Key Takeaways

- S&P Global (SPGI -0.16% ) is one of the “big three” rating agencies and is an established and leading provider of financial data solutions.

- US Regulators have just conditionally approved a merger with IHS Markit. We believe this is a bullish catalyst, and savings from synergies may be underestimated by consensus.

- The company has four divisions and multiple opportunities for growth. Notably, the management and firm have a solid track record of delivering to shareholders over the past years.

- We believe it is reasonable to think that growth will be higher as management takes advantage of enhanced scale and synergy. Execution risk is always present in a merger this size.

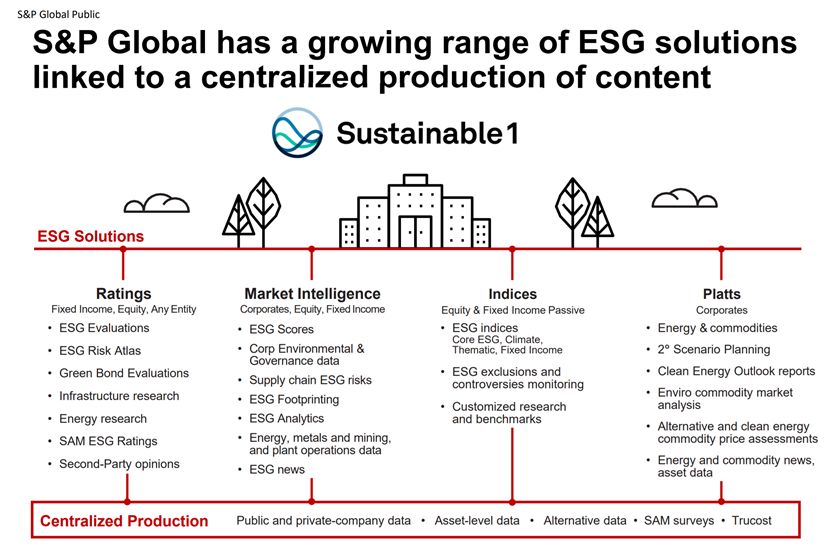

- We believe the company has ample opportunities for growth and think recent product launches show that the company is positively enmeshing itself with long-term trends. It is, for example, an emerging leader in ESG data.

“Without big data analytics, companies are blind and deaf, wandering out onto the web like deer on a freeway.”- Geoffrey Moore

This week’s company is one of the very lynchpins of the global financial system. It is part of a triumvirate of companies that, in a way, set the tempo for the rest of the tremendous financial ensemble by rating and analyzing the risk of the most senior part of the capital structure. When these companies are working correctly, they add immense value, and their services are essential and needed by most industry players. They can prove catastrophic for the financial system when things go wrong, as the 2008 GFC proved.

However, as we often point out in our analysis, crises can sometimes be the very thing the Doctor ordered for jolting newfound life into companies on a previously dull path. As we’ve mentioned for Epicenter companies that were forced to cut costs and innovate or perish, we are big believers that when companies survive the unthinkable intact, odds are what didn’t kill them made them stronger. S&P Global has been through two existential crises in the last two decades, and their ability to deliver to shareholders through the thick and thin is a crown jewel, in our opinion.

S&P Global is on the verge of becoming an absolute titan of financial data. Of course, the company is a lynchpin of the modern financial system, which you might be able to deduce from the title of the most critical American stock index. This firm has proven itself a capable long-term steward of shareholder capital, and it doesn’t hurt to have survived two existential crises in less than two decades. Most have only survived one. It breeds corporate hardiness and resilience.

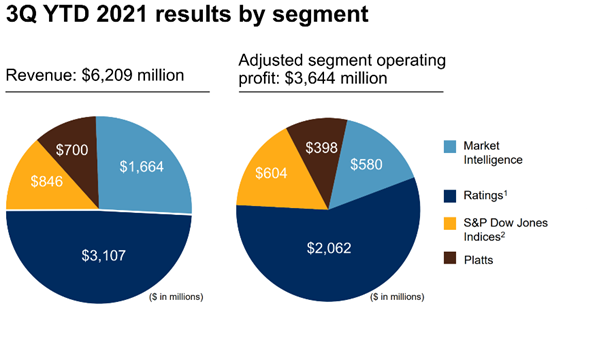

The company is undoubtedly enmeshed in the financial landscape, but its business model is very different from many financial companies. It is best known for its primary profit driver of credit rating. Still, it also has three other divisions that are all growing, and we like the company’s slow and steady strategy to continued profitability. It has had high growth compared to peers, and we believe the merger’s success only adds to and enhances the competitive moat of this soon-to-be Titan.

You’ve Got To Have Money To Make Money

In our opinion, IHS Markit makes a lot of sense as a target. It is a leading financial data intelligence firm and has the cream of the crop as its clients. To paint a picture, 94 of the 100 largest US corporations, 10 out of 10 of the largest automobile manufacturers, 80% of Fortune Global 500, and 49 of the 50 largest US banks use the firms’ data services.

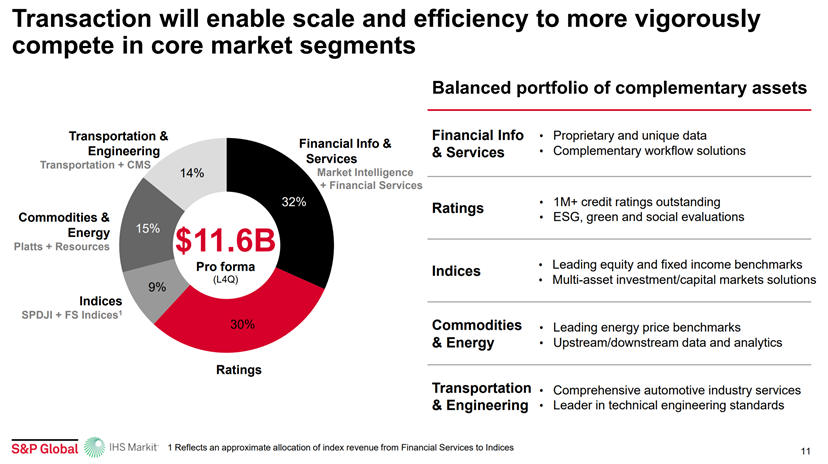

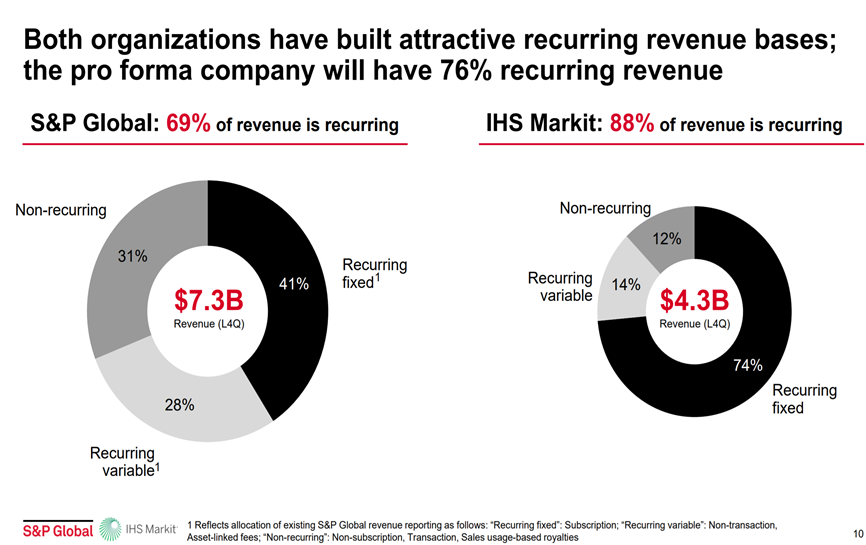

The combined entity will have revenue of over $11 billion which nearly doubles the company’s size. It’s been valued at $44 billion, and the transaction will be all-stock. IHS Markit (INFO -0.28% ) shareholders will end up owning 32.50% of the combined company, and SPGI shareholders will own approximately 32.50% of the post-merger entity.

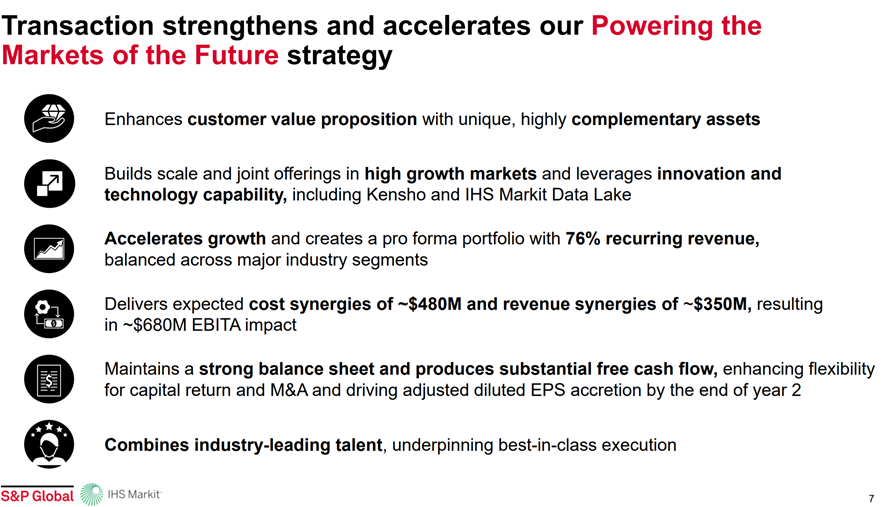

The deal has now cleared the key hurdles of being conditionally approved by US and EU antitrust regulators. The companies had to divest a few divisions and eliminate a non-compete with another business, but the deal should now close in Q12022. We believe the rationale for the deal is solid, and we think there’s a higher likelihood that the combined entity will outperform the consensus growth expectations than underperform.

In any event, the financial data behemoth that is being created has a lot of bells and whistles and exciting products that are significantly complemented by market penetration and reputation. Of course, some may contend that deal is already priced in, but we suspect that the recent upward revisions of synergy savings bode well for the transaction. Of course, we’d mention that any deal of this breadth and scale is subject to execution risks.

The tie-up definitely seems accretive to us, though. While S&P Global is a century-and-a-half-old institution with some of the most iconic indexes and most robust ratings businesses globally, IHS Markit is kind of the new kid on the block.

Their ability to complement their debt data businesses and IHS bringing their auto and engineering data expertise to bear should work nicely and result in better customer offerings. The combined scale and capability simply make sense. This is not a pie-in-the-sky deal despite the presence of serious growth opportunities at both shops. The recurring revenue profile of both businesses is enticing and shows that grown-ups run these guys.

The combination is a lot of what you look for in an accretive merger and a harmonious marriage. The companies will both benefit from this deal. As we’ve said, we believe this deal significantly increases the prospects for both revenue and EPS growth which SPGI has been delivering consistently for years. We’re excited to see what the company will be able to do with the new assets, synergies, and clients. You’ll want to hold this name for a while as the accretive aspects will likely take a few years to realize fully.

An Impressive Record Of Delivering Through Thick and Thin

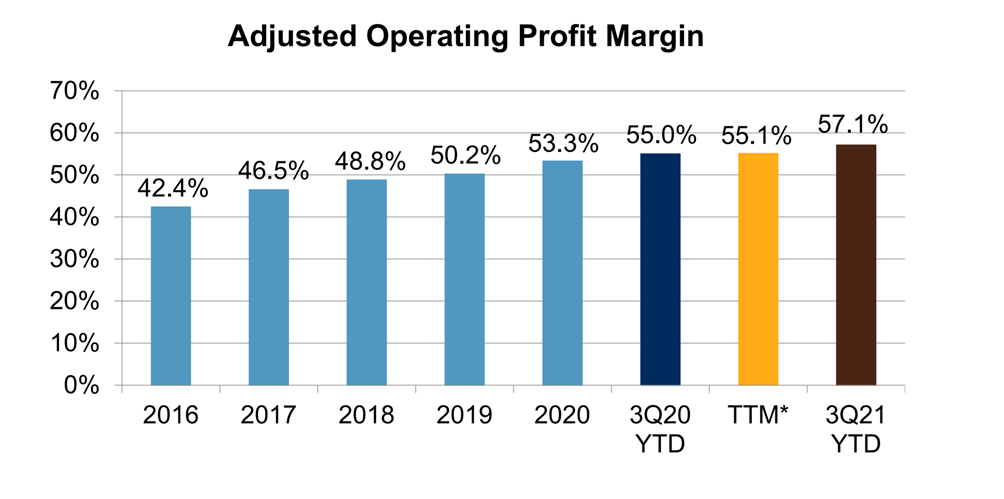

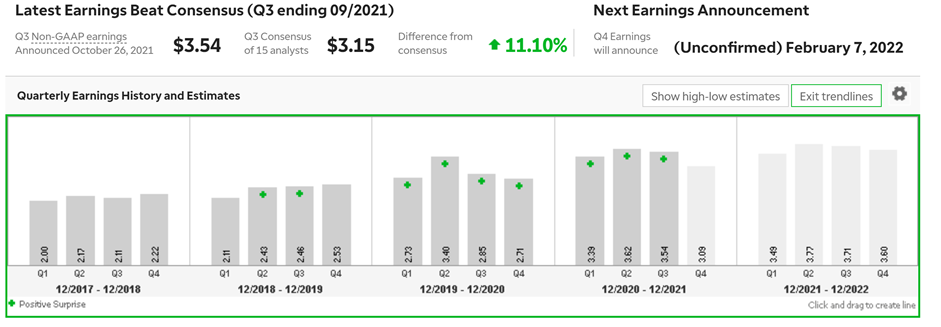

The company recently reported very strong Q3 2021 earnings, and it has repeatedly exceeded the analyst estimates for both revenue and earnings per share. We see this trend as something that will continue with the additional scale and synergies that will likely be achieved from the coming merger.

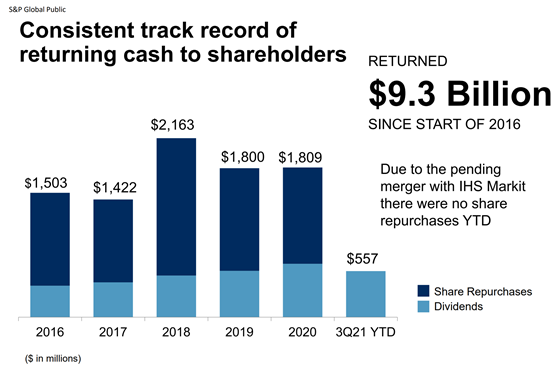

The company had a strong buyback history that has been paused temporarily in anticipation of the coming transaction. However, we believe the steady and consistent growth of this company will continue, even behind the specter of potentially rising rates.

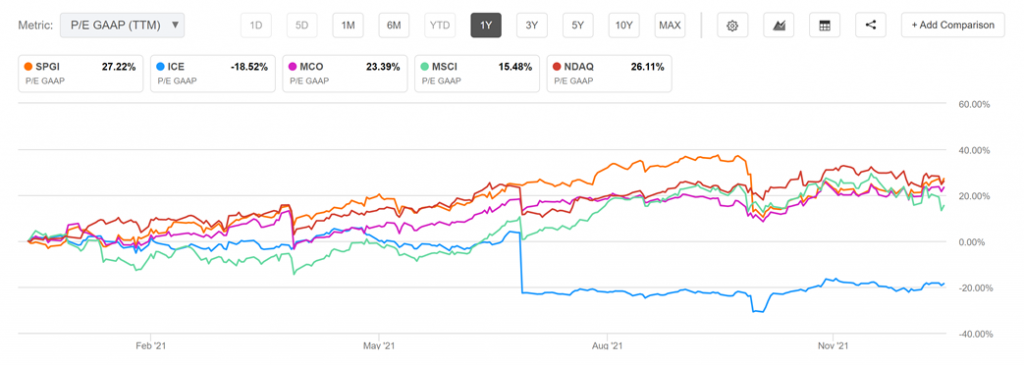

We think this company is well-managed and has a lot of fantastic talent that will be more supplemented and hopefully augmented by collaborative value when the merger is final. When measured from a Price-to-earnings perspective against peers, we find S&P Global tends to be at the higher end if not the highest. We think this premium makes sense given the strong reputation and relationships enjoyed by this ratings maven. This company has made over 1 million credit issues, and despite the prospect for slowing issuance in the face of rising rates, we think there’s a lot to be excited about at this company.

The company is also becoming a leader in specific emerging areas like unstructured data analysis. For example, the S&P Capital IQ platform has repurposed a tool developed for the intelligence community. This tool gives users a quick way to analyze multiple earnings periods and identify key phrases and words that are recurring or that change.

In general, the company is doing some interesting things with AI and data and is also building on its burgeoning index business. The company is a leader in defining and monitoring credit risk, and the needs for this are increasing in a world marked by record issuance.

The company has also been one of the leaders and chief beneficiaries of the passive investing revolution. While we are big believers in active management here at Fundstrat, we’d be remiss if we didn’t mention that the general trend has been for assets to shift to indexes and factor-based and passive strategies at a greater and greater clip. We believe the company will continue to benefit from this and will have a greater depth to its eco-system to attract and retain clients.

More to ESG Than Eyerolls, Sneers, and Groans

Along with being primely positioned to continue benefitting at the convergence of finance and the digital transformation this firm has been an undisputed leader in the ongoing and undeniable shift to Environmental, Social, and Governance concerns that have become more central to investing in our modern world. While some used to joke that ESG content is usually met with eye-rolls, sneers, and groans, we think that the realities of our modern world will undoubtedly continue to make these considerations important.

One exceedingly important thing that ESG-conscience investors must be cognizant of is to avoid “green-washing,” or meretricious attempts to trick well-meaning capital into gimmicks and tricks that do little else but lower the cost of capital for disingenuous management teams.

For investors truly interested in finding where the rubber meets the road in ESG investing, S&P Global has one of the leading practices in the associated data with this new genre, or lens of investing. The company’s new tie-up will also increase chances to make inroads in private markets, industry-specific data applications, and the obviously very important supply-chain analytics that we’ve all become more reliant on.

Risks And Where We Could Be Wrong

Well, you might be thinking that right after the Fed announces an accelerated taper and expectations for lift-off are moving up would be a funny time to recommend a rating agency. The logic is that when rates rise, it is less appealing for companies to issue debt and this therefore hurts the bottom line of businesses who make their money on debt issuance. To this we’d say that the company underwent a direct onslaught on its business model from the Dodd-Frank regulatory overhaul and has still managed to put up admirable returns for shareholders. Did we mention that the company’s free-cash flow has been increasing rapidly and that the merger should only accelerate this process? We believe this management team has proven its prowess at innovating or merging, around obstacles if necessary to ensure that they are good stewards of shareholder capital.

Nonetheless, a merger between two financial data firms can get a little bit complex. Something of such scale and complexity is always prone to risks and miscalculations, but one of the reasons we like this deal is because we believe the upside outweighs the downside from our evaluation. Synergy assumptions are not overly generous, and as we mentioned they were revised upwards even after anti-trust conditions required the firms to divest of some pretty lucrative divisions.

S&P Global is very tied to global debt markets and we believe a Fed policy error would be bad for equities in general and particularly bad for this name. Dislocations in the debt markets or a policy error could definitely lead to this stock suffering from some price hits. However, the company has had seven straight quarters of positive surprises on earnings, and we don’t see anything that will immediately de-rail this momentum.

There are definitely significant price risks given the continued upward trajectory of the stock. Like we said, it tends to be at the higher end of valuation compared to peers but we think the premium is justified given the track record of management. Any risk or course of economic events that causes the stock to begin missing earnings and revenues estimates is likely to adversely effect the price and the multiple of this stock.