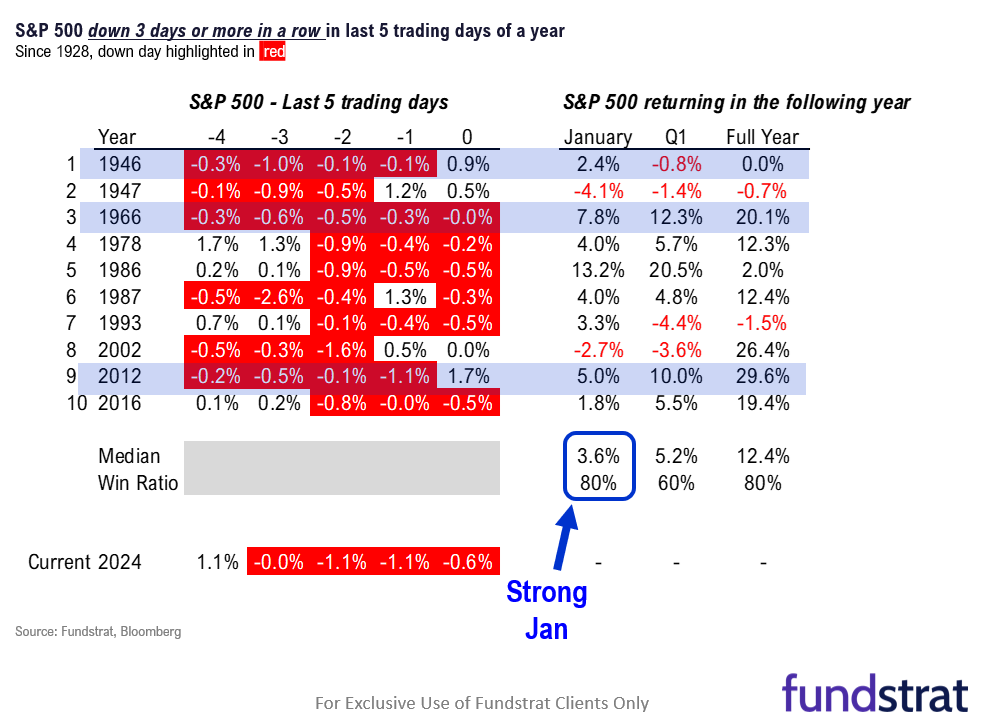

Equity markets are ending 2024 with a whimper. The S&P 500 has been down 4 of the 5 final trading days of 2024. Yet, equities are still finishing 2024 up 23%, making two back to back annual gains of 20% (2023 and 2024).

- Notably, the S&P 500 had 4 consecutive declines in the final week of 2024.

– since 1928, in the final week

– there are 10 instances down 3 consecutive days

– there are 3 instances down 4 consecutive days - For 3 consecutive declines, the forward returns are strong:

– 3 consecutive declines

– next 1M gain +3.6%, 80% win-ratio

– next 12M gain +12.4%, 80% win-ratio - For 4 consecutive declines, 3 instances are:

– 1946, 1966 and 2012

– 1M gain: +2.4%, +7.8%, +5.0%, respectively

– 12M gain: +0%, 20%, 30%, respectively - Why are markets faltering at the end of the year?

- Foremost, to me, this can be attributed to profit taking. After all, markets were so strong throughout 2024. Is this period of weakness a sign of a turning point? We don’t think so.

- Interest rates are up but they are hardly pushing levels that should undermine markets. And keep in mind the Fed doesn’t want financial conditions to tighten. This would offset any actions of Fed easing. This is the Fed put.

- Moreover, the fundamental picture remains strong for 2025 and tailwinds are arguably stronger in 2025 than 2024. The new incoming administration is a positive. The Fed is dovish. ISM is bottoming and should turn up.

- Mark Newton, Head of Technical Strategy, warns that weakness might continue into early January. So be mindful that we could see some early spillover into 2025.

- But we would view that pullback as a buying opportunity. Buying the dip continues to make sense, in our view.

Happy New Year!!!

_____________________________

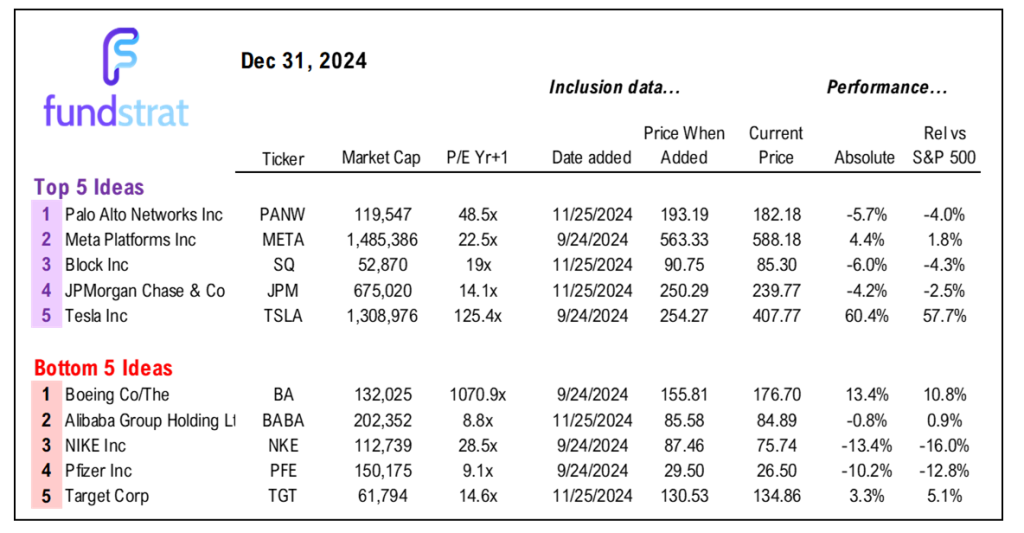

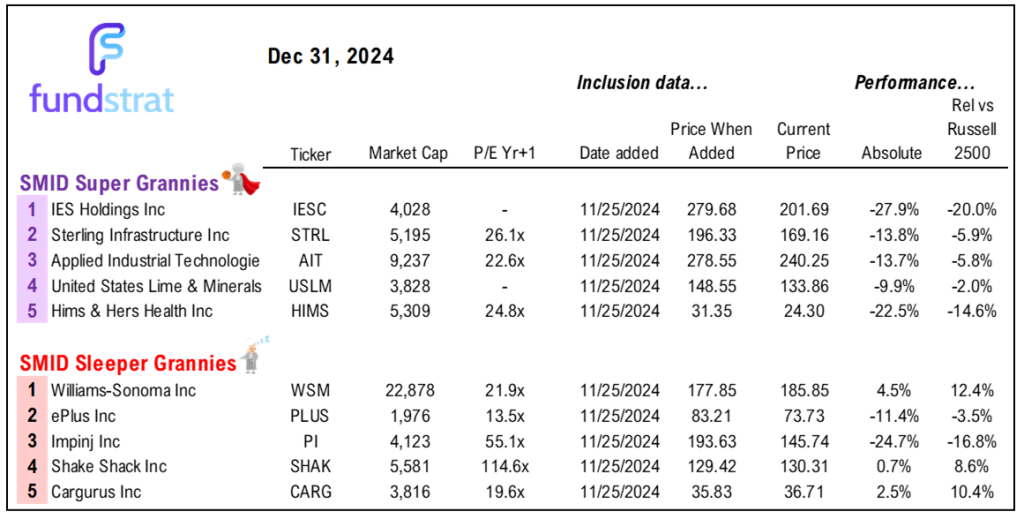

44 SMID Granny Shot Ideas: We performed our quarterly rebalance on 11/25. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

___________________________

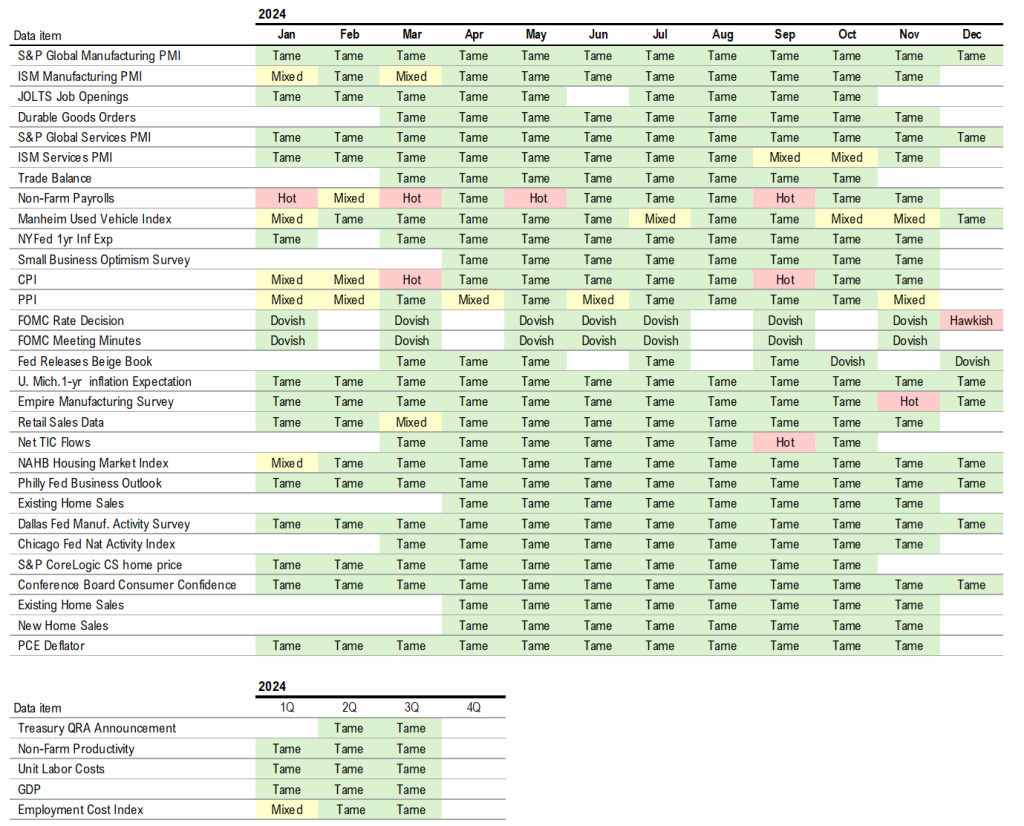

Key incoming data December:

12/2 9:45 AM ET: Nov F S&P Global Manufacturing PMITame12/2 10:00 AM ET: Nov ISM Manufacturing PMITame12/3 10:00 AM ET: Oct JOLTS Job OpeningsTame12/4 9:45 AM ET: Nov F S&P Global Services PMITame12/4 10:00 AM ET: Nov ISM Services PMITame12/4 10:00 AM ET: Oct F Durable Goods OrdersTame12/4 2:00 PM ET: Fed Releases Beige BookDovish12/5 8:30 AM ET: Oct Trade BalanceTame12/6 8:30 AM ET: Nov Non-Farm PayrollsTame12/6 9:00 AM ET: Nov F Manheim Used vehicle indexMixed12/6 10:00 AM ET: Dec P U. Mich. Sentiment and Inflation ExpectationTame12/9 11:00 AM ET: Nov NY Fed 1yr Inf ExpTame12/10 6:00 AM ET: Nov Small Business Optimism SurveyTame12/10 8:30 AM ET: 3Q F Non-Farm ProductivityTame12/10 8:30 AM ET: 3Q F Unit Labor CostsTame12/11 8:30 AM ET: Nov CPITame12/12 8:30 AM ET: Nov PPIMixed12/16 8:30 AM ET: Dec Empire Manufacturing SurveyTame12/16 9:45 AM ET: Dec P S&P Global Manufacturing PMITame12/16 9:45 AM ET: Dec p S&P Global Services PMITame12/17 8:30 AM ET: Nov Retail Sales DataTame12/17 9:00 AM ET: Dec P Manheim Used vehicle indexTame12/17 10:00 AM ET: Dec NAHB Housing Market IndexTame12/18 2:00 PM ET: Dec FOMC DecisionHawkish12/19 8:30 AM ET: 3Q T 2024 GDPTame12/19 8:30 AM ET: Dec Philly Fed Business OutlookTame12/19 10:00 AM ET: Nov Existing Home SalesTame12/19 4:00 PM ET: Oct Net TIC FlowsTame12/20 8:30 AM ET: Nov PCE DeflatorTame12/20 10:00 AM ET: Dec F U. Mich. Sentiment and Inflation ExpectationTame12/23 8:30 AM ET: Nov Chicago Fed Nat Activity IndexTame12/23 10:00 AM ET: Dec Conference Board Consumer ConfidenceTame12/24 10:00 AM ET: Nov New Home SalesTame12/24 10:00 AM ET: Nov P Durable Goods OrdersTame12/30 10:30 AM ET: Dec Dallas Fed Manuf. Activity SurveyTame12/31 9:00 AM ET: Oct S&P CoreLogic CS home priceTame

Economic Data Performance Tracker 2024:

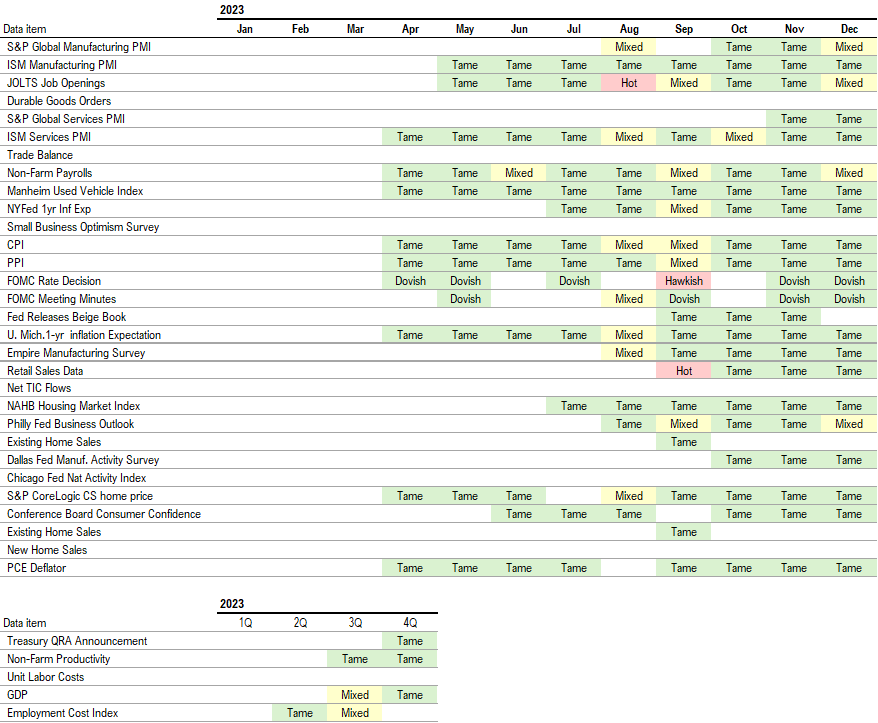

Economic Data Performance Tracker 2023: