“In every battle, there comes a time when both sides consider themselves beaten, then he who continues the attack wins.” — Ulysses S. Grant

General Grant commanded Union armies in the American Civil War. The American Civil War was when the industrial age and warfare became fully acquainted, resulting in incomprehensible death and destruction. While before that remarkable contest, armies were accustomed to professional militaries maneuvering on the frontiers with agreed-upon rules, the Civil War degenerated into trench warfare in its later stages as armies burrowed into the ground to shelter from raining metal, not too dissimilar from what is going on in Donbas. As the “total war” that defined the first half of the twentieth century began, industrial capacity became as important as the fighting spirit for victory. Indeed, a modern amendment to this quote could be “he who continues to produce wins.”

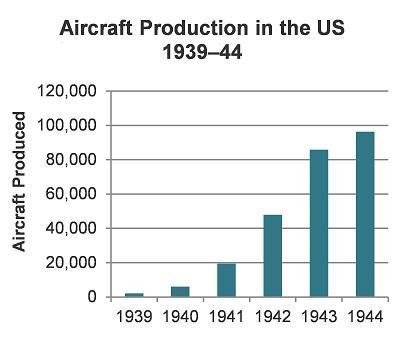

During the Second World War, America’s industrial might ensure her victory more than any other national characteristic. On May 26, well before the United States entered into the war, President Roosevelt held a fireside chat in which he ordered American manufacturers to produce 50,000 combat aircraft in a year. This goal was profoundly ambitious. Roosevelt’s number exceeded the total number of planes built in the United States since the Wright Brothers first took flight. While the Axis powers essentially had superior weaponry at this time, they wouldn’t be able to continue producing it because thousands of American strategic bombers destroyed their capacity to do so.

The nascent aviation industry had doubts. Airplanes were a lot more complex and cumbersome to produce than automobiles. As Dutch Kindelberger, President of North American Aviation, said, “You can’t expect a blacksmith to make a watch overnight.” However, the American manufacturing base rose to the challenge. Not only could Ford produce the complicated B-24 Liberator at its Willow Run Factory, but it could also produce one every hour at peak production. The amazing achievement of American mass production and ingenuity was crucial to the defeat of the Axis powers and central to America’s ascent as world hegemon.

Initial Success of American Weaponry Masks Problems in the Defense Industrial Base

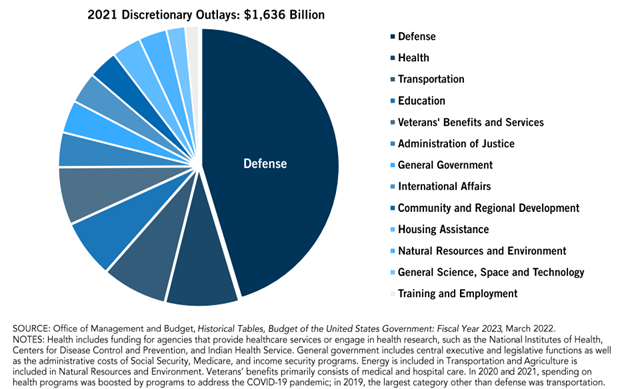

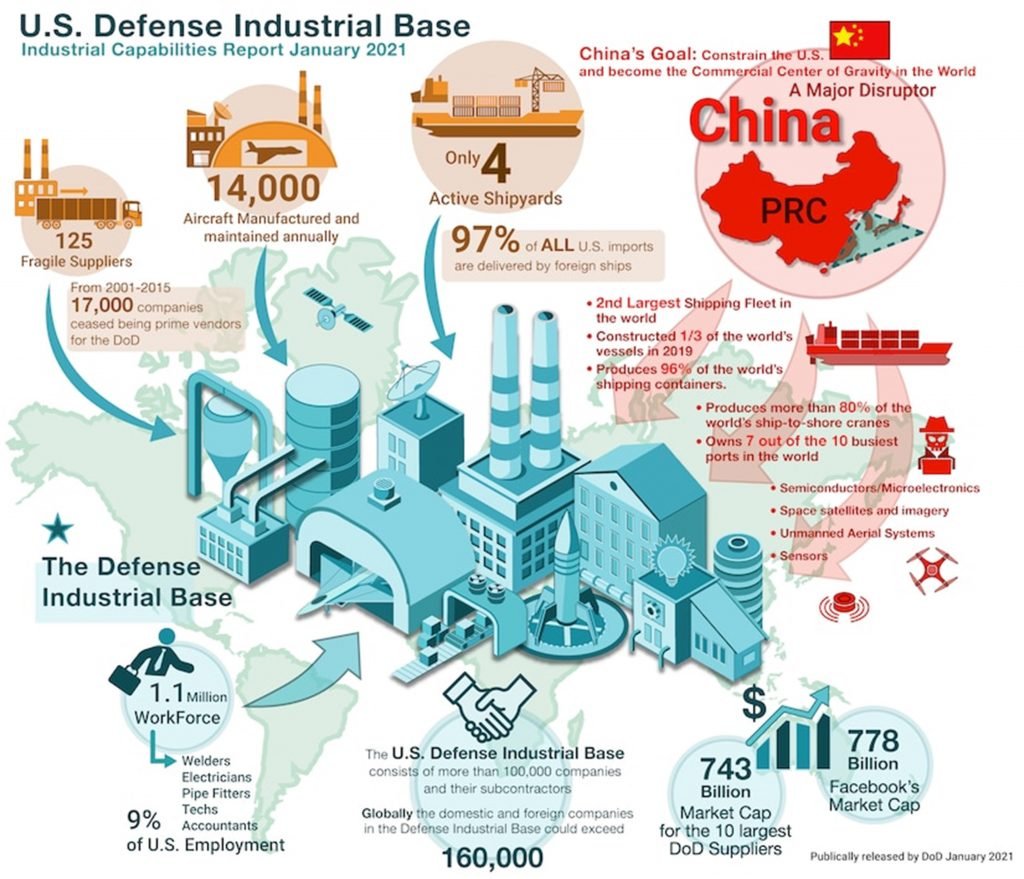

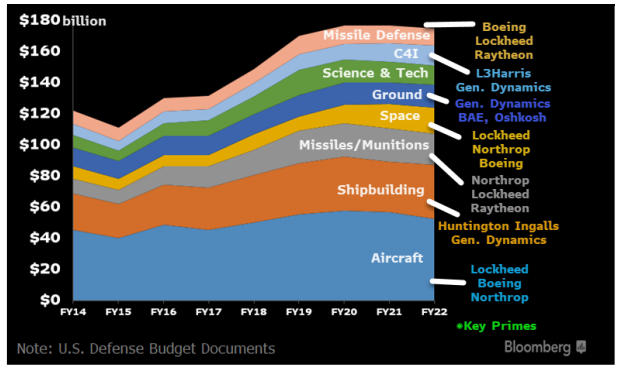

America’s defense industrial base has evolved prodigiously since the most significant conflict in human history. Instead of hundreds or thousands of rivets, many of the weapons necessary for modern warfare now have thousands of semiconductors. Over 100,000 companies in dozens of countries comprise the defense industrial base today. Defense spending is nearly half of the US government’s discretionary budget (which excludes things like Social Security and Medicare).

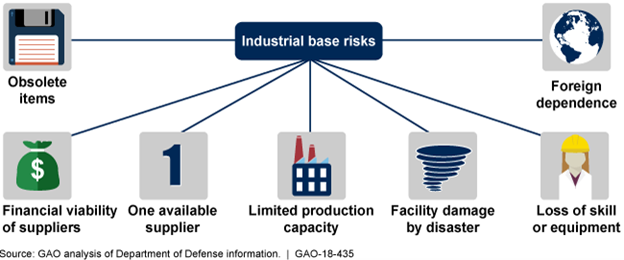

The sprawling global network of supply chains, factories, and networks needed to support the US military is vast and sometimes vulnerable, as COVID showed. It has also evolved in a world that primarily abhorred and avoided traditional inter-state conflicts of similar intensity to the world wars. The focus was on shiny weapons systems with a mind for deterrence and protecting peace and prosperity, not on winning a resource-intensive European ground war. However, that is precisely what the defense industry needs to respond to now, and it is ill-equipped to do so. A generation ago, the weapons America produced to halt a potential Soviet advance into Western Europe proved particularly effective in Ukraine, often facing the same Soviet weapons systems they were designed to destroy.

But as effective as some of these weapons are, the peacetime American defense industry often prioritizes expensive systems it can get paid for, not the quantity required for high-intensity conflicts. For example, in about 100 days of fighting, we have already likely donated or sold around a third of the total stock of these weapons. Finding employees, having firm orders the company can count on (in the defense industry, producers can be forced to eat excess capacity costs), and most importantly, sourcing materials and components, can all be problematic.

Throw into this rampant inflation, supply chain woes, and the fact that incentives are so perverse in the Aerospace and Defense industry they could make a Medicare actuary blush, and it’s easy to see that initial success could be harder to maintain without some revamping of the war machine. For instance, consider the controversial F-35 program, which was crafted to have economic ties to nearly a dozen countries and 46 US states to help make it too politically difficult to consider alternatives. These kinds of political tricks cause inefficiency and a lack of accountability that may need to be reformed if the US is to once again be the arsenal of democracy.

Ukraine Is a Major Catalyst for the Aerospace and Defense Industry

On February 24th, 2022, the world was forever changed when Russia began its unprovoked invasion of Ukraine. Many had doubted that Russia was doing anything but posturing and thought it would be a limited affair focusing on the eastern regions of Donetsk and Luhansk if Russia did invade. Instead, Russia launched a full-scale invasion, and Ukraine performed better than almost any mainstream analyst predicted. The reason for Ukraine’s better-than-expected performance is a combination of morale, or esprit de corps, as Napoleon called it, and very effective military equipment and training provided to it by the United States and its allies.

The initial fighting in Ukraine was marked by Russian efforts to seize important population centers, including the capital of Kyiv. The Russians could not quickly disable Ukraine’s air defense capabilities which foiled Russia’s approach. The cream of the crop of their military suffered catastrophic casualties, particularly in the crucial mid-level and junior officers necessary for adequate combat power.

A report by CSIS, a think tank, suggests that Russian casualties could have been as high as 25% of the initial attacking force. These casualty rates would be more at home in General Grant’s time or during the First or Second World War. They are much higher than most late 20th century or early 21st century conflicts. As a result, Russia was forced to abandon its prodigious objective of seizing the country quickly like Czechoslovakia in 1968 for more limited, face-saving objectives.

The conflict has changed in character from one of high-intensity urban combat to more protracted but also highly resource-intensive trench warfare. Remember, the Ukrainians and Russian proxy forces had been battling in the Donbas for eight years. While the Russians are progressing by concentrating their superior firepower in Luhansk, they must suffer high casualties given their demonstrated lack of proficiency at assaulting complex defensive positions with effective combined arms coordination.

Their exclusive focus has also led to Ukrainian counteroffensives gaining success in strategic areas like Kherson Oblast. However, the Ukrainians are also losing a lot of men. President Zelensky said his nation’s military is suffering as much as 600 KIA and WIA every day. As the conflict shifts to a more traditional military standoff, Ukraine needs different kinds of weapons than those that were effective in the first phase of the conflict.

But the US defense industrial base must respond to multiple threats in a world of rising geopolitical tensions, including countering China’s threat to Taiwan. The fighting in Ukraine has also updated thinking on achieving this objective effectively. Taiwan will likely need many weapons that make Ukraine “indigestible” instead of fighter jets that China’s numerically superior forces might quickly destroy. One of the problems the defense industry must address is how to ramp up the production of crucial and scarce weapons systems that help achieve this outcome. Supplies are already low from giving significant portions of total military supplies to the embattled Ukrainians.

The Shifting Conflict Is Putting Strain on a Peacetime Defense Posture

The most likely outcome is a continued protracted stalemate or a frozen conflict that allows Russia to prevent Ukraine from getting closer to Europe and sap its resources and people to discourage a flourishing democracy on its doorstep. Either way, the Ukrainians will need much support from the West going forward, and European austerity on military spending has been shattered. These developments are favorable for the US defense industry. Still, we want to show you which companies we expect to benefit from this tragic new world order more than others.

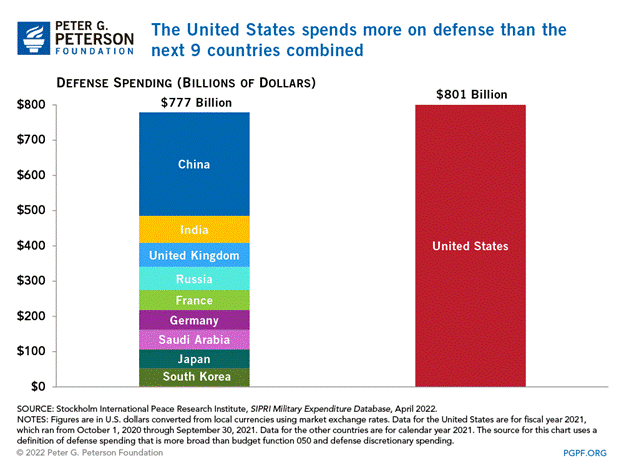

Before the invasion, the defense budget was seen as an area to curtail in favor of other programs. The unexpected and tragic war has undoubtedly changed the calculus behind that thinking. Now Democrats and Republicans are both firmly dedicated to ensuring that we have a robust defense industrial base prepared to meet the challenges of resurgent Russian aggression and increasing tensions with a rising China undergoing its own military buildup.

As the war in Ukraine enters its first month, the highest intensity conflict of the 21st century has dramatically changed the thinking about how to best prepare for future conflicts. The US defense budget was already beginning to shift back to Great Power Standoff from the counterinsurgency thrust mandated by the wars in Afghanistan and Iraq. But the high resource demands of a hot ground war in Europe demand that the industry make some significant changes from its peacetime posture.

The stellar performance of hard-to-produce legacy systems like the Stinger anti-aircraft missile in the field has thrown the logic behind previous procurement efforts out of whack. If you’ll remember, the Stinger was also crucial to the success of the wily mujahideen in Afghanistan against Soviet forces. It was being phased out by the US military and needs a redesign given the strain on supply chains for existing components. The goals and capabilities of a peacetime defense industry focused on deterrence have shifted to meet the needs of a hot war against a battered but formidable adversary. The theoretical has been replaced with the needs of the real world. The peacetime industry is focused on advanced and expensive systems.

As we shift to supporting an embattled ally in a high-intensity conflict with munitions needs more similar to the world wars than any of the recent conflicts the US has been involved in, a significant pivot is needed. We want to give you a tour of the war machine and discuss how the changing needs of a world where conflict is rising and cooperation is falling will affect a US defense industrial base that is more vulnerable and less responsive than is intuitively apparent.

Increasing European Defense Spending Will Be a Tailwind for American Defense Firms

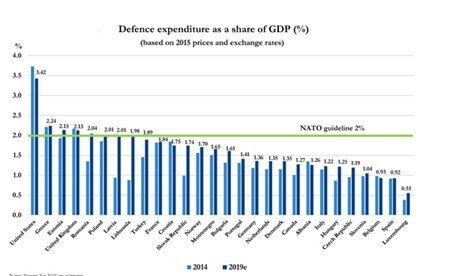

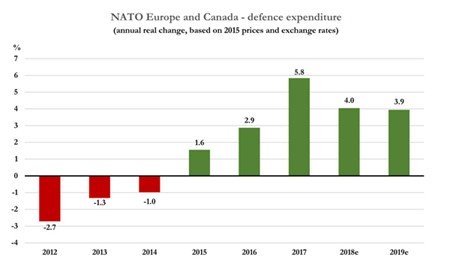

The Aerospace and Defense industry was already largely on its backfoot from the massive interruptions to the supply chain caused by COVID-19. The creaky supply chains that got gummed up were particularly problematic for an industry with such a wide and diverse footprint. If you’ll recall, President Trump chided NATO members for contributing below the mandated level of spending at 2% of GDP. What seemed to be a secular reality was that Europe de-prioritized defense spending compared to the US.

The reversal of this trend will be a major boon for American defense firms. For example, from 1992 to 2021 EU combined defense spending grew only 20% compared to 66% for the United States, nearly 300% for Russia, and nearly 600% for the People’s Republic of China. Since the invasion of Ukraine, members of the European Union have already announced close to $200 billion in additional defense spending. Much of the benefit will go to the US Aerospace and Defense sector despite there being some proficient European defense firms. American weapons and capabilities have been shown to be very good at stopping Russian forces. We’ll go into some detail below as to which components of the S&P 500 Aerospace and Defense industry will be poised to benefit the most from this boon in defense spending by our European allies.

NATO defense expenditures will likely be rising more than at any time in recent history. While Ukraine has shown the weakness of Russia’s army, it has also shown the erratic and bellicose nature of Russia’s leadership. Implicit in their humiliating performance in Ukraine and the Putin regime’s truculent nuclear rhetoric is the need for different types of weapons systems that the Ukrainians need for the ongoing conflict. The European nations on NATO’s eastern flank and even further west will need more protection against Russia’s weapons of mass destruction and cruise missiles. Expensive platforms like Patriot missile batteries will likely be needed.

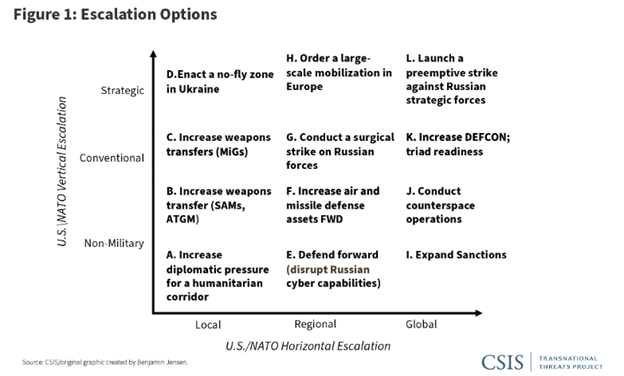

President Biden Defines Boundaries of US Involvement in Ukraine

On May 31, President Biden wrote an op-ed in the New York Times. He outlined some of the country’s goals and which weapons systems the US would continue to supply. Notably, President Biden stated he would not send US troops or provide weapons systems that could allow the Ukrainians to strike deep into Russia. He stated that he wanted to get Ukraine in the best negotiating position possible, which may signal an attempt to give Putin an offramp. The West has laid out a clear strategy that relies on not escalating to direct conflict with Russia. Russia’s intent and leadership are more opaque and unpredictable.

While the free world has undoubtedly maintained a stronger and more united front than Mr. Putin seems to have expected, there are still fissures in that front partially caused by the intense economic interdependence, particularly in energy and commodities, of the European countries with Russia. Europe, not America, must bear the brunt of the self-inflicted economic consequences of the most robust sanctions in history. Below is a list of weapons systems mentioned by Biden and the US defense firms that produce them.

Javelin Anti-Tank Missiles

Lockheed Martin (LMT 2.57% ) and Raytheon (RTX 0.43% ) have a partnership to produce Javelin missiles. President Biden recently visited their production facility in Alabama. These weapons have supply chain challenges, and components need to be modernized. Lockheed Martin recently announced plans to double production from about 2,100 a year to 4,000 a year. While they are overhauling current supply chains, the CEO of Lockheed Martin recently said that it would take at least a few months, maybe even years, to hit the new production goal because of supply chain frailty. Luckily, our European allies have adequate substitutes like the Next-Generation Light Anti-tank Weapon (NLAW). Also, America is less reliant on these weapons for our military operations given our high reliance on airpower and precision munitions.

Artillery and Precision Rocket Systems

Stalin once famously called artillery the “God of War.” Russian military doctrine certainly reflects this sentiment. In trench warfare, one of the main ways militaries try to break the stalemate is to rain as much metal down on their opponents as possible. The Russians have the clear advantage in this capacity, although the Ukrainians have been using American technology and their own artillery quite effectively, as a foiled Russian river crossing proves.

As the character of the war shifted to trench warfare in the Eastern part of the country, the humble howitzer, which is an old but effective weapon, is needed by the Ukrainians to counter Russian superiority in the area. The M777 howitzer has been sent to the Ukrainians. This weapon is manufactured by BAE systems, a British firm. Other allies are also providing these battle-tested weapons that have a range of about 15 miles and which are highly portable. The Ukrainians have been using them effectively. However, given the character of the conflict, the supply of ammunition will be particularly crucial. The 183,000 shells the United States included could be used in a few days if the fighting escalates. However, luckily our European allies have a lot of 155mm shells that they can now easily give to the Ukrainians to help establish firepower parity in critical theaters. Poland and other allies are also supplying artillery.

As the Russians began to focus on Donbas and make progress by concentrating their battered forces, one of the main things requested by the Zelensky government was precision rocket systems. The United States has partially abided by this request and is sending an undisclosed number of M142 High Mobility Artillery Rocket Systems (HIMARS). This platform will allow Ukrainians to conduct precision strikes on Russian targets, including their plentiful artillery. However, the United States declined to provide longer-range systems that might be used to strike deep into Russia.

Stinger Anti-Aircraft Missiles

Stingers were crucial in defeating the Soviet invasion of Afghanistan and they’ve also been central to Ukrainian efforts to prevent Russia from gaining air superiority over the embattled nation’s skies. The Stinger entered service in 1981. The DoD hasn’t ordered new ones since 2003 and the production line was shut down before being opened last year for a foreign customer. It should be noted that when production lines are serving foreign clients they are considered less central by the US government so supply lines aren’t as well protected. Raytheon has mentioned that it only has a limited stock of parts and that some components simply aren’t commercially available any more. The company will have to redesign the weapon and assembly line, which will cause a major lag.

Radars and Intelligence

One of the most valuable things the Ukrainians have gotten from the United States is intelligence. This has been the bane of Russia’s officer corps, which hasn’t suffered such significant casualties since the dog days of fighting on the Eastern Front in World War II. When Stalingrad was besieged by Nazi forces from June 1941 to November 1942, the Russians lost an average of about six generals every month. This is amazing and about the same as the current toll Russians have suffered in Ukraine.

Western intelligence and a lack of sufficient encrypted communications equipment available to Russian forces likely help explain this. Russia’s advantage in artillery is being severely curtailed because of the counter-artillery radars provided to the Ukrainians by American forces, which help them conduct vital counter-battery fire. These detect the origin of shells in flight and allow our allies to neutralize Russian guns, one of their main advantages.

Unmanned Aerial Vehicles (UAVs)

UAVs received a sinister reputation in America’s counter-terrorism wars. They are one of the weapons most feared by those facing them because they kill silently and without warning. The Ukrainians are using drones for several different missions, as are the Russians. There are large-scale drones used for surveillance and strikes, but the headline grabbers have been the “kamikaze” loitering munitions that have proved very problematic for unsuspecting Russian forces and helped the Ukrainians evict the Russian army from the outskirts of Kyiv. Drones also helped document war crimes by Putin’s forces in places like Bucha. Without drones, the scale of death and destruction in Mariupol may have been less apparent as well. Turkey has been considered one of the foot-draggers in NATO, but has contributed to Ukraine’s war effort nonetheless by providing Bayraktar TB-2 drones, which have proven quite effective. One Ukrainian expert estimates Ukraine is operating more than 6,000 drones for reconnaissance purposes alone. The US will continue providing effective Switchblade drones to Ukraine.

Mi-17 Helicopters

The United States had purchased the Russian-made Mi-17 helicopter for use by the ignominiously defeated Afghan army. This drew the ire of some US lawmakers who wanted to use American-produced choppers, but the decision has proved fortuitous for our efforts to help the Ukrainians. The US pioneered the use of helicopters in warfare during Vietnam. These can be used both for transport and can be outfitted with rockets. The Ukrainians have also shown quite a bit of dash in their use of helicopters when they likely attacked an oil depot in Belgorod. Ukraine denies the attack and the US discourages the Ukrainians from expanding the war onto Russian soil for fear of provoking an escalation of the conflict.

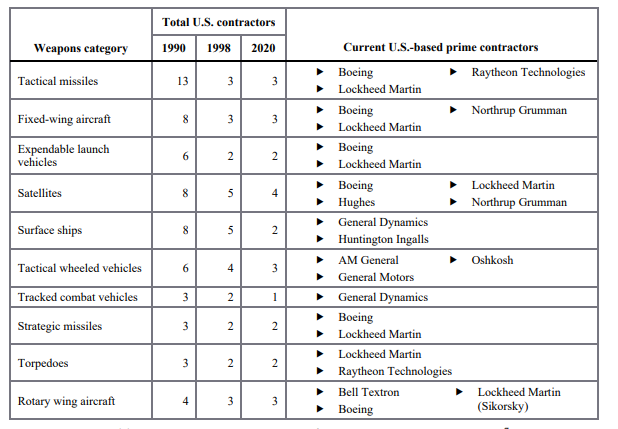

Industry Characteristics of the US Aerospace and Defense Industry

This industry is considered defensive because it is not as cyclical as most other industrials. While the industry has some oligopoly characteristics, and has definitely been consolidating over the last years, one of its main defining features is actually that it is somewhat of a monopsony. A monopsony is the opposite of a monopoly; instead of one seller that can name their price to consumers there is one major buyer, in this case Uncle Sam. As a monopoly can dictate terms to consumers, the US government can dictate terms to the major defense contractors, and doing business with Uncle Sam is incredibly complicated. There are many different types of defense contracts that can have a direct bearing on incentives. For example, due to low inflation over the past decades, many contracts no longer hold a cost-adjustment provision. So, given the decades-high rates of inflation, some contractors may be hesitant to do work for fear they won’t be compensated for cost overruns. This, of course, happens on a contract-by-contract basis and is just one example.

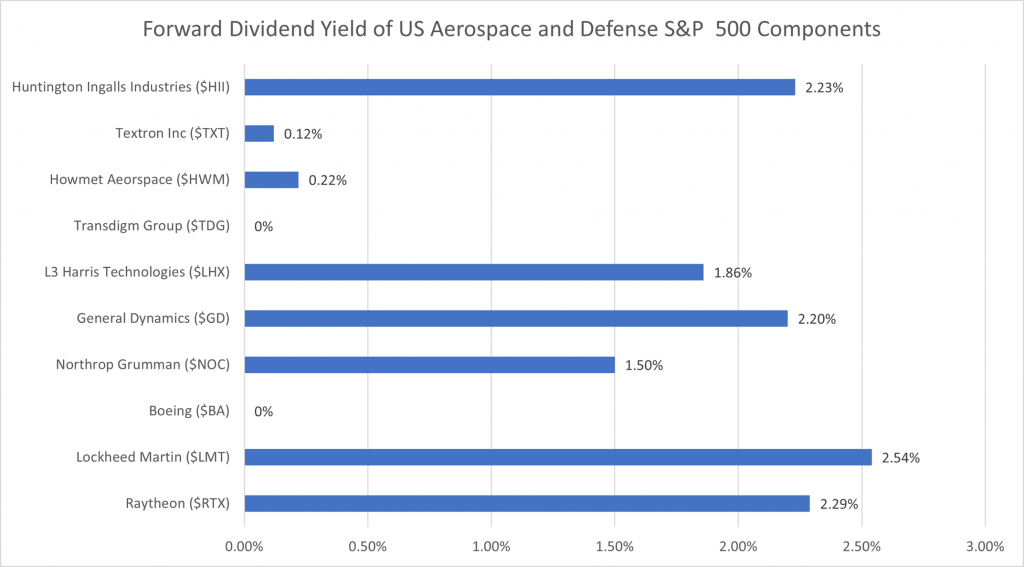

Another defensive characteristic of this industry is that many companies have attractive dividend yields, and also a stellar track record of rewarding shareholders over time. The attractive dividend yields and detachment from economic cycles make these good members of a portfolio during down-cycles. In a down-cycle, where the catalyst is a high-intensity ground war in Europe and resurgent authoritarian ambitions across the globe, it will likely be even better than a normal downturn to own this area.

While the defense budget has grown predictably over the last decades, inflation could be a major problem for the Defense industry. Biden’s recent budget didn’t even keep pace with inflation. The Aerospace Industries Association and other supportive think tanks have been arguing that given the multiple competing priorities, the FY2023 defense budget should be 3% to 5% higher than inflation. This would result in a huge uptick in spending and could get bipartisan support as the war rages on.

One major trend over the past decades has been consolidation. While large defense contractors still make a lot of acquisitions and create a ton of partnerships, the complexity of dealing with and maintaining complicated contracts with Uncle Sam makes the barrier to entry in this industry very high. This means you can count on these companies’ future cash flows about as well as any company given their revenue sources and the secular increase in demand for their products across several dimensions.

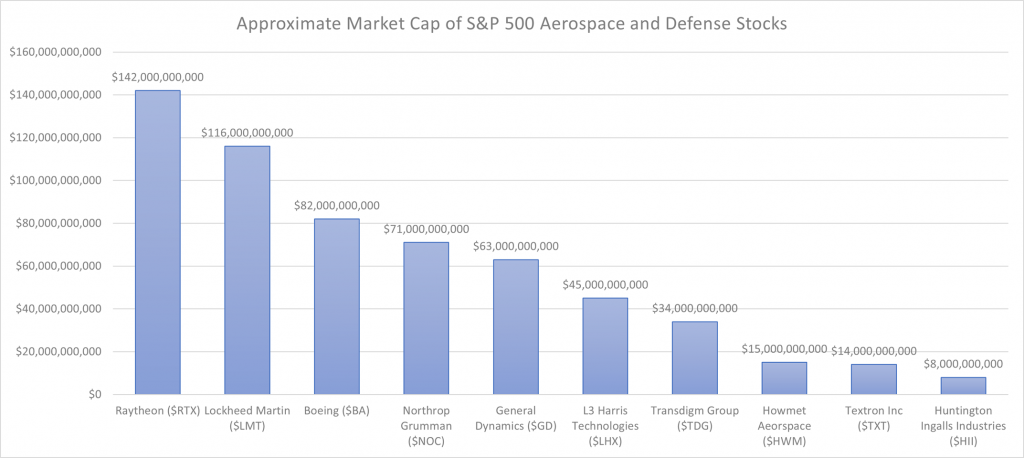

Aerospace and Defense Industry S&P 500 Components

RTX – Raytheon Technologies

Raytheon’s four divisions, Raytheon Intelligence & Space, Collins Aerospace Systems, Pratt & Whitney, and Raytheon Missiles & Defense, offer services globally for government, military, and civilian applications. The Raytheon Intelligence & Space segment provides customers with advanced communication systems, sensors, and software solutions. The Collins Aerospace Systems subsidiary supplies products and components for avionics, surveillance systems, and interior cabins. The Pratt & Whitney subsidiary constructs and supplies engines for commercial, private, and military aircraft. The Raytheon Missiles & Defense segment primarily creates military defense systems for air, land, and naval warfare.

LMT – Lockheed Martin

Headquartered in Bethesda, Maryland, the company is structured into four divisions consisting of Aeronautics, Space, Rotary & Mission Systems, and Mission & Fire Control. The Aeronautics division produces manned aircraft, drones, and support systems for military use. The Space division’s product offerings primarily consist of advanced missile systems, commercial satellites, and space transportation vehicles. The Rotary & Mission Systems division manufactures systems for radar, ground defense missiles, and helicopters for commercial, private, and military applications through Sikorsky, a Lockheed Martin subsidiary. The Missiles & Fire Control division develops aerial defense systems and vehicles and provides combat mission support.

BA – Boeing

The Boeing Company is a corporation headquartered in Chicago, Illinois. Boeing’s business revolves around the development, manufacturing, and sales of jet aircraft. It also offers satellites, missile defense applications, and space exploration systems as a part of its product offerings.

The Global Services division’s primary offerings consist of data analytics, supply chain management, and aircraft maintenance services. The Commercial Airplane division produces aircraft for civilian and cargo transport applications. The Boeing Capital division facilitates sales, leasing, and financing flexibility of aircraft for its customers. The Defense division concentrates on the production of weapons, plus satellite and surveillance systems, along with producing drones for military use.

NOC – Northrop Grumman

Northrop Grumman is a corporation headquartered in Falls Church, Virginia. The company is structured into four divisions consisting of Space, Defense, Mission, and Aeronautics Systems. Northrop’s Space Systems division provides customers with satellites, missile interceptors, and ground missile offerings. The company’s Defense Systems division is responsible for the design, development, and production of military weapon systems. Northrop’s Mission Systems division produces sensors, communication systems, and missile propulsion systems. In addition to producing a variety of aircraft for military use, the Aeronautics Systems division develops systems for drones and combat situations.

GD – General Dynamics

General Dynamics is structured into four divisions consisting of Combat Systems, Technology, Aerospace, and Marine Systems. The Combat Systems division of General Dynamics produces armored ground vehicles, portable bridge systems, and combat vehicles for military applications. In addition to providing AI, big data solutions, and cloud computing, the Technology division offers customers combat support services, communication devices, and reconnaissance systems. The Aerospace division of General Dynamics offers customers a product line of jets for private and business applications through Gulfstream. It also offers fleet management, chartering, and maintenance services through its Jet Aviation subsidiary. In addition to providing maintenance services and retrofitting options for the United States Navy fleet, The Marine Systems division is responsible for the construction of submarines and ground deterrents.

LHX – L3Harris Technologies

L3Harris is structured into four divisions consisting of Space & Airborne Systems, Aviation Systems, Communication Systems, and Integrated Mission Systems. The Space & Airborne Systems division develops products for cyber warfare, avionics, and sensors. Through the Aviation Systems division of L3Harris, the company provides pilot training, air traffic solutions, and air defense products. The Communication Systems division offers radio communication, terminals, and battlefield systems for military ships, cars, and aircraft. The Integrated Mission Systems division of the company provides ISR capabilities, fleet management, and electrical systems for customers.

TDG- TransDigm Group

TransDigm Group is structured into three divisions consisting of Power & Control, Airframe, and Non-aviation. The Power & Control division products consist of generators, sensors, and lifting devices. The Airframe division is responsible for producing interior cabin components, security systems, and audio systems. TransDigm also has a non-aviation division that produces safety components, actuators, and fuel systems for space and land vehicles.

HWM- Howmet Aerospace

Howmet Aerospace is structured into four divisions consisting of, Forged Wheels, Engineered Structures, Fastening Systems, and Engine Products. The Forged Wheels division produces wheels catered toward commercial ground transportation. The Engineered Structures division is responsible for providing customers with titanium, aluminum, and nickel products for aviation and military use.

The Fastening Systems division makes safety equipment and fasteners for industrial and aerospace applications. The Engine Products division of Howmet produces components for jet engines and industrial turbines. These components consist of disks, rings, and airfoils.

TXT- Textron

Textron is structured into four subsidiaries and divisions consisting of Financing, Industrial, Bell, Textron Systems, and Textron Aviation. A similar service to Boeing Capital, the Financing division at Textron provides customers of Bell helicopters with flexibility in purchasing aircraft. The Bell subsidiary of Textron offers a product line of helicopters for civilian and military applications. The Textron Systems division is responsible for developing and producing drone systems, piston engines, and armored vehicles. The Industrial division of Textron makes off-roading and recreational land vehicles along with fuel systems for government, personal, and commercial purposes.

HII – Huntington Ingalls

Huntington Ingalls is structured into three divisions consisting of Newport News Shipbuilding, Ingalls Shipbuilding, and Technical Solutions. Ingalls Shipbuilding division of Huntington Ingalls is responsible for the production and development of ships for the United States Navy, Coast Guard, Marine Corps, and for commercial use. The Newport News Shipbuilding division produces nuclear-powered submarines and aircraft carriers. The division also conducts fleet management for the U.S. Navy. The Technical Solutions division offers global security products for commercial customers and governments.