The S&P 500 rose to fresh records of 6,280.46 on Thursday, as did the Nasdaq Composite to 20,630.66. Much of the credit for that move higher goes to Nvidia, whose market value ticked above $4 trillion, the first ever company to do so. The AI chip giant surged as reports surfaced that it is planning to launch a new AI chip specifically for the Chinese market to sidestep export restrictions.

Neither of the indexes held onto those gains to finish the week. The broad-based index fell 0.3% Friday, while the tech-focused index lost 0.2%. They ended the week down 0.3% and less than 0.1%, respectively.

The gains reversed at the end of the week after Trump announced that the U.S. would hike tariffs on Canadian imports to 35%, up from the former 25% rate. While Canada aims to clinch a trade deal by the Aug. 1 deadline, stocks dropped Friday.

Even with that, there’s signs that the stock market remains in good shape. Fundstrat Head of Data Science Ken Xuan said the S&P 500’s industrials sector hit all-time highs this week, indicating that the market rally is broadening beyond just tech leaders.

Early quarterly reports, too, injected fresh life into the market, Xuan said. Delta Air Lines shares skyrocketed 12% Thursday, after the company announced it expects a better third quarter than what it signaled earlier in the year.

Head of Technical Strategy Mark Newton agreed with that perspective, adding that the percentage of stocks moving above their 200-day moving average—a key technical indicator of market breadth—hit 60% this week. He added that few are talking about how the small-cap focused Russell 2000 is playing catch-up with its larger-cap peers, gaining 11% over the past ten weeks.

All this came with yet another delay on tariffs. After April’s 90-day pause was set to end on July 9, Trump pushed back the deadline by three more weeks to Aug. 1. He also announced steeper reciprocal tariffs, including a 50% rate on Brazilian imports.

Lee added that if the Federal Reserve cuts interest rates later this year, it would lower borrowing costs for companies and make AI investments more attractive. Since lower rates bring down the “bar” or the minimum return companies need to justify an investment, AI spending becomes more worthwhile.

Minutes from the June 18 Federal Open Markets Committee meeting released this week showed that some officials think rate cuts sooner rather than later would be appropriate. That makes next week’s consumer-price index report all the more important, because if it comes in mild, then the case for rate cuts in the summer arguably becomes insurmountable, Xuan said.

For now, Newton said, “It’s actually a very good market. It’s sort of a Goldilocks type time because the economy is hanging in.”

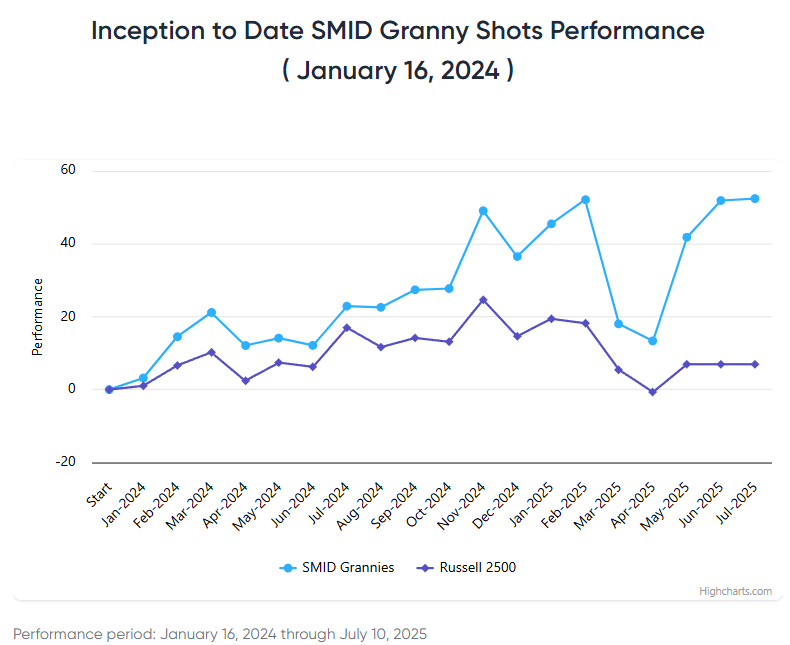

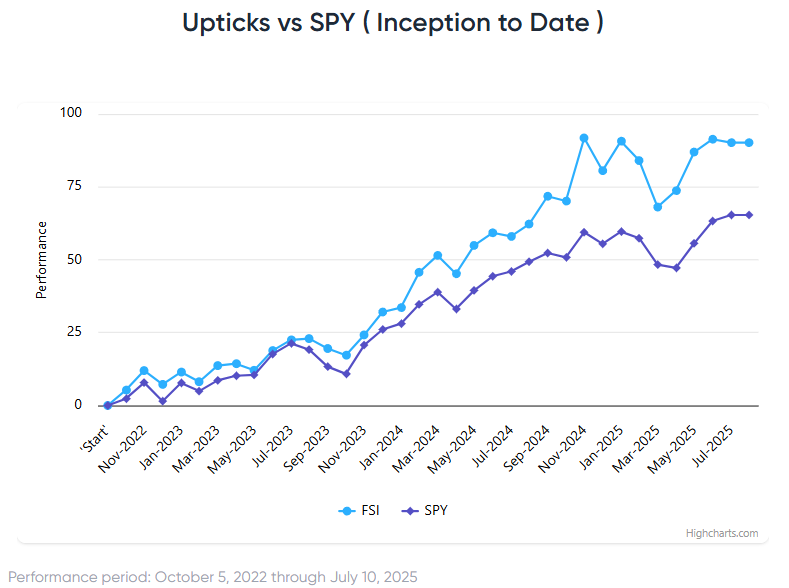

Chart of the Week

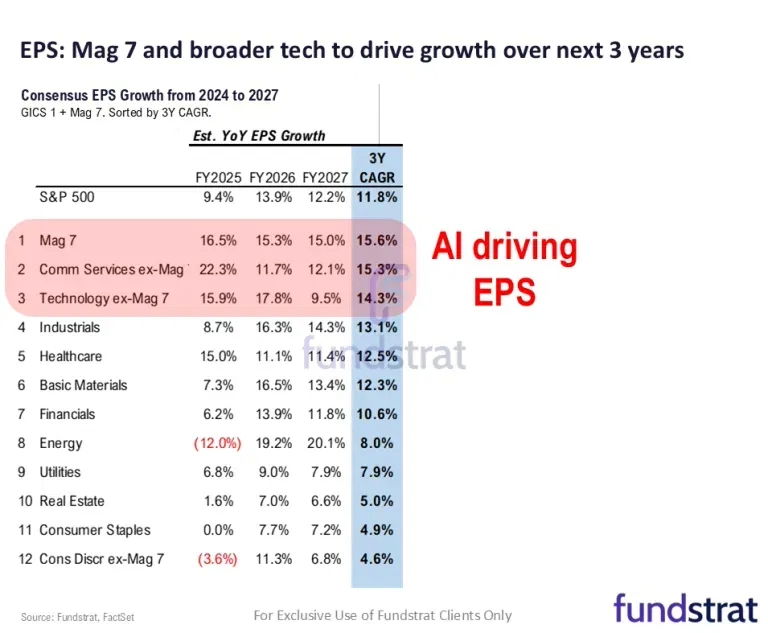

Next week, all eyes will be on the second-quarter earnings season, which kicks off with big banks reporting on Tuesday. Analysts surveyed by LSEG expect companies in the S&P 500 to post an earnings growth of 5.8%. This number has been revised down by 4.2%, consistent with trends seen in recent quarters. The biggest downward revisions came from basic materials and energy, which were cut by 6.5% and 19%, respectively. Looking forward, analysts expect the strongest three-year earnings growth rates could come from the Magnificent Seven, as well as the communication-services and technology sector. “So basically, AI continues to be the biggest driver of S&P earnings,” said Fundstrat Head of Research Tom Lee, “and really that’s the story around the world.”

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

7/1 9:45 AM ET: Jun F S&P Global Manufacturing PMITame- 7/

1 10:00 AM ET: May JOLTS Job OpeningsMixed 7/1 10:00 AM ET: Jun ISM Manufacturing PMITame7/3 8:30 AM ET: Jun Non-farm PayrollsMixed7/3 8:30 AM ET: May Trade BalanceTame7/3 9:45 AM ET: Jun F S&P Global Services PMITame7/3 10:00 AM ET: May F Durable Goods Orders MoMTame7/3 10:00 AM ET: Jun ISM Services PMITame7/8 6:00 AM ET: Jun Small Business Optimism SurveyTame7/8 9:00 AM ET: Jun F Manheim Used Vehicle IndexMixed7/8 11:00 AM ET: Jun NYFed 1yr Inf ExpTame7/9 2:00 PM ET: Jun FOMC Meeting MinutesMixed- 7/15 8:30 AM ET: Jun Core CPI MoM

- 7/15 8:30 AM ET: Jul Empire Manufacturing Survey

- 7/16 8:30 AM ET: Jun Core PPI MoM

- 7/17 8:30 AM ET: Jul Philly Fed Business Outlook

- 7/17 8:30 AM ET: Jun Retail Sales

- 7/17 9:00 AM ET: Jul M Manheim Used Vehicle Index

- 7/17 10:00 AM ET: Jul NAHB Housing Market Index

- 7/17 4:00 PM ET: May Net TIC Flows

- 7/18 10:00 AM ET: Jul P U. Mich. 1yr Inf Exp

- 7/22 10:00 AM ET: Jul Richmond Fed Manufacturing Survey

- 7/23 10:00 AM ET: Jun Existing Home Sales

- 7/24 8:30 AM ET: Jun Chicago Fed Nat Activity Index

- 7/24 9:45 AM ET: Jul P S&P Global Services PMI

- 7/24 9:45 AM ET: Jul P S&P Global Manufacturing PMI

- 7/24 10:00 AM ET: Jun New Home Sales

- 7/24 11:00 AM ET: Jul Kansas City Fed Manufacturing Survey

- 7/25 8:30 AM ET: Jun P Durable Goods Orders MoM

- 7/28 10:30 AM ET: Jul Dallas Fed Manuf. Activity Survey

- 7/29 9:00 AM ET: May S&P CS home price 20-City MoM

- 7/29 10:00 AM ET: Jul Conference Board Consumer Confidence

- 7/29 10:00 AM ET: Jun JOLTS Job Openings

- 7/30 8:30 AM ET: 2Q A GDP QoQ

- 7/30 2:00 PM ET: Jul FOMC Decision

- 7/31 8:30 AM ET: Jun Core PCE MoM

- 7/31 8:30 AM ET: 2Q ECI QoQ

Stock List Performance

In the News

| More News Appearances |