Technical Strategy Video (Recorded Thursday, November 11th):

Key Takeaways

- China slowly but surely bottoming out, and recent stabilization bodes well for buying into Chinese Equities ahead of Beijing 2022 Winter Olympics

- Technology stocks in China look relatively attractive vs US Technology; While this trend is just starting to turn up, this will become more appealing on a breakout above October in relative terms when looking at ETF’s like KWEB

- Emerging markets are starting to hold up quite well, even during a Dollar rally. Wave structure in EEM, VWO remain corrective, suggesting an eventual push back to highs

China Bottoming

Don’t look now, but FXI -1.14% (iShares China Large-Cap ETF) looks to be forming a Reverse Head and Shoulders pattern which would be confirmed on a close over 42.70. Given Thursday’s surge to multi-day highs, weekly charts are shaping up nicely and momentum is improving. It looks right to favor a bounce in China into next year, positioning here and using any weakness to average down. Initial upside targets lie between $46-48.

China Technology firming up vs US Technology

KWEB, the KraneShares CSI China Internet ETF, looks to be bottoming out, similar to FXI. The downtrend from February has given way to range-bound consolidation since late July. While a move above October is necessary to officially confirm this rally, it looks right to position now

Relative charts of Chinese Tech is showing similar stabilization vs US Technology when looking at ratios of KWEB to RYT (Invesco’s Equal-weighted Technology ETF) Given the pickup in momentum and break of this downtrend from nine months ago, it looks right to buy at current levels, looking to add on any further weakness.

Sentiment has been bearish on China for months, and this reduced appetite to buy (50%-70% or more) weakness from February peaks makes this interesting technically

Regardless of various reasons why China “could be” bottoming and moving higher (Singles Day, Olympics anticipation), technically this is shaping up and DeMark’s TD Buy Setup officially recorded a “1 count” higher (following a daily close above the close from four days prior)

Initial long exposure looks right technically at current levels, looking to add to longs on any movement over October peaks. This should allow for acceleration higher at a time when many are avoiding China in favor of US Technology. Given that many of the key “FAANG” names, the high growth stocks within US Technology and Discretionary, have weekly and/or monthly RSI readings in the mid’80’s, diversifying into China at compressed levels makes sense from a risk/reward basis.

Emerging Markets likely to turn back higher and outperform as the US Dollar hits resistance/peaks

EEM, the iShares Emerging Market ETF, has begun to show similar amounts of stabilization as many China ETF’s. (This makes perfect sense given that China makes up more than 25% of EEM)

While the US Dollar has been trending higher since May 2021, EEM has held up relatively well of late and a decidedly neutral, vs bearish pattern in recent months.

End of year seasonality bodes well for laggards like Emerging markets to start to show some mean reversion and turn higher. Thus, buying dips in laggard themes in November makes sense.

Movement back up over $52.62 would officially signal a breakout of the downtrend from early 2021, arguing for strength back to challenge 2021 highs and exceed these levels. Thus, positioning long here in EEM makes sense technically speaking, looking to add on a breakout above October highs, which lies at $52.62.

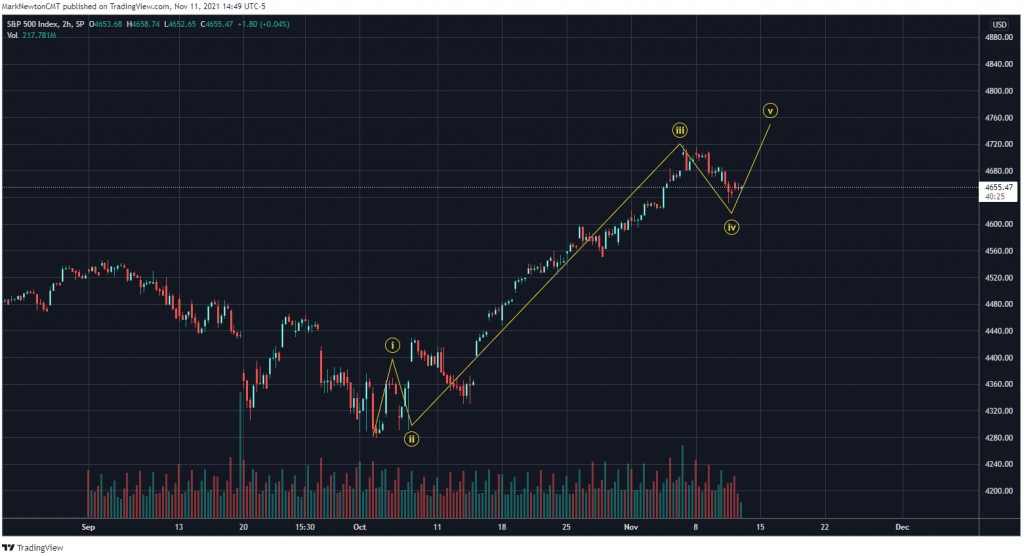

Finally, S&P minor consolidation looks nearly complete

Buying dips into Friday and/or looking to press longs over 4661-SPX makes sense for a push back to new highs. Wave structure suggests this should be a fourth wave as part of an overall pattern of an Elliott-wave impulsive 5-wave Advance. Thus, this minor dip we’ve seen this week doesn’t look all that serious, particularly given the ongoing strength in Technology. Movement back to 4750-65 looks likely and this should be led by Technology and recently strengthening groups like Materials and Industrials. Energy looks to lag a bit longer, but dips should be buyable into late November/early December.