Summary

- BKNG has so far lagged behind its online travel peers this year despite several strengths we see potentially leading to price appreciation as travel recovers.

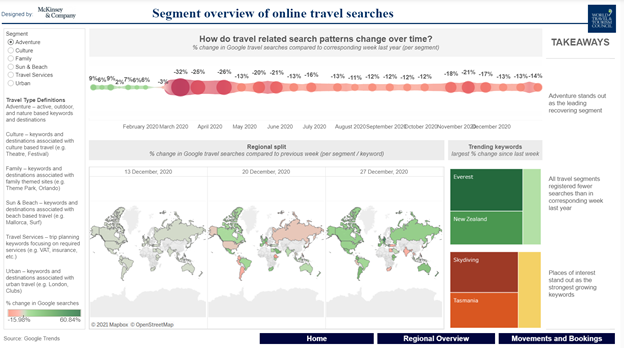

- BKNG has a much more significant portion of International revenue, with as much as 90% of revenue coming from outside the US. This will prove an asset as 2021 progresses.

- The company has maintained costs and operated extra lean to get through the pandemic but should return higher growth as travel occupies a disproportionately large consumer wallet share.

- The green shoots are sprouting in BKNG’s case, and the company’s steady and forward-looking pandemic management has put it in an excellent position to capture pent-up demand.

- The leading criticism of the stock is its high share price and valuation. If it was based in Silicon Valley instead of Connecticut, we think these concerns would be diminished.

Everyone in America loves a David and Goliath story. Perhaps it is a cultural feature of a nation whose birth involved a nearly hopeless military struggle against the world’s leading power, The British Empire. Nonetheless, this cultural quirk of ours could often do well to be left out of our stock-picking process. We love a good David story and have focused on some stocks unfairly possessing scarlet letters in this column. And while we love to see the success of Davids and indeed root for it, let us also remember that the story’s significance is mainly in overcoming long odds. Well, we want to be on the right side of the odds in the stock market if we can!

Source: Seekingalpha.com

Thus many investors with wealth preservation goals will want the bulk of their assets to be in Goliaths. Many people own stocks for different reasons, and for those who want a track record of management who knows how to build shareholder value and is now coming up against a once-in-a-lifetime travel boom, well, here’s your stock. It’s a simple business, more straightforward than, say, the airlines and cruise lines, and it has a growth record on par with FAANG names.

BKNG is overlooked in its own way too. Despite having a track record of Silicon Valley-Esque performance and numbers over the years, growth-minded investors often ignore it. Yet, the current valuation is suggesting investors buy that management can get back on the speedway that COVID so violently knocked it off. Recovery looks as if it is underway.

Source: Seekingalpha.com

Booking Holdings is more of a picks and shovels play insulated from many of the risks of the actual proverbial mining that airlines, cruise lines and asset-heavy hotel names have to deal with in a post-COVID world. The long and short of the stock market is survival of the fittest. Many more stocks than you may think may eventually go to zero regardless of prevailing business conditions, and owning Goliaths over Davids is not a bad strategy if you have time to let the benefits of equity ownership accrue.

The company’s rise to the leading E-Travel name in the world, by far, primarily occurred under a different name, Priceline.com. The famous “name your own price” feature was a marketing home run at the height of the web boom. Today’s company is almost more like a massive exchange for hotel rooms, rental cars, flights, and restaurants. A challenging asset for the company to hold during the pandemic was OpenTable.com. Restaurant bookings plunged, so the company pivoted and adapted the app to use it for booking time at groceries and pharmacies in the lockdowns. So, it can innovate on the fly as well.

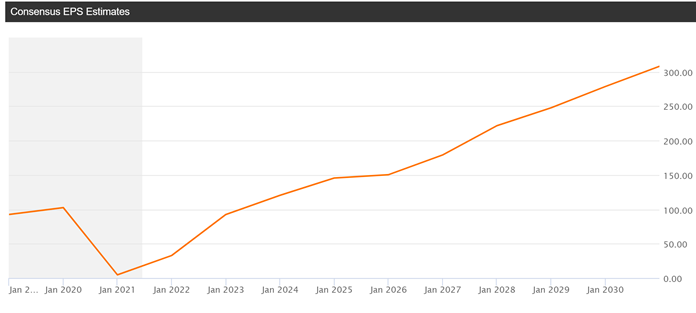

While this company is an Epicenter name being highly concentrated in travel, and thus much more greatly impacted by COVID-19 than the average company, many may forget that between 2007 and 2017, Priceline’s pre-tax earnings has grown at a compound annual rate of 42%, which was faster than Apple, Amazon, Netflix and Alphabet over the same period! The company also used to boast a 96% gross margin at this time, which has obviously plummeted in the face of the pandemic. However, green shoots are appearing here in a big way. Also, Booking’s app is still the number one downloaded travel app on a global basis, not a bad perch to have.

The fact that the company has delivered like this in the past certainly doesn’t guarantee it will happen in the future, but a company whose management already had cult fans all over Wall Street before the pandemic has come out of it with knives sharper than ever. The question is when it will be able to take the new build for a spin and show investors how fast it can get from zero to sixty with more normal levels of demand. We bet that the market underestimates how well the streamlined BKNG will do in the face of a torrent of travel demand, particularly when international travel returns.

Accommodation, Accommodation, Accommodation

BKNG has traditionally done better than rivals Expedia and Orbitz primarily because of its accommodation-centric model, a higher margin approach. The commissions collected on hotel bookings are significantly higher by a factor of four or five. BKNG has quietly built an invisible moat around itself with its sprawling network of relationships and massive data advantage.

Before the pandemic, it was rumored to be the world’s largest spender on Google search terms. It deployed that capital wisely and is by far the most widely recognized and utilized online travel booking service on Earth. Those who think barriers to entry in this industry to get on BKNG’s scale are low are thoroughly underappreciating the massive task of managing relationships with 70,000 hotel properties in hundreds of countries. You try it. See how it goes for you.

Source: Seekingalpha.com

The significance of this strategy can even be seen in the name. Priceline was a strong brand, and the marketing work of this company is quite formidable and exemplary. Nonetheless the company changed its name in 2018 to reflect to outsized contributions made by Booking.com.

This company shows the place the excellent business sense still has in a world of incomprehensively advanced technologies. Priceline doesn’t own or develop any cutting-edge technologies, but it sure uses them cleverly and to benefit shareholders. Priceline’s now-legendary acquisition of the Dutch Hotel site that aggregated travel inventory, Booking.com, for a price of $135 million is hands down one of the most prescient and profitable acquisitions of the internet age so far. So, we’d say management has earned the benefit of the doubt in some respects, and we think that valuation reflects this.

It’s not building chips, space ships, or electric cars but simple innovations like rating hotels by wifi strength and a deep bench of data and decades of existing relationships with consumers. The synergies developing with AI, big data, and machine learning which are already utilized in an advanced way, should bring more efficiencies that are lopsided to players with data advantages like BKNG as time progresses. Also, valuation doesn’t look incredibly stretched especially relative to peers. Trefis has a pretty conservative price model that shows BKNG as pretty close to fairly valued with a little upside.

Source: Thinkorswim

Who Has My Money?!

We see so many articles on companies that fail to mention management. We want you to remember that when you buy a stock on a very base level, you are giving a stranger your money, and if they lose it, there’s essentially no recourse for you. That’s the risk you’re taking, so it behooves you to understand who is calling the shots, what their track record is, and if they have the type of mind and strategy you want in a person who you’re forking your hard-earned dollars over to.

Source: Seekingalpha.com

Before the unmitigated chaos in the travel industry caused by the pandemic, Priceline/Booking was considered one of the best-managed firms on Wall Street from shareholders’ perspectives. Part of this may be that the current CEO was bred on Wall Street. He was an airline analyst at an investment bank trying to join the firm. Any feathers in his cap to speak of?

Why funny, you should ask, that legendary acquisition of Booking.com, which was one of the shrewdest plays of the entire internet area, was his idea. He has a clear vision to offer a one-stop holistic travel site. He is ruthlessly chipping away at rivals’ market share in airfares which his higher-margin business model permits him to do. When you hear Mr. Fogel cooly respond to loaded questions about share splits, the brevity and routine with which he dismisses critics indicate a level of professionalism and work ethic that exudes confidence. He has the track record to back it up, and we think underestimating a manager of his caliber in the coming travel rebound would be a huge mistake.

But What About The Disrupters? BKNG May Still Bear That Title After The COVID Dust Settles.

You may be thinking, what about all these new business models in the space? Isn’t Airbnb and others going to eat the lunch of this member of the ancient regime? Not so fast. When you look under the hood of what’s going on at some of the newer companies, you might be surprised to see that they are trying to become a lot more like Booking.com than you might assume. The brand is very strong throughout the world and is more associated with the underlying innovation Airbnb is known for in international markets which may be missed by Americans.

For all the innovation these companies brought, and all the value they unlocked, the direction of their business plans look starkly similar to the one that Mr. Fogel and his company have already been implementing successfully for decades. Here’s the thing as well, BKNG also offers “alternative accommodations,” which are essentially the same service as Airbnb, except it has, on average higher-quality properties that are more likely to be professionally managed. So for what it lacks in numbers, it compensates for with an edge in quality. In Europe, people don’t really use Airbnb for the service it’s known for. Instead they use BKNG.

Risks And Where We Could Be Wrong

Despite the track record of success, the company has shown it is very much at the mercy of the path of COVID-19. However, we do think ultimately, the shortcomings that proved so heavy and problematic during the height of the pandemic will prove equally fortuitous when travel demand returns. While you may be hesitant by the number of 90% international business when you look at how the company’s various brands work, they still catch excellent portions of domestic travel in many international markets. So, it wasn’t even as much of a disadvantage during the pandemic as you may have thought.

We spoke about some of the risks that arise competitively from new entrants. However, one risk that is pretty significant to the company is two-fold in its relationship with another powerful company, Google. First, the company dramatically leverages its advantage using the capabilities of Google in search to help maintain its dominance. Second, some legislation out of Washington threatens to change the dynamics around search, and there’s no way of getting around that this would be a major spoke in the wheels of this firm. Furthermore, Google appears interested in taking on Booking.com directly and certainly doesn’t lack in competitive prowess.

The other considerable risk is that there is a severe curtailment in the return of international travel. While we don’t give too much credence to the thesis that international travel and trade experienced a negative fait accompli as a result of the vicious pandemic we just endured, it is an outside possibility that could undoubtedly be complicated by things like rising international tensions between the US and China. The other area of exposure is that BKNG does have a lot of its revenue coming from regions that have made a lot less significant progress on vaccinations than the US and Israel. It thus continues to be subject to the considerable risks of continued and sporadic lockdowns across the rest of the world. The vaccination progress of Europe is of particular concern to the company’s revenue drivers.