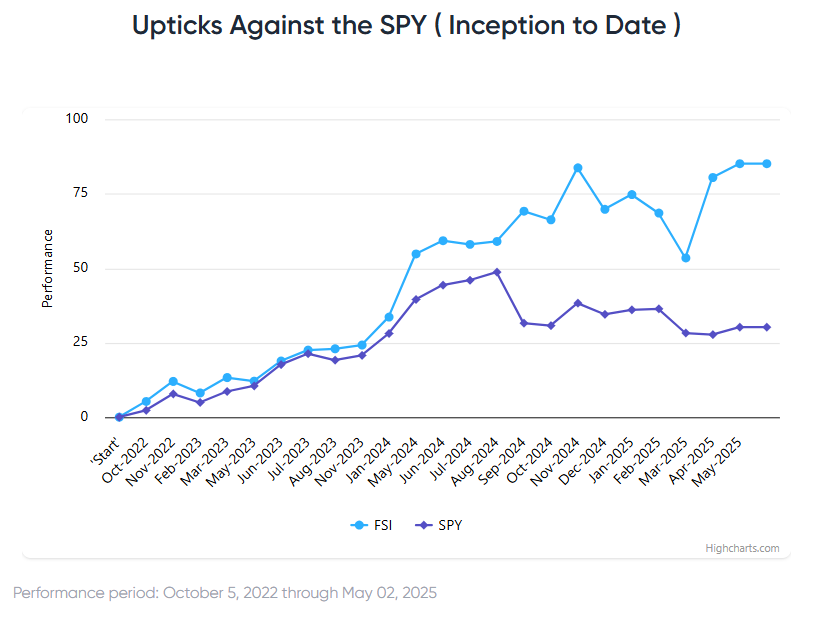

Corporate earnings came to occupy investors’ attention last week, despite uncertainty around the tariff issue that remains ongoing. That was unsurprising, as more than a third of companies released their 1Q2025 results, including closely watched tech giants like Microsoft, Meta, Amazon, and Apple. As our Chart of the Week (below) shows, those earnings were good, helping the S&P 500 to notch its ninth straight day of advances on Friday and recoup its post-Liberation Day losses. Fundstrat Head of Research Tom Lee views markets as being “in a better place this week compared to last week” and earlier in the month, with probabilities favoring a V-shaped recovery.

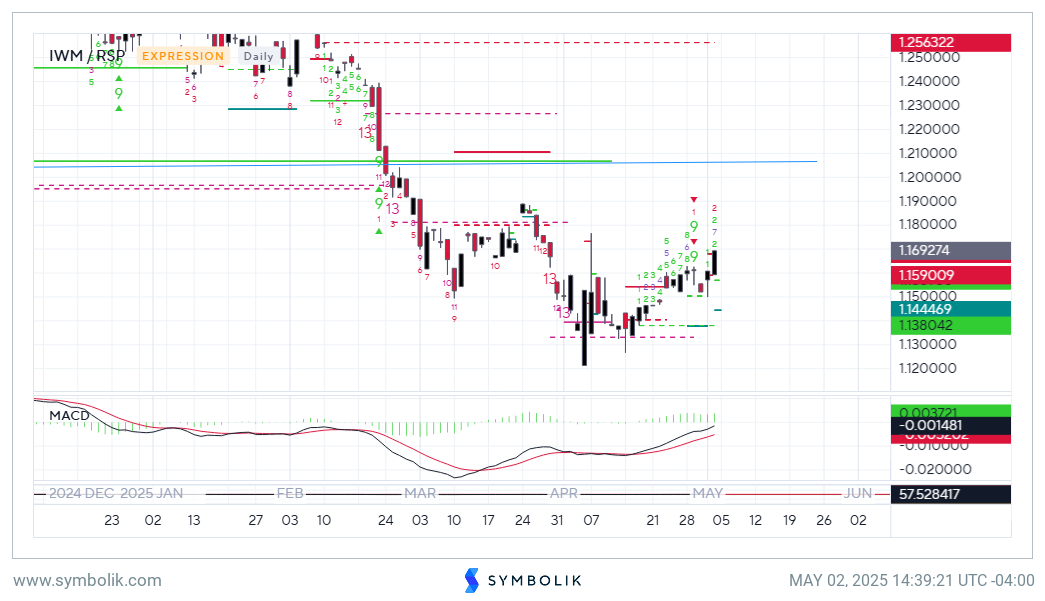

Mark Newton, Fundstrat’s Head of Technical Strategy, is somewhat in agreement, but not entirely. Newton acknowledged that “yes, we’ve had a great rally the last few weeks, and the price action has been phenomenal – both in technology and the broader market.” As a result, “we’ve had some meaningful improvement in breadth and momentum. And cycles and seasonality suggest that markets did in fact bottom in April.”

However, “I don’t think [the recovery] will be a straight line, if only because momentum is still quite negative on a weekly basis.” As he explained, “when short-term momentum gets overbought while weekly momentum remains negative, sometimes [markets] can prove to be choppy and not a V-shaped move straight back to the highs. And so that’s what I’m expecting over the next month.”

Newton was pressed to elaborate on timing, and he did so, albeit without high conviction. “I think ideally we get up to 5,750, right near March highs, and then I think we probably are going to have to give some of that back. It probably starts, who knows, potentially within a couple weeks,” he said. That said, he added that, “I don’t sense that we’re going to give back a lot, probably a maximum of 50% of this whole move is given back before we make a move higher.” Overall, however, Newton said he is in agreement with Lee “with regards to thinking that lows are in, this is still a bull market, and we can push back to highs.”

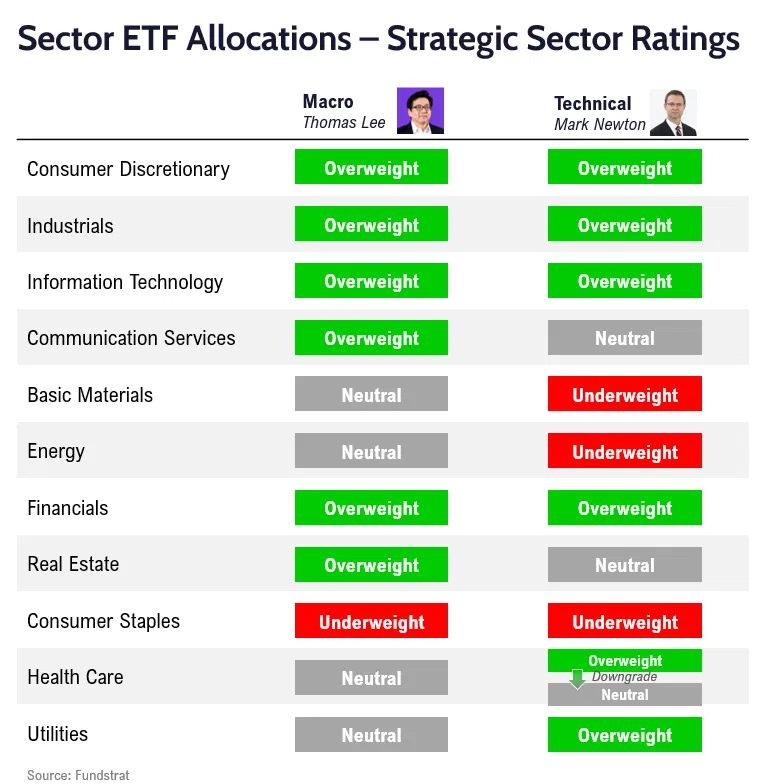

Sector Allocation Strategy

These are the latest strategic sector ratings from Head of Research Tom Lee and Head of Technical Strategy Mark Newton – part of the May 2025 update to the FSI Sector Allocation Strategy. FS Insight Macro and Pro subscribers can click here for ETF recommendations, precise guidance on strategic and tactical weightings, detailed commentary, and methodology.

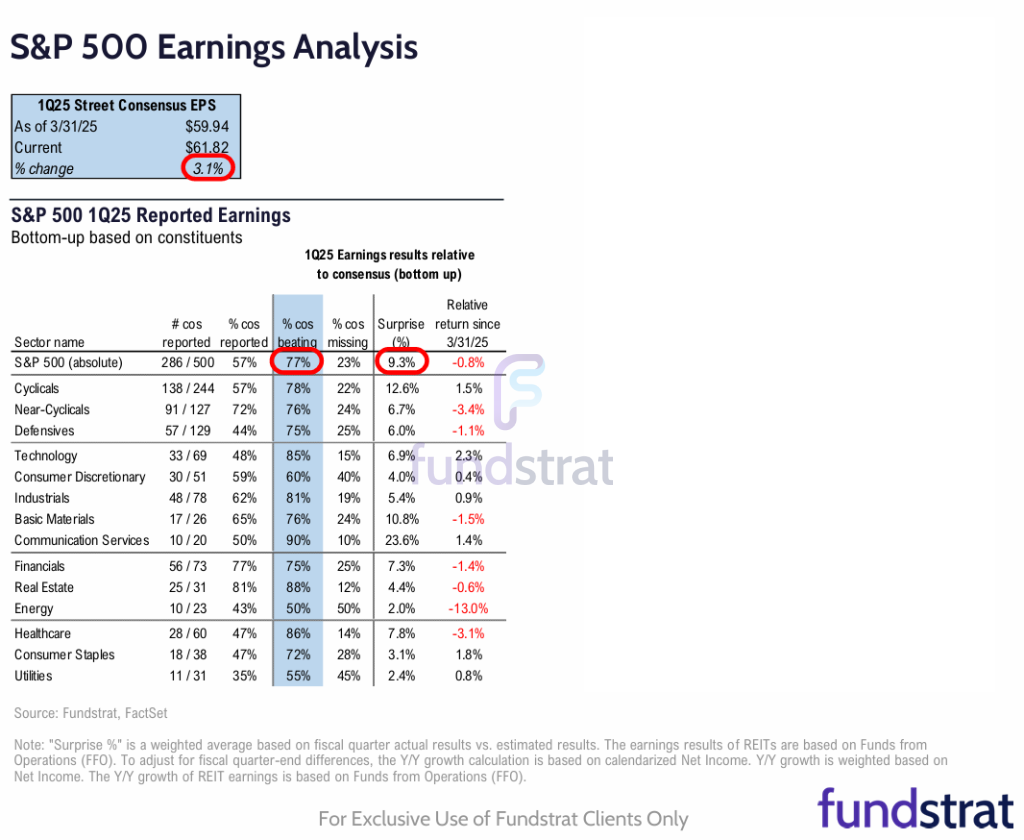

Chart of the Week

As shown in our Chart of the Week, as of Friday morning, about 77% of the companies that have reported during the current ongoing earnings season have beaten estimates, with an average beat of around 9.3%. “That’s actually very good,” Head of Data Science Ken Xuan told us at our weekly research huddle. “It’s higher than the five-year average of around 8.8% and the 10-year average of around 7%.” Head of Research Tom Lee sees this as evidence that “U.S. companies do an exceptional job of managing shocks,” though he warned that the tariff issue might present bigger challenges to companies in the next quarter.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

4/28 10:30 AM ET: Apr Dallas Fed Manuf. Activity SurveyTame4/29 9:00 AM ET: Feb S&P CS home price 20-City MoMTame4/29 10:00 AM ET: Apr Conference Board Consumer ConfidenceTame4/29 10:00 AM ET: Mar JOLTS Job OpeningsTame4/30 8:30 AM ET: 1Q A GDP QoQTame4/30 8:30 AM ET: 1Q ECI QoQTame4/30 10:00 AM ET: Mar Core PCE MoMTame5/1 9:45 AM ET: Apr F S&P Global Manufacturing PMITame5/1 10:00 AM ET: Apr ISM Manufacturing PMITame5/2 8:30 AM ET: Apr Non-Farm PayrollsTame5/2 10:00 AM ET: Mar F Durable Goods Orders MoMTame- 5/5 9:45 AM ET: Apr F S&P Global Services PMI

- 5/5 10:00 AM ET: Apr ISM Services PMI

- 5/6 8:30 AM ET: Mar Trade Balance

- 5/7 9:00 AM ET: Apr F Manheim Used Vehicle Index

- 5/7 2:00 PM ET: May FOMC Decision

- 5/8 8:30 AM ET: 1Q P Unit Labor Costs

- 5/8 8:30 AM ET: 1Q P Non-Farm Productivity QoQ

- 5/8 11:00 AM ET: Apr NY Fed 1yr Inf Exp

Stock List Performance

In the News

| Start Your 30-Day Free Trial Now! More News Appearances |