Key Takeaways

- The world was rocked by COVID-19 and it derailed many existing trends, but one that remains intact is the economic rise of the most numerous and educated generation in history.

- Demographics drive economic activity. As millennials enter their prime earning and spending years they will fuel generational consumption that has been at the core of previous bull markets.

- We also discuss the rise of millennial investors and some of the dislocations they’ve created in financial markets. We analyze why we think millennial investors have successfully identified thematic trends.

- We provide a list of five stocks that we believe are tied to the “iron trend” of millennials’ economic rise.

Competition is at the heart of markets. While markets have guardrails and regulations that distinguish them from the unrestrained competition of the jungle, so to speak, it can be useful to learn competitive lessons from nature to help inform the less consequential kind that occurs in markets. The stakes are money in markets as opposed to life and death in nature, but nonetheless, many of the principles and successful strategies used for survival can be quite useful in understanding what strategies will help you successfully preserve and accumulate wealth. Survival strategies in nature are highly tailored by life’s supreme ability to adapt over time.

Have you ever wondered why the prodigiously sized tiger appears bright orange? It doesn’t appear to be camouflaged with our primate perceptions. It seems counterintuitive that a beast that depends on stealth to support the massive calorie intake required for its survival would be one of the brightest and most distinguishable colors. To our perception, this makes no sense. However, to the primary prey of Tigers that are “color blind,” their adversary appears green. So, from the perspective of their intended prey, they are camouflaged. This type of different perception can be thought of as an analog for why sometimes younger generations are the best at spotting endurable trends.

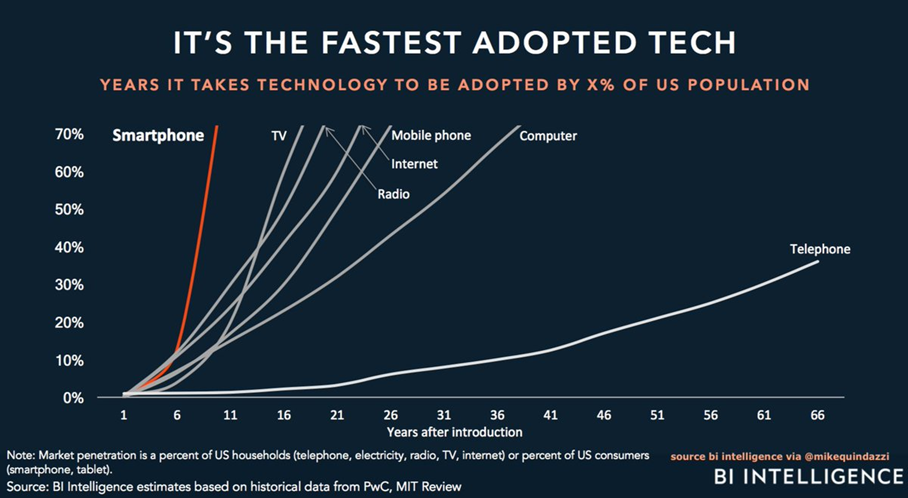

When our Head of Research, Tom Lee, was getting his start in research he was a non-consensus voice on the future prospects of mobile telephones. Hindsight is of course 20/20, and we all now understand the significance of mobile phones and a huge portion of humanity carries one around daily. However, when the technology first emerged many on Wall Street thought that it was a niche product for the ultra-wealthy and any expansion would be curtailed by the powerful incumbent telecom industry.

When Tom has discussed this extraordinary call, he mentioned that he saw young people as voracious adopters of the technology who understood its potential. The old guard on Wall Street was “color blind” like a tiger’s prey, whereas Tom Lee and the young folks and pioneers he spent time with in the course of his analysis saw a bright orange tiger ready to make mincemeat of legacy telecoms.

COVID-19 Made Millennials and Markets Like Peas and Carrots

The post-pandemic markets were much more resilient than many commentators believed during the onset of COVID-19. At the time, some even theorized that the global economy would be knocked so hard off its axis that what was left would look nothing like what came before. Instead, we saw strong companies quickly pivot to the rapidly changing economy and business environment and many have come out stronger, leaner, and meaner than they were before the crisis. The global economy and many publicly traded companies suffered the greatest stress test in modern history and passed with flying colors. A global coordinated economic shutdown, or even one at the national level, had never occurred and it resulted in full revenue interruptions for many firms.

As stimulus from governments around the world helped keep many folks who couldn’t work afloat, and as sports events were also canceled, a large cadre of millennial investors decided to try their hands at markets. For many, their first foray into markets seemed deceptively easy. After the lightning-fast recession from COVID-19, markets began a dramatic “V-shaped” recovery as generally occurs after big exogenous shocks. Our Head of Research, Tom Lee, made one of the great modern buy when there’s blood in the streets calls when he told investors to pile into stocks at the “Epicenter” of the crisis.

Sure enough, after a brutal swing to the downside markets had a rapid recovery aided by a super accommodative FOMC and liquidity environment. One thing that may accelerate the economic impact of millennials is their burgeoning interest in investing. Before the uptick in interest caused by the idiosyncrasies of pandemic life, they were already becoming a core constituent of key economic purchases that drive economic growth and activity.

While Dave Portnoy may have said he is way better at investing than Warren Buffet, we have begun to analyze unstructured data from preferred message boards of millennial investors. Investing is still investing and the army of retail day-traders, while they have shown proficiency at identifying certain technological trends, are still not the “smart money” yet.

Remember though, that one day they will be. Our Head of Quantitative Research, Adam Gould, has been doing some excellent analyses of Reddit discussions on certain stocks, we call the product Reddit Alert. The key takeaway is that more heavily discussed stocks generally tend to underperform the market for a short period after their mentions peak. So, to clarify, our thesis for millennials is based on the economic impact they will have, not necessarily the stocks retail millennial traders prefer. Although there can be a signal here as well with a long-time horizon. Tesla was the original meme stock and hated by the street, but many millennials successfully identified a fierce tiger. Perhaps they understand intuitively better what trends will resonate with consumers and which won’t: like the above example of mobile phones.

Millennials Show Thematic Prowess, But Demographics Are The “Iron Trend”

“In times of rapid change, experience could be your worst enemy.” – J. Paul Getty

One of the perennial privileges of age and experience is looking down on the young. Plato himself famously said that the young “disrespect their elders,” and “ignore the law.” The man certainly wasn’t a close-minded guy or subpar thinker. One factor in earning power is of course education as it has a direct bearing on a worker’s productive capacity.

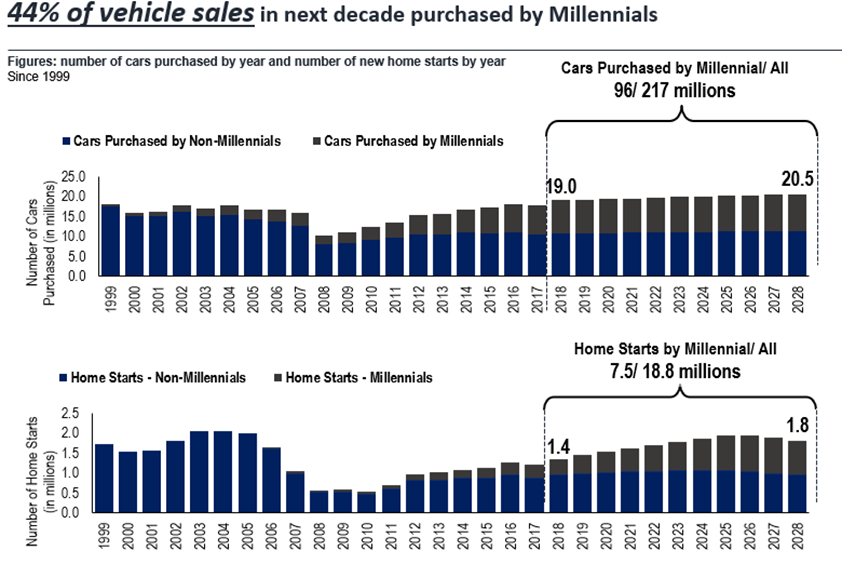

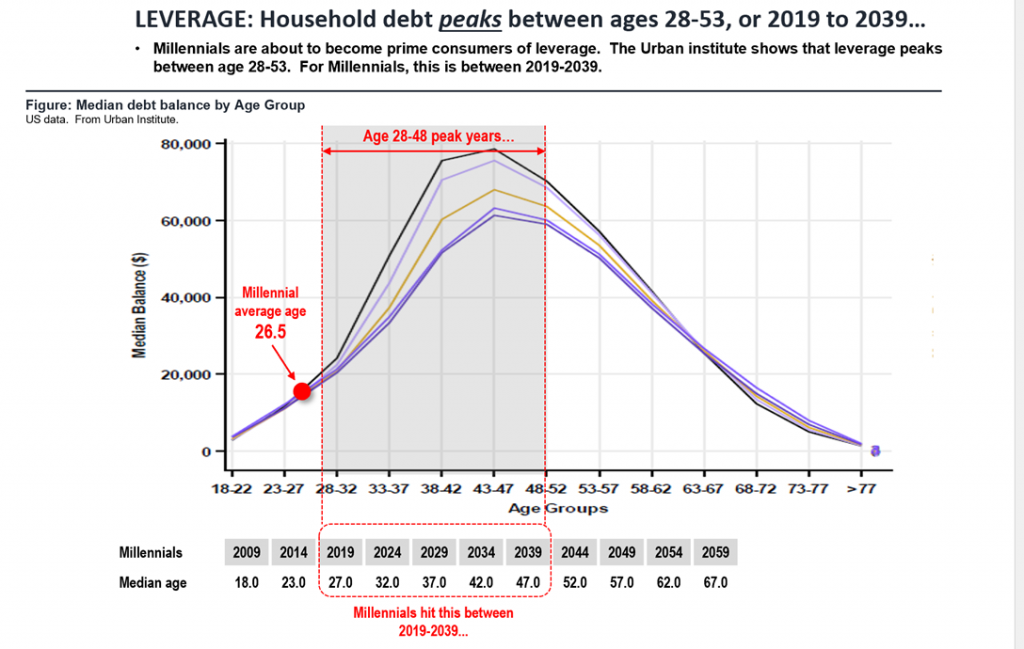

Despite being the most educated generation in history, millennials have so far lagged the earnings power of their predecessors at the same stage of their life. So, this numerous and highly educated generation is entering the period of their life cycle where they are at peak earning, borrowing and spending. On the aggregate, millennials seem to have foregone key financial milestones like buying a house, but that will change. One perpetual fact of this world is that the young will one day become the middle-aged, and then the old.

Many “trendy” industries and firms who present themselves as disrupters may be mere “paper tigers” clad in buzz words rather than actual disruptive potential. When we are discussing our thesis involving the Economic Rise of Millennials, we don’t want you to get confused and put all your savings into the hottest Metaverse SPAC in town. We do think many millennial investors are able to better perceive successful thematic investments of the future because they understand what their generation wants and inherently may have a sense of what will “work” with their generation and what will not.

Many trends we thought might have been inalterable, like urbanization, were quickly reversed because of the massive shock that COVID-19 caused. Remote work and the perception that cities were unsafe led to a reversal of urbanization, which may or may not be temporary. Similarly, the adoption of E-Commerce was greatly accelerated by the pandemic.

One thing that the pandemic could not alter is the “iron trend” of demographics being closely tied to bull markets and rises in consumer spending. Let’s remember that consumer spending is the lion’s share of US economic activity, so the entrance of the largest and best-educated generation into their period of maximum economic activity is a major tailwind for the US economy. While millennials may be known for having a late start to things like homeownership and may have less traditional sources of income, they are slated to inherit tens of trillions of dollars at the aggregate level which will further fuel their economic activity.

One of the great things about the American economy as well is that we constantly churn out new companies that displace incumbents. This is not a feature of every developed economy. The age when people are at their maximum economic engagement tends to coincide with the founding of disruptive companies. Millennials have already founded some of their contributions to the landscape of American enterprise, but more will surely come. Let’s remember that the great innovations of the Baby Boomer founders were outperformers for years. Some still are.

So, let’s walk through some stocks we believe are poised to benefit from the rise of this massive and highly educated generation. Wealth statistics can be deceiving. Young families seem poor until they are not and as they age and enjoy the benefits of accruing wealth, the consumption patterns seem to have a certain predictable cadence despite the unique conditions that provide the setting for the progression of each generation’s economic journey.

One of the most fundamental drivers of economic activity is how many people there are and how much money they earn, borrow and spend. We believe this is one of the most reliable trends to form an investing strategy around and one of the most resilient. However, please be conscious that such generational-based investment strategies can take years to play out. We are, nevertheless, are convinced that beneficiaries of it will outperform stocks that are not as directly exposed to it, with all else being equal.

American Express (AXP 1.61% )

One area that will certainly benefit as millennials learn to put on their “big boy” pants, so to speak, is of course financial services. This company has a proactive strategy to capture the fastest growing spenders: millennials and small businesses. Many millennials have recently started small businesses as they began ramping up their economic engagement. This company has been rewarding shareholders for decades and they appear to have a jump on efforts to attract millennials. Prior to the pandemic they had consistent growth rates above 10%. Recent company guidance puts growth at 18% to 20% for 2022 and the mid-teens in 2022.

Part of the offset for a slower-than-expected travel recovery has been the company’s customer acquisition efforts. These are focused heavily on millennials. Of course, the company is known for its travel benefits and one feature of millennial consumption patterns is that they take more trips a year than their elders. The company faces risks in a rising rate environment. Default rates have been abnormally low and while the strength of the consumer balance sheets right now this never lasts forever. So credit risk will be factoring back in. Regulatory hurdles overseas have also stymied new customer acquisition in huge markets like China. These risks should be considered but remember to benefit from demographic trends takes time!

Expedia (EXPE 0.64% )

We mentioned that millennials have a proclivity for travel. They are of course the first generation of the digital age and they use online travel services at a far higher clip than their predecessors. Aside from the unique tailwinds coming from pent-up demand, we believe this stock will be a long-term beneficiary of the millennial generation entering their prime spending years. Expedia found that 65% of millennials are currently saving money to spend specifically on travel. This reflects the well-documented trend that millennials tend to value experiences over possessions. Rather than languishing in the face of diminishing travel demand over the last years, Expedia has made significant fixed cost cuts that we believe should increase operating leverage.

Certainly, the anticipated travel recovery faces hurdles that could derail a rosy picture for this company. While pandemic headwinds have receded, they can always unfortunately return. Furthermore, an additional risk is the ongoing War in Ukraine in the case that it expands or that commodity spikes eviscerate the portions of consumer wallet that folks have been saving for travel. Of course, Expedia could also fail in execution and continued cost discipline will be critical to their success. Expedia has a big international footprint and may suffer from both the war and continued prevalence of COVID in China and other Asian markets.

Molson Coors (TAP)

Millennials love to have a good time. Perhaps this is a perennial feature of youth. In particular though, they punch above their weight in the consumption of beer and spirits. A survey of our young staff indicates that they do love a cold Coors Light. Millennials accounted for about a quarter of the population pre-COVID but they consumed about 35% of beer. They are also big wine drinkers and they go out to bars far frequently than their elders. As millennials families settle into their new suburban routines, you can bet that many of them will have the ware of this firm stocked in their garage refrigerators. The consumption of alcohol should also benefit from seasonal as it warms up.

One thing we like about this firm as well is that it has most of its business concentrated in the United States. However, the exposure to Europe might weigh on projections if the war in Ukraine grinds on. The company is focusing on a shift to premium priced products with higher margins that also appeal to millennial appetites. There are of course risks that could derail a positive outcome for this company.

One big sea-change is that if marijuana is decriminalized at the Federal level it may eat into the portions of consumer wallet usually reserved for beer. There is also competition in the space and millennials. Also, despite the advantageous geographic profile, the company’s margins may come under pressure from inflation in the costs of inputs. Aluminum is a major share of the packaging costs for the American segment of the firm and this metal’s price could be adversely affected by continued conflict, among other inputs.

Lululemon (LULU -19.97% )

Millennials love Lululemon products, and they aren’t the only ones either. The company seems in healthy straits as well. For example, the company met its 2023 sales targets earlier. They have a knowledge of their consumer and a quality premium that translates into a successful model in our estimation. They have been having healthy store traffic. They have made innovative product and material strides and we think they have their finger on the pulse of athleisure consumer preferences. They have also successfully benefitted from e-commerce trends.

The competition here is very aesthetic but of course supply chains and manufacturing prowess matters greatly. Most of the company’s products are made in Asia (74% of production) and these areas may still be affected by COVID-19 interruptions to production. Furthermore, if globalization is indeed in decline, the company’s sprawling international supply chain could lose some of its luster. The company has tried to address the issue, for example it persuaded one manufacturer to move to Haiti. Supply-chain disruptions can cause major headwinds for Lululemon if they persist or worsen.

Coty (COTY 1.23% )

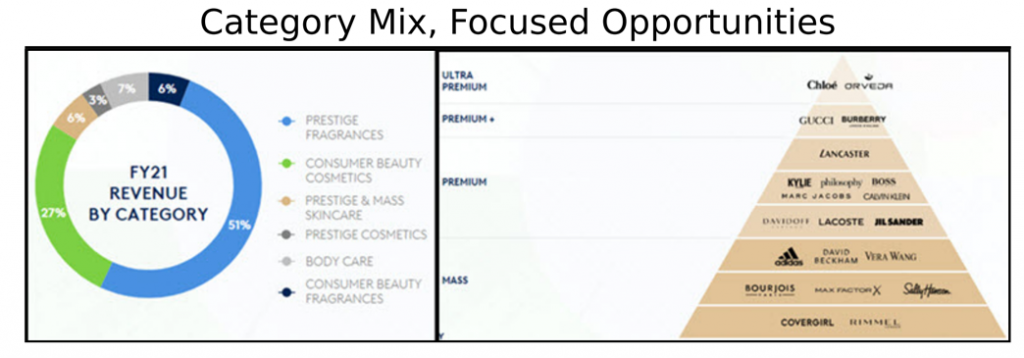

Millennials are known for valuing the experiential economy, but that doesn’t mean they don’t like luxury goods. Female millennial consumers have no problem allocating large portions of their wallet to the luxury fragrances and cosmetics that this company has a particular strength in. The company has acquired key brands that resonate with millennial consumers like Kim Kardashian’s beauty line which will help even out their earnings since luxury fragrances have high exposure to travel retail. These efforts should pair up nicely with the upcoming travel boom. The company’s acquisitions clearly show that they have an eye on buttering their bread with the economic rise of millennials and the strategy appears to be paying off. The CEO’s experience in high-end skincare is a plus and her focus on margin expansion with premium products should payoff for shareholders. The company is making improvements on several planes that should converge with fattening millennial wallets.

The company’s improving product mix seems to be off to a good start and it has a number of flagship brands under its umbrella. Of course, the company has wide international exposure and it will be subject to the same pressures as many products if war and its consequences result in inflation. Luxury consumers can be fickle and predicting favored brands of the future is difficult work. The company has been improving its balance sheet, but the strains of a potential recession could reverse this trend and obviously reduces consumer spending on discretionary items like luxury goods.