Screw it all the way over, reach through the handlebars to raise the headlight beam, the needle leans down on a hundred, and wind-burned eyeballs strain to see down the centerline, trying to provide a margin for the reflexes. But with the throttle screwed on there is only the barest margin, and no room at all for mistakes. It has to be done right.. and that’s when the strange music starts, when you stretch your luck so far that fear becomes exhilaration and vibrates along your arms.- Hunter S. Thompson, Hell’s Angels

Few companies could be a better poster-child for why many institutional investors hate what we like to call Epicenter stocks then the quintessential but also centenarian motorcycle manufacturer. Sure, Harley Davidson makes a unique product that certain diehard consumers love, but those consumers are aging. As are there factories and unionized laborers. Gas guzzling choppers are a thing of the past right? They would have to completely re-invent not only their supply-chain, but also re-invent who their brand and products appeal to to compete in a 21st century marketplace. Trends would have to reverse and a new generation would have to become interested; and they simply would not be interested by the legacy products. The company’s recent quarter was the type of miracle turnaround that we have been foretelling in Epicenter names.

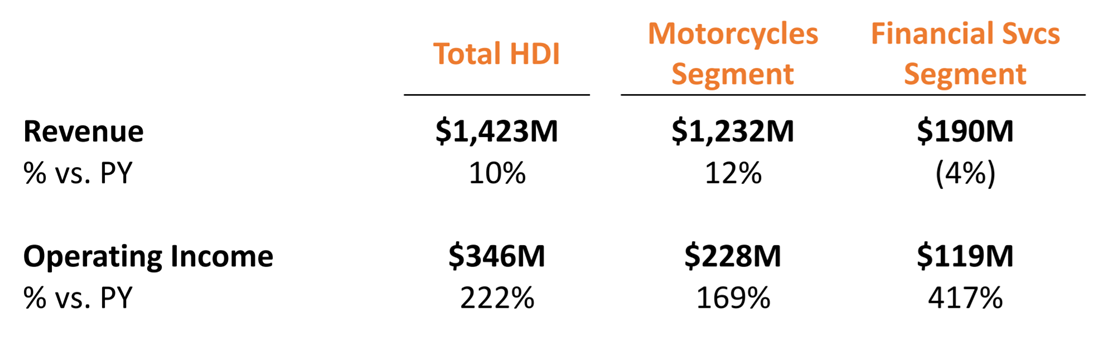

When you look at the Operating Income, you can see that Harley Davidson is the perfect example of our narrative on these stocks coming to fruition. Epicenter stocks have the best risk/adjusted return because they have the highest probability of significant bullish earnings suprises like HOG 0.05% just pulled off. Well when a company survives a disaster like the pandemic, succesfully introduces brand-transforming products and puts up Operating Income numbers like that (not to mention EV upside) then we are going to notice.

Source: Company Reports

A Prodigal and Fortunate Son of American Manufacturing

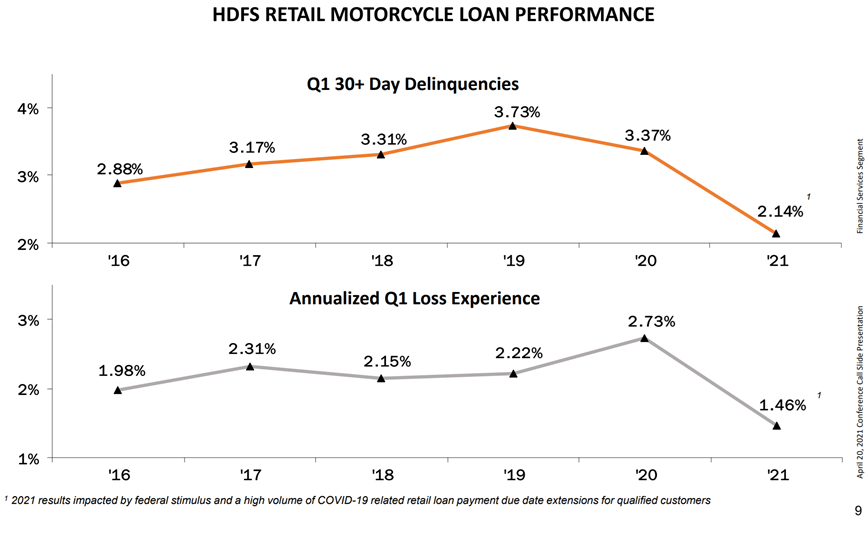

Based on Harley-Davidson’s latest earnings reports and a slew of long-elusive analyst upgrades it appears to have done just what many bears, maybe even plausibly, argued was impossible. That’s the thing about a lot of the Epicenter names; where growth-obsessed investors see business models not packaged as shiny as a SPAC prospectus, there’s still a lot of exciting things going on from a shareholders perspective. We see cornered management teams fighting to survive and insodoing, exemplifying some of the best principles of management. Impressively, the company’s gross margin went from 29% to 34.1% on a higher-margin sales mix, organic top-line growth and savings from marketing. Also, the financial services arm which can be an albatross in down-times is booming. Delinquency rates are at lows and it contributed more than four times as much to Operating Income as it did in the same quarter last year.

Source: Company Reports

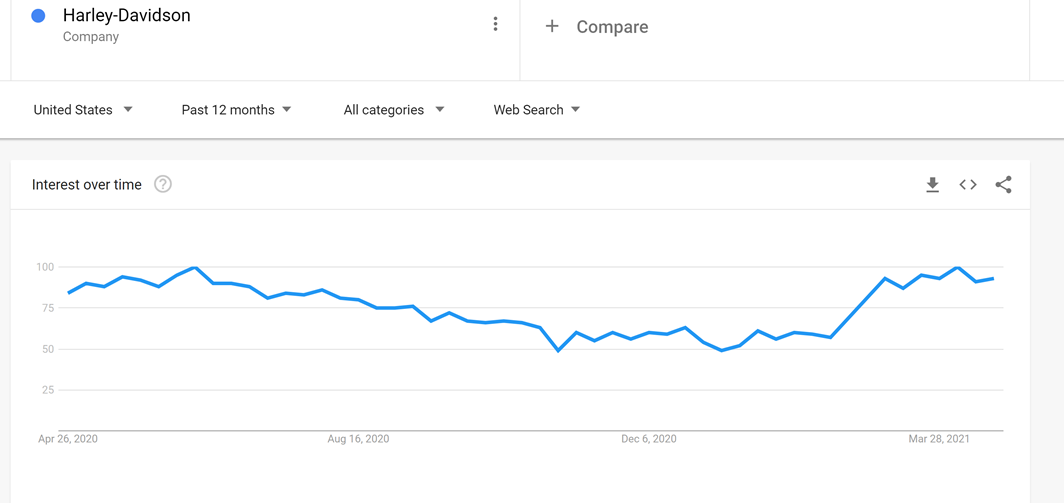

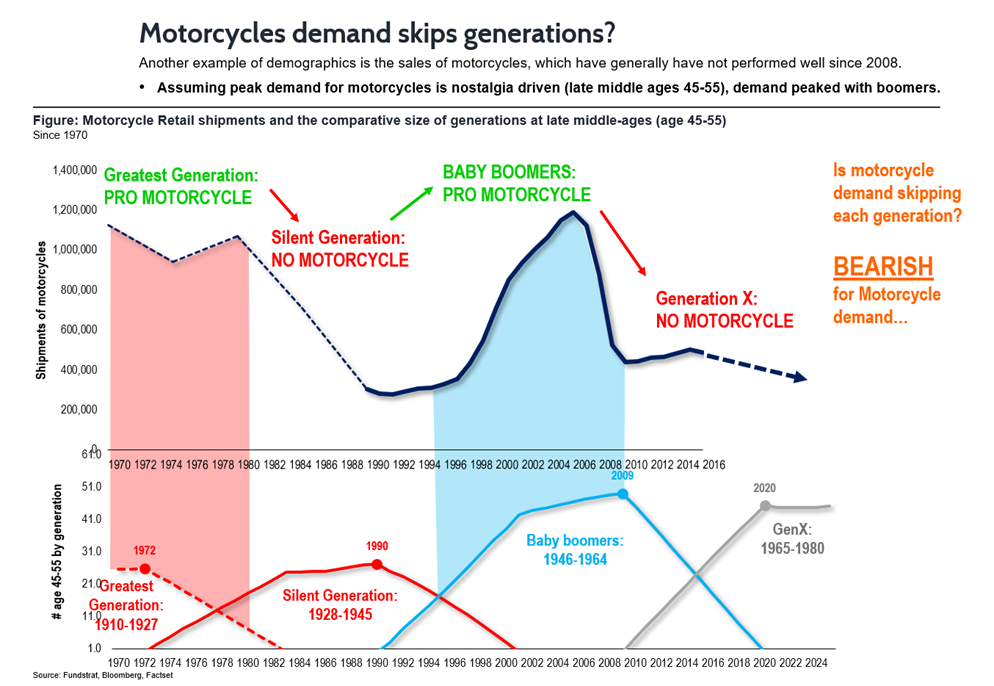

The American character has always been partially defined by rebellion. This has been true of our founders through every subsequent generation. Whereas rogues, criminals, and revolutionaries are largely castigated in many societies, to some extent they are glorified and celebrated in ours. Sometimes adept brands can even capitalize on our uniquely American rowdiness. Few have done so as successfully as Harley-Davidson. One of the more endearing and enduring modern manifestations of our fascination with outlaws was the mid-twentieth century advent of the motorcycle club and “outlaw’ motorcycle culture. It is hard to think of a brand more synonymous with a cultural movement than Harley Davidson and motorcycle clubs. It is also hard to think of a brand that commands more loyalty and emotional appeal despite its prime demographic aging. Motorcycle demand appears to skip generations and Harley’s efforts to appeal to millennials with new products have so far gone quite well, including its first Electric Bike. Interest has been rising in the company recently.

Source: Google Trends

That’s a Harley?

Some of our subscribers may be tired of hearing about Epicenter stocks. We’ve been saying since the depths of the pandemic that the best risk-adjusted returns would be in those names closest to the economic and social consequences of the virus. However, more than that, we focused on the fact that the unprecedented economic cessation actually created a situation where shareholder incentives and those of management became uniquely aligned; cutting costs, expanding margins, and delivering to shareholders became a new religion in boardrooms across America. It is much easier to do so when the alternative is ruin.

The status quo simply was no longer acceptable. Companies had to adapt or perish. Harley is no exception, and by the looks of its amazing first earnings report it has adapted. Companies that nearly double EPS expectations rarely are on their way out. You also know management has changed when a brand associated with high-costs offers one of the best performing and competitively priced bikes in the millenial-heavy market for adventure bikes. Harley’s PanAmerica has so far gotten rave reviews and is highly in demand. The company’s first electric bike (which also appears more like a naked sports-bike than a traditional Harley) has also gotten great reviews and is widely considered the world’s best electric motor cycle. Forays into areas like electric bicycles and a new EV infrastructure show the forward-thinking bent initiated by the relatively new CEO, Jochen Zeitz who rose to fame by turning Puma around from the brink of bankruptcy.

Source: Harley Davidson

Harley’s Turnaround Shows The Company Can Pivot

Harley Davidson (HOG 0.05% ) is an iconic American company that had fallen on tough times even before COVID-19. The company’s prime demographic was aging, and its product mix seemed antiquated. However, counting Harley out, like many Epicenter stocks, was decidedly premature. It shattered Wall Street’s expectations when its adjusted earnings came in at $1.68 a share. The estimate for EPS was $.90 cents on revenue of $1.25 billion. Actual revenue came in 13% higher. The company significantly raised its expectations for revenue growth to 30% to 35% from 20% to 25%. Things are definitely moving in the right direction at the world’s best-known motorcycle manufacturer.

Companies that have been around for a long time with as prolific a brand and place in the American psyche as Harley-Davidson can sometimes meander their way back to relevance, particularly if manufacturing is involved. The company dramatically simplified its manufacturing profile and cut costs by relying on subsidiaries and partners in many foreign markets. It is abandoning unprofitable markets, focusing on promising ones, and doing the same with its product mix. Look at the recently resurgent American auto companies. We think Harley’s story is very similar. We think their path to success, leveraging the historical strengths of an iconic brand while answering the demands of a different future, is quite similar, except they are a bit earlier in the process. It seems like we aren’t the only ones who saw the similarity. Ford’s CEO, Jim Farley, is slated to join the company’s board soon. His expertise will be welcome and useful for the management team.

Like many Epicenter names, its core business was hurt by the pandemic. Still, the company also has millions of highly loyal customers across the world. It is one of the best at cultivating value from its community, like its wholehearted embrace of Sturgis. Like many of the stocks we like to highlight in this column, this company has orchestrated an impressive turnaround and has capitalized on some trends that COVID-19 heightened. The company’s leadership is implementing a 5-year restructuring plan called Hardwire. This quarter’s results clearly show that the company has turned around what appeared to be an irreversible decline by adapting, innovating, and leveraging one of its greatest assets; its iconic and valuable brand.

Secular Trends In The Company’s Favor

We started this article off with a quote that captures why people love motorcycles. On a larger level, motorcycle demand seems to have skipped generations. One thing that the Greatest Generation and Boomers (both motorcycle-loving generations) had in common was the collective traumatic experiences of the Second World War and Vietnam. We bet that as the millennial generation begins their post-COVID, and for many of them post-urban, lives that the timeless appeal of the “iron horse” will be rejuvenized. It is hard to not take a company with the storied history of Harley-Davidson at its word when it says that beyond building machines, promoting the freedom of the soul is its mission.

We also see other secular trends that will be helpful, not the least of which is the economic rise of millenials. There has definitely been some heightened interest related to the cabin-fever associated with COVID-19, but more than that autombiles will soon be mostly driverless. Maybe, the company’s product will enjoy a heightened premium in the wake of this coming reality.

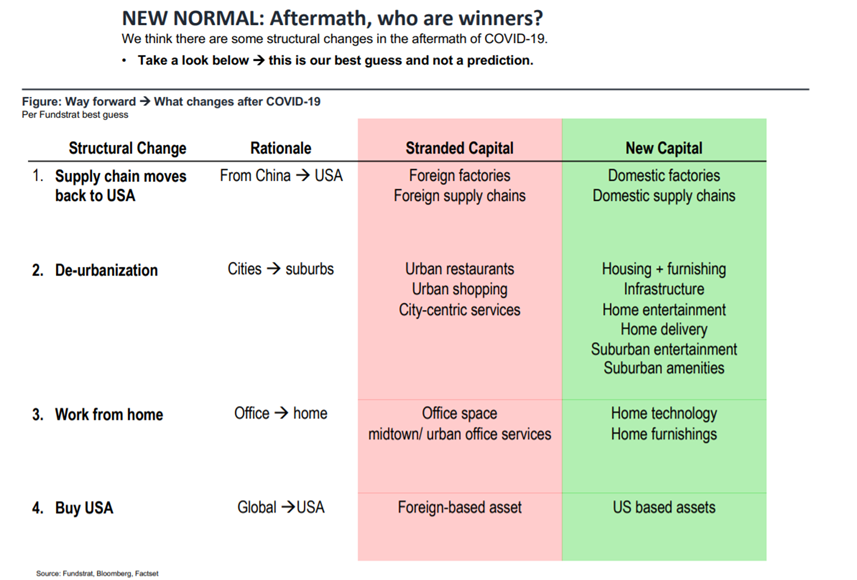

While it’s been clear that Harley-Davidson has been a victim of trade disputes it has no control over with the introduction of the EU tariffs, we actually think this could cut both ways. Surely, a company whose loyal clientele coined the phrase “I’d rather see my sister in a whorehouse than my brother on a Honda” may experience some ancillary benefits from post-COVID-19 trends of buying American and de-urbanization. The rugged individualism that has long defined the American ideal has always been at home at Harley-Davidson. You’ve got to think in today’s day and age; it is a pretty impressive brand feat to carry the outlaw mantle perhaps more than any other American brand while simultaneously supplying law enforcement with a whole lot of motorcycles!

Risks And Where We Could Be Wrong

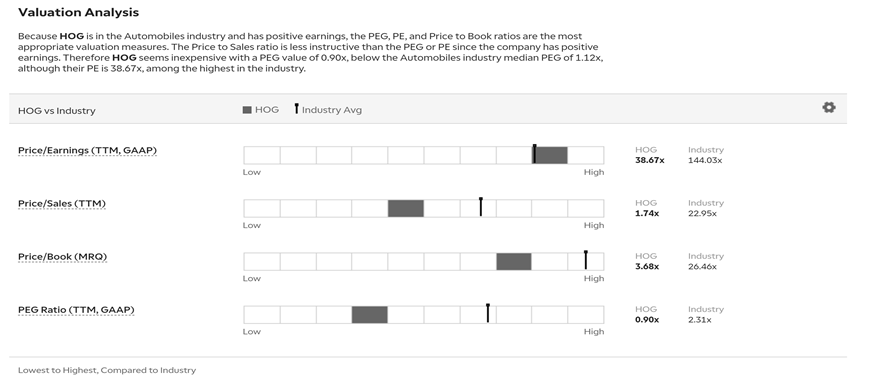

The company appears to have a new lease on life, partially because it stopped fighting one of its largest competitors (its own used products) and started capitalizing on them. Dealers, analysts, and riders have all so far responded favorably to the company’s new efforts. While we pointed out some demographic trends we see in the company’s favor, we will admit that the primary risk to the company is still that it doesn’t replace its core customers. Typically, Harley has been a premium motorcycle brand. Although its newest products have been successful, it’s hard to tell if they will be sticky enough to sustain the type of growth the company needs to get a higher multiple. That being said, we’d say this company also has a heightened ability to create new revenue streams and capitalize on its loyal community. In one light, the shares have recently hit a 3-year high, and you may think that means you shouldn’t touch the stock. Ordinarily, this may be a warning sign, but given the nearly decade-long decline that Harley-Davidson suffered, it seems more like an upside breakout to us. Of course, a stock that has gone up so much has more valuation risk than one that does not, but we still view it as undervalued by some metrics compared to industry averages.

Source: TDAmeritrade, Morning Star

Prior “Signals”

| Date | Topic | Subject / Ticker | The Signal |

| 04/15/21 | Stock | ASML Holdings (ASML) | ASML: The Jewel of The Empire |

| 04/08/21 | Stock | Alaska Air Group Inc. (ALK) | ALK: Fortune Favors The Strongest Balance Sheet |

| 03/27/21 | Stock | MGM Resorts Intl. (MGM) | MGM: When Boring Becomes Brilliant |

| 03/19/21 | Stock | Schlumberger (SLB) | A Stalwart Energy Name Well Positioned For Coming Boom |

| 03/12/21 | Stock | GoPro (GPRO) | GoPro: An ‘Epicenter’ Stock With Reasonably Priced Growth.. |

| 03/05/21 | Stock | Deutsche Bank AG (DB) | DB Is On The Mend And Very Cheap Compared To Peers |

| 02/26/21 | Stock | Six Flags (SIX) | SIX: An Industry-Leading Re-Opening Play With Upside Pot. |

| 02/17/21 | Stock | Real Networks (RNWK) | RNWK: From Cautionary Tech Tale To AI Multibagger |

| 02/11/21 | ETF | S&P High Beta ETF (SPHB) | SPHB: Getting to Alpha By Way of Beta |

| 02/05/21 | Stock | Exxon-Mobil (XOM) | Why Exxon-Mobil Is A Buy Despite Mixed Earnings |

| 01/28/21 | Sector | Energy GICS-1 (XLE) | If You Like TSLA’s 2020 Performance, Try The Energy Sector |

| 01/15/21 | Stock | Ford (F) | ‘Epicenter’ Stock With EV Upside and Great Management |

| 11/05/20 | Stock | Ingalls & Snyder | Despite Gyrating Markets, This Manager Returned 40% in ‘19 |

| 10/21/20 | Stock | 10-K Filings Part 3 | Other Voices: Why Reading 10-K Filings Is Crucial; Part 3 |

| 8/19/20 | Stock | 10-K Filings Part 2 | Other Voices: Why Reading 10-K Filings Is Crucial; Part 2 |

| 8/6/20 | Stock | Truist Financial (TFC) | Never Heard of Truist? This Bank Stock Could Rise Up to 30% |

| 7/29/20 | Stock | Weight Watchers (WW) | Weight Watchers Can Continue to Outperform Post COVID-19 |

| 7/22/20 | Stock | Xilinx (XLNX) | If EPS Rises to Pre-Covid-19 Level, XLNX Could See Old Highs |

| 7/15/20 | Stock | Market Concentration | Narrow Mkt Rally Fuels Worry; We Expect Cyclicals To Join |

| 7/8/20 | Stock | SEC Filings | Other Voices: Why Reading 10-K Filings Is Crucial; Part 1 |

| 7/1/20 | Stock | Simply Good Foods (SMPL) | Post-COVID-19, Simply Good Foods Stock Looks Appetizing |

| 6/24/20 | Stock | Lam Research, Applied Materials | Lam Research, Applied Materials Set to Reap IoT Harvest |

| 6/17/20 | Stock | Nordic Semiconductor (Nod.NO) | Continued IoT Growth Good News for Nordic Semiconductor |

| 6/10/20 | Stock | Helmerich & Payne (HP) | Helmerich & Payne Stock Could Energize Your Portfolio |

Disclosures

This research is for the clients of Fundstrat Global Advisors only. For additional information, please contact your sales representative or Fundstrat Global Advisors at 150 East 52nd Street, New York, NY, 10022 USA.

Conflicts of Interest

This research contains the views, opinions and recommendations of Fundstrat. At the time of publication of this report, Fundstrat does not know of, or have reason to know of any material conflicts of interest.

General Disclosures

Fundstrat Global Advisors is an independent research company and is not a registered investment advisor and is not acting as a broker dealer under any federal or state securities laws.

Fundstrat Global Advisors is a member of IRC Securities’ Research Prime Services Platform. IRC Securities is a FINRA registered broker-dealer that is focused on supporting the independent research industry. Certain personnel of Fundstrat (i.e. Research Analysts) are registered representatives of IRC Securities, a FINRA member firm registered as a broker-dealer with the Securities and Exchange Commission and certain state securities regulators. As registered representatives and independent contractors of IRC Securities, such personnel may receive commissions paid to or shared with IRC Securities for transactions placed by Fundstrat clients directly with IRC Securities or with securities firms that may share commissions with IRC Securities in accordance with applicable SEC and FINRA requirements. IRC Securities does not distribute the research of Fundstrat, which is available to select institutional clients that have engaged Fundstrat.

As registered representatives of IRC Securities our analysts must follow IRC Securities’ Written Supervisory Procedures. Notable compliance policies include (1) prohibition of insider trading or the facilitation thereof, (2) maintaining client confidentiality, (3) archival of electronic communications, and (4) appropriate use of electronic communications, amongst other compliance related policies.

Fundstrat does not have the same conflicts that traditional sell-side research organizations have because Fundstrat (1) does not conduct any investment banking activities, (2) does not manage any investment funds, and (3) our clients are only institutional investors.

This research is for the clients of Fundstrat Global Advisors only. Additional information is available upon request. Information has been obtained from sources believed to be reliable but Fundstrat Global Advisors does not warrant its completeness or accuracy except with respect to any disclosures relative to Fundstrat and the analyst’s involvement (if any) with any of the subject companies of the research. All pricing is as of the market close for the securities discussed, unless otherwise stated. Opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, risk tolerance, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies. The recipient of this report must make its own independent decision regarding any securities or financial instruments mentioned herein. Except in circumstances where Fundstrat expressly agrees otherwise in writing, Fundstrat is not acting as a municipal advisor and the opinions or views contained herein are not intended to be, and do not constitute, advice, including within the meaning of Section 15B of the Securities Exchange Act of 1934. All research reports are disseminated and available to all clients simultaneously through electronic publication to our internal client website, fundstrat.com. Not all research content is redistributed to our clients or made available to third-party aggregators or the media. Please contact your sales representative if you would like to receive any of our research publications.

Copyright 2021 Fundstrat Global Advisors LLC. All rights reserved. No part of this material may be reprinted, sold, or redistributed without the prior written consent of Fundstrat Global Advisors LLC.