(This report is part of our occasional Other Vices format, as we run across interesting investment ideas or practices from outside our firm. Today’s piece is written by David Zion, founder of the Zion Research Group, an independent research firm focused on accounting and tax issues, and his colleagues Ravi Gomatam and Ben Wechter. It is excerpted from Zion’s annual 10-K Checklist, which includes tricks of the trade, potential red flags, questions to ask and common-sense tips to help you navigate the 10-K filings.)

Few investors other than Warren Buffett, perhaps, enjoy reading SEC documents, but they are crucial to a complete understanding of the company whose shares you are considering. Buying a stock without reading the 10K is like driving to an unknown destination without a map. You can do it, but it’s better with navigation. Zion Research Group is expert at deciphering corporate SEC filings. To help you navigate this thicket, we are running excerpts from Zion’s reports about 10Ks. This is the first of three.

MD&A

The Management Discussion and Analysis (MD&A) is where you get to have a look at the results of operations and the financial condition of the business through the eyes of management. (If it’s blurry, be careful, put on your green eye shades and get to work).

✓ A low-quality MD&A simply regurgitates what you can easily see in the financial statements (e.g., sales were down y/o/y).

✓ A high-quality MD&A goes further by explaining why and how things changed and provides information to help you better forecast. Remember that if management knows about a material event, trend, demand, commitment or uncertainty that would cause past performance to not be indicative of future results or financial condition, it’s required to discuss that in the MD&A. That disclosure could highlight where the reported results aren’t sustainable (a key piece of information).

Results of Operations

✓ Evaluate trends and key metrics to determine whether management is making progress on its long-term goals (if you know what those are). Is that seemingly smooth and steadily growing earnings stream really so smooth and steady? Is the company turning its earnings into cash?

✓ Look for a balanced view. Does management only draw attention to the impact of the items outside its control (e.g., FX, inflation, etc.) when they are negative? What is management doing to manage those items? How much are you willing to pay for companies to take on these risks?

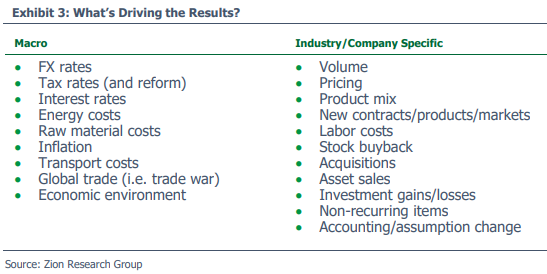

✓ Who’s in the driver’s seat? Mr. Market or the management team? Focus on what’s really driving the results, not just the items management highlights. When evaluating the drivers in table below, ask yourself if they reflect the company’s competitive advantage or did they just get lucky.

Check the MD&A for info on related party transactions. The MD&A could provide hints as to where the reported results aren’t sustainable. Are the decisions that management makes consistent with the long-term strategy for the business? What about the use of non-GAAP items? Zion’s view is that non-GAAP reporting has gotten out of control. Make sure you’re not being asked to ignore ongoing operating costs and don’t just accept every adjustment that companies throw at you.

Liquidity and Capital Resources

✓ Can the company pay its bills? What are the main sources of liquidity? Is it operating cash flow, sale of receivables, access to capital markets and credit facilities, etc? If there are liquidity issues, the MD&A should discuss how the company plans to tackle them. Are there restrictions on cash?

What are the key cash flow drivers, the real sources and uses of cash? The MD&A should go beyond what you can plainly see on the cash flow statement. Noting that an increase in cash flow is due to an increase in payables is not enough. The MD&A should highlight why payables increased. For example, was it due to supply chain financing? Use word searches in the 10K like “supply chain finance”, “extended payment term”, “reverse factoring”

✓ Look for info on customer concentration. Powerful customers may demand concessions like extended payment terms which could trigger liquidity problems.

Are companies using non-GAAP to manage earnings? Don’t be surprised if you see more info on supply chain financing; the SEC is looking for it.

Contractual Obligations and Commitments

Don’t forget the contractual obligations table. It includes a simplified payment schedule for contractual obligations like long-term debt, leases, purchase obligations and other liabilities. Commitments like surety bonds and letters of credit will appear here as well. Check out the footnotes to the table as they’ll highlight potential variability in the obligations along with information on other cash requirements like uncertain taxes or Pension/OPEB funding. Too bad the SEC is considering getting rid of it.

✓ Measure the cash cushion (especially in the current environment). Compare short term obligations to unrestricted cash to understand what type of cash cushion the company has (i.e., how long can it pay obligations with cash on hand). Monitor changes. Is it a problem if the company went from having a one-year cushion to just one month?

✓ There might be some forward-looking information here. Changes in purchase obligations may be a leading indicator. For example, if there’s a big increase in the purchase obligations due in less than one year (versus what was disclosed last year) does that signal management expects a pick-up in demand, which could drive higher sales? On the other hand, if that demand doesn’t materialize, we could see inventory build, resulting in margin pressure, markdowns and possibly impairments. Yikes.

Critical Accounting Polices & Estimates

✓ Looking for accounting red flags? When we’re in search of accounting risk, we focus on those areas that involve the most management judgment. This section of the MD&A is a good place to start, since it’s supposed to cover the handful of critical accounting policies and estimates that can have a big impact on the financial statements and require management to make tough judgment calls.

✓ Is accounting driving the results? Does the company lay out how it determined the estimate? How accurate have these estimates been in the past? How much do they vary over time? How sensitive are the reported results to a change in estimate? Are the policies/estimates conservative or aggressive? Are changes in accounting estimates driving results? If the company doesn’t provide enough information to answer these questions that’s a signal of weak disclosure.

Stay tuned for Part 2, coming soon.