“Knowledge of the oceans is more than a matter of curiosity. Our very survival may hinge upon it.” – President John F. Kennedy, 1961

Chart of the Day

Good morning!

As we have written about on numerous occasions, China enjoys a dominance in the supply and processing of such materials that gives the Middle Kingdom a powerful lever to use against most other countries – including the U.S. A critical part of the U.S.-China trade détente announced last week involved an agreement by China to suspend the restrictions on the export of rare earth metals and magnets that it had previously imposed as trade tensions escalated.

Unsurprisingly and like Joe Biden before him, President Donald Trump has devoted a significant share of his attention to strengthening U.S. access to critical minerals and metals, hoping to neutralize the potency of China’s leverage. This has been an explicit and implicit part of Trump’s recent moves with regard to Ukraine, the Democratic Republic of Congo, and Greenland, as well as recent proposals regarding minerals processing on U.S. military bases – to list just a few examples.

Trump has now expanded that front to the oceans. On April 24, he signed an executive order directing the U.S. government to facilitate the deep-sea mining of critical metals, including in international waters. The administration believes that such efforts could yield a supply of nickel, cobalt, copper, manganese, titanium, and rare earth elements. The order calls for streamlined permitting for “prospecting and granting leases for exploration, development, and production of seabed mineral resources.”

That’s a proposal that has obvious potential advantages. “With the same energy, we can get more materials: nickel, cobalt, copper and manganese,” according to Daisuke Sasaki, a spokesperson for Japanese metals processor Pacific Metals. He also told the Financial Times that deep-sea mining is “more economic and environmental than land-based mining.”

There are a lot of environmental advocates who disagree with that last assessment, however, and their arguments have convinced the governments of at least 33 countries to call for at least a temporary moratorium on the practice, including many U.S. allies. The International Seabed Authority (ISA), a United Nations-affiliated entity that claims “the legal mandate to regulate mineral-related activities” in international waters (though the U.S. is not a signatory to the U.N. treaty that created the ISA), has consistently denied applications for such activities in international waters, and China’s reaction to Trump’s executive order cited the regulatory body. “No country should bypass the ISA or international law to unilaterally authorise exploration and development activities in the international seabed area,” its Foreign Ministry said.

Is it a coincidence that China is the largest financial backer of the ISA? Is it a coincidence that China has long been actively engaged in the deep-sea minerals exploration of the type that Trump wants to expedite for the U.S. and the private sector (with five out of the 31 contracts the ISA has awarded for mining-related deep-sea exploration)?

Perhaps that question isn’t important – at least, not important enough to override the reality that both the U.S. and China need these materials badly, and neither are likely to let regulations stand in the way of their pursuit. Despite legal and environmental concerns, and despite the physical risks and engineering challenges of working in the ocean depths (anywhere from 0.5 miles to 4 miles underwater), the quest for the ocean’s riches are, as the National Oceanic and Atmospheric Administration put it after Trump’s announcement, “the next gold rush.”

Share your thoughts

Are you excited about the prospect of deep-sea mining, or do you think the risks override the potential? Click here to send us your response.

📧✍️Here’s what a reader commented📧✍️

Question: Are you personally excited about expanded access to private markets?

Answer: A resounding no. As you mentioned, individuals have varying levels of financial understanding and risk tolerance. Expanding access to private markets introduces challenges, particularly for 401(k) investors, who may struggle with the lack of liquidity, higher fees (despite potentially higher returns), and the complexities of private equity investments. While flexibility in investment choices is important — such as access to direct stock market investments — introducing private equity may not align with the average investor’s needs or capabilities.

Catch up with FS Insight

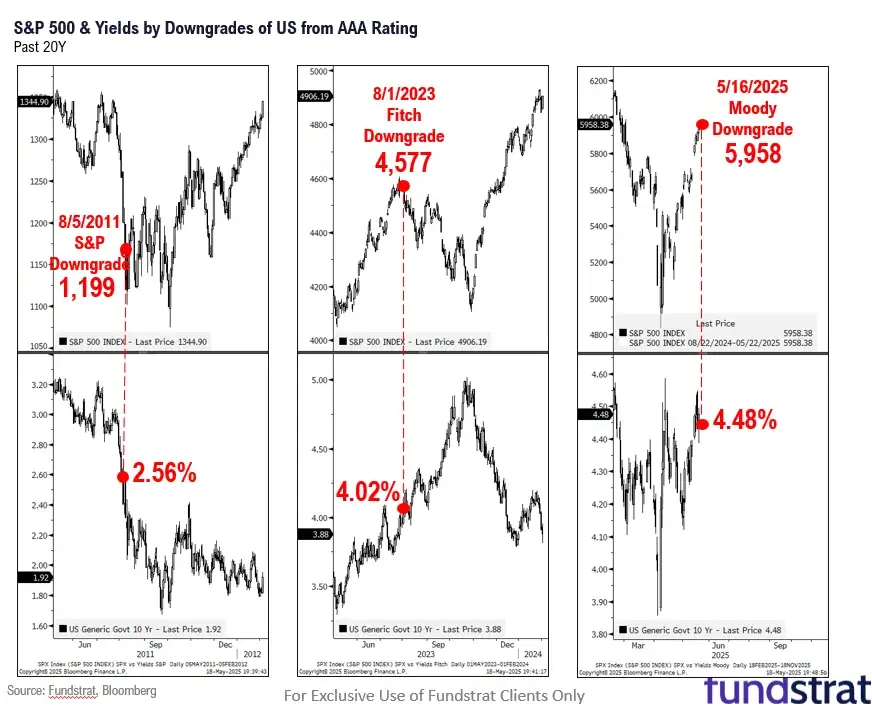

We believe this rating downgrade is largely a non-event. And if there is any stock weakness, we would be buying this dip aggressively.

Technical

“Safe-haven” trades like Gold, Treasuries, Japanese Yen, and/or Swiss Franc have all shown signs of starting to bottom out, and these should all begin to turn higher in the back half of May.

Crypto

Bitcoin miners rallied on AI demand and short covering. Moody’s downgraded the U.S. credit rating. BTC held firm, and with implied volatility hitting 12-month lows, the options market is offering an attractive entry point.

News We’re Following

Breaking News

- Biden Diagnosed With Metastatic Prostate Cancer WSJ

- New Jersey Transit and Engineers’ Union Agree to Deal to End Strike NYT

Markets and economy

- Will Anyone Take the Factory Jobs Trump Wants to Bring Back to America? WSJ

- Fed’s Bostic says he’s ‘leaning’ toward just one rate cut this year CNBC

- US borrowing costs top 5% after Moody’s downgrade FT

- El-Erian says the era of U.S. exceptionalism is on pause MW

- JPMorgan Chase Reiterates 2025 Net Interest Income Forecast of $94.5 Billion. Stock Slips. BR

Business

- Jamie Dimon’s Would-Be Successors Audition for the Top Job at JPMorgan WSJ

- Nvidia Pushes Further Into Cloud With GPU Marketplace WSJ

- Trump tells Walmart to ‘eat the tariffs’ after retailer warned it will raise prices CNBC

Politics

- The Stark Math on the GOP Tax Plan: It Doesn’t Cut the Deficit WSJ

- Trump meme coin dinner likely to include mostly non-Americans based on top TRUMP holders CNBC

Overseas

- Spain orders Airbnb to block 65,000 holiday rentals over rule violations AP

- Pope Leo XIV and JD Vance meet ahead of US-led diplomatic flurry to reach ceasefire in Ukraine AP

- Netanyahu says Israel will control all of Gaza and allow in ‘minimal’ aid BBC

Of Interest

- The Unlucky Business Owners Who Named Their Companies ‘DEI’ Before It Was a Thing WSJ

- US college graduates enter a ‘freezing’ labour market FT

| Overnight |

| S&P Futures -60

point(s) (-1.0%

) overnight range: -83 to -28 point(s) |

| APAC |

| Nikkei -0.68%

Topix -0.08% China SHCOMP +0.00% Hang Seng -0.05% Korea -0.89% Singapore -0.56% Australia -0.58% India -0.30% Taiwan -1.46% |

| Europe |

| Stoxx 50 -0.68%

Stoxx 600 -0.50% FTSE 100 -0.36% DAX +0.01% CAC 40 -0.70% Italy -1.82% IBEX -0.25% |

| FX |

| Dollar Index (DXY) -0.83%

to 100.26 EUR/USD +0.94% to 1.1268 GBP/USD +0.71% to 1.3377 USD/JPY +0.55% to 144.90 USD/CNY +0.03% to 7.2118 USD/CNH -0.03% to 7.2128 USD/CHF +0.48% to 0.8336 USD/CAD +0.16% to 1.3946 AUD/USD +0.58% to 0.6443 |

| UST Term Structure |

| 2Y-3

M Spread widened 1.9bps to -33.2bps

10Y-2 Y Spread widened 5.0bps to 52.4bps 30Y-10 Y Spread widened 1.2bps to 47.3bps |

| Yesterday's Recap |

| SPX +0.70%

SPX Eq Wt +0.98% NASDAQ 100 +0.43% NASDAQ Comp +0.52% Russell Midcap +1.04% R2k +0.89% R1k Value +0.95% R1k Growth +0.56% R2k Value +0.51% R2k Growth +1.24% FANG+ +0.32% Semis -0.29% Software +0.73% Biotech +1.86% Regional Banks -0.02% SPX GICS1 Sorted: Energy -0.18% Tech +0.12% Comm Srvcs +0.65% Fin +0.69% SPX +0.70% Cons Disc +0.85% Materials +0.91% Indu +1.04% Cons Staples +1.08% REITs +1.27% Utes +1.42% Healthcare +1.96% |

| USD HY OaS |

| All Sectors +3.3bps

to 366bps All Sectors ex-Energy +3.2bps 336bps Cons Disc +4.0bps 360bps Indu +2.1bps 273bps Tech +1.9bps 331bps Comm Srvcs +2.5bps 529bps Materials +2.0bps 337bps Energy +5.3bps 426bps Fin Snr +4.1bps 298bps Fin Sub +1.2bps 276bps Cons Staples +4.6bps 254bps Healthcare +3.0bps 368bps Utes +4.3bps 245bps * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 5/22 | 9:45 AM | May P S&P Manu PMI | 49.9 | 50.2 |

| 5/22 | 9:45 AM | May P S&P Srvcs PMI | 51 | 50.8 |

| 5/22 | 10:00 AM | Apr Existing Home Sales | 4.1 | 4.02 |

| 5/22 | 10:00 AM | Apr Existing Home Sales m/m | 1.99 | -5.85 |

| 5/23 | 10:00 AM | Apr New Home Sales | 690 | 724 |

| 5/23 | 10:00 AM | Apr New Home Sales m/m | -4.7 | 7.4 |