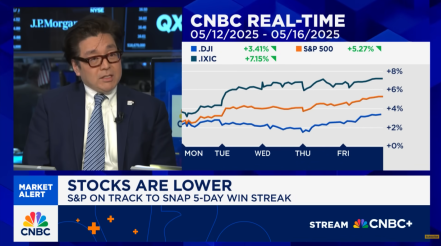

The S&P 500 flirted with all-time highs for much of last week, finally setting a new high-water mark on Friday with a close at 6,173.07. This was not a surprise, given Bitcoin’s setting a new all-time high about a month ago, on May 22. As Fundstrat Head of Research Tom Lee has previously noted, Bitcoin has been a leading indicator for equities of late. Lee had also noted that non-recession waterfall declines, such as the one we saw after the April 2 “Liberation Day,” have tended to be followed by V-shaped rallies.

Head of Technical Strategy Mark Newton reminded us that “as always, trying to time stocks with economic data is ill-advised, and the push to new highs by SPX has momentum and signs of broad-based participation that makes it tough to immediately fade.”

In fact, Newton viewed this broadening participation as perhaps more noteworthy than the S&P 500’s advance to new all-time highs. “A lot of people, even myself, thought that at new all-time highs, you would probably stall out,” he admitted during our weekly research huddle. “Now I’m questioning that, just given the degree of broadening out in the rally that we’ve seen. In my view, this week’s big takeaway is that we have started to see evidence of the market trying to broaden out a bit, which had not happened throughout May.”

Expanding on his revised view, he noted that “historically, we have seen technology outperform, but now we’re actually seeing financials break out, which, of course, is the second largest sector within the S&P at 14%. Over the last week, when you look at what’s outperformed, it’s been financials up over 3% – a very, very good sign to me. Industrials has snapped back almost 3%. Discretionary up around 2.4%. These are great signs for sectors largely that had not participated before.”

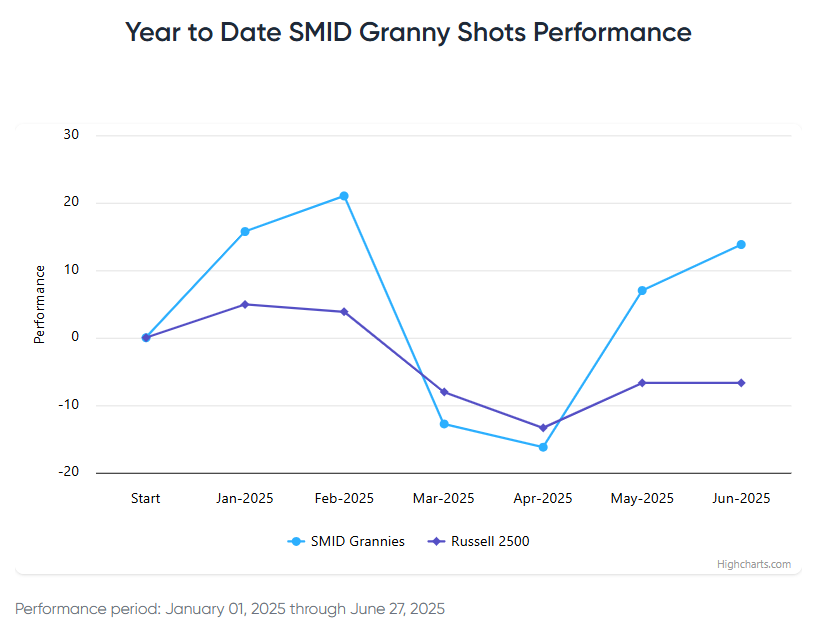

Although retail investors, particularly younger cohorts, appear to be participating in this rally, institutional players largely remain on the sidelines. For this reason and more, Lee said, “I do think that at the end of the day, we are at the start of a new bull market” with upside potential still untapped.

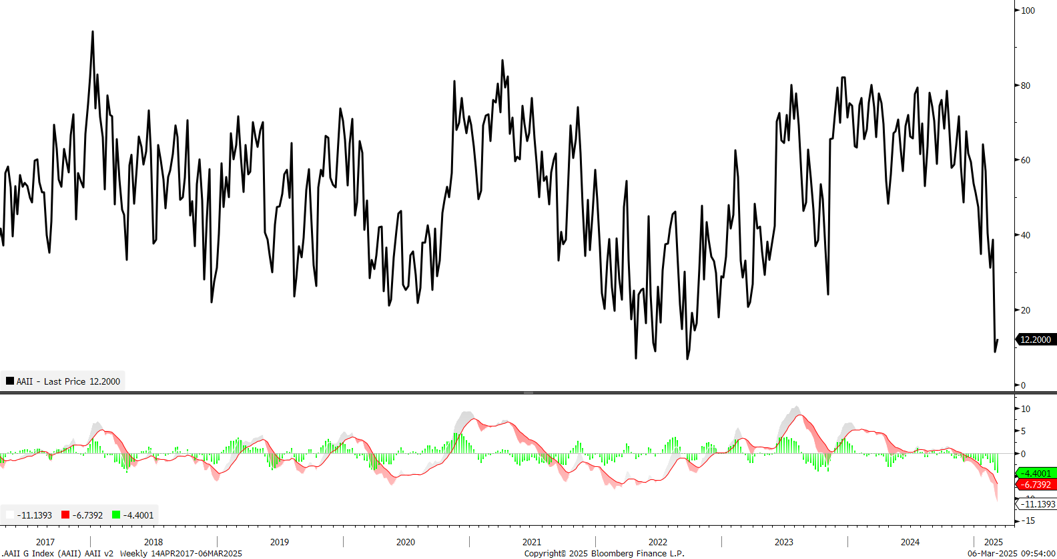

Chart of the Week

Federal Reserve Chair Jerome Powell delivered his biannual testimony to both chambers of Congress last week, with Republicans questioning Powell about why the central bank has yet to cut rates, despite recent data showing progress on inflation (as seen in our Chart of the Week.) Powell gave what Lee thought was an unexpectedly dovish response: he told senators that “a one-time [increase in the price level] could be the base case” before pointing out that the majority of Federal Open Market Committee members still expect to cut rates before the end of the year. For his part, Lee argues that tariffs shouldn’t be viewed as inflationary at all. “Inflation tends to be driven by an imbalance of supply versus demand – oil shocks, for example,” but in comparison, “tariffs are a one-time price rise and [thus] unlikely to be inflationary.”

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

6/23 9:45 AM ET: Jun P S&P Global Services PMITame6/23 9:45 AM ET: Jun P S&P Global Manufacturing PMITame6/23 10:00 AM ET: May Existing Home SalesTame6/24 9:00 AM ET: Apr S&P CS home price 20-City MoMTame6/24 10:00 AM ET: Jun Conference Board Consumer ConfidenceTame6/24 10:00 AM ET: Jun Richmond Fed Manufacturing SurveyTame6/25 10:00 AM ET: May New Home SalesTame6/26 8:30 AM ET: May P Durable Goods Orders MoMTame6/26 8:30 AM ET: May Chicago Fed Nat Activity IndexTame6/26 8:30 AM ET: 1Q T GDP QoQTame6/26 11:00 AM ET: Jun Kansas City Fed Manufacturing SurveyTame6/27 8:30 AM ET: May Core PCE MoMMixed6/27 10:00 AM ET: Jun F U. Mich. 1yr Inf ExpTame6/30 10:30 AM ET: Jun Dallas Fed Manuf. Activity SurveyTame- 7/1 9:45 AM ET: Jun F S&P Global Manufacturing PMI

- 7/1 10:00 AM ET: May JOLTS Job Openings

- 7/1 10:00 AM ET: Jun ISM Manufacturing PMI

- 7/3 8:30 AM ET: Jun Non-farm Payrolls

- 7/3 8:30 AM ET: May Trade Balance

- 7/3 9:45 AM ET: Jun F S&P Global Services PMI

- 7/3 10:00 AM ET: May F Durable Goods Orders MoM

- 7/3 10:00 AM ET: Jun ISM Services PMI

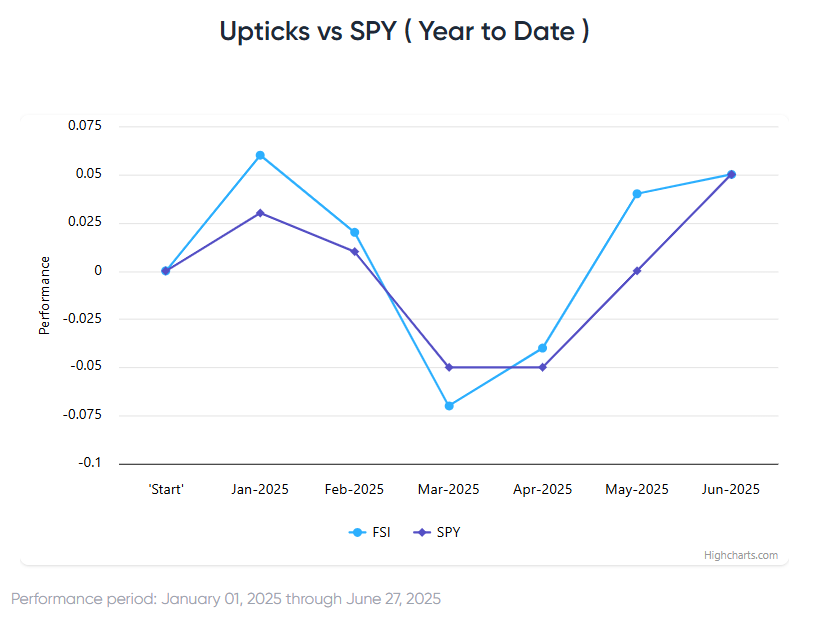

Stock List Performance

In the News

| More News Appearances |