Major stocks indexes pared back some of last week’s gains, hurt by the ever-changing tariffs policy and warning of a hit to a major chipmaker’s earnings.

The S&P 500 fell 1.5% this week, with the declines led by tech stocks. The consumer discretionary sector and information technology sector were the worst performers, down 3.2% and 3.6%, respectively. Meanwhile, the Nasdaq Composite fell 2.6%.

Despite being a holiday-shortened trading week, there was no shortage of market-moving events. On the tariffs-front, the percentage imposed by the U.S. on China became “further absurd,” rising to as much as 245%. Fundstrat Head of Research Tom Lee isn’t too worried about that number because he believes that this is not a normal market at this moment. “In this post-Liberation day environment, ‘headlines’ not fundamental developments drive market moves,” he said.

Another drag on markets came Wednesday morning when Nvidia said it would record a $5.5 billion charge on its quarterly earnings, after the U.S. asked it to require a license for exporting the company’s H20 processors to China and other countries. Head of Data Science “Tireless” Ken Xuan said during the weekly huddle that he likes that Nvidia Chief Executive Jensen Huang visited Beijing on Thursday to allegedly discuss new chip designs for Chinese customers.

The losses picked up steam later that afternoon when Federal Reserve Chair Jerome Powell warned that tariffs could make it harder for the central bank to address both of its dual mandates of stable prices and maximum employment.

The messaging was undoubtedly perceived hawkishly by investors and President Donald Trump, who said Thursday that the chair’s end of tenure “cannot come fast enough.”

But Xuan said that Powell wasn’t necessarily negative. “It has been the same message delivered by Powell, so nothing new. The Fed is basically in the wait-and-see game, which is fair because there are no clear signs” he said.

Sentiment and momentum, however, remain negative for now. Head of Technical Strategy Mark Newton said that, “it’s not unrealistic to think we’re still going to be choppy, but the bigger picture is that in the second half of the year, I expect it to be much better.”

Chart of the Week

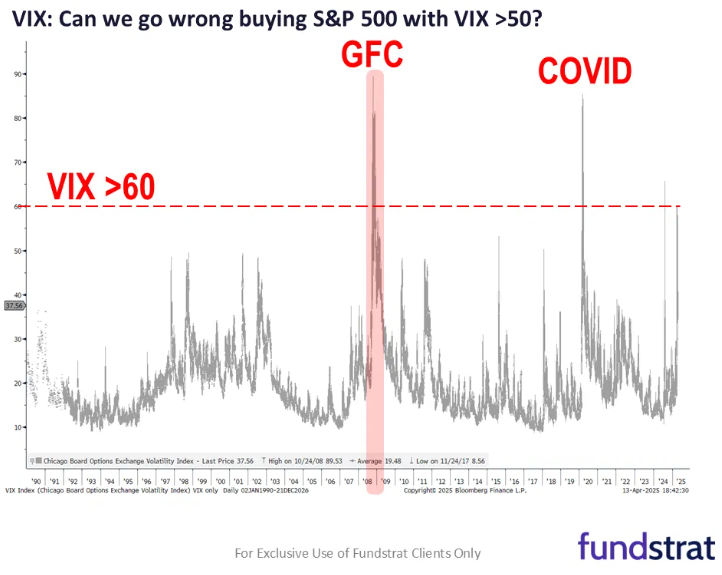

Fundstrat Head of Research Tom Lee likes that the VIX, considered to be Wall Street’s fear gauge, fell to about 30 after surging to 60. Historical data show that the VIX has surged above those levels only two other times. The first was during the financial crisis in 2008 and the second was during the onset of Covid-19 in 2020. Both of those instances were accompanied by stocks rallying furiously afterward. “The fact is—it is wise to buy stocks when the VIX is above 50, and especially when it makes a move back below 50,” Lee said.

Recent ⚡ FlashInsights

- Fed can’t act until they know what impacts tariffs will have

- Tariffs impact ultimately determined by White House (aka Trump)

- In short, Fed will act after White House sets path

- Not a surprise since Powell said this last week

FS Insight Video: Weekly Highlight

Key incoming data

4/1 9:45 AM ET: Mar F S&P Global Manufacturing PMITame4/1 10:00 AM ET: Mar ISM Manufacturing PMITame4/1 10:00 AM ET: Feb JOLTS Job OpeningsTame4/2 10:00 AM ET: Feb F Durable Goods Orders MoMTame4/3 8:30 AM ET: Feb Trade BalanceTame4/3 9:45 AM ET: Mar F S&P Global Services PMITame4/3 10:00 AM ET: Mar ISM Services PMITame4/4 8:30 AM ET: Mar Non-farm PayrollsHot4/7 9:00 AM ET: Mar F Manheim Used Vehicle IndexTame4/8 6:00 AM ET: Mar Small Business Optimism SurveyTame4/9 2:00 PM ET: Mar FOMC Meeting MinutesMixed4/10 8:30 AM ET: Mar Core CPI MoMTame4/11 8:30 AM ET: Mar Core PPI MoMTame4/11 10:00 AM ET: Apr P U. Mich. 1yr Inf ExpHot4/14 11:00 AM ET: Mar NYFed 1yr Inf ExpMixed4/15 8:30 AM ET: Apr Empire Manufacturing SurveyTame4/16 8:30 AM ET: Mar Retail SalesTame4/16 10:00 AM ET: Apr NAHB Housing Market IndexTame4/16 4:00 PM ET: Feb Net TIC FlowsTame4/17 8:30 AM ET: Apr Philly Fed Business OutlookTame4/17 9:00 AM ET: Apr M Manheim Used Vehicle IndexMixed- 4/23 9:45 AM ET: Apr P S&P Global Services PMI

- 4/23 9:45 AM ET: Apr P S&P Global Manufacturing PMI

- 4/23 10:00 AM ET: Mar New Home Sales

- 4/23 2:00 PM ET: Apr Fed Releases Beige Book

- 4/24 8:30 AM ET: Mar P Durable Goods Orders MoM

- 4/24 8:30 AM ET: Mar Chicago Fed Nat Activity Index

- 4/24 10:00 AM ET: Mar Existing Home Sales

- 4/25 10:00 AM ET: Apr F U. Mich. 1yr Inf Exp

- 4/28 10:30 AM ET: Apr Dallas Fed Manuf. Activity Survey

- 4/29 9:00 AM ET: Feb S&P CS home price 20-City MoM

- 4/29 10:00 AM ET: Apr Conference Board Consumer Confidence

- 4/29 10:00 AM ET: Mar JOLTS Job Openings

- 4/30 8:30 AM ET: 1Q A GDP QoQ

- 4/30 8:30 AM ET: 1Q ECI QoQ

- 4/30 10:00 AM ET: Mar Core PCE MoM

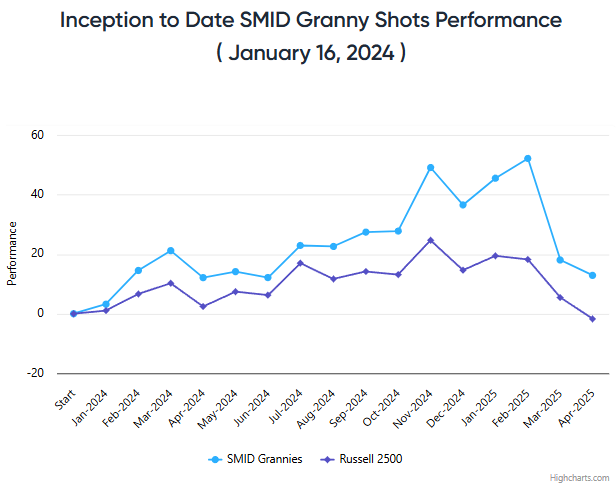

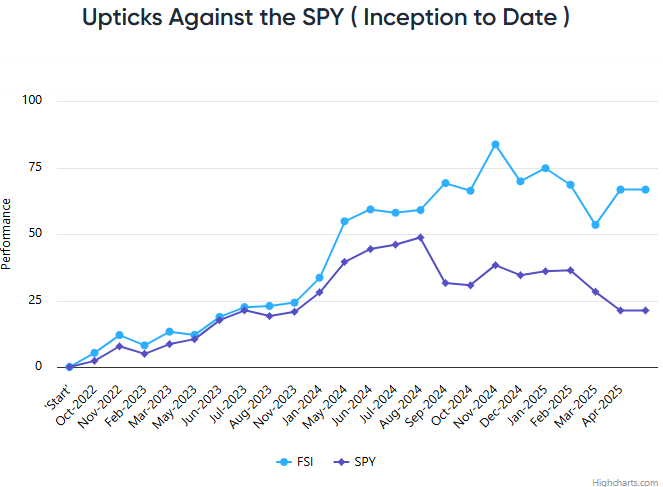

Stock List Performance

In the News

| More News Appearances |