The market carnage extended for a fourth straight week, dragged down by investors wrestling with a flip-flopping tariffs policy and intensifying recession fears. This week, the S&P 500 tumbled 2.3% and the Nasdaq Composite fell 2.4%. Both sharply rebounded Friday but failed to exit correction territory—defined as a drop of 10% or more from a recent high.

While there is pain, Fundstrat Head of Technical Strategy Mark Newton reminded investors that the declines are in line with what is historically noted during the first quarter of any new administration. Besides, it was a mere 17 trading days ago that the S&P 500 set a fresh all-time high, he pointed out.

“The economy arguably is still in very good shape, the earnings picture is good—even as fear levels are higher,” Newton said during the weekly huddle. “I don’t think we can jump to conclusions and talk ‘recession’ just based on these declines.”

Stocks’ “dire” situation is not shared by bonds, Head of Research Tom Lee said. Sure, Treasury Secretary Scott Bessent said that there is no Trump put for stocks, but “there may be one on the economy,” meaning that the White House could be forced to turn around its policies if it sees the economy deteriorate too much, Lee highlighted.

The bond market is also pricing in odds of 3.4 interest-rate cuts from the Federal Reserve this year, up from 1.5 previously, he said. The divergence between stocks and bonds has historically been a “pretty good entry point for stocks,” said Lee, citing data from Renaissance Macro Research.

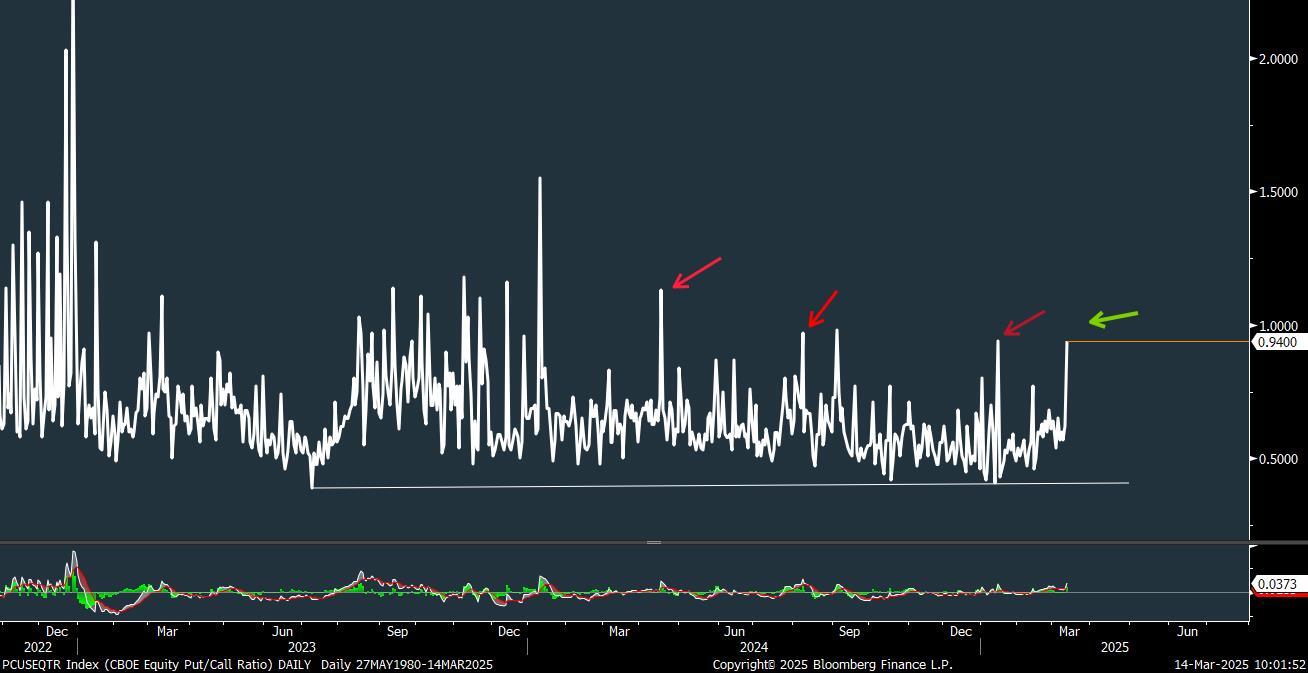

On the technical side, Newton has been encouraged to see stocks down to the same levels of oversold territory as the ones that coincided with bottoms seen in August and April of 2024. “People are disgruntled, but we’re certainly not seeing evidence of true fear,” he said.

He expects that lows to this sell-off could be “achieved within the next two weeks from a timing perspective, and prices are nearing possible support.”

Chart of the Week

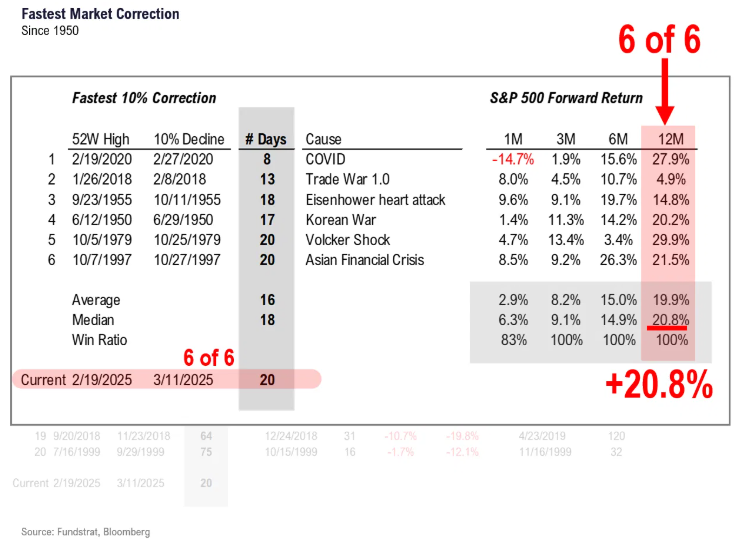

Putting the recent declines into perspective, Fundstrat Head of Research Tom Lee said that the 10% correction noted in the S&P 500 is the fifth-fastest in the past three quarters of a century, taking 20 days. The median gain from all prior declines was 21% over the next 12 months. The quickest was from the Covid decline, prompting Lee to say, “Is this worse than the global pandemic? I don’t think so.”

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

3/3 9:45 AM ET: Feb F S&P Global Manufacturing PMITame3/3 10:00 AM ET: Feb ISM Manufacturing PMITame3/5 9:45 AM ET: Feb F S&P Global Services PMITame3/5 10:00 AM ET: Feb ISM Services PMITame3/5 10:00 AM ET: Jan F Durable Goods OrdersTame3/5 2:00 PM ET: Mar Fed Releases Beige BookTame3/6 8:30 AM ET: 4Q F Non-Farm ProductivityTame3/6 8:30 AM ET: Jan Trade BalanceTame3/6 8:30 AM ET: 4Q F Unit Labor CostsTame3/7 8:30 AM ET: Feb Non-Farm PayrollsTame3/7 9:00 AM ET: Feb F Manheim Used Vehicle indexTame3/10 11:00 AM ET: Feb NY Fed 1yr Inf ExpTame3/11 6:00 AM ET: Feb Small Business Optimism SurveyTame3/11 10:00 AM ET: Jan JOLTS Job OpeningsTame3/12 8:30 AM ET: Feb CPITame3/13 8:30 AM ET: Feb PPITame3/14 10:00 AM ET: Mar P U. Mich. Sentiment and Inflation ExpectationHot- 3/17 8:30 AM ET: Feb Retail Sales Data

- 3/17 8:30 AM ET: Mar Empire Manufacturing Survey

- 3/17 10:00 AM ET: Mar NAHB Housing Market Index

- 3/19 9:00 AM ET: Mar M Manheim Used Vehicle index

- 3/19 2:00 PM ET: Mar FOMC Decision

- 3/19 4:00 PM ET: Jan Net TIC Flows

- 3/20 8:30 AM ET: Mar Philly Fed Business Outlook

- 3/20 10:00 AM ET: Feb Existing Home Sales

- 3/24 8:30 AM ET: Feb Chicago Fed Nat Activity Index

- 3/24 9:45 AM ET: Mar P S&P Global Manufacturing PMI

- 3/24 9:45 AM ET: Mar P S&P Global Services PMI

- 3/25 9:00 AM ET: Jan S&P CoreLogic CS home price

- 3/25 10:00 AM ET: Mar Conference Board Consumer Confidence

- 3/25 10:00 AM ET: Feb New Home Sales

- 3/26 10:00 AM ET: Feb p Durable Goods Orders

- 3/27 8:30 AM ET: 4Q T GDP

- 3/28 8:30 AM ET: Feb PCE Deflator

- 3/28 10:00 AM ET: Mar F U. Mich. Sentiment and Inflation Expectation

- 3/31 10:30 AM ET: Mar Dallas Fed Manuf. Activity Survey

Stock List Performance

In the News

| More News Appearances |

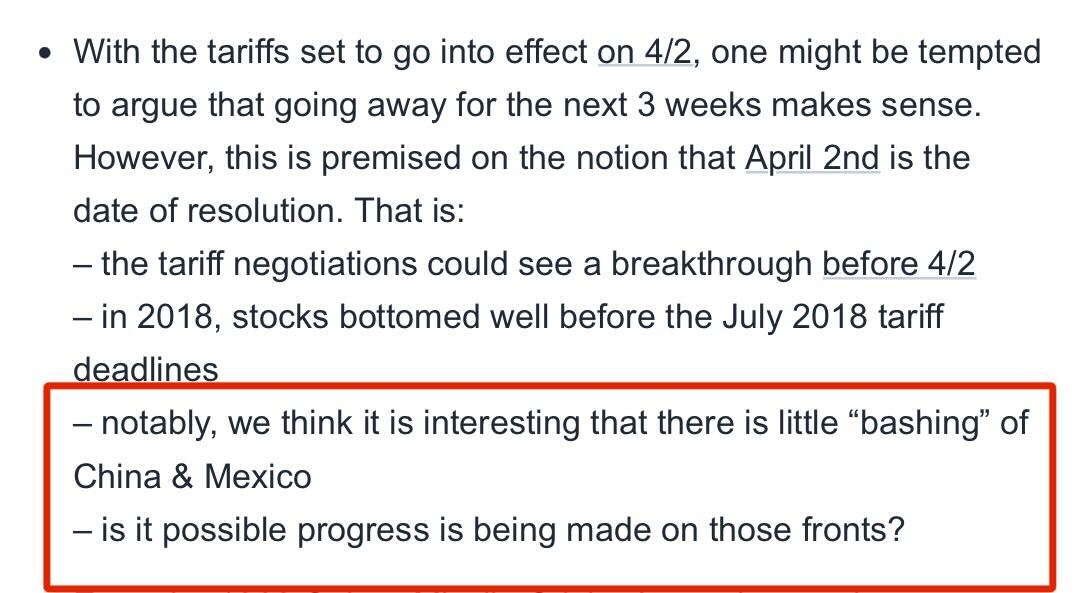

- I would put >50% probability that a deal with one of those 2 countries is announced within the next 2 weeks

This would end talk of “White House wants a recession” Stay the course