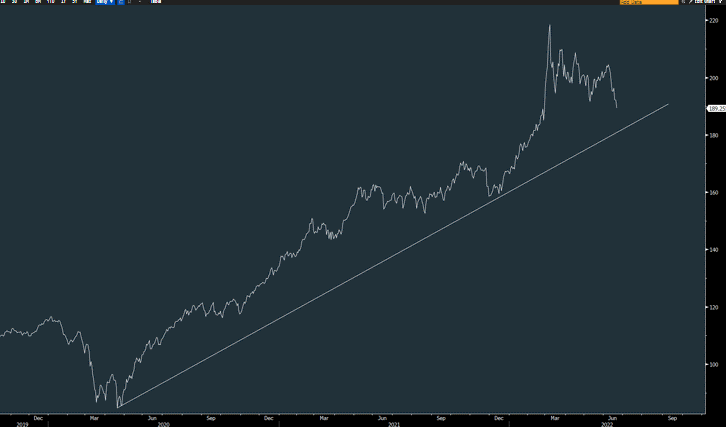

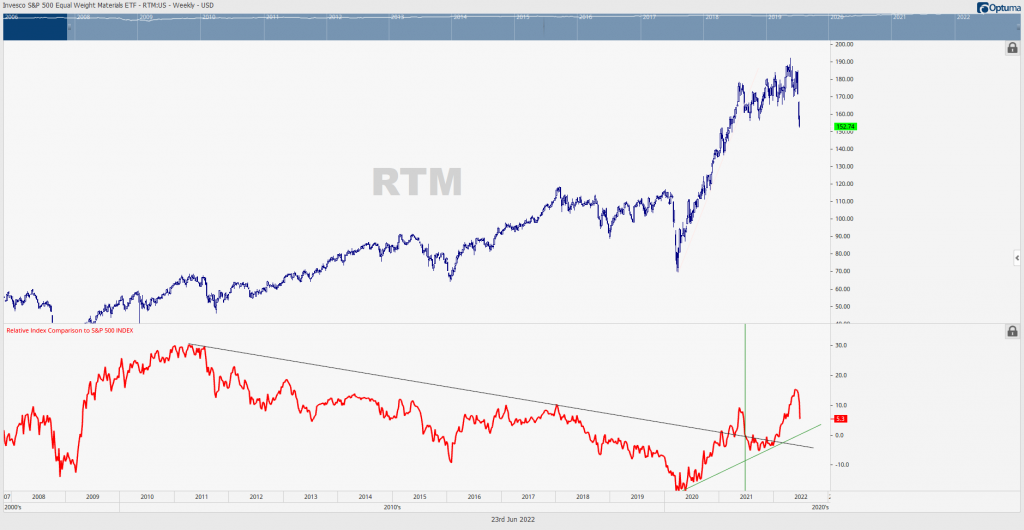

Materials sector “Down” but not “Out”

When eyeing the equal-weighted Materials sector, as shown by Invesco’s RTM, the last few weeks have brought about a meaningful snapback to absolute and relative strength, which has caused prices to break down to new monthly lows.

Weakness in the grains has spread to base metals, with Iron Ore, Steel, Aluminum, Nickel and Copper all having begun big pullbacks in the last week. Energy has followed suit, with precious metals looking like the last man standing. (I feel like this latter group is the next “Shoe to Drop” and likely starts to pull back to new multi-month lows as the US Dollar slowly creeps back to monthly highs).

Interestingly enough, the easy-to-identify “Head and Shoulders” pattern seen in XLB 0.36% looks quite different when viewing the equal-weighted RTM. On a relative chart vs SPX, however, weekly charts show only minor weakness in Materials when stripping out some of the larger cap stocks like LIN, DOW, SHW, FCX, and/or APD.

This pullback in Materials should move lower into July; however, the larger relative uptrend vs. SPX remains very much intact. Overall, this is a short-term downtrend in Materials at present, as part of a larger uptrend. Thus, weakness in precious metals and any further weakness in WTI Crude into July should translate into an excellent time to buy dips in Materials.

The absolute and relative charts of equal-weighted Materials along with equal-weighted Materials vs. SPX, are shown below. As seen below, the rally in 2021 resulted in a multi-year downtrend being exceeded. Thus, near-term weakness, while extreme in many commodities and in the XLB, has not violated areas which would translate into intermediate-term commodity weakness. Bottom line, Materials sector weakness into next month likely is buyable.