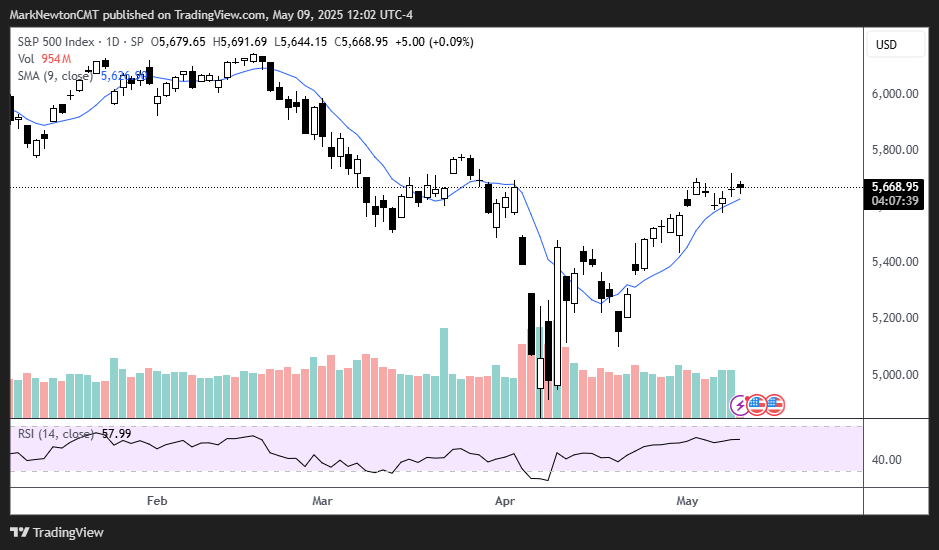

The unveiling of the first trade deal wasn’t enough to lift stocks out of their rut this week.

The S&P 500 fell 0.5% this week, while the Nasdaq Composite declined 0.3% Both logged their first down week in three weeks.

Markets have recently sharply rebounded from their April lows, emboldened by a good earnings season and progress on trade deals. Risky assets have made a big comeback. Bitcoin shot up to over $100,000, Tesla has rallied, and the small-cap Russell 2000 index has finished in the green for five straight weeks.

About 90% of the companies in the S&P 500 have reported earnings, with profits projected to have climbed 13.6% from a year ago, according to FactSet. Big Tech earnings in particular have been good, helping improve the market sentiment some, according to Head of Data Science Ken Xuan.

The biggest highlight of the week was the Federal Reserve meeting, where members unanimously decided to extend their wait-and-see outlook on interest rates yet again. Fed Chair Jerome Powell warned that tariffs were raising risks of higher unemployment and higher inflation. However, as he and the FOMC see it, the impact from tariffs hasn’t shown up in concrete data to the extent that a rate cut would be justified at this juncture.

Xuan interpreted the meeting as hawkish.

“I know it’s no surprise that they didn’t cut in this meeting, of course, but I thought if they’re going to cut in June, Powell should start to telegraph some signal. But he didn’t really signal much,” he said.

The ball on trade deals got moving this week. President Trump announced on Thursday frameworks of a trade deal with Britain. Details have yet to emerge, but definitely showed progress and the administration’s willingness to quickly get deals done, Xuan said.

Chart of the Week

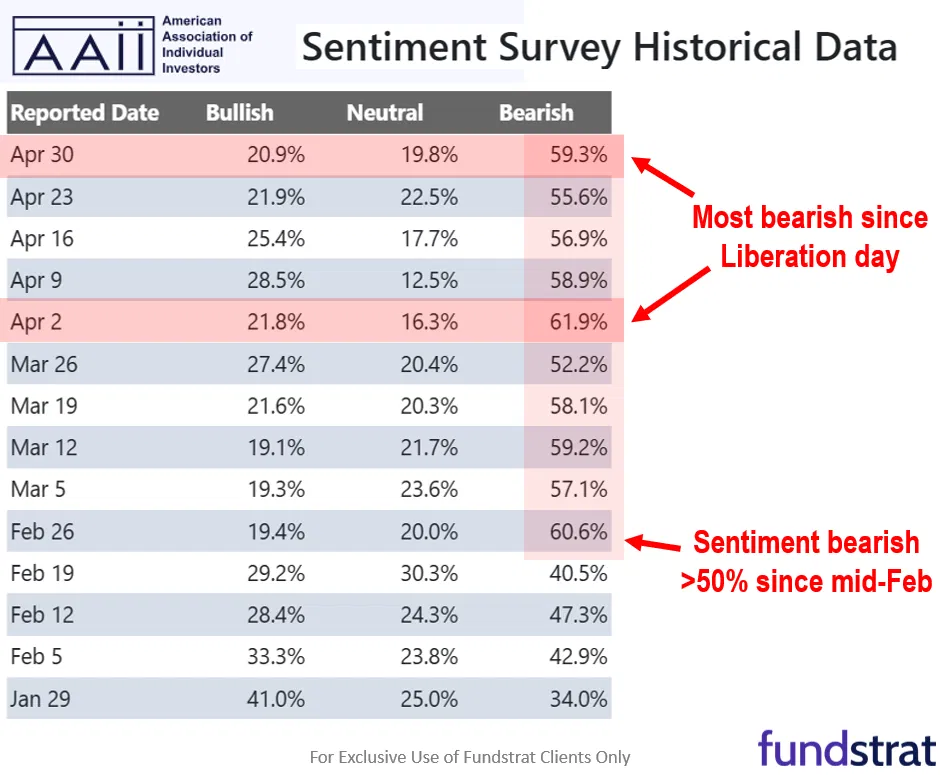

Despite markets rallying in recent weeks, sentiment remains visibly bearish. This is evident by the many commentaries from macro investors and strategists who warn of declines ahead and is evident in the AAII sentiment surveys, according to Head of Research Tom Lee. He pointed out that in the latest AAII survey, the percentage of bears hit the highest level since April 2.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

5/1 9:45 AM ET: Apr F S&P Global Manufacturing PMITame5/1 10:00 AM ET: Apr ISM Manufacturing PMITame5/2 8:30 AM ET: Apr Non-Farm PayrollsTame5/2 10:00 AM ET: Mar F Durable Goods Orders MoMTame5/5 9:45 AM ET: Apr F S&P Global Services PMITame5/5 10:00 AM ET: Apr ISM Services PMITame5/6 8:30 AM ET: Mar Trade BalanceTame5/7 9:00 AM ET: Apr F Manheim Used Vehicle IndexHot5/7 2:00 PM ET: May FOMC DecisionMixed5/8 8:30 AM ET: 1Q P Unit Labor CostsTame5/8 8:30 AM ET: 1Q P Non-Farm Productivity QoQTame5/8 11:00 AM ET: Apr NY Fed 1yr Inf ExpMixed- 5/13 6:00 AM ET: Apr Small Business Optimism Survey

- 5/13 8:30 AM ET: Apr Core CPI MoM

- 5/15 8:30 AM ET: May Philly Fed Business Outlook

- 5/15 8:30 AM ET: Apr Core PPI MoM

- 5/15 8:30 AM ET: May Empire Manufacturing Survey

- 5/15 8:30 AM ET: Apr Retail Sales

- 5/15 10:00 AM ET: May NAHB Housing Market Index

- 5/16 10:00 AM ET: May P U. Mich. Sentiment and Inflation Expectation

- 5/16 4:00 PM ET: Mar Net TIC Flows

- 5/19 9:00 AM ET: May M Manheim Used Vehicle Index

- 5/22 8:30 AM ET: Apr Chicago Fed Nat Activity Index

- 5/22 9:45 AM ET: May P S&P Global Services PMI

- 5/22 9:45 AM ET: May P S&P Global Manufacturing PMI

- 5/22 10:00 AM ET: Apr Existing Home Sales

- 5/22 11:00 AM ET: May Kansas City Fed Manufacturing Survey

- 5/23 10:00 AM ET: Apr New Home Sales

- 5/27 8:30 AM ET: Apr P Durable Goods Orders MoM

- 5/27 9:00 AM ET: Mar S&P CoreLogic CS home price

- 5/27 10:00 AM ET: May Conference Board Consumer Confidence

- 5/27 10:30 AM ET: May Dallas Fed Manuf. Activity Survey

- 5/28 10:00 AM ET: May Richmond Fed Manufacturing Survey

- 5/28 2:00 PM ET: May FOMC Meeting Minutes

- 5/29 8:30 AM ET: 1Q S GDP QoQ

- 5/30 8:30 AM ET: Apr Core PCE Deflator MoM

- 5/30 10:00 AM ET: May F U. Mich. Sentiment and Inflation Expectation

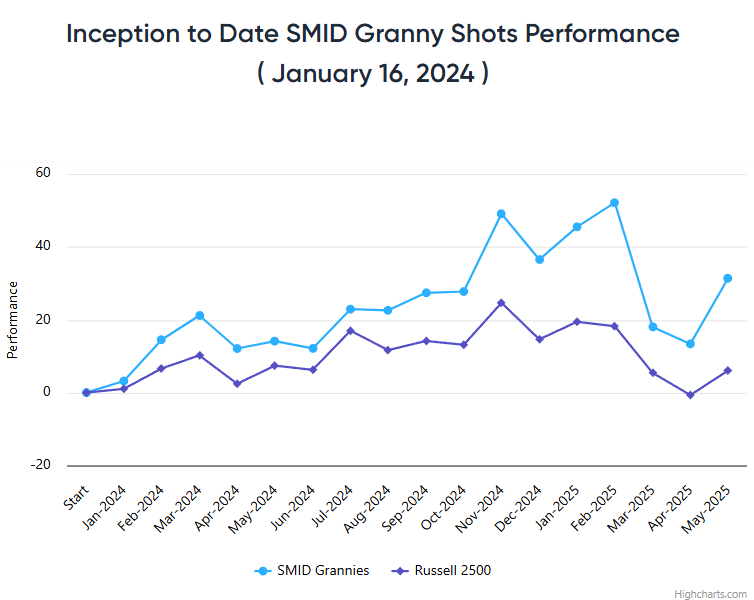

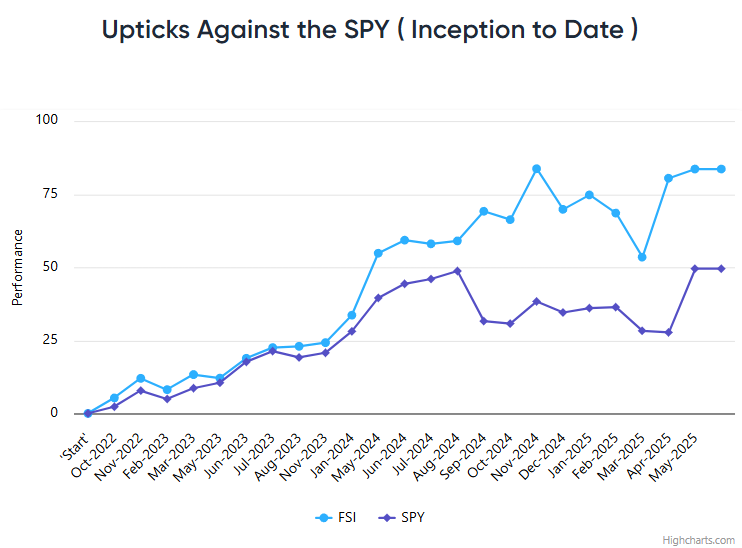

Stock List Performance

In the News

| Start Your 30-Day Free Trial Now! More News Appearances |