Although the S&P 500 closed down 1.28% and the Nasdaq slipped 1.09% this week, Fundstrat Head of Research Tom Lee reiterated his call that any pullbacks are likely to be shallow, as we remain in what he describes as one of the “most-hated V-shaped rallies” in his experience. Last week’s renewed hostilities in the Middle East might have raised some investors’ anxieties, but the actual impact on the market was arguably minimal. As Lee noted, VIX rose to elevated levels, but with a peak around 22 (as of Friday close it was just under 21), these were levels we also saw in late May. “And late-May was hardly a time to be de-risking,” he noted.

Investors were arguably more focused this week on the press conference that followed the conclusion of the Federal Open Market Committee (FOMC) meeting on Wednesday. The Federal Reserve left rates unchanged, as widely anticipated, but Fed Chair Jerome Powell’s responses to a question about inflation expectations apparently spooked investors. “Everyone that I know is forecasting a meaningful increase in inflation in coming months from tariffs because someone has to pay for the tariffs,” Powell said. “It will be someone in that chain that I mentioned, between the manufacturer, the exporter, the importer, the retailer, ultimately somebody putting it into a good of some kind or just the consumer buying it.”

Lee understands the alarm. To him, the response signaled “a change in the Fed’s view from data dependence to forward-looking,” and based on multiple follow-up questions, other reporters also appeared to interpret Powell’s answer in this manner. Arguably, so did investors. “Ultimately [investors] are saying this doesn’t make much sense,” Lee said. “The Fed is essentially finding more reasons not to cut and look at long-term rates,” which largely weakened this week, including ahead of the FOMC meeting.

Still, Head of Technical Strategy Mark Newton saw a bright note in the FOMC meeting. “The biggest positive following the FOMC meeting is that the traders’ outlook for rate cuts now aligns with what the FOMC said,” he noted, pointing out that when there is a disparity between market and Fed expectations on rates, “there can be some jitters in the market.” Two cuts now appear likely by year-end, and as he noted, this has triggered some bullish steepening in the yield curve and improved sentiment around risk.

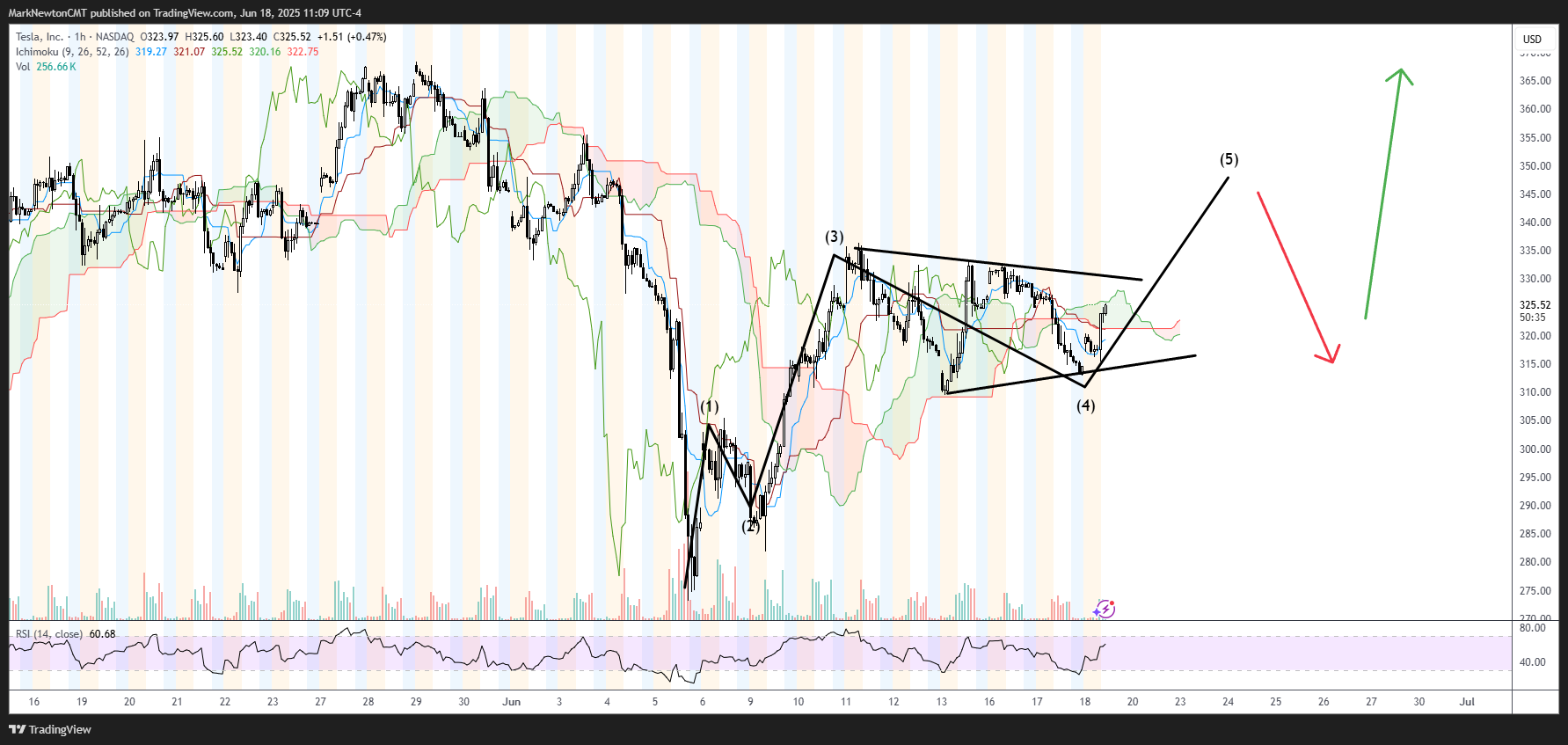

The week’s declines did not do any technical damage to the overall pattern, in Newton’s view. “In general, we are setting up for a classic ‘ABC’ type of corrective pattern” that ultimately “could give way to a move back to new all-time highs,” but “not anytime soon.” The possibility exists for an impending move back up to around the 6,100 level, Newton acknowledged, but that would likely be followed by a stallout or pullback. Thus, Newton used words like “choppy” and “grind” to describe his expectation for markets over the next month or so. For those with a focus on the longer term, however, “I do think it’s right to be still positive.”

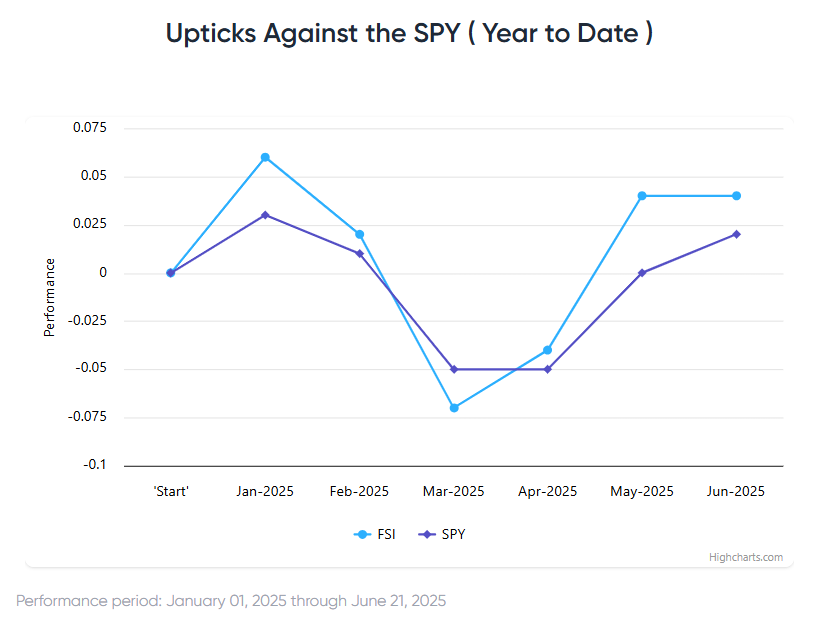

Chart of the Week

Although wars have very real and serious human consequences, they tend to have little long-term impact on equity markets. For this reason, Fundstrat’s Tom Lee said, We expect any dips to be bought, especially as we know that many investors are not even exposed to stocks at the moment.” This underweighting in equities is supported by a look at hedge funds’ net-positioning in the S&P 500, as shown in our Chart of the Week.

Recent ⚡ FlashInsights

- Chair Powell’s press conference focused on two themes: uncertainty largely caused by tariff policy and the Committee’s view that the Fed is in a good place to deal with the uncertainty. My guess this is not what the White House wanted to hear. Chair Powell stayed clear of any comments on views expressed by President Trump.

FS Insight Video: Weekly Highlight

Key incoming data

6/16 8:30 AM ET: Jun Empire Manufacturing SurveyTame6/17 8:30 AM ET: May Retail SalesTame6/17 10:00 AM ET: Jun NAHB Housing Market IndexTame6/18 9:00 AM ET: Jun M Manheim Used Vehicle IndexMixed6/18 2:00 PM ET: Jun FOMC DecisionTame6/18 4:00 PM ET: Apr Net TIC FlowsTame6/20 8:30 AM ET: Jun Philly Fed Business OutlookTame- 6/23 9:45 AM ET: Jun P S&P Global Services PMI

- 6/23 9:45 AM ET: Jun P S&P Global Manufacturing PMI

- 6/23 10:00 AM ET: May Existing Home Sales

- 6/24 9:00 AM ET: Apr S&P CS home price 20-City MoM

- 6/24 10:00 AM ET: Jun Conference Board Consumer Confidence

- 6/24 10:00 AM ET: Jun Richmond Fed Manufacturing Survey

- 6/25 10:00 AM ET: May New Home Sales

- 6/26 8:30 AM ET: May P Durable Goods Orders MoM

- 6/26 8:30 AM ET: May Chicago Fed Nat Activity Index

- 6/26 8:30 AM ET: 1Q T GDP QoQ

- 6/26 11:00 AM ET: Jun Kansas City Fed Manufacturing Survey

- 6/27 8:30 AM ET: May Core PCE MoM

- 6/27 10:00 AM ET: Jun F U. Mich. 1yr Inf Exp

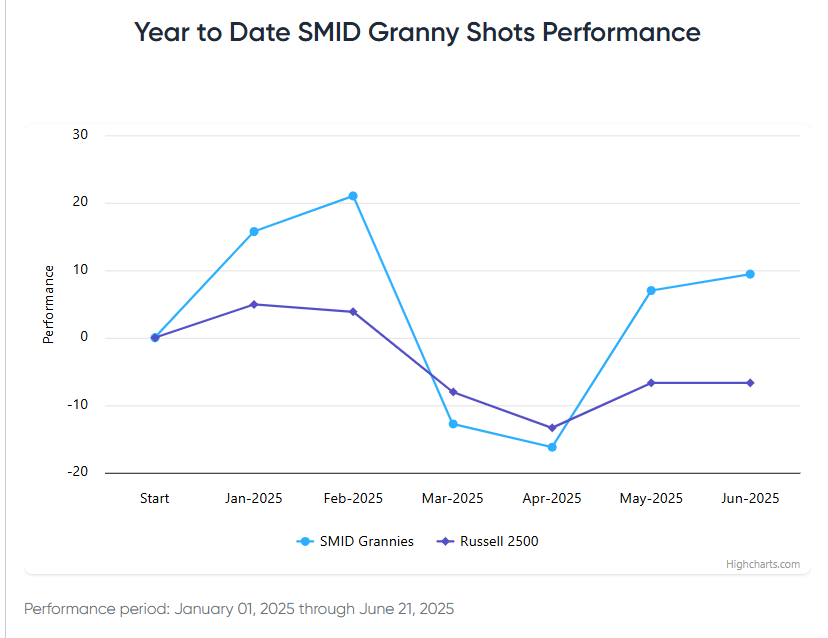

Stock List Performance

In the News

| More News Appearances |