Post-Election Surge Recedes Array ( [cookie] => 704342-17d6de-ebc608-c5e687-567dcb [current_usage] => 1 [max_usage] => 2 [current_usage_crypto] => 0 [max_usage_crypto] => 2 [lock] => [message] => [error] => [active_member] => 0 [subscriber] => 0 [role] => [visitor_id] => 208344 [user_id] => [reason] => Usage under limits [method] => ) 1 and can accesss 1

Our Views

- Equities fared poorly this week, down by roughly 2% (S&P 500), while small-caps are down a larger 4%. While simple profit taking explains a lot of this (after the post-election surge), some of this is attributable to investors having become incrementally “hawkish” on Fed and inflation recently.

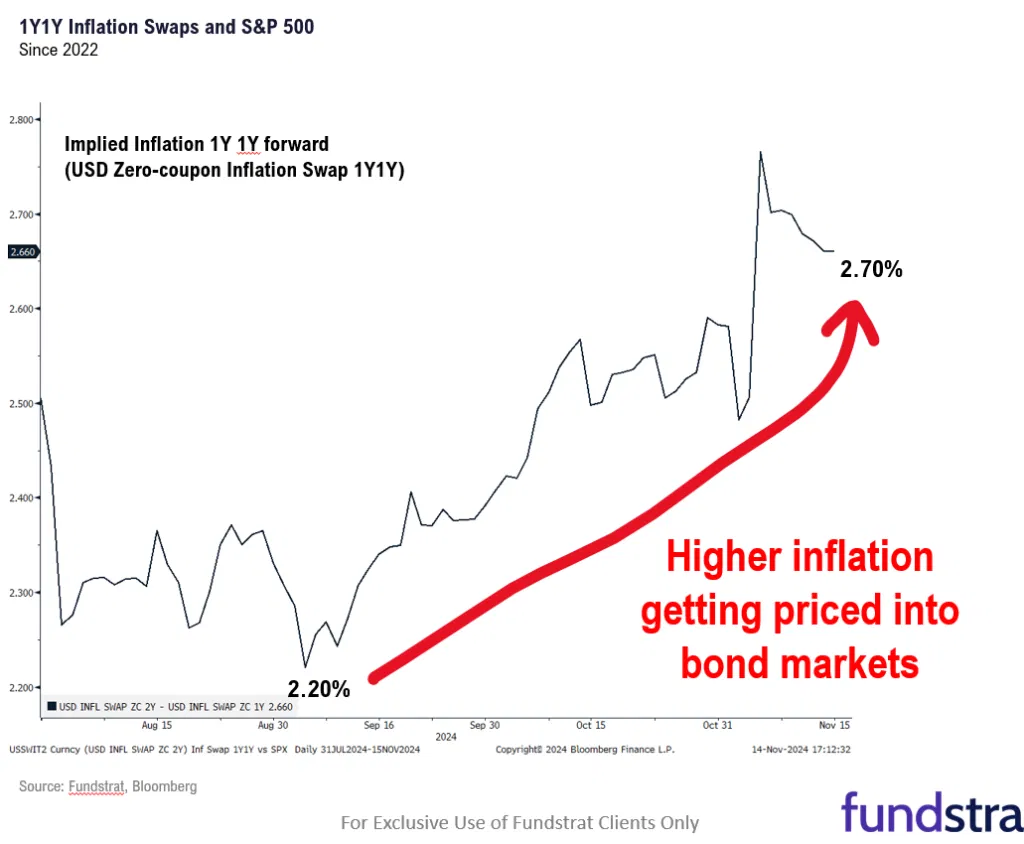

- This incremental hawkishness is evident in the 1Y1Y inflation forwards, a measure of expectations for “inflation over the next year” one year from now (or Nov 2025 to Nov 2026). This has crept up from 2% in July to 2.72% recently. We regard this as a meaningful increase.

- The drivers behind this have been stronger economic data and inflation reports that have been interpreted as showing stubborn inflation, even though as we noted previously, the internals of the Oct CPI report are arguably better than the overall.

- Nevertheless, the supports for a year-end rally remain in place. In our view, fundamentals are solid and the Fed, despite recent Fedspeak, is dovish. There is cash on the sidelines and there is a seasonal tailwind. We see the growing possibility of some sort of pullback late November to early December, but we would view that as buyable – and “buy the dip.”

- Equity trends remain bullish from early August but structurally have reached levels that represent what I see as poor risk/reward over the next 5-6 weeks.

- The post-election surge for US Equities produced a multitude of breakouts of various triangle patterns on numerous stocks and indices. However, despite the strong price strength, the lack of broad-based breadth and momentum follow-through remains a bit troublesome.

- US Dollar and US Treasury yields both appear vulnerable to weakness, which likely gets underway by November expiration, a time when US Stocks also could show some evidence of requiring consolidation. While some choppiness could happen in the short run, I still anticipate that the back half of November should produce consolidation given cycle composites, Elliott-wave theory, DeMark exhaustion signals, and near-term breadth deterioration.

- Bottom line: While trends are bullish, I think it’s wise not to get too complacent given the numerous factors that are suggesting the potential for short-term pullback that could get underway in mid-November.

- While temporary consolidation is possible, many signs of froth (sustained elevated funding rates, Kimchi Premium >5%, massive breadth) are simply not present.

- The ongoing rerating of regulatory risk in crypto has led to a massive influx of capital into ETFs and stablecoin creations.

- Despite CORE’s modest performance relative to BTC in the recent rally, the emergence of a MicroStrategy-like buyer and growing adoption as a BTC scaling solution support maintaining a small position of CORE within one’s portfolio.

- Core Strategy – In addition to a favorable macro environment, crypto is poised to benefit from strong regulatory and political tailwinds, likely extending through inauguration day. We remain overweight on SOL and still like altcoins such as BNB, HNT, JTO, BONK, RAY, STX, and CORE, emphasizing assets with high SOL and (potential) BTC beta. Minor adjustments have been made to certain weights this week, detailed at the end of this note.

- President-elect Trump has started to announce his nominees for key positions within his upcoming administration, with familiar names from his campaign among the ranks.

- Trump’s team is reportedly looking to bypass the traditional Senate confirmation process. However, with narrow GOP majorities in both houses of Congress, it is uncertain whether this strategy can be implemented.

- Senate Republicans will have a new leader in South Dakota’s John Thune, who has previously been a deputy to his predecessor in this role, Mitch McConnell. In the House, Mike Johnson seems to have support to continue as Speaker, but the official vote will not occur until January 3.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- The S&P 500 sank 2.08% to end the week at 5,870.62, and the Nasdaq declined more sharply, falling 3.15% to 18,680.12. Bitcoin was at $91,259.77 on Friday afternoon, up roughly 13.5% from Monday levels.

- Fundstrat Head of Research Tom Lee remains constructive heading into year-end, but views rising inflation expectations as a possible concern.

- Head of Technical Strategy Mark Newton warns of complacency, expressing short-term breadth-driven concerns despite a bullish outlook in the longer term.

"Learn from yesterday, live for today, look to tomorrow, rest this afternoon." ― Charles M. Schulz

Good evening,

Stocks gave back their gains from the post-election surge this week, and then some. Much of that followed worries about inflation and its effect on Federal Reserve policy. Investors got the chance to review fresh inflation this week, with CPI showing inflation no closer to the Fed's 2% target. However, Core CPI arrived roughly in line with expectations, and to Fundstrat Head of Research Tom Lee, the October CPI report was actually "better than it appears at first glance."

A 30% annualized surge in used car prices was one of the largest contributors to the rise in Core CPI MoM. Head of Data Science Ken Xuan hypothesized that used car prices were affected by previous hurricanes, and Lee concurred, viewing it as a "distortion [that] will disappear next month." As he reminded us, "The used-car CPI component tends to lag Manheim wholesale used car prices by two months. If this trend holds, then based on recent Manheim data. this component is set to tank."

As implied by Fed Funds futures trading, odds of another rate cut at the FOMC meeting in December surged from 55% to 82% after CPI data was released. Lee saw this as evidence that bond investors agree with his CPI assessment. "In my view, the bond market realizes that this Core CPI of +0.28% should really be viewed as +0.22% MoM if one strips out the impact of the used-car component – and that is basically at the Fed's target."

Looking beyond the immediate-term and through to the end of the year, Lee remains constructive. At our weekly research huddle, he suggested that investors are being too skeptical: "Just remember how many times this year that we heard someone warning that a recession was imminent, or that the labor market was falling apart, or that the Fed was behind the curve. I think that same wall of worry is in place now. But we know the seasonals are really pretty strong, and at the end of the day, the Fed is still dovish."

Is there the potential for a proverbial fly in the ointment? To Lee, "the only thing I'm kind of worried about is the one year-one year inflation forward swap," an implied measure of where the market thinks one-year forward expectations will be one year from now (in other words, inflation from November 2025 to November 2026). As shown in our Chart of the Week, this number has risen sharply over the past two months, nearing "a level that indicates that the market is starting to worry about inflation."

To Lee, these expectations are important "even though we're not worried about inflation. The Fed responds to these numbers," he noted, "and they influence policymakers."

Asked to weigh in, Head of Technical Strategy Mark Newton had this to say: "My main thought is that this number started to rise exactly when Treasury yields started to bounce, and a lot of that happened as the narrative shifted to worries about the [then-potential] Trump administration leading to inflation." In his view, "I'm not certain that we can say that inflation is going to continue to escalate. The media is telling us that Trump's policies are likely inflationary, but I don't think they are necessarily correct. In my view, it's possible that any pressures in that direction will be offset by crude prices, which I suspect will decline."

In the near term, "my concerns are really with breadth," Newton said. "Broader breadth, on a larger scale, is very good in my view. Short-term breadth is what concerns me. Historically after elections, we've seen the market start to turn up sharply, with breadth of four-to-one or even five-to-one positive. But this time it was more like three-to-two. Almost a third of stocks did not participate in the post-Election Day rally. I still have a lot of confidence in the stock market between now and next spring summer, but I'm just not certain it's going to be a straight shot. I have short-term concerns, and by short-term I mean probably over the next four or five weeks. I think it's definitely wise not to get too complacent right now."

Elsewhere

The U.S. finalized $6.6 billion in funding to Taiwan Semiconductor Manufacturing Co., signing a binding contract to help the chipmaker build three fabrication plants in Arizona as part of President Biden's 2022 CHIPS Act. The White House has been rushing to secure the incentives amid fears that the incoming Trump administration might try to repeal the act.

Klarna has filed for a U.S. IPO, though details have yet to be determined. The Swedish fintech company plans to go public amidst growing concern by U.S. and UK regulators about whether buy-now-pay-later products should be regulated in the same way that credit cards are.

Chinese e-commerce giants like Alibaba and JD reported robust order growth for China's Singles Day, arguably the country's biggest shopping holiday of the year. However, the disclosures did not present a clear picture of Chinese consumer sentiment. Singles Day (11/11) began as an Alibaba sales promotion in 2009, but it has since spread to countries throughout Asia and become a weeks-long event, and neither company disclosed gross merchandise value or sales revenues linked to the holiday.

Amazon unveiled its new Haul storefront, seeking to compete with super-cheap Chinese e-commerce sites like Temu and Shein. Haul, currently only accessible through Amazon's mobile app, offers similarly low-priced deals, but because the goods are shipped directly from China, the delivery time is generally longer than purchases made on Amazon's regular channels.

The United Nations warned that as many as 33 million Nigerians, including 5.4 million children, could face a "monumental hunger crisis" next year. The country's citizens have long been beset by out-of-control inflation and ongoing conflict instigated by Boko Haram terrorists, and widespread flooding that destroyed more than 3.7 million acres of farmland.

The satirical news site The Onion purchased Infowars, the media group formerly run by conspiracy theorist Alex Jones. Jones forfeited the company after losing a $1.5 billion defamation lawsuit brought by families of the 2012 Sandy Hook Elementary School massacre, who he had accused of being actors perpetrating a "giant hoax." The acquisition was partly financed by money raised by those families.

And finally: Rolex, which has historically kept sales and production figures a closely guarded secret, disclosed that it has sold nearly 4 million of its iconic divers watches since 1953, including both the base-model Submariner and the more robust Sea Dweller models. All told, analysts estimate that this amounts to roughly $50 billion worth of watches.

Important Events

Est.: 44 Prev.: 43

Prev.: 48.5

Prev.: 55.0

FS Insight Media

Stock List Performance

| Strategy | YTD | YTD vs S&P 500 | Inception vs S&P 500 | |

|

SMID Granny Shots

|

+40.97%

|

+23.07%

|

+23.07%

|

View

|

|

Upticks

|

+34.82%

|

+11.94%

|

+43.54%

|

View

|

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 704342-17d6de-ebc608-c5e687-567dcb

Already have an account? Sign In 704342-17d6de-ebc608-c5e687-567dcb

Want to receive Regular Market Updates to your Inbox?

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 704342-17d6de-ebc608-c5e687-567dcb

Already have an account? Sign In 704342-17d6de-ebc608-c5e687-567dcb