The Dow Jones Industrial Average’s shortcomings have been its saving grace this year, but investors and analysts are wondering how long the good times can last.

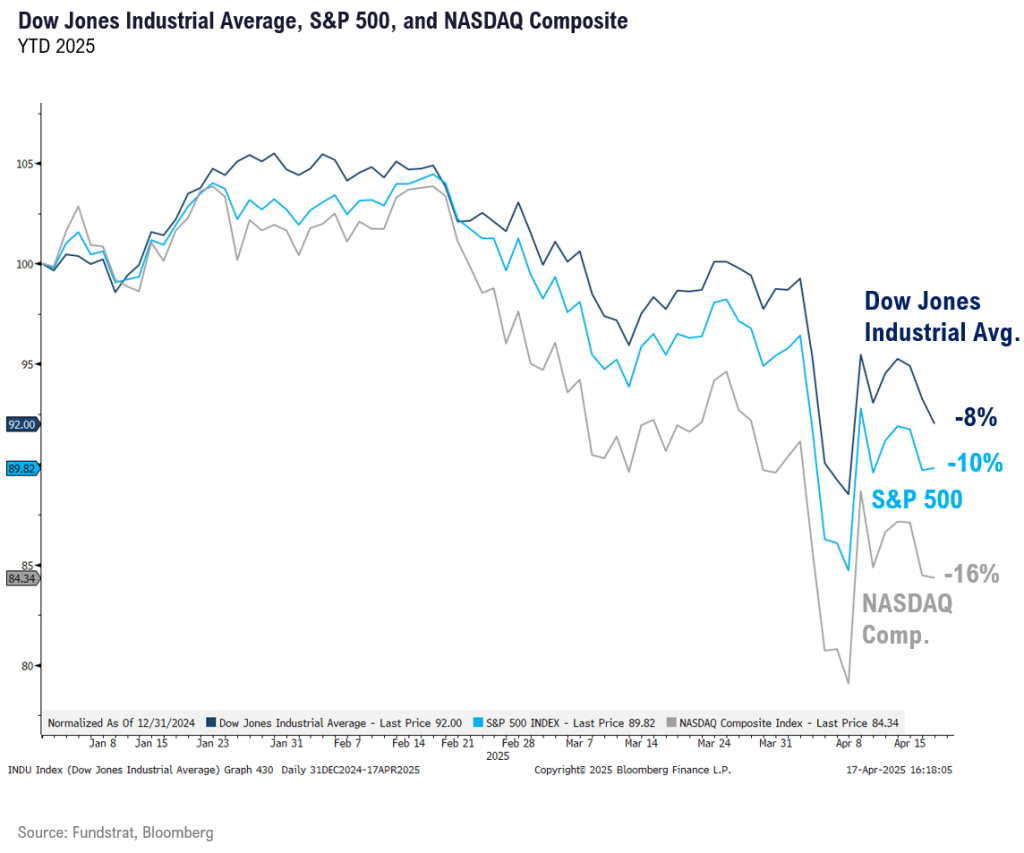

The blue-chip index has declined 8% this year, with a chunk of those losses coming Thursday after shares of UnitedHealth Group sharply dropped. In comparison, the S&P 500 and the Nasdaq Composite, which are mostly composed of large technology companies and other growth stocks, are down 10% and 16%, respectively.

Relentless back and forth on tariffs by President Donald Trump has sown seeds of confusion among investors, simultaneously dragging down stocks and bonds. Economists are worried that tariffs could raise inflation and weigh on consumer spending, while corporate executives are scrambling to dissect the fallout on supply chains.

Despite the broader market rout, the Dow has emerged as a relative bright spot, marking a reversal of fortunes for the 128-year-old index that has been criticized in recent decades for its lateness in identifying super cycles, its stodgy holdings, and its weighting method.

The reason why the Dow hasn’t declined as sharply as its peers is because the stock market carnage has been led by the darling Big Tech. Since they’ve powered the market higher in recent years, they’re more vulnerable to a pullback given any hint of bad news.

The first blow this year came from DeepSeek and then the second one was delivered by tariffs, pushing investors to scrutinize the higher multiples commanded by tech stocks and rethink a strong consumer appetite for tech.

In the Magnificent Seven, Tesla is down 40%, Nvidia is down 24%, Apple is down 21%, Amazon is down 21%, Alphabet is down 20%, Meta Platforms is down 14%, and Microsoft is down 12%.

Luckily for the Dow, it only contains four of those seven—Microsoft, Apple, Amazon, and Nvidia—which has helped insulate the index from the steeper declines posted by Tesla.

Yet worries remain on whether the Dow can continue to hold its own. Instead of growthier names, the index remains old-economy heavy, holding companies like Caterpillar and Chevron. Those could be susceptible to declines in a tariffs-induced recession due to their cyclical nature, meaning their gains and losses ebb and flow with those of the economy. Tech and growthier could be better suited for a recessionary environment because of their stronger balance sheets and better fundamentals.

And if tech does lead a market rebound, it means the Dow could once again be left in the dust like it has been in the past few years. In 2024, the Dow increased 13%, while the S&P 500 rallied 23% and the Nasdaq jumped 29%.

That recent lag is part of a bigger trend, according to James Glassman, co-author of the book “Dow 36,000.” He wrote that the S&P 500 has outperformed the Dow in five of the last six years, returning better than one-third more.

It’s surprising because from 1992 to 2024, the Dow and the S&P 500 returned almost exactly the same: a yearly average of 11.5% for the Dow and 11.3% for the S&P 500, with similar levels of volatility, Glassman wrote.

What the Dow does matters because it has long been considered the hallmark of companies that best represent America, which in turn, makes the Dow a representation of America itself. It hit the milestone of 40,000 points last spring and finished Thursday slightly below those levels at 39,142.23 points.

But in a glitzy age of artificial intelligence, the Dow has lost its prominence as a gauge of American strength. Its importance has been reduced, and it seems to matter only to the aging demographic that grew up learning about it. (In some ways, it’s a relic of the bygone era.) In fact, most might agree that they only care about the Dow when it loses or gains 1,000 points in a single day’s sell-off and makes headlines on CNBC.

One reason the Dow is so slow to incorporate changes based on supercycles is because of its stock pickers.

A committee composed of representatives of S&P Dow Jones Indices and The Wall Street Journal makes the call on the Dow’s constituents on an as-needed basis. The committee focuses on an eligible company’s reputation, its history of sustained growth, its interest to investors, and how its sector represents the broader market, according to S&P Global.

Some like Glassman appreciate the human component of this selection process, arguing that, “In a world increasingly determined by numbers and algorithms, the Dow injects some humanity into the daily market action, reflecting a more holistic picture of the market.”

The Dow committee added Nvidia in November of last year, replacing laggard Intel. Now that Nvidia has declined sharply this year, it has only confirmed the fears of those who have been warning about the Dow being too late.

The biggest critique is perhaps that unlike the S&P 500 and the Nasdaq Composite, the blue-chip index is price-weighted, not by market capitalization. It is calculated by adding the prices of the 30 stocks and then dividing it by a divisor that accounts for changes such as stock splits and index entrants. That means the higher the share price, the bigger the sway, regardless of their total market value.

So it can be assumed that since shares of Goldman Sachs, the heaviest weighting in the Dow at a price of $509.49, have fallen 11% this year, this has hurt the index.

The latest example of the issues with a price-weighted index came Thursday, when the second-largest weighting, commanded by UnitedHealth Group at $454.11, sank 22%. That contributed to dragging the Dow down 1.3%, compared to a gain of 0.1% for the S&P 500. UnitedHealth’s stock is down 11% for the year.

Conclusion

It’s hard for an old dog like the Dow to learn new tricks, but if it wants to maintain its legacy, it must adjust the way it reacts to market cycles. And sure, it hasn’t backfired as a strategy this year, but the fact remains that if the economy does weaken, the Dow wouldn’t necessarily do better than others. The question of whether the Dow can maintain its edge in a tariffs-roiled market remains anyone’s guess.

As a reminder, Signal From Noise should be used as a source of ideas for further research rather than as a source of investment recommendations. We encourage you to explore our full Signal From Noise library, which includes deep dives on gene editing, wonky economic indicators, artificial intelligence and healthcare, rising wealth of women, and an update to our overview of the semiconductor industry. You’ll also find discussions about the TikTok demographic, artificial intelligence, and weight loss-related investments.