A daily market update from Fundstrat — what you need to know ahead of opening bell

“Twenty years from now you will be more disappointed by the things you didn’t do than by the things you did.” — Mark Twain

Overnight

Murder at Dawn: A Top Executive’s Final Moments in Manhattan WSJ

Bitcoin Hits $100,000, Lifted by Hopes of a Crypto-Friendly Washington WSJ

What Fed Chief Powell said about crypto that may have aided bitcoin’s rally to $100,000 CNBC

‘Last minute spending spree’ by Biden, including Rivian loan, to get DOGE scrutiny, says Vivek Ramaswamy CNBC

The Trump M&A Boom Is Coming. A Top Dealmaker Spells Out What’s Next. BR

Billionaires Are Multiplying. Here’s Whose Wealth Has Tripled. BR

France’s political crisis just saw the government ousted — but Paris’ problems have just begun CNBC

Trump Picks Paul Atkins to Run SEC WSJ

Trump taps former aide Navarro as senior counselor for trade and manufacturing POL

Robinhood considering move into sports betting, CEO Vlad Tenev says CNBC

Bengals’ Joe Burrow Reveals He Bought $2.9M Batmobile on HBO’s ‘Hard Knocks’ CNN

Spotify Wrapped says this year belonged to the ‘pink pilates princesses’ CNN

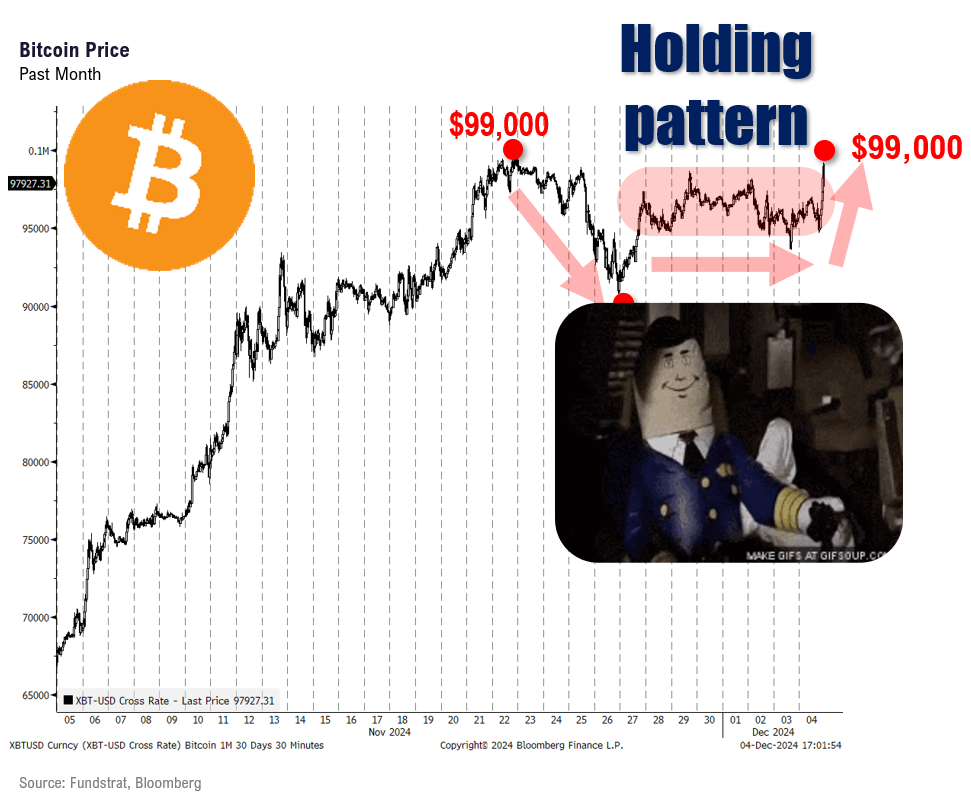

Chart of the Day

| Overnight | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| APAC | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| UST Term Structure | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yesterday's Recap | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD HY OaS | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 12/5 | 8:30 AM | Oct Trade Balance | -75 | -84.359 |

| 12/6 | 8:30 AM | Nov AHE m/m | 0.3 | 0.4 |

| 12/6 | 8:30 AM | Nov Unemployment Rate | 4.1 | 4.1 |

| 12/6 | 8:30 AM | Nov Non-farm Payrolls | 215 | 12 |

| 12/6 | 10:00 AM | Dec P UMich 1yr Inf Exp | 2.7 | 2.6 |

| 12/6 | 10:00 AM | Dec P UMich Sentiment | 73.2 | 71.8 |

| 12/9 | 11:00 AM | Nov NYFed 1yr Inf Exp | n/a | 2.87 |

| 12/10 | 6:00 AM | Nov Small Biz Optimisum | 94.1 | 93.7 |

| 12/10 | 8:30 AM | 3Q F Nonfarm Productivity | 2.2 | 2.2 |

| 12/10 | 8:30 AM | 3Q F Unit Labor Costs | 1.4 | 1.9 |

| 12/11 | 8:30 AM | Nov CPI m/m | 0.2 | 0.2 |

| 12/11 | 8:30 AM | Nov Core CPI m/m | 0.3 | 0.3 |

| 12/11 | 8:30 AM | Nov CPI y/y | 2.7 | 2.6 |

| 12/11 | 8:30 AM | Nov Core CPI y/y | 3.3 | 3.3 |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 12/5 | 8:30 AM | Oct Trade Balance | -75 | -84.359 |

| 12/6 | 8:30 AM | Nov AHE m/m | 0.3 | 0.4 |

| 12/6 | 8:30 AM | Nov Unemployment Rate | 4.1 | 4.1 |

| 12/6 | 8:30 AM | Nov Non-farm Payrolls | 215 | 12 |

| 12/6 | 10:00 AM | Dec P UMich 1yr Inf Exp | 2.7 | 2.6 |

| 12/6 | 10:00 AM | Dec P UMich Sentiment | 73.2 | 71.8 |

| 12/9 | 11:00 AM | Nov NYFed 1yr Inf Exp | n/a | 2.87 |

| 12/10 | 6:00 AM | Nov Small Biz Optimisum | 94.1 | 93.7 |

| 12/10 | 8:30 AM | 3Q F Nonfarm Productivity | 2.2 | 2.2 |

| 12/10 | 8:30 AM | 3Q F Unit Labor Costs | 1.4 | 1.9 |

| 12/11 | 8:30 AM | Nov CPI m/m | 0.2 | 0.2 |

| 12/11 | 8:30 AM | Nov Core CPI m/m | 0.3 | 0.3 |

| 12/11 | 8:30 AM | Nov CPI y/y | 2.7 | 2.6 |

| 12/11 | 8:30 AM | Nov Core CPI y/y | 3.3 | 3.3 |

MORNING INSIGHT

Good morning!

We discuss the fact the Fed needs to move to neutral, and a slower pace of cutting means a longer dovish cycle. Also, bitcoin is breaking out of its holding pattern, which is positive for equities.

Click HERE for more.

TECHNICAL

- Strong leadership out of large-cap technology stocks continues to be a tailwind.

- Bond yields should turn back down to monthly lows into mid-December .

- Cryptocurrencies got a much needed wake-up call after Paul Atkins SEC appointment.

Click HERE for more.

CRYPTO

- Recent declines in yields and the DXY provide favorable conditions for liquidity-sensitive assets.

- Core Strategy – Our base case assumes that the macro environment will remain accommodative for crypto through year-end.

Click HERE for more.

First News

The U.S. labor market won’t let up. But it’s not great if you want to get hired either.

Federal Reserve Chair Jerome Powell said on Wednesday that the economy is strong – stronger than it looked in September when the central bank started cutting interest rates.

In the job market, there’s enough openings, at least according to one measure of labor market strength. The October JOLTS report showed that openings came in higher than expectations, with the rate of openings as a share of the labor force ticking up to 4.6% from 4.4%. Layoffs also fell from the prior month.

The report, however, showed that hiring slowed to 3.3%, likely dragged down by hurricanes and labor strikes.

The fresh data reiterates the tightness that has been evident in the labor market all year long. Some workers are likely not leaving their jobs because of uncertain economic prospects, whereas employers might be hesitant to lay off employees because they’re already short staffed.

As a result, those looking for a new job have been left feeling stuck. The number of U.S. workers actively seeking a job is at the highest level since 2015, a recent Wall Street Journal article said, citing Gallup data.

One potential reason why job seekers are having such a hard time landing jobs is because of artificial intelligence, the Financial Times reported. More job seekers are using AI to enhance their resume and improve their chances of landing a job, forcing more companies to put candidates through the wringer when it comes to verifying qualifications and identifying the best fit. Job seekers, who were already too familiar with endless rounds of interviews, super days, working for free before being hired, and more, now have to jump through extra hoops if they want to switch jobs.

On the surface, the U.S. job market looks resilient. But a closer look reveals some worrying signs. If workers feel less confident about changing jobs and are unable to improve their economic prospects, then this raises questions about the strength of the overall economy – or at least the job market.

For now, all eyes are on the release of the jobs report on Friday, which will provide the latest insight into the health of the labor market.